Leon Neal

It’s a mess!

This is the description of the cryptocurrency market phenomenon called FTX after its bankruptcy occurred.

The whole cryptocurrency phenomenon has been built upon the assumption that with modern information technology, central control or regulation was not a necessary component of the industry structure.

Here people could create a product, market it directly to its customers, and then function with no outside oversight or control.

In the cryptocurrency market, we could build a medium of exchange and a store of value that would have worldwide acceptance without any kind of interference or restrictions upon what it could do, totally unlike the monetary systems that existed in the past.

Yet, here was a real star organization and a star innovator that ended up being defined as “a mess.”

What is wrong with this picture?

Well, I would start off by saying that we need to look at the assumptions behind the argument that a new financial innovation did not really need any oversight or regulation, or control.

The major assumption behind the advancement of cryptocurrencies is that the world functions best as a free-market economy where decisions are made without outside interference.

Two of the most basic economic assumptions of laissez-faire economics that serve as a foundation for the construction of this free-market narrative are:

First, gathering information is costless;

And, second, every decision-making economic unit has complete information.

The free-market economic model is built using these two assumptions.

Of course, there is no need for economic regulation or control, no need for central banks, and no need for any kind of supervision or oversight.

The cryptocurrency world was mentally constructed using these two assumptions.

FTX

Unfortunately, the world of FTX was constructed in a way that violated these two assumptions.

First of all, FTX was created and led by an individual, Sam Bankman-Fried, who had no training, had no experience, and had no staff that would provide him with the resources to run a major $32 billion organization, let alone manage a cutting-edge technology in a segment of the monetary world that was completely “cutting edge.”

The result was “a mess.”

Yet, billions and billions of dollars were given to this young man, less than thirty years old, to build such an empire.

And, there was no market oversight or regulation to guide a young company into appropriate channels of construction and leadership.

Consequently, FTX was constructed out of good ideas accompanied by little experience and little information about how to run such a company and account for it.

Investors did not have complete information. No one had complete information. Information is costly and the application of information is even costlier.

Those that have gone through the books of FTX are amazed. Amazed at how badly things were handled.

Second

The cryptocurrency world was also built around the assumption that cryptocurrencies would provide economic value to the product by being a medium of exchange.

Early on, cryptocurrencies were the successor to bank deposits, an asset that could serve as a medium of exchange and revolutionize the structure of the payments system.

Didn’t happen. The medium of exchange function did not work out.

The primary reason for the failure of this function was that information in the cryptocurrency market was missing, could be manipulated, and could be just forgotten.

Guess what?

The central bank of China “banned” cryptocurrencies.

Oh, yes, digital currencies were OK. The Chinese government could build and use digital currencies because the central bank had oversight and control of this kind of an asset.

There was too much uncertainty surrounding the construction, marketing, and execution of cryptocurrencies.

The Chinese believed that the evolution of cryptocurrencies could not be regulated or controlled.

Therefore, ban them!

This meant that cryptocurrencies that did develop only had the characteristic of being a store of value. The medium of exchange disappeared.

So, it turned out that if cryptocurrencies did not have the medium of exchange function, cryptocurrencies were like savings accounts that only drew investors when the investors believed that the price of the asset was going to change.

Here we get into Jamie Dimon, leader of JPMorgan, Chase & Co., who, early on, claimed that cryptocurrencies were just a Ponzi scheme, an asset that had no value.

The price of a crypto asset depended solely upon whether or not someone was willing to pay a price for the asset.

No buyers, no value.

Third, The Fed Bubble

But, there were buyers around.

Lots and lots of buyers.

It just so happened that the Federal Reserve decided to open up the money window, just around the time that cryptocurrencies became “hot.”

Although Bitcoin (BTC-USD) had been around since 2008, crypto never really caught on until 2020 or so.

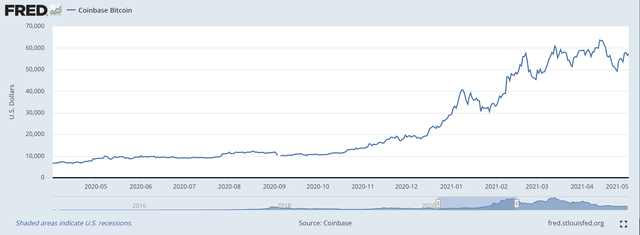

Coinbase Bitcoin (Federal Reserve)

In this picture, the price of bitcoin goes from less than $10,000 to just more than $60,000 during the April 2020 through May 2021 period.

What was the Federal Reserve doing during this same time period?

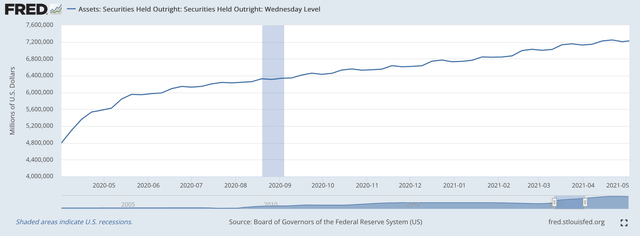

During this time period, the Federal Reserve increased its securities portfolio by $2.3 trillion. Yes, that is in trillions of dollars, moving from a portfolio of around $4.8 trillion to one of $7.3 trillion.

Money was flowing all around the cryptocurrency market.

High-profit people like Sam Bankman-Fried had no trouble raking in the money, even if he had no experience or little or little talent around him.

And, this happened throughout the market. Money was flowing everywhere.

Fourth, The Bubble Burst

The problem is that markets like these cannot continue on.

The Fed talked about monetary tightening throughout the fall of 2021.

The current regime of monetary tightening really got started in the middle of March 2022, but markets responded before then.

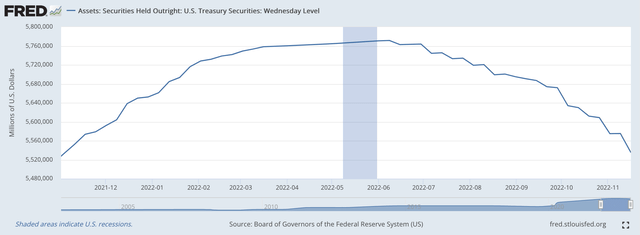

The price of Bitcoin peaked on November 8, 2021, at around $67,500. Here is the bitcoin performance.

Coinbase Bitcoin (Federal Reserve)

On November 8, 2021, bitcoin closed at $67,500, and on November 18, 2022, bitcoin closed at $16,667.

The air was out of the bubble.

As for the Fed…here is what the Fed was doing during this time period.

Note: the Fed was talking up monetary tightening all during 2021, and this “talk” finally got through to the bitcoin market. It peaked in anticipation of the tightening that the Fed was going to do.

The Fed’s quantitative easing ended early in 2022, and Fed tightening began soon thereafter.

FTX Fallout

It was argued that companies like FTX did not need regulation, oversight, or any other kind of government interference.

An innovation market, it was argued, could function on its own… if built right.

After all, the market place had complete information of the situation because information was costless to obtain.

So, cryptocurrencies had little or no supervision.

Cryptocurrencies drew lots of intelligent, energetic, and dedicated young people into its walls.

The cryptocurrency space was greatly benefited by the work of the Federal Reserve that injected trillions of dollars into the financial markets at this time.

Lots and lots of these monies went into the crypto-world, into blank-check companies, and many other investment outlets.

And, time caught up with the crypto-world, just like it is catching up with other segments of the financial world that benefited from the Fed’s largess.

The assumptions lurking behind the rise of the crypto-world are convenient for logically consistent, deductive philosophical systems.

However, when applied to the real world, they can come up short.

I will not argue: I am in favor of less regulation rather than more regulation.

But, I am not in favor of no regulation.

We have just experienced the reason for this conclusion.

Be the first to comment