FactoryTh/iStock via Getty Images

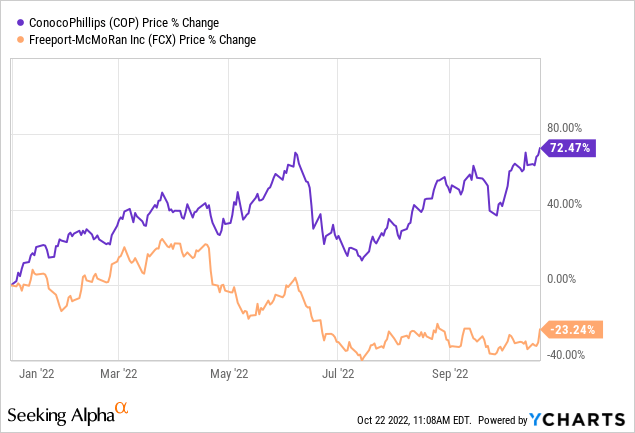

Shares of Freeport-McMoRan (NYSE:FCX) were up 10% on Friday, greatly outpacing the ~2.4% rise in the DJIA and S&P500 indexes. Was the pop in the shares due to short-covering, a restart of stock buybacks (suspended since July, but $3.2 billion available under FCX’s current repurchase program), or were investors stepping in to make long-term investments in the future of copper? Perhaps all of the above, but I suppose only time will tell. One thing we do know is that ConocoPhillips’ (COP) CEO Ryan Lance recently sold a big slug of his oil & gas company’s stock and bought nearly $1 million worth of FCX. The two stocks have certainly been on opposing trajectories this year (see below). That being the case, it appears as though Lance was taking advantage of COP being at a near all-time high in order to buy a beaten down FCX stock that – given the global EV and clean-energy transition – has excellent long-term potential. Investors sitting on substantial energy stock gains might consider doing the same.

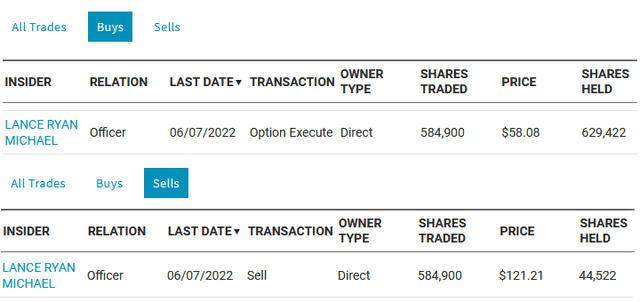

As shown in the graphic below, Lance bought 584,900 share of COP in June via a company stock option priced at $58.08/share. On the same day, he sold those shares for $121.21/share, reaping a whopping $36.9 million profit:

Source: Nasdaq.com

Early last month we learned that Lance bought nearly $1 million worth of Freeport-McMoRan stock at an average price of $31.88/share. While that pales in comparison to the $36.9 million profit he made in shares of COP, it is a notable purchase.

Now, I should point out that in November of last year Lance was appointed to the Freeport-McMoRan’s Board of Directors as a member of the Corporate Responsibility Committee. That being the case, one could argue that the $1 million purchase in FCX stock was simply a token of Lance’s appreciation for landing an arguably cushy FCX Board position. However, I think there is more to the story than that.

Obviously, as both CEO and Chairman of the Board at Conoco, Lance is on the receiving end of perpetual annual COP stock option grants as long as he retains those dual roles at the company. So, as a natural means of diversification, the huge COP stock sale makes sense for his portfolio – especially given the fact that – in one year alone – the sales price was more than double the option price.

Going a bit deeper on copper, it is clear that global demand is likely to be very strong for many years into the future. That said, the 2022 bear market’s risk-off sentiment (excluding Friday’s massive gains …) has severely beaten down the price of copper from its March high of ~$5/lb by about 30%:

Which, of course, explains why the stock of Freeport-McMoRan has also been beaten down this year. However, despite the current relatively low-price of copper, note what Freeport-McMoRan had to say about market conditions in its Q3 Earnings report on Thursday:

Physical market fundamentals remain tight as evidenced by low levels of global exchange stocks. FCX’s global customer base reports healthy demand for copper. FCX believes the outlook for copper fundamentals in the medium- and long-term remain favorable, with studies indicating that demand for copper may double in 15 years based on the global movement towards decarbonization. FCX also believes substantial new mine supply development will be required to meet the goals of the global energy transition, and current prices for copper are insufficient to support new mine supply development, which is expected to add to future supply deficits.

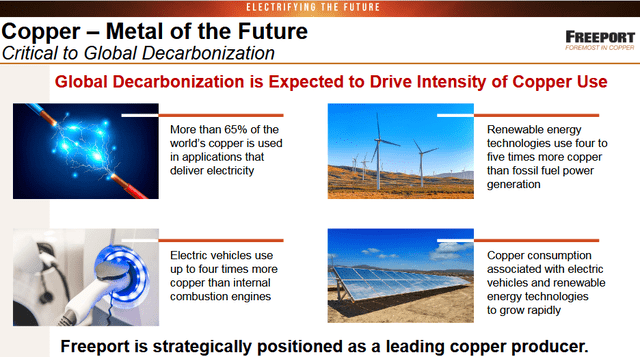

Indeed, as most of you know, copper is required for a plethora of uses including transmission lines, wires, windings for electric motors, and etchings on printed circuit boards that are used in virtually every electronic product. The bottom line here: there is no “clean energy” transition without copper.

Meantime, despite what some considered to be a Q3 earnings miss last week, note what Tesla (TSLA) CEO Elon Musk had to say about demand for the company’s EVs on the Q3 conference call:

There weren’t enough boats, there weren’t enough trains, there weren’t enough car carriers. Tesla got too big. I can’t emphasize enough we have excellent demand for [the fourth quarter] and we expect to sell every car we can make as far in the future as we can see. To be frank, we’re very pedal to the metal come rain or shine. We are not reducing our production in any meaningful way, recession or not recession.

Indeed, in Q3 Tesla produced over 365,000 vehicles and delivered over 343,000 vehicles (+54% yoy). That’s a lot of electric motors, and a lot of copper windings on those motors. Indeed, on the previously mentioned conference call, Musk went on to say:

Demand is a little higher than it would otherwise be. But as I said earlier, we are extremely confident of the great Q4, and we anticipate continuing to grow our vehicle production, sales deliveries by — on average 50% a year as far into the future as we can see.

As for a recession, typically recessions cause a significant drop in copper demand. However, we might find that this time around copper demand will be much more resilient as compared to the recent past. That’s because the transition to EVs and clean energy is likely to continue through a recession. As a result, copper demand is likely to continue to be quite healthy. I say that because the world’s two biggest economies, the U.S. and China, have both passed strong governmental support for EVs and clean energy. As a result, and as Freeport likes to point out, copper truly is the “metal of the future”:

Source: FCX Q3 Presentation

In the U.S., the Biden administration was able to push-through the largest infrastructure legislation in many decades as well as a very large clean-energy package. Spending on both of these packages will continue for years to come (recession or no recession) as the U.S. is now competing head-on with China in EVs and clean-energy technology – and for the excellent manufacturing jobs that go along with the related clean-tech supply chains.

Meantime, readers of my past Seeking Alpha articles on Chinese EV and battery manufacturer BYD (OTCPK:BYDDY) (OTCPK:BYDDF) already know that the Chinese government has for many years been lending strong support to the EV, battery, and clean energy supply chains because the Chinese understood years ago the strategy economic advantage it would have by controlling the clean-tech supply chains the world was demanding (even as the U.S. was going off half-cocked on the idiotic “strategy” to “make coal great again”). Note that BYD’s EV sales (and profit) are soaring while a German rental car company recently agreed to by 100,000 BYD EVs.

That being the case, my view is that the fundamental underlying demand for copper over the coming years is very bullish. We could very easily see an extended period of structural supply deficits in copper because the current low-price of copper is not sufficient to support investment in developing new mines or even to add significant capacity expansion at existing mines.

Risks

Risks include lower copper prices as well as – to a lesser extent – lower prices for gold and molybdenum. Note that in Q3 FCX produced:

- 1.06 billion lbs of copper

- 448,000 ounces of gold

- 19 million pounds of molybdenum

Note that each $0.25/lb increase in the price of copper adds an estimated $1 billion in EBITDA for FCX.

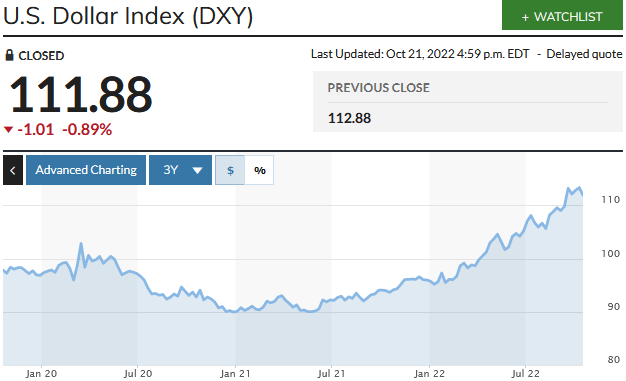

Being globally traded commodities, each of FCX’s three main commodities are typically traded in U.S. dollars. That being the case, the strong U.S. dollar has been a huge headwind for FCX this year because it pushes down the prices of these commodities:

MarketWatch

However, FX markets change over time and the U.S. dollar is not likely to keep rising at the recent rate or stay this strong forever. In commodities, it’s always better to invest in down-cycles as opposed to up-cycles.

Another downside risk would be continued economic weakness in China due to COVID-19 pandemic related shut-downs and global economic weakness due to Putin’s horrific war on Ukraine that effectively broke the global energy and food supply chains. That has led to rampant global inflation and rising U.S. interest rates (thus, one reason the U.S. dollar has been so strong).

An upside catalyst is the potential for a strong rebound in copper prices due to continuing “healthy demand” as reported by FCX in the Q3 report. A copper price rebound could come sooner than many investors expect – even if the U.S. were to fall into recession next year. FCX is highly levered to the price of copper: a $0.50/lb rebound in the price of copper to $4 would mean an estimated $2 billion in additional incremental EBITDA for Freeport-McMoRan. That is an estimated $1.40/share and is considerably more than FCX’s current annual dividend of only $0.90/share.

Summary & Conclusion

I think the fundamental set-up for copper going forward is very bullish. Although buying FCX stock now may be a bit early, it is always better to buy commodity producers during down-cycles and copper is – no doubt – currently in a down cycle. However, demand remains strong and there is no way that EV and clean-tech related demand is going to be satisfied without continued growth in the copper supply. That is going to lead to rising copper prices, and a rising stock price for Freeport-McMoRan. This may be one reason ConocoPhillips’ CEO has been selling oil and buying copper. I have done the same. FCX is a STRONG BUY.

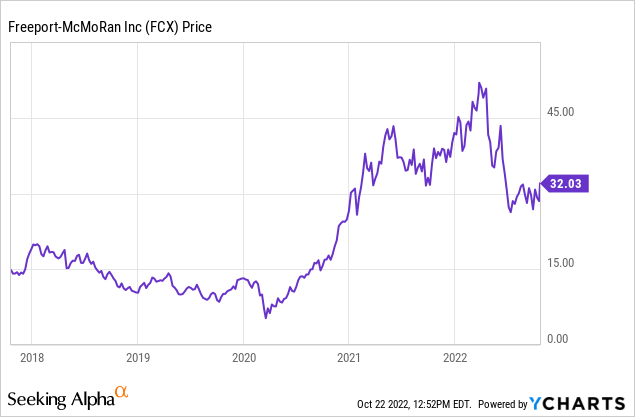

I’ll end with a 5-year price chart of FCX’s stock price and note that as recently as April the stock was over $50/share, more than double the current price:

Be the first to comment