lightstock/iStock via Getty Images

Introduction

Previous stock chart performance is not an indicator of future expectations. With a decade of no change in its share price, some investors may be quick to dismiss a company as a potential investment opportunity. This, however, is where a company can go from being priced at an unreasonable valuation, to a valuation suddenly appearing attractive.

The name of the company is G-III Apparel Group, Ltd. (NASDAQ:GIII). It is an American clothing company that designs and manufactures clothing for men and women. The company has an international presence in the form of a portfolio of well-known proprietary and licensed brands.

Fundamentals

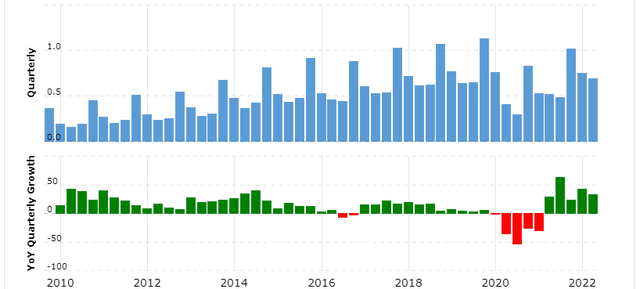

Despite the fact that the share price has stagnated, the company’s top line has continued to grow. Although growth has been slowing in recent years prior to the Covid-19 hit, it was still growing at a modest single digit pace. Revenue has in recent months recovered most of the decline following the shutdowns, and should continue to set new highs again, as the company continues to reinvest earnings back into the business.

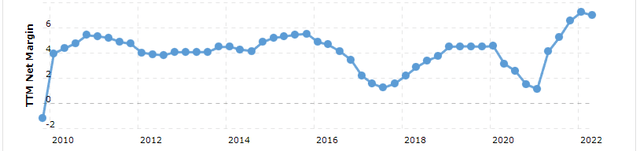

Margins have also been consistent and predictable, only temporarily declining in 2016-2017 as a result of acquisition costs, non-cash charges and operating losses from Wilsons and Bass, both of which have since been reduced. The net profit margin is currently well above average. To avoid having unrealistic expectations, I would not expect the current margin to be maintained. A margin of ~4.5% seems more realistic.

Net profit margin (Macrotrends.com)

A constantly growing top line combined with a somewhat stable profit margin has been a major source of net income. The company has maintained its profitability for >12 years and is not expected to change anytime soon.

Despite the fact that the net income set a new high this year and that the number of shares outstanding have not increased since 2017, the price of the shares continues to remain stagnant.

Capital allocation

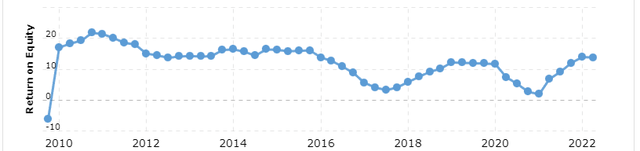

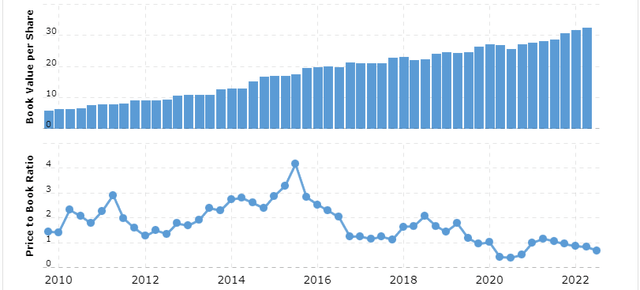

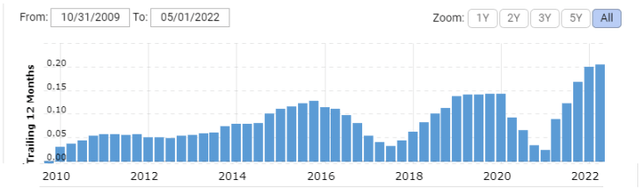

G-III has been cautious about the use of reinvested earnings. This is evident from the impressively high and consistent return on equity, which has averaged ~12%. A very respectable reinvestment rate considering that no earnings are used for dividends or share buybacks. Book value per stock has likewise grown by ~12%. With the company currently trading at below book value of 0.61, it seems cheap given the double digit growth.

Return on equity (Macrotrends.com)

Buybacks of shares at these prices, as they have done in recent months, will increase the book value per share at a faster pace than compared to growing earnings.

Since it is arguably easier to buy back shares than to invest in new capital-producing assets, and because share buybacks are giving a better return at current valuations, they should be preferred.

Book value per share (Macrotrends.com)

G-III has a long history of being able to reinvest back into the business at double digits. For a company with such ability to trade so far below book value is a rare sight. Even if the market continues to keep the price suppressed, the underlying business will continue to grow. Fundamentals will ultimately prevail given time. As the company seems to be gravitating towards the idea of doing share buybacks, investors should actually appreciate the current low valuation. This is because the buybacks are currently contributing more than new reinvestments will.

Valuation

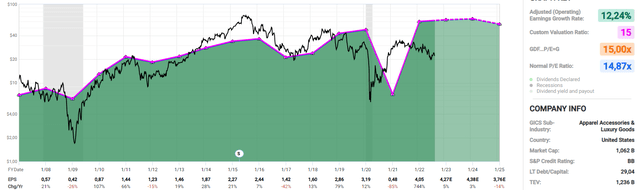

As with a majority of consistently growing companies, a 15 earnings multiple has proven to be close to intrinsic value. Given that the company has been reinvesting earnings back into new equity at a rate of 12%, it comes as no surprise, that earnings have also averaged ~12% growth.

The current multiple of 4.69 is well below its average multiple of 14.87. A large amount of debt would here be something to check for, as that will often suppress the awarded multiple. G-III as of their most recent quarter has a total amount of outstanding debt of $700m and cash, cash equivalents and short-term investments of $438. The net debt of $262, which considering that the market cap at a 15 multiple would be $3b, is not enough to justify its current low multiple.

A return to a proper multiple of ~15 would mean a return of 200% + 12% per year from EPS growth.

Earnings multiple & price (Fastgraphs.com)

Stock chart

Quick disclaimer. A technical analysis in itself is not a good enough reason to buy a stock but combined with the company’s fundamentals, it can greatly narrow your price target range when you buy.

The stock also appears to be attractively valued based on its stock chart performance, with the stock currently priced slightly below its 200-month moving average. Typically with consistently profitable and growing companies, this moving average is a strong area of support. This has been the case in the past, and given the strong fundamentals and decent future projections, it should be this time as well.

Final thoughts

G-III is a stable business. Management has been able to grow the business at a rate of 12%, which doesn’t seem to be slowing down. Impressively, the growth is not the result of an inflated balance sheet, but instead of prudent capital allocation. Since the buybacks are currently providing more than what the company is able to build in equity, I think it is very encouraging to see that share buybacks have been introduced.

The company trades well below book value while being able to grow BVPS by +12%. The average p/e has been 14.87. As growth does not appear to be slowing down and the balance sheet is kept healthy, the current 5 p/e seems far too low.

I believe the upside potential far outweighs the downside, with a high probability of double-digit returns from current valuations. As long as the stock is trading below its 200-month moving average and the fundamentals continue to improve, then I will remain bullish on the company.

Be the first to comment