Grinya_kiev/iStock via Getty Images

Games Workshop (OTCPK:GMWKF) is a company that produces plastic and resin miniatures in Nottingham that are sold the world over. These miniatures are thematic, and are used to play the Warhammer tabletop wargames that are set in the 41st Millennium for Warhammer: 40,000, and in their unique fantasy setting for Warhammer: Age of Sigmar. The Warhammer IP really is one of the best IPs in the world, and has been growing a loyal following since the 80s. If you’ve never heard of it, it has a similar culture to Dungeons & Dragons, except the focus is on selling miniatures that are actually needed to play out the strategies in a wargame. They have ruffled feathers lately with a crackdown on fan content, and this does them no favours. Longer term this isn’t the real problem though, with the key risk being 3D printing. Entry level 3D printers can compete with the print quality of Games Workshop figurines and are only getting better. Games Workshop is going to see the same kind of disruption that the music industry will see, and the main source of value will be the IP and the content creation through Warhammer+, their streaming service. This is something we wouldn’t want to bet on at the moment. Be aware of these structural risks, as the company profile could go through a decade-long transformation.

FY Results

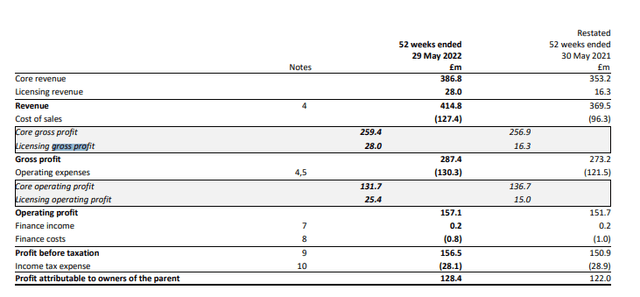

The FY results were not great. Volumes and price increases, for which GW is famous, grew revenues at still a substantial pace towards the end of the year. These revenue results which saw approximately 20% YoY growth were in line with what the commissioned research predicted. Cost of sales were not expected to rise this much. Inflation in labor costs and also in the costs of plastics and resins, which were more elevated for the majority of 2022 than 2021, although falling now towards the end of the year to break some local lows, ate into gross and profit margin performance. The growth in highly profitable licensing revenue, which goes for a gross margin of 100%, was the only source of improved gross profits. Operating profit on a comprehensive basis was flat, and saw no growth despite GW’s substantial pricing power and loyal, essentially fanatical markets.

IS (GW Annual Report)

The licensing revenue is coming from video games that have been allowed to use the IP. The Dawn of War RTS franchise for PC, but also other mobile games are sources of revenue. The new Space Marine: 40,000 will come out at some point this decade which could be something to look out for, but the release date has not yet been disclosed.

Bottom Line

There is also the streaming service Warhammer+ which has just launched. It costs as much as Netflix (NFLX) and has a really limited library, some of it of really limited quality. Because animated content is the only way to go with something as fantastical as Warhammer, projects are hard to make well, and expensive to make well. The IP affords options, but GW hasn’t done itself favours by cracking down on Youtubers who were making fan content to generate interest rather than somehow recruiting them. Streaming markets are also so competitive. People don’t want to be spending hundreds of dollars on different services every month.

We don’t think a streaming service is going to do much to offset the pressure that could come from another threat which is 3D printing. For $350 dollars you can get a resin printer that can produce models with almost if not as much detail depending on how you parameterise the print as the GW official minis. In our last article we calculated that it’s worth buying a 3D printer if you plan to own more than 1500 points in Warhammer: 40k armies as a benchmark. Since the IP is compelling, and 1500 points is just a skirmish army, you’re quire likely to go way beyond that in terms of collecting minis. The threshold for it being worth investing in a 3D printer is very low and still getting lower at a very high rate! Both as prices rise, which is GW’s M.O, and also as printing technology develops, will the threshold for economy of buying a 3D printer come down. GW is a candle burning at both ends in that respect, and geeks are sophisticated enough to work this out.

Ultimately, we have lots of terrible precedents for what happens when you have to face off against piracy as a business. Blender artists can publish thousands of free prints all over the place that are fully using the 40k IP, and crackdowns are difficult there. GW could see the same declines as music publishing companies or sales of DVDs. No thanks at a 20x PE – maybe at a 10x PE we’d bite with the streaming backstop, but not here.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment