monticelllo/iStock Editorial via Getty Images

There are major movements happening behind the scenes in the carbon markets.

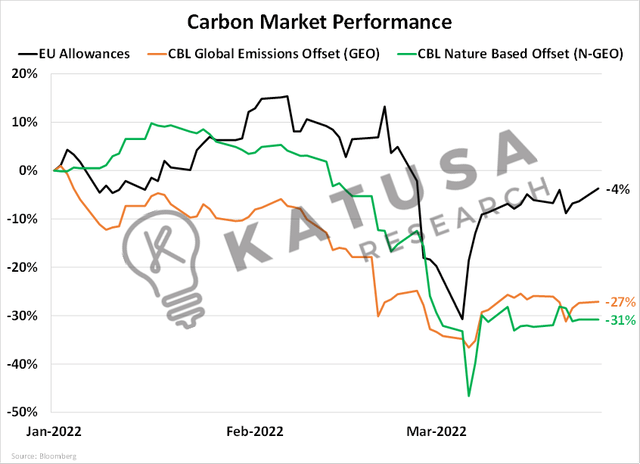

You wouldn’t know it because of the recent price corrections of the EU ETS and Voluntary Markets (NGEO and GEO), caused by the Ukraine and Russia crisis.

Carbon Market Performance 2022 (Katusa Research/Bloomberg)

While a calm breath was needed from fast price spikes (especially in the EU market)….

I’ve never in my career seen a coordinated regulatory framework accelerating at this pace between world governments and major corporations.

Carbon Markets are Moving FAST

SEC Chair Gary Gensler recently made a major announcement that the SEC is looking at climate disclosures.

With new guidelines potentially coming this year, in his words, “It’s essential we get this right.”

- I don’t think 99.99% of investors understand how this could have a massive ripple effect on every single publicly listed stock in North America.

Companies will have to create new departments to deal with coming “Climate Accounting” in their financial statements.

And it’s coming quicker than you think.

According to The Washington Post (emphasis added):

Under a ground-breaking new rule the SEC is expected to propose… hundreds of businesses would be required to measure and disclose greenhouse gas emissions in a standardized way for the first time.

The article goes on to reveal (emphasis added)…

“The move could mark the most sweeping overhaul of corporate disclosure rules in more than a decade, and could put the United States on closer footing with other countries set to begin mandated emissions reporting over the next three years.

Tick. Tock.

The alarm is set.

Fortunately, at Katusa Research, we’ve prepared for this over the last 18 months.

But, I must say, that I’m shocked at how fast things are changing and getting implemented.

We’ve modelled many major commodity companies in the energy and metal sectors and what the effect of showing Scope 1 and 2 emissions will be to their bottom line.

Some companies will be fine, and others will be in big trouble.

From “Barley to Bar”

Major tech darling companies like Tesla (TSLA), Facebook (FB), Apple (AAPL), and Microsoft (MSFT) aren’t out of the woods, either. However, they’re much more ahead of the game than many resource companies.

They’ve outlined net-zero plans and spending a lot of capital.

- For example, in 2021, Apple set aside a $200 million fund for reforestation projects.

The Restore fund will focus on managed forest properties, in which tree-planting activities will become equal to the estimated lifetime carbon emissions produced from charging iPhones.

Like Apple, Microsoft is also aiming to recruit the help of its suppliers and customers through a climate innovation fund valued at over $471 million.

The fund will help the company improve its global development technologies to streamline reducing, capturing, and removing carbon.

Most of the carbon emissions produced by the company come from indirect carbon emissions commonly associated with the manufacturing and the production of its products.

- In 2021, Microsoft emitted 14 million metric tons of carbon, and 13.8 million of it came from indirect carbon emissions

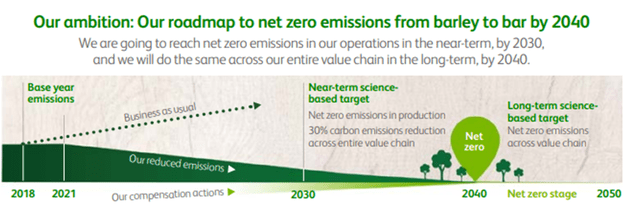

Even liquor giant Heineken (OTCQX:HEINY) is not immune…

One of the largest liquor companies in the world, Heineken set an intermediate goal to reach net-zero emissions in production by 2030. And reduce their value chain by 30%.

Their plan is called “Brew a Better World… From Barley to Bar“.

Heineken Net Zero Outlook “From Barley to Bar”. Company homepage (Heineken Annual Report 2022)

First, The Storm

According to the Glasgow Financial Alliance for Net Zero (GFANZ), $130 trillion has been mobilized for net-zero targets around the world.

That’s a mind-boggling number…

Nearly $16,250 per living person on the planet today.

GFANZ also says that over 3,000 companies have committed to net-zero targets while over 5,000 have committed to science-based targets.

These are staggering figures.

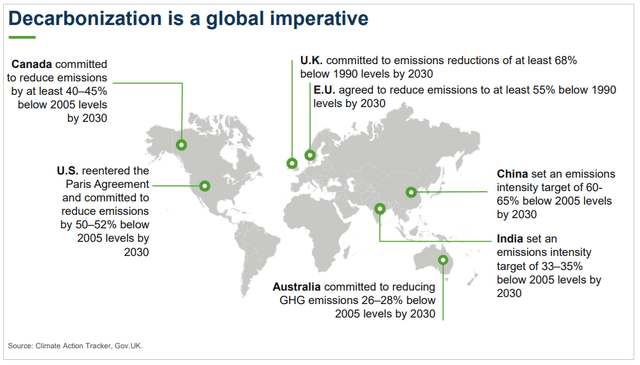

- Decarbonization is a global movement that governments, companies and individuals around the world are buying in to.

Climate Action Tracker, U.K. Government

These days it is nearly impossible to find an asset class which is not already widely available for purchase, sale or consumption worldwide.

Markets these days are deep, well-integrated, and for the most part highly efficient. That wasn’t always the case though.

Rewind to History

In 1611, the Dutch East India Company became the first publicly traded company on the Amsterdam exchange.

In the late 1700s, merchants would gather to sell securities in New York, initiating the creation of the New York Stock Exchange.

Soft commodities like rice, grains and salt along with gold and silver have been bought, sold and traded in markets for centuries. Oil started small also.

Oil is now a multi-trillion dollar a year market.

- I believe that the voluntary carbon market has the ability to grow from a sprouting $1 billion market to a $5-$10 billion market or more, over the coming decade.

Now… could you imagine being a part of the oil trade in its early years?

This is the stage I believe the carbon markets are at right now.

The Next 24 Months Will See Incredible Sector Growth

The adoption curve is real.

- Network effects are already in play with hundreds of public companies announcing their net-zero plans.

The rules, regulations, opportunities and pitfalls are being created before our very eyes today.

If you don’t understand the market, the players involved and the direction the market is going, you could lose your shirt, house and everything else.

That said, newly created sectors also generate enormous opportunity to create wealth.

With any new commodity or sector, thousands of rounders will crop up overnight.

Hundreds of legitimate companies will spring up, too. Only a small handful will actually make it to the big time.

10 percent of your investments make 90 percent of your gains.

What if you knew which 10 percent those were – and you could put money into them?

We’re early. Very early.

This is going to be a wild ride.

Regards,

Marin Katusa

Chairman, Katusa Research

Marin Katusa is the Chairman of www.katusaresearch.com and publisher of the New York Times bestseller “The Colder War” and the Wall Street Journal and Amazon bestseller, “The Rise of America.”

Be the first to comment