GBP price, news and analysis:

- GBP/USD will take its cue from this session’s US inflation figures, while EUR/GBP traders will react to the latest decision by the ECB on Eurozone monetary policy

- However, neither will likely break out of its recent relatively narrow trading range even though concerns remain about the latest EU-UK trade spat and a possible delay to the planned full reopening of the UK economy.

GBP/USD waits for US inflation data

US consumer price inflation data for May, due at 1230 GMT, will dominate trading in GBP/USD this session, as well as trading in the other major pairs, with economists expecting large increases in both the core and headline numbers.

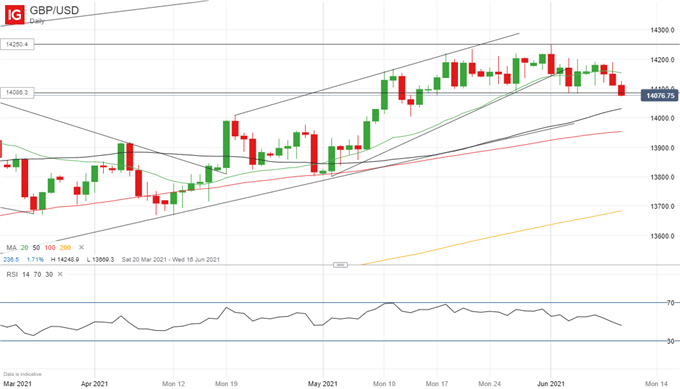

However, the figures are not expected to shift the pair far out of its recent narrow trading range between the June 1 high at 1.4249 and the June 4 low at 1.4083 despite an early test of that support level this session.

GBP/USD Price Chart, Daily Timeframe (March 22 – June 10, 2021)

Source: IG (You can click on it for a larger image)

EUR/GBP looks to ECB meeting

For EUR/GBP, the main events are the decisions on Eurozone monetary policy by the European Central Bank, to be announced at 1145 GMT, and the subsequent press conference by ECB President Christine Lagarde at 1230 GMT. Little is expected from the Bank but traders will be watching out for any hints that it is considering tapering its monetary stimulus program, as I wrote here.

As long as the ECB sticks to the script, that should leave EUR/GBP between the May 10 high at 0.8676 and the May 12 low at 0.8560.

EUR/GBP Price Chart, Daily Timeframe (February 26 – June 10, 2021)

Source: IG

As for GBP more generally, there is still scope for the currency to suffer from the EU-UK spat over trade between Great Britain and Northern Ireland – particularly if the EU decides to impose tariffs and quotas on UK goods entering the bloc. A possible delay to the planned lifting of all coronavirus restrictions in the UK on June 21 would also be negative for Sterling.

— Written by Martin Essex, Analyst

Feel free to contact me on Twitter @MartinSEssex

Be the first to comment