270770

Introduction

In April, I wrote an article on SA about Mexico-focused silver miner Gatos Silver, Inc. (NYSE:GATO) in which I said that it’s possible that zinc or lead reserves could be overstated and not silver ones. The company’s mine was briefly shut down after that, and the market valuation has almost halved. However, I think that this could be a good time to open a small position. Sure, there are a lot of issues that need to be resolved, but Q1 2022 production was strong and cash reserve levels are good. Let’s review.

Overview of the recent developments

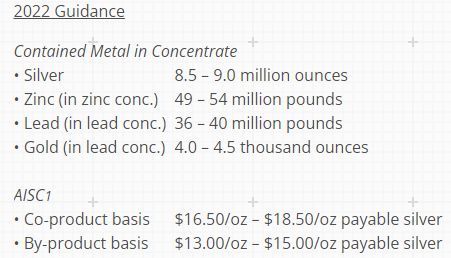

In case you haven’t read my previous article on Gatos Silver, here is a brief description of the business. The company owns a 70% interest in a JV that operates the Cerro Los Gatos polymetallic mine in northern Mexico, which started operations in 2019. It’s a high-cost mine, and all-sustaining costs (AISC) on a by-product basis are expected to come in at $13.00-$15.00 per ounce of payable silver, according to the 2022 production guidance.

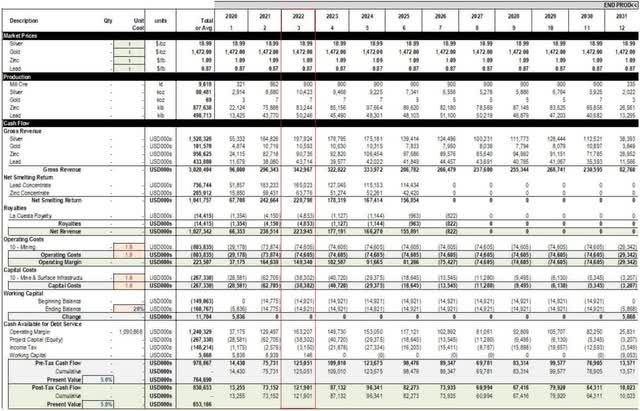

According to the 2020 technical report for Cerro Los Gatos, the project had a net present value (NPV) of $653.2 million. However, Gatos Silver said in January 2022 that there were mistakes in the technical report and that the metals content of the mineral reserve could decrease by 30% to 50%. This sounds really bad, but I think that the reduction will affect mainly the zinc and lead reserves, considering the production of these two metals has been behind schedule ever since the mine was opened. The new mine plan and updated reserve estimate should be released sometime in the second half of 2022.

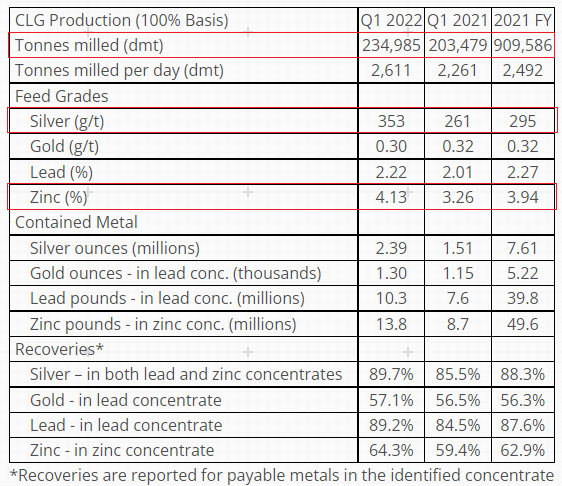

Looking at the latest production figures, I think the situation wasn’t that bad. Feed grades for silver and zinc improved significantly compared to Q4 2022 and Gatos Silver said that unit costs were below its annual guidance range. In addition, tonnes milled jumped to almost 235,000 which puts the mine in a good position to surpass the 900,000 tonne mark set for 2022 in the current life of mine plan.

Gatos Silver

However, you can see from the 2020 technical report that zinc and lead production are still nowhere near where they should be this year. In order to achieve those targets, Cerro Los Gatos needs to be producing about 2.6 million ounces of silver, 20.8 million pounds of zinc, and 10.7 million pounds of lead per quarter.

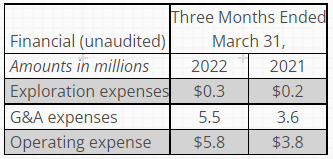

While the production results are still behind the mine plan, Cerro Los Gatos remains a highly profitable mine. In April, the JV company paid its first dividend of $20 million to its partners. Gatos Silver received $6 million of that amount, and the JV company was left with $28 million in cash as of the end of April. Those $6 million are just about enough to cover the quarterly expenses of Gatos Silver, so I think stock dilution risk isn’t high here at the moment.

Gatos Silver

So, if production results are relatively good and the company seems to have enough cash to cover its expenses, why is the share price continuing to slide? Well, the answer is because new issues keep appearing. On April 27, Gatos Silver revealed that mine operations were shut down after the explosive and blasting permit for Cerro Los Gatos was suspended after a blasting incident. Two blasts were detonated prematurely during underground development, and this is the first time I’ve heard of such an accident since I started investing in the mining space in 2016. It’s really unusual. Fortunately for Gatos Silver, the explosive and blasting permit was reinstated and mining operations resumed less than 2 weeks later.

This mine shutdown shouldn’t have a large impact on production, as Gatos Silver has kept its 2022 guidance unchanged. The company expects high-grade ores in Q2 to offset the lower amounts of material processed.

Gatos Silver

I think that another issue for Gatos Silver was that an independent non-executive director passed away in June. This won’t have a significant impact on the operations of the company, but I think it affects sentiment somewhat. And since the new mine plan is still not ready, Gatos Silver still hasn’t released its annual report. With so many issues emerging in the span of just a few months, I think it’s unsurprising that the market valuation of the company has dipped below $200 million.

Overall, I think that this is a good time to buy Gatos Silver shares as there is blood on the streets. Sure, reserves will decrease, but this is unlikely to affect the life of the mine as silver production rates are close to the original mine plan. And it’s unlikely that another blasting accident like the one from April will happen again. Cerro Los Gatos currently has about 70 million ounces of silver left and over 85% of the mineral rights package has yet to be drilled. In my view, the share price of Gatos Silver is likely to return to around $10 once the new mine plan is released.

Investor takeaway

It seems that Gatos Silver investors just can’t catch a break, as new issues keep emerging at Cerro Los Gatos. Yet, I think that Q1 2022 production and costs were good and the guidance for the full year remained unchanged despite the brief shutdown of the mine in April.

In my view, the Q1 2022 production results confirmed that the errors in the reserve model are mainly related to zinc and lead, and I think that Gatos Silver looks oversold at the moment. Cash flow from Cerro Los Gatos is strong and stock dilution risk here seems low.

I expect the share price of Gatos Silver to eventually return to levels of around $10 once the new mine plan and reserve estimate are released in the coming months. I rate this one as a speculative buy.

Be the first to comment