Philiphotographer/iStock Unreleased via Getty Images

Thesis

I have had Fresenius SE & Co. KGaA (OTCPK:FSNUF, OTCPK:FSNUY) shares in my portfolio for several years and have occasionally bought additional shares to lower my average purchase price.

I like the company that is serving and profiting from a megatrend in the form of an aging population. By the way: Fresenius is the only dividend aristocrat in Germany’s most important stock index, the DAX, which means the company has increased its dividend every year for at least 25 in a row.

Based on a sum-of-the-parts (SOTP) analysis and due to the low P/E ratio and solid growth prospects, I consider the company undervalued and thus a strong buy. In particular, prices below 25 euros are buy prices in my view, which is why I almost doubled my position in the stock last week.

I have not yet purchased any shares in Fresenius Medical Care AG & Co. KGaA (FMS / FMCQF), however, this company also seems to be undervalued.

In my opinion, the market is overvaluing the short-term problems of the Fresenius Group, which in turn gives opportunities for long-term gains.

FMC is also a buy, but I prefer the diversified group, which is purely a matter of taste. I’m hoping that the price might go into the low-twenties or even lower in the next few weeks. If that happens, I will buy even more shares.

Business Model

Fresenius is a vertically integrated and leading health care group with more than 300,000 employees and a global presence in over 100 countries. Annual sales in the previous fiscal year of €37.5bn were generated in 4 business areas:

Illustration 1: Fresenius Group Overview (Fresenius Company Presentation March 2022)

Fresenius Medical Care: The company is a global market leader in dialysis with ca. 345.000 patients in more than 4.100 clinics. Fresenius holds only about 32% of its subsidiary FMC. However, due to the control exercised, FMC is fully consolidated.

Fresenius Kabi: Kabi supplies drugs and medical devices for infusion, transfusion and clinical nutrition. This is the core business that was the focus when the company was founded in 1912. The management is convinced that this business will bring the greatest growth and return in the future.

Fresenius Helios: Helios is Europe’s largest private hospital operator with a 6% share in German acute care and 12% in Spanish private hospital market.

Fresenius Vamed: Vamed is a leading global specialist for hospital services and projects. The company manages construction and expansion projects and provides services for healthcare facilities worldwide. Fresenius holds only 77% of the shares.

The most important sales region is North America, especially the USA with a share of sales of around 40%.

Difficult market conditions put pressure on share price

Even though the Corona pandemic is currently considered to be largely over, Fresenius and especially FMC are still suffering from the after-effects and side-effects of the pandemic like:

- Dialysis patients were particularly severely affected by Covid-19 due to their age and exhibited excess mortality, which is a main issue for FMC.

- The pandemic puts pressure on healthcare systems and health insurers, whose regulatory influences determine Fresenius cash-generating capacity.

- The U.S. labor market has shifted strongly in favor of employees after Covid-19. It has therefore become more difficult for Fresenius (especially for FMC) to find suitable employees at reasonable salaries.

- The U.S. government health insurance company Medicare only increases its rates with a delay of up to two years. In a phase of rapidly rising prices and thus costs, Fresenius, like many other companies, is therefore unable to adjust sufficiently to inflation.

Do these headwinds justify the current share price?

I believe that the capital market has overweighted the current problems and lost sight of the good long-term prospects and the advantages of the company’s business model like:

- Fresenius good diversification along the value chain

- Fresenius & FMCs sustainable businesses which serve the macro trends of an increasingly aging population

- The group and its subsidiaries economies of scale & synergies

- Bargaining power of the group and its subsidiaries due to strong market positions in key regions and markets and the company’s sheer size

- Strong long term growth potential due to good positioning in emerging markets

However, Fresenius Management is under pressure to regain the confidence of the capital market and the confidence of its most important and long-term shareholder, the Else Kröner Fresenius Stiftung. The current dividend yield of 3.7% for both companies is really good for such stable business models, but of course not satisfactory without the corresponding share price performance.

Therefore, Fresenius wants to sharpen its profile and is now pursuing the following strategy for its segments:

The key driver for Fresenius’ growth prospects is to strengthen the products side of Fresenius Kabi, the historical core of the company. The company, therefore, identified key goals with its Vision 2026 initiative. As one of many steps Fresenius Kabi recently announced the acquisition of a majority stake in mAbxience and the acquisition of Ivenix. – mAbxience enhances Kabi’s presence in high-growth biopharmaceutical market and Ivenix strengthens Kabi’s MedTech business (via a next-generation infusion therapy platform in the U.S.).

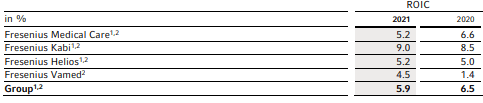

Given the segment’s ROIC, which is by far higher than the ROIC of the others, the strategy seems reasonable.

Fresenius – ROIC of business segments (Fresenius annual report 2021 p. 86)

For Helios and Vamed, Fresenius management is open to sell stakes. Possible is a sale of 20% of the stakes in Helios to a Private Equity firm to accelerate growth. According to Bloomberg, Helios is valued at $15bn.

FMC, which is currently the biggest concern, will be reorganized to leverage efficiencies. A sale of the remaining shares currently seems unlikely to me, as FMCs share price is very low and Fresenius continues to emphasize that vertical integration is a strategic cornerstone of the company – at least in the short to medium-term.

SOTP valuation prices Fresenius as a bargain

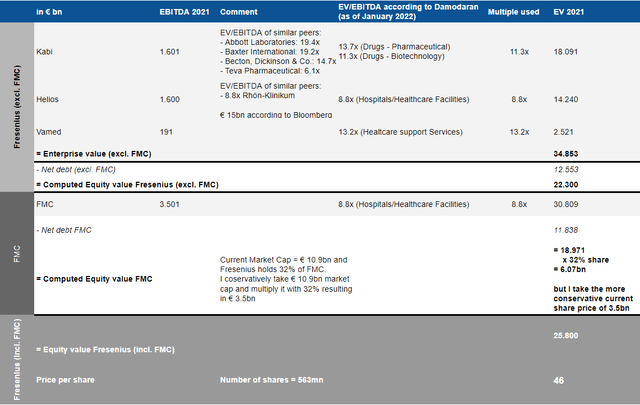

Therefore, I took the EBITDA of the four segments for 2021 and multiplied it by an appropriate multiple, which a I took from the valuation master Damodaran. To check the multiples for plausibility, I compared them with multiples from peers (if available) or other sources like rumors from the media (e.g., the valuation of Helios).

After calculating the enterprise value for the first three segments, I subtracted the net debt of these segments to calculate the equity value, excluding the shares of FMC. To account for a margin of safety, I used the more conservative multiples and values, when more than one reasonable value was available.

Fresenius SOTP Analysis (Own representation)

Subsequently, I also valued the shares in FMC. Once again, I found a large discrepancy between the current market value and the valuation based on multiples. FMC also seens to be undervalued according to various reasons:

- The equity value based on the EV/EBITDA-multiple less net debt at the end of 2021 should be around $19bn instead of the current market value of $10.9bn – an upside of more than 70%.

- The price-earnings ratio is also low at around 12x, even lower than when the Corona pandemic broke out. In my opinion, a realistic P/E ratio is between 16x and 18x, which gives an upside potential of more than 30 up to to 50%.

- Even though many patients have died from Covid, which is truly a human tragedy, I see no reason why new patient peaks should be reached in the next few years. FMC continues to expand and people are getting older.

The market seems to have overestimated the current problems for both company’s and punished the stocks too much. Moody’s obviously has a similar view and has recently confirmed FMCs rating and considers the operational headwinds to be temporary.

In the end, I added both equity values (but took the current market value for FMC) and divided the final equity value by the number of shares and obtained a fair (conservatively calculated) share price of around 46 euros for Fresenius, i.e., an upside of over 80%.

Fresenius P/E ratio at a historical low

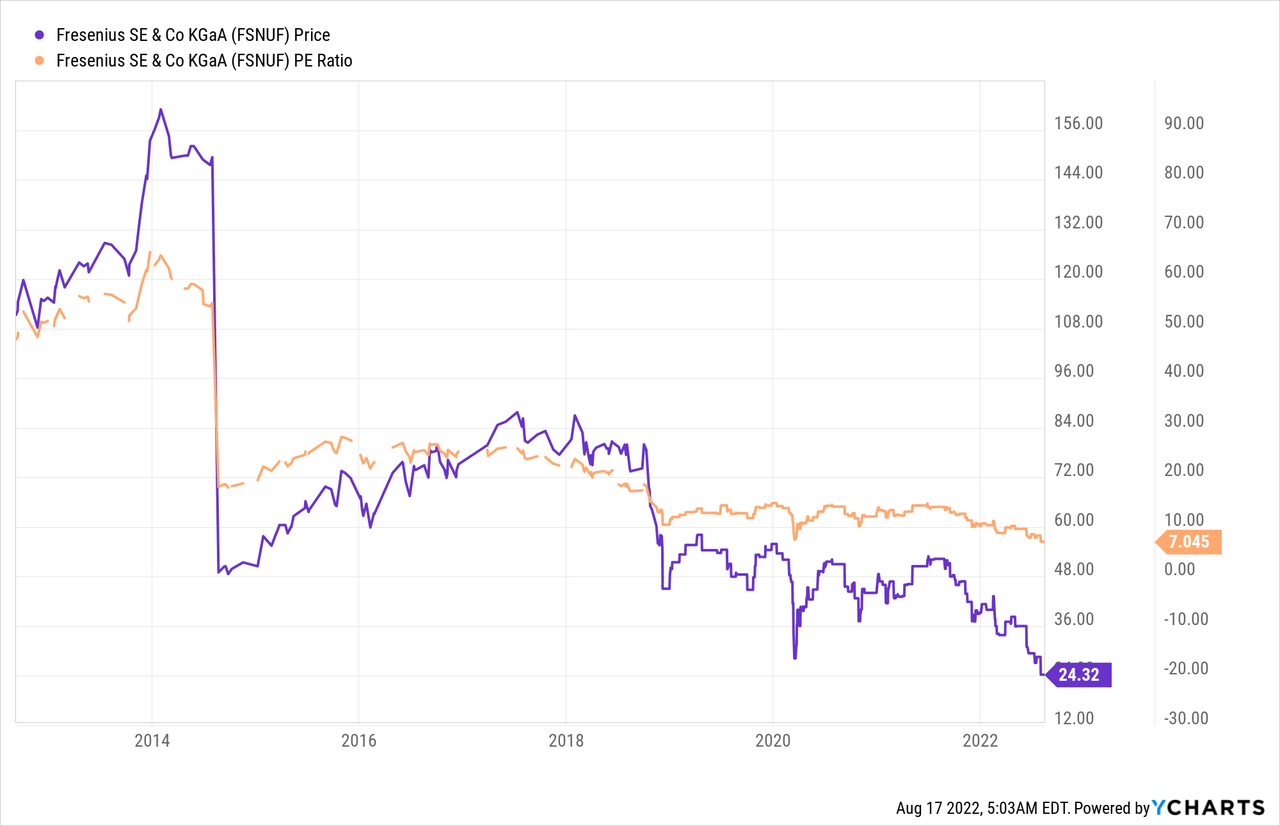

To check the plausibility of the calculated value again, just take a look at the chart. Since the chart itself is very powerful, I will be brief: Fresenius currently has a P/E of 7x, which I think is way too cheap given the growth prospects.

The level is about the same as at the beginning of Covid-19. Everyone can ask themselves the question: When was the outlook and uncertainty in the healthcare sector worse? Then or now?

Given the stable business model, I think a normalized P/E of 15x is plausible, resulting in an upside potential of over 80%.

Conclusion

Fresenius and its well known subsidiary Fresenius Medical Care appear to be significantly undervalued with regard to my multiple approach (EV/EBITDA and P/E). Management has recognized this and wants to bring out the fair value of Fresenius. Since I like Fresenius’ vertical integration much better than FMC’s pure dialysis business and FMC has bigger challenges overall, I give Fresenius a “strong buy” and FMC a “buy.”

It could take some time for the market to revise its assessment of Fresenius and FMC. Until then, we can look forward to a dividend yield of 3.7% for both companies, which I think is really good value for such stable business models.

Be the first to comment