Fahroni/iStock via Getty Images

On 8 June 2022, the Freeport LNG export facility on Quintana Island in Brazoria Co., Texas, suffered a leak in the pipe racks, which support the transfer of LNG from the storage tank area to the terminal’s dock facilities, resulting in an explosion and subsequent fire. Liquefaction operations and approximately 2 Bcf/d of feed gas deliveries were suspended, with preliminary expectations for a three-week complete shutdown. On 14 June 2022, the project operator revealed that a return to normal operation could be delayed until late 2022 with resumption of partial activity in about 90 days.

The market’s initial reaction was swift and expanded following the project operator’s update on 14 June suggesting a longer outage period.

The bearish demand implications led to the New York Mercantile Exchange (NYMEX) prompt month contract quickly shedding about $0.68/MMBtu, or over 7%, to fall to $8.61/MMBtu by 13 June 2022. Following the 14 June update, NYMEX cratered by nearly 19% during the trading session to $7/MMBtu, before recovering some ground to end at $7.19/MMBtu. Nonetheless, NYMEX volatility remains high while production is still rangebound (95-96 Bcf/d) and a heatwave accelerates gas-fired power generation.

The price shock served as a form of whiplash for the market, which had been navigating record highs before the incident. Henry Hub prices had previously risen sharply in the several months preceding the explosion, briefly surpassing $9/MMBtu in early June 2022. Concerns over supply from production in the prevailing capital discipline environment have been compounded by limited fuel-switching flexibility in the power sector between coal and gas. At the same time, US lower-48 LNG feed gas volumes had risen to record levels. The culmination spooked markets and contributed to prices that continued to rise amid a 341 Bcf storage deficit (below the lagging five-year average) as of May 2022.

The longer outage extending through much of the summer season will have far-reaching implications for the US lower-48 market and its pricing benchmark, Henry Hub.

NYMEX prompt month settlements retreated to roughly $6/MMBtu following the Energy Information Administration (EIA) reporting a much larger-than-expected net injection for the week ended 17 June, even amid high power burn. The EIA reported a net injection into US gas storage facilities of 74 Bcf that week, far outstripping the market consensus and the most unexpected build took place in the South Central region – the region that houses Freeport LNG.

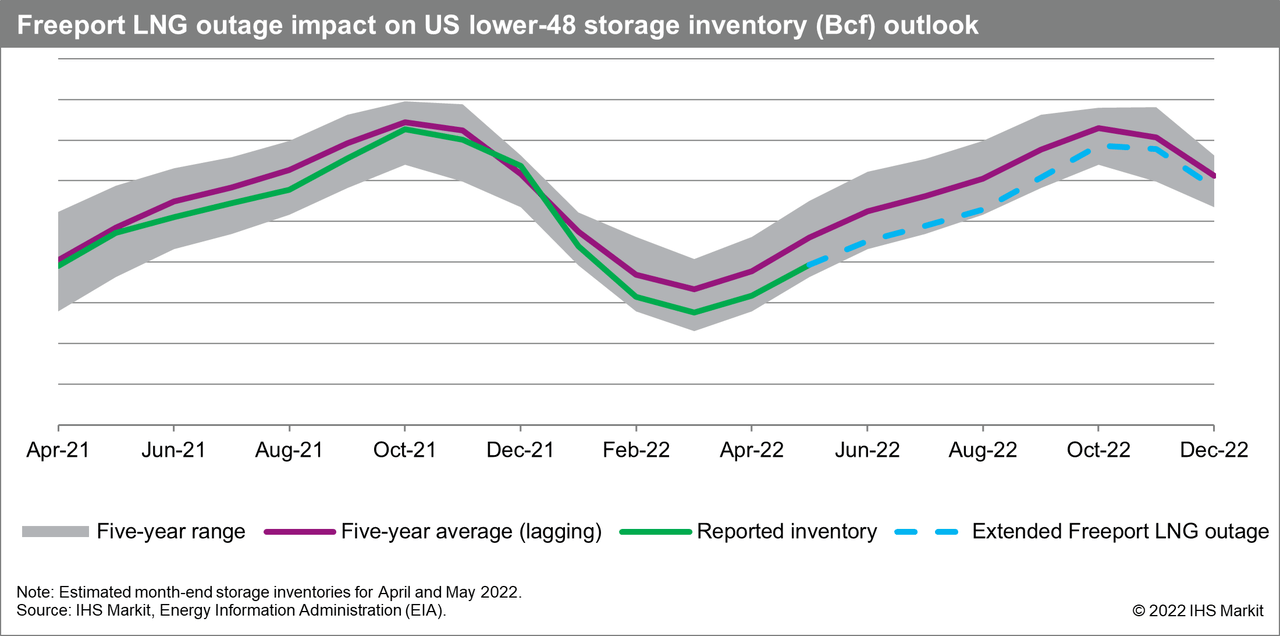

Even if partial liquefaction and export operations resume at the facility in the second half of September (approximately 90 days from the 14 June 2022 announcement), this summer’s storage refill rate will significantly accelerate above our earlier expectations, all else held equal.

Storage inventories will likely exit summer 4% below the prior five-year average, but 7% higher than our short-term outlook prior to the unexpected outage (see Figure 1).

The timing of the Freeport incident and shut-in of roughly 2 Bcf/d of feed gas demand may partially be offset by elevated gas-fired power generation in June. A widespread heatwave is setting record temperatures in many parts of the contiguous United States, and wildfire smoke in the US West could possibly displace some solar generation with natural gas. Prior to the Freeport LNG incident, or the first week of June, US and South Texas power demand averaged 32 Bcf/d and 4.3 Bcf/d, respectively. The following weeks saw daily US power burn top 40 Bcf/d on most days, and Texas power burn surged above 5 Bcf/d on nearly half the days over the same period.

The roughly 2 Bcf/d of displaced Freeport LNG feed gas cannot meet rising power loads throughout the United States and is mostly captive to South Texas and around the Gulf Coast owing to its supply origins and infrastructure limitations. Freeport LNG’s supply will mostly be redirected to storage while the balance serves rising power demand in South Texas. The redistribution of gas over the balance of the summer season will have a material impact on shrinking the inventory deficits and make for a more bearish winter than previously expected.

While the market should still face a storage deficit at the tail end of summer, prices are positioned to ease rapidly in September-October as cooling demand swiftly declines.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment