GBP/USD FUNDAMENTAL HIGHLIGHTS:

- Political Instability Adds to GBP Weakness

- BoE Rate Rise Unlikely

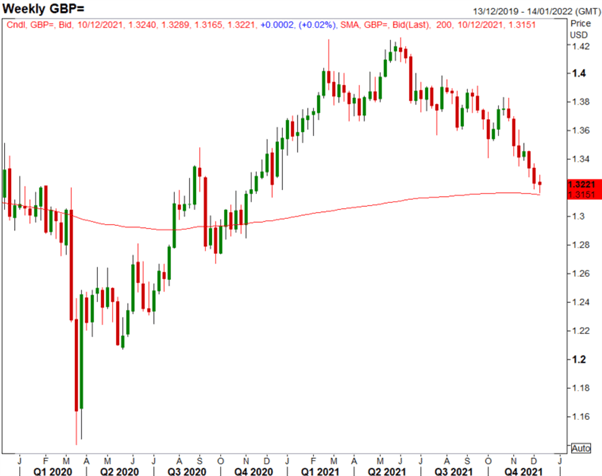

Another week, another fresh 2021 low for GBP/USD. A stark contrast to the once-popular vaccine trade that propelled the Pound to multi-year highs in Q1. However, in light of an unwind in BoE tightening bets, stemming from renewed social distancing measures and a rise in political instability risks amid this weeks headlines surrounding the UK Government, the Pound finds itself languishing around the 1.32 handle.

While market pricing for a rate rise next week has slipped, OIS markets do still price in a 42% chance of a 15bps rate rise, as well as near four hikes for next, which will be hard for the BoE to match. Therefore, risks remain tilted to the downside for the Pound and eyes will be firmly fixed on the 200WMA at 1.3155. That being said, with the FOMC also scheduled to announce its monetary policy decision, it will be important for traders to remain agile and not get married to a trade. I remain bearish on the Pound, however, I do think we are getting close to peak bearishness, given the lack of appetite for markets to keep Cable on a 1.31 handle and with net shorts in the currency at multi-year highs, there is fuel for a reversal.

MONEY MARKETS SEE A 42% CHANCE OF A BOE RATE RISE NEXT WEEK

Source: Refinitiv

GBP TECHS

As I have mentioned previous, the target for bears is the 200WMA, with a close below opening up the doors for a move sub-1.31. A reassessment of this view, however, would be a break above 1.3335-40.

GBPUSD Chart: Weekly Time Frame

Source: Refinitiv, DailyFX

“The Need to Know Complete Guide on Trading the Pound (GBP)”

Be the first to comment