GasLog Ltd. (GLOG) is one of the few ‘bluechip’ shipping companies (excellent management, ultra-modern assets, $4Bn+ GasLog family backlog secured by long-term contracts) trading at heavily depressed valuations. The GasLog brand has been tarnished due to the massive 78% distribution cut at the daughter entity, GasLog Partners (GLOP). Since then, everything has gone downhill, with both GLOG and GLOP down more than 60% YTD.

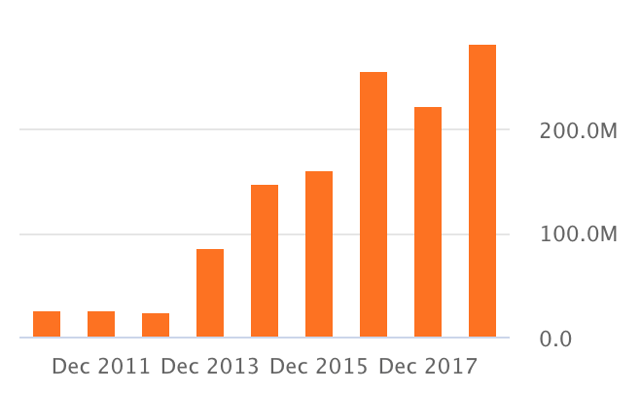

GLOG’s current newbuild program alone is expected to contribute more than $140M in fixed annualized EBITDA. Add into the mix more than $350M in annual EBITDA from the existing on-the-water fleet and distributions (albeit lower) received from GasLog Partners. On a pro-forma basis, annual EBITDA will exceed $500M and annual cash from operations is set to exceed the $350M mark, once growth projects come online.

GLOG annual cash from operations 2010-2019 TTM:

Source: Seeking Alpha

Source: Seeking Alpha

On the one hand, we have record revenue backlog and cash flow generation. On the other hand, we have a record low share price. It is important to emphasize that GLOG’s cash flow is highly predictable, through 2026 and beyond. On a fully delivered fleet basis, the majority of the cash flow will be fixed i.e., it will not be affected by the shipping market spot rates (more on this below).

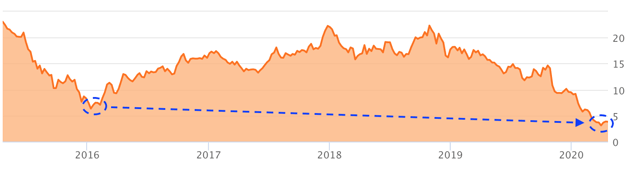

GLOG has been on my radar for several years, but I always felt the valuation was fairly expensive relative to other shipping names. This is because GLOG is one of the best-managed shipping companies, building sustainable equity value and consistently rewarding shareholders (including special dividends) over time. Hence the premium.

The share price is now at levels below the energy crash in 2015/16. Back then, there were fears of a China slowdown. Now, we are battling with the coronavirus, which has caused a global alarm.

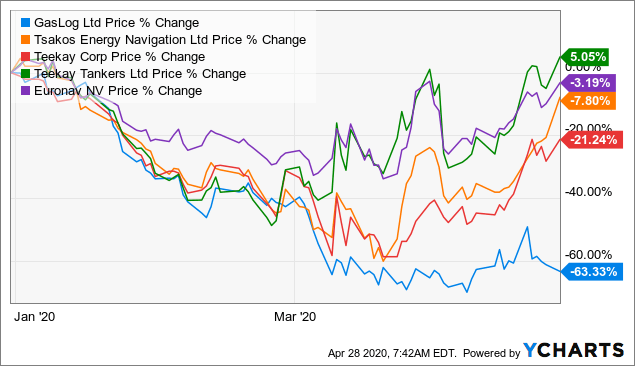

The energy space is under unprecedented turmoil, on the verge of collapse due to the coronavirus pandemic, which in turn has caused a global crude glut. The OPEC+ agreement failed to stabilize the market. The great oil collapse continues, with oil plummeting to the lowest point since 1999. We even experienced negative oil prices one day before the May ‘20 contract would expire. The world is flooded with oil and the oil market is running out of storage space. Oil tankers are being used to hold record amounts of crude at sea (referred to as floating storage). This benefits my investment in Teekay Corporation (TK), which owns tankers via its daughter Teekay Tankers (TNK), Euronav (EURN), which owns a large fleet of VLCCs (very large crude carriers) and Tsakos Energy Navigation (TNP). It is interesting to graph the divergence between tanker companies and GLOG.

Data by YCharts

Data by YChartsTankers are hot right now, and for good reason. However, there are other beaten-down sectors like LNG and dry bulk that are worth considering. For example, besides GLOG, I also like Navios Maritime Partners (NMM) (dry bulk and containers), which is in deep value territory.

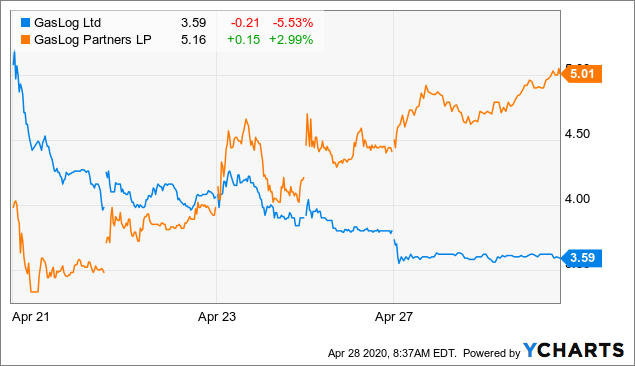

What is more interesting to graph is the very recent divergence between GLOG and GLOP.

Data by YCharts

Data by YChartsBased on today’s pre-market activity, GLOP is poised to open higher again:

Source: Author’s brokerage account

Source: Author’s brokerage account

This divergence is not something that will last for too long in my opinion. It is fair to say that the parent, GLOG, is way better positioned than the daughter, GLOP, on virtually all fronts (fleet quality, contracted cash flow, dividend, insider participation, etc.).

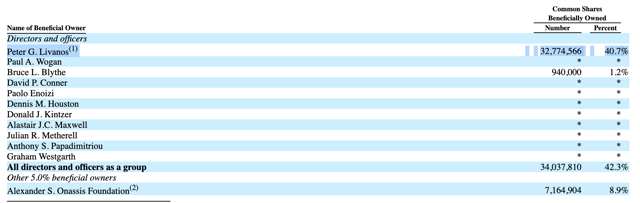

GasLog’s founder and chairman, Mr. Peter Livanos, owns his stake via GLOG. He has a lot of skin in the game, owning ~40.7% of the company.

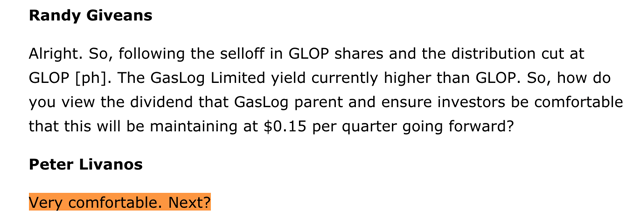

The Alexander Onassis Foundation has been supporting the company since the early stages. Like Mr. Livanos, they are interested in a stable dividend. When asked during the most recent conference call, Mr. Livanos noted he feels “very comfortable” with the current dividend of $0.15 per quarter, despite GLOP’s recent distribution cut.

The Alexander Onassis Foundation has been supporting the company since the early stages. Like Mr. Livanos, they are interested in a stable dividend. When asked during the most recent conference call, Mr. Livanos noted he feels “very comfortable” with the current dividend of $0.15 per quarter, despite GLOP’s recent distribution cut.

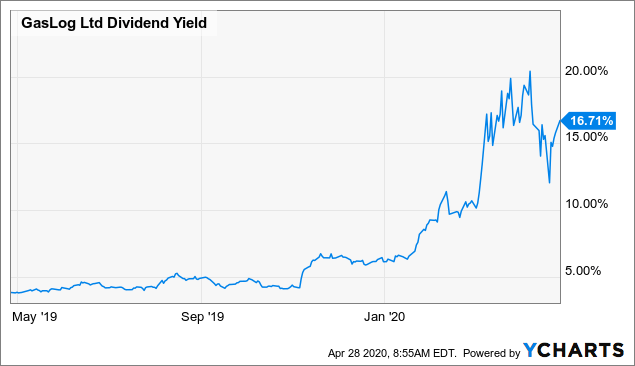

At the time of writing (share price below $3.70), the dividend yield is in excess of 16%.

Data by YCharts

Data by YChartsGoing forward, I expect dividend yield compression driven by a significant recovery in the the share price. Perhaps Q1 2020 earnings, scheduled for 7 May 2020, will serve as a catalyst to highlight the stability of GLOG’s backlog and operating cash flow.

To make it clear, my investment in GLOG at today’s levels is not based on the dividend. The dividend is more than welcome but one needs to be mindful of the depressed LNG environment. For example, according to Reuters, at least 20 cargoes of U.S. liquefied natural gas (LNG) have been cancelled by buyers in Asia and Europe. Perhaps GLOG U-turns and cuts the dividend for accelerated deleveraging purposes… who knows?

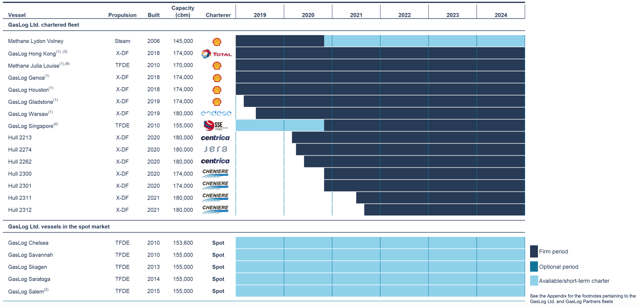

That said, GLOG’s fixed long-term contracted revenue acts as a buffer, largely insulating the company from the current turmoil. The charter contracts are designed to generate attractive and predictable cash flow. In particular, they are:

- long-term contracts through 2026 with some contracts and optional periods stretching all the way to 2030+

- fixed rate contracts, not impacted by commodity prices and the LNG shipping spot rates

The real risk is if charterers default or find ways to not honor their long-term commitments (force majeure clauses, etc.). At this point, it is important to highlight that GLOG’s charterers are blue chip companies like Centrica (OTCPK:CPYYF), Shell (NYSE:RDS.A) (NYSE:RDS.B) and Total (NYSE:TOT).

Source: GLOG Q3 2019 Earnings Presentation, Appendix

Source: GLOG Q3 2019 Earnings Presentation, Appendix

In a recent company update (2 April 2020), GLOG mentioned that:

the charter parties for all of the Group’s term-chartered vessels remain in effect with revenues as per the contract terms

This is good news, in line with expectations. Despite this announcement, the share price continues to be under substantial pressure (unlike GLOP).

Another positive development is that GLOG took delivery of the GasLog Windsor, which will immediately commence a seven-year charter with Centrica. The vessel was delivered on time and on budget, despite the industrial disruption in South Korea caused by the COVID-19 outbreak.

Even though most of GLOG’s backlog is fixed, backed by long-term contracts, GLOG also has several vessels on the spot market. During Q1 2020, the Group’s tri-fuel diesel-electric vessels operating in the spot and short-term market delivered time charter equivalent earnings of ~$44,000/day. I expect better days ahead once the coronavirus situation stabilizes, but $44K per day adds a bit to operating cash flow. In this environment, every little helps.

In closing, a key emphasis of this article is to highlight the divergence between GLOG and GLOP. Between the two GasLog entities, GLOG is the place to be in, in my view. I believe that the drop in GLOG’s share price is a reflection of market sentiment, not long-term fundamentals. Going forward, GLOG’s cash flow will be just fine, albeit with some continued swings depending on the performance of its spot market vessels. However, once all fixed-rate growth project contracts hit the water, this volatility will be greatly reduced.

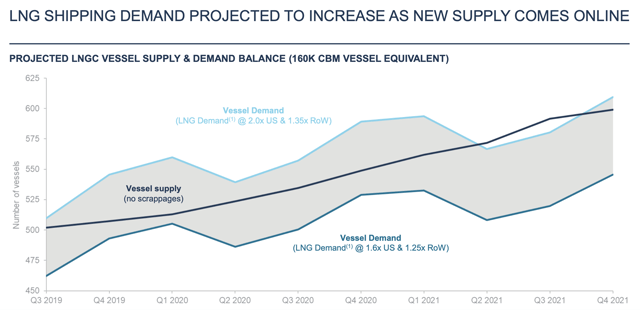

Talking about fundamentals, LNG is a growth story and “gas will supply the largest share of energy demand growth, supplying over 40% of additional demand by 2035”, according to Shell’s outlook. Not all energy is the same. LNG is cheaper and cleaner but only represents ~3% of today’s energy mix. According to EIA, LNG is 30-44% cleaner than oil and coal on CO2 emissions and 80-100% cleaner on other key emission metrics. However, oil is 10 times larger and coal is 7 times larger than LNG. According to Wood Mackenzie, LNG demand is set to grow by 6% CAGR 2018-25.

Source: GLOG Q3 2019 Earnings Presentation, slide 16

Source: GLOG Q3 2019 Earnings Presentation, slide 16

Importantly, growth is globally diverse and 81% of demand growth comes from outside of China. What’s more, ~52% of future new capacity is located in the US, and US LNG exports are shipping intensive (~40% of US cargoes delivered to Asia and the Middle East in Q3 19). Now, all this might seem like a different world given the disruption caused by the coronavirus. However, it is important not to lose sight of fundamentals.

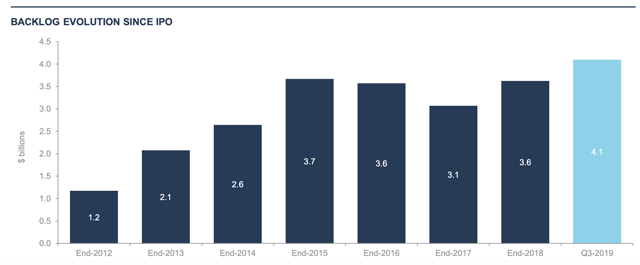

LNG is a growth story and ships play a critical role in LNG transportation. GLOG’s record backlog provides long-term visibility and stability. This provides the ability to focus on multiple corporate priorities, including debt reduction, growth initiatives, dividends and share repurchases. The significant growth program is coming close to fruition, with most vessels scheduled for delivery in 2020. GLOG’s management is amongst the best in the space. I consider GLOG to be a shipping blue chip. The share price is currently at levels not seen since the energy crash of 2015/16. However, GLOG’s cash flow going forward is largely fixed (i.e. not impacted by market sentiment and commodity prices). I have been on the sidelines until now but went long below $5. I feel GLOG has the potential to rally once sentiment improves and the increased cash flow from growth projects is reflected in the financials.

GLOG’s backlog is sitting at record levels of $4.1Bn. To put things into perspective, in the year of the IPO in 2012, the backlog was $1.2bn ($2.9Bn less compared to today). Source: GLOG Q3 2019 Earnings Presentation, slide 10

Source: GLOG Q3 2019 Earnings Presentation, slide 10

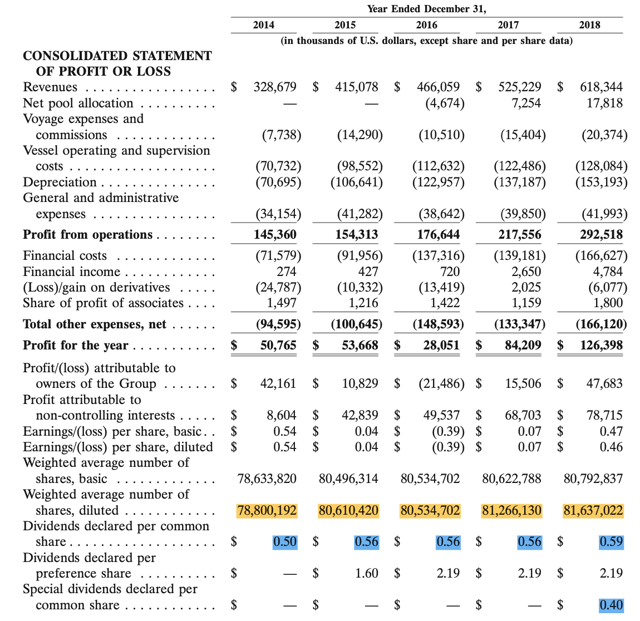

At the end of 2012 (IPO year), GLOG’s diluted share count was ~56.5M. Following accretive equity raises, the share count increased to ~78.5M in year-end 2014. Since then, the share count has remained more or less the same, as illustrated by the section highlighted in yellow below.

Source: GLOG 2018 Annual Report

Source: GLOG 2018 Annual Report

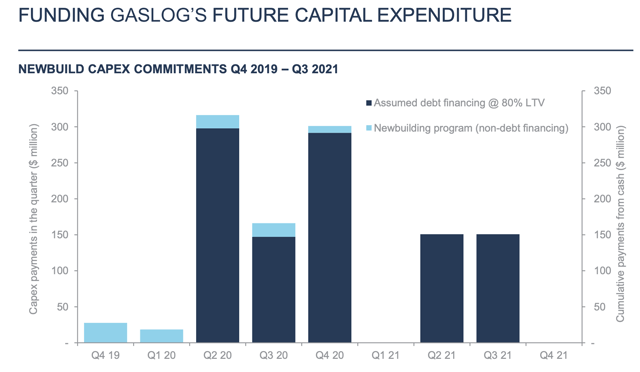

As of Q3 2019, the diluted share count stood at 80.9M. This is less than year-end 2018, as a result of a repurchase program up to $50M announced in November 2018. The current share price presents a great opportunity for GLOG to substantially reduce the share count, which will be highly accretive on per share metrics. That said, we have to be mindful that GLOG is finalizing a large growth newbuilding program, with 5 deliveries scheduled for 2020 and 2 for 2021. Note, the newbuild vessels are fully funded and chartered out on long-term contracts. In other words, they are not speculative newbuilds.

Source: GLOG Q3 2019 Earnings Presentation, slide 9

Source: GLOG Q3 2019 Earnings Presentation, slide 9

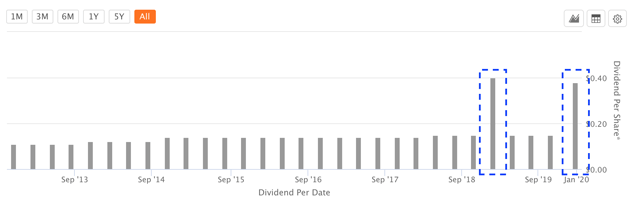

Again, even though GLOG should in theory be repurchasing shares hand over fist today, they need to strike the right balance between growth, debt reduction and returning capital to shareholders. It is worth noting that GLOG has also rewarded shareholders with a large special dividend of 0.40 per share in 2018 and $0.38 per share in 2019. This is on top of the regular progressive common dividend, paid every quarter since IPO. Source: Seeking Alpha (the blue-dotted rectangles represent the special dividend)

Source: Seeking Alpha (the blue-dotted rectangles represent the special dividend)

This is an impressive track record and I am particularly excited about the prospects once all aforementioned growth vessels hit the water through 2021 and start producing cash flow. I am also excited about future initiatives like the FSRU project via Gastrade.

It is important to reiterate that GLOG predominantly focuses on long-term employment, following a similar model to Teekay LNG (TGP), which I like, as it provides substantial cash flow visibility. This in turn provides the ability to focus on multiple corporate priorities at the same time, including debt reduction (very important), growth initiatives, dividends and share repurchases. Ultimately, this is a recipe for success.

Lastly, I wouldn’t be surprised is GLOG absorbs GLOP.

Disclosure: I am/we are long GLOG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I own a small position in GLOP.

Be the first to comment