sefa ozel

Investment Thesis

It’s been a year since FS/KKR Advisors consolidated its funds, culminating its efforts with the FS KKR Capital Corp (NYSE:FSK) and FS KKR Capital Corp. II (FSKR) merger, creating the second-largest BDC, for whatever that’s worth. NAV gains in recent quarters are primarily due to external market forces (renewed interest in private equity) and a temporary share buyback program instead of an advantage from its newly acquired consolidated scale. Management had been running one origination platform for all its funds, engaging in big deals before dividing financing across its now merged BDCs. Today, it consolidates its investments in one book, but fundamentally, neither the deal size nor the origination platform has changed.

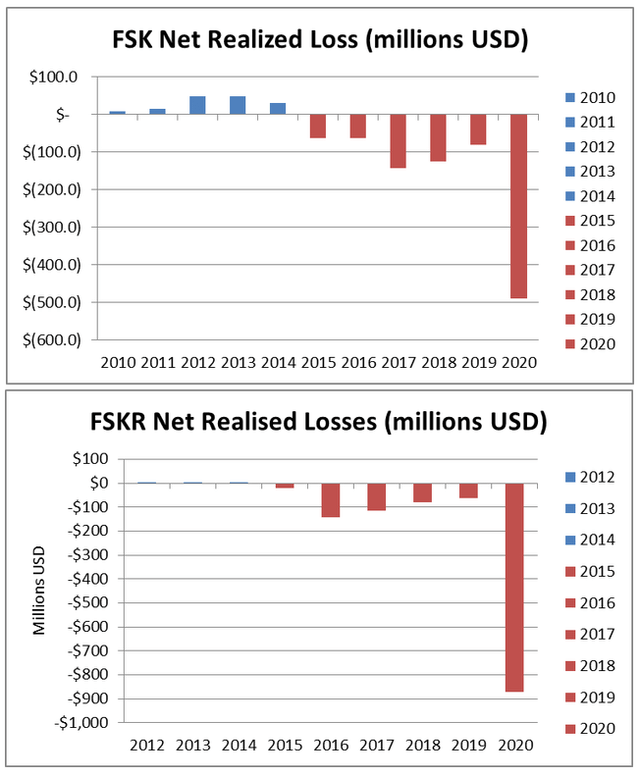

Over the years, FSK, and its sister funds, accumulated hundreds of millions of dollars in realized losses, highlighting the investment risks inherent in the US middle market and perhaps an overestimated origination platform. Despite the defensive nature of debt investments (which constitute the majority of FSK’s holdings), I don’t believe that the dividend yield is enough to compensate for capital gain losses in a recession scenario. Only a fifth of publicly-traded BDCs have a history that goes beyond the great recession, and only one succeeded in recovering NAV lost during the period.

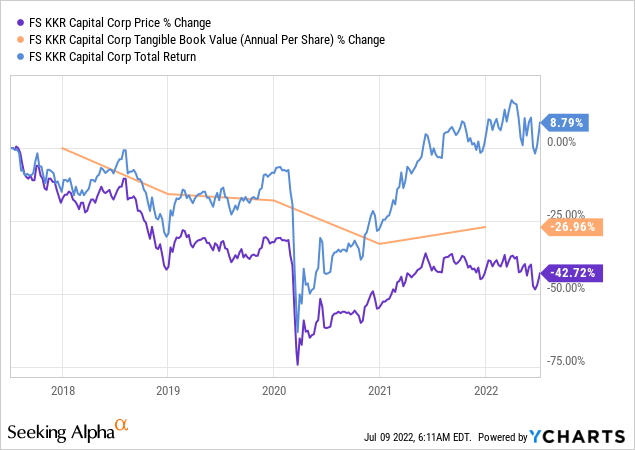

Historically, three-quarters of all BDCs with more than three years of operations have lost NAV since inception. However, dividend distributions were more than enough to cover capital losses, bringing total return to positive territory. I believe these dynamics will continue in a no-recession scenario, especially given the renewed interest in PE, supporting book values. The following chart summarizes these dynamics, showing FSK’s decreasing NAV and share price over the past five years, offset by dividend yield, generating a 9% total return.

The stock market has been better at discounting prospects of a recession in recent months than the BDC sector, as mirrored in a 20% decline in the S&P 500 (SPY) compared to a 10% decline in the Wells Fargo BDC Index (BDCZ), highlighting the former’s imbalanced risk/reward profile. Thus, I believe that the stock market offers a better risk-adjusted price level compared to the BDC sector.

Revenue Trends

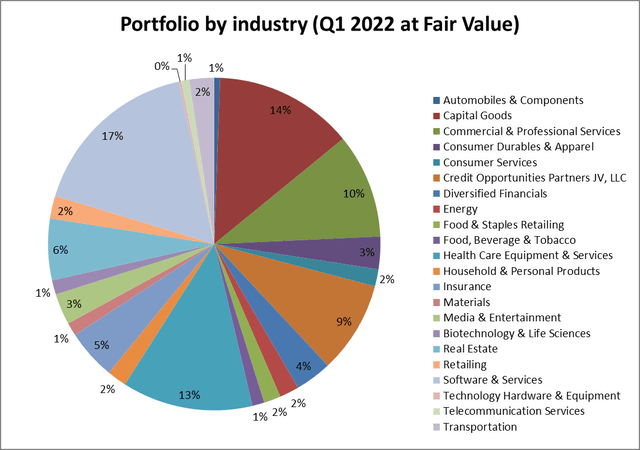

FSK carries well-diversified private equity and debt portfolio, consisting of 193 portfolio companies across several industries and regions (including 5% international exposure,) reducing concentration risk but not necessarily translating to above-average returns.

Table created by the author (FS KKR Capital Corp)

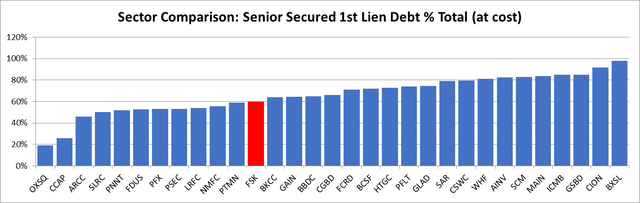

Portfolio diversification is weighted against above-average exposure to second-lien and asset-based financing having characteristics of Mezzanine debt, exacerbating risks associated with investing in leveraged SMEs.

Author’s estimates, based on company filings

Management’s appetite for risk created hundreds of millions of realized losses, aside from the initial years of inception when the company benefitted from the economic rebound after the great recession when it was formed.

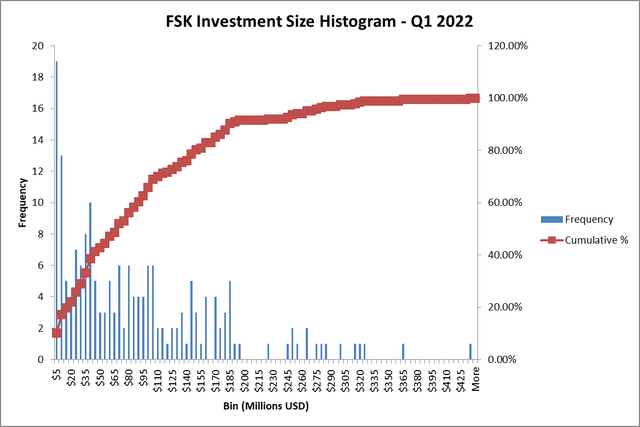

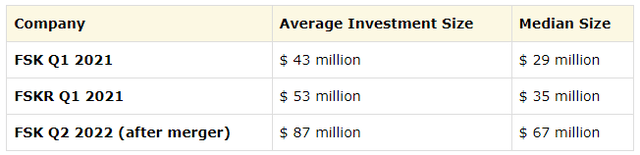

In its annual report, management lists FSK’s size as a competitive advantage, allowing it to pursue opportunities in a less crowded market, with fewer lenders having enough scale to serve the financing needs of larger firms. Last year’s merger created the second-largest BDC with an average investment size of $87 million and a median of $67 million, double that before the merger.

Excluding COPJV. EUR/USD 1.03, SEK/USD 0.0095, GBP/USD 1.19, AUD/USD 0.68, CAD/USD 0.77 (Author’s estimates based on FSK filings) Author’s estimates based on company filings. Excludes COPJV

However, the investment size increase is primarily due to the similarity between FSK and FSKR portfolios rather than a shift in investment strategy. For example, FSK and FSKR shared 71 % of their holdings, investing in the same companies. Adding COPJV to the mix will likely lead to higher average investment size, given that the joint venture also shares 70% of its portfolio with FSK.

Next quarter, I believe FSK will record increased investment income, most likely followed by a dividend increase, in line with the general rise in benchmark interest rates. Most of the company’s debt holdings are tied to floating interest payments covenants, as opposed to its debt, primarily consisting of fixed-rate notes. In Q1, LIBOR increased from 0.2% to 0.96%. However, it remained below average rate floors attached to debt covenants, mostly around 1%. It wasn’t until April this year that LIBOR exceeded 1% reaching 2.35% at the time of this writing. Thus, the impact of rising interest rates on revenue will be most likely felt in the Q2 earnings release.

Balance Sheet

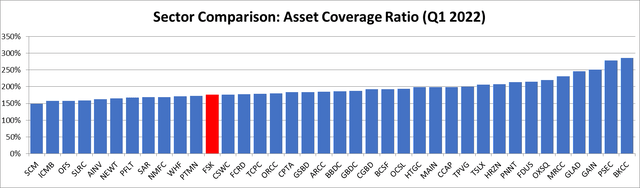

As of March 2022, FSK recorded $9.7 billion in debt, with an effective borrowing rate of 3.14%, giving it an advantage over other leveraged peers with higher borrowing costs. Interest expenses stood at $77 million, compared to $297 million in EBIT, translating to a solid interest coverage ratio. The main concern is that FSK’s Asset Coverage ratio stands near regulatory limits. A 15% reduction in fair value, say in a recession scenario, would push FSK out of asset coverage regulatory limits of 150%, forcing management to raise equity at a time of economic turbulence, a disastrous outcome in terms of dilution.

Author’s estimates based on company filings

Summary

Three-quarters of publicly-listed BDCs have lost NAV since inception, including FSK, which lost more than a third of NAV per share since 2012, demonstrating a frail asset base and risks associated with investing in leveraged SMEs. Only 20% of BDCs have experienced a recession, and only one succeeded in recovering NAV it lost during the 2007 – 2009 financial crises.

As prospects of a recession loom, it is critical to have conviction in your assets, deposing high-risk securities that might not survive a recession. FSK was founded in 2009, capitalizing on the post-recession rebound a few years after its foundation. However, despite the US GDP growing by 45% since its inception, NAV performance has been dismal. The company’s high leverage puts it in a precarious situation, near the regulatory leverage limits. When a recession hits, management will be under pressure to raise capital during economic turbulence, exacerbating dilution risk.

Be the first to comment