RomarioIen/iStock via Getty Images

About the Company

The Del Monte brand has been in existence since 1892. Fresh Del Monte Produce (NYSE:FDP) is a vertically integrated, global organization operating in more than 80 countries. The company owns and leases approximately 99,000 acres of farmland, used for growing high quality fruits and vegetables. They operate more than 40 distribution centers and own a fleet of refrigerated shipping vessels for transporting their produce.

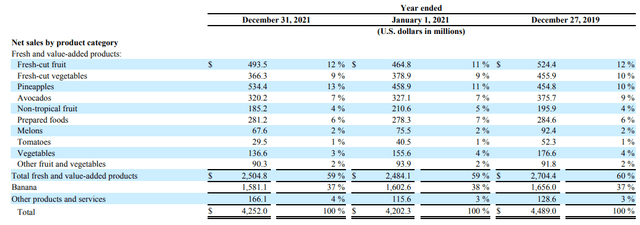

Their primary businesses are bananas and pineapples which account for 37% and 13% of sales, respectively. FDP is the largest marketer of fresh pineapple and the third-largest marketer of bananas in the United States. The remainder of revenues are displayed in the following table:

FDP 2021 10K

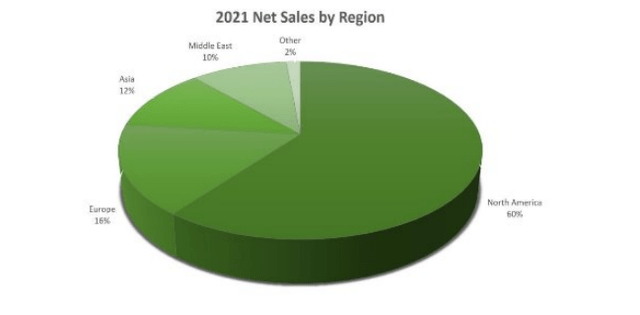

North America accounted for 60% of sales in 2021, followed by Europe, Asia and Middle East.

FDP 2021 10K

In addition to fruit and vegetable production, the firm has diversified into what it refers to as value-added products. Company owned distribution centers and fresh-cut facilities allow for preparation of fresh-cut fruits, vegetables, and prepared salads as well as ripening, sorting, and packaging operations, used to satisfy demand from retailers and foodservice operations. Fresh Del Monte is aggressively pursuing opportunities to expand its product offerings in the value-added space in order to become a less commodity-oriented business.

Operating Performance

When examining the operating performance of FDP, it’s easy to understand why investors have given up on the stock. Revenues were negatively impacted by Covid as a result of restaurants and food service operations shutting down. Expenses have increased significantly due to inflationary pressures across every category of the company’s operations. Transportation, fuel, container prices, fertilizer and labor costs, just to name a few, have skyrocketed. All of the aforementioned issues are expected to remain headwinds for at least the next several quarters.

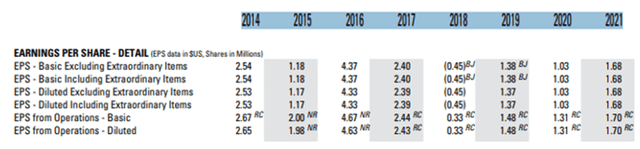

Earnings per share have been all over the map, as demonstrated below:

Compustat

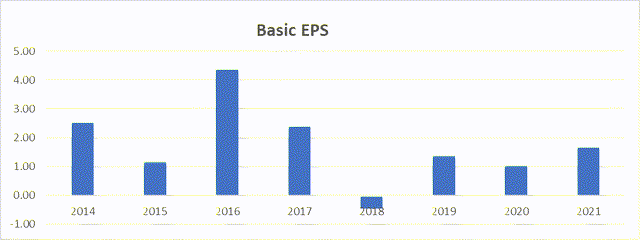

Author

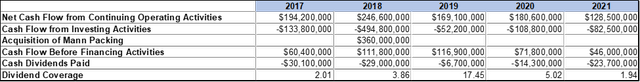

On the positive side, Fresh Del Monte has remained profitable on an operating basis throughout the past eight years. Cash flows from operations minus investing activities provide ample coverage of the dividend and leave room for share repurchases or debt reduction.

Morningstar

Outlook

The near-term outlook remains unclear due to continued Covid lockdowns in Asia, rampant inflation, supply chain constraints and transportation disruptions, but FDP does possess the ability to pass on some of the cost increases which have negatively impacted the bottom line. Management is committed to drive shareholder value through innovation and expansion of value-added categories. The company reported earnings of $0.55 per share during the first quarter of 2022 which is a positive sign that they are able to continue to operate profitably in the current difficult environment. Estimates for this year and next year are $1.41 and $1.95, respectively. Those estimates should be considered a reasonable midpoint with a high degree of variability attached.

Investment Thesis

The current stock price has a lot of negative news priced in. Fresh Demonte’s business is simple, and its products are, and always will be, in great demand. Consumer preferences for fresh fruits and vegetables continue to grow as diets become healthier and global population growth expands.

Although FDP has produced highly inconsistent earnings, the company has remained solidly profitable and shareholder equity has continued to grow. The management team is strongly aligned with shareholders and is therefore highly incentivized to drive additional value.

Risk reward remains favorable with a tangible book value of nearly $27 per share limiting downside. The company owns 60 thousand acres of farmland, in addition to its distribution centers and fleet of thirteen ships, which all provide insulation from inflation. Barriers to entry are enormous and large customers demand the quality, reliability and scale provided by Fresh Del Monte.

There is no near-term catalyst to drive the stock price higher, but patient investors should eventually be rewarded. Mohammad Abu-Ghazaleh, the current CEO, is eighty years old. He has been managing the company since 1996 and the stock price is in the same place it was in 1998. It is fair to say that either a new management team or a sale of the company would both lead to a significant higher revaluation of the stock. Continued weakness should be used as an opportunity to scale in to the stock, as long as the firm continues to increase shareholder equity.

Be the first to comment