Pgiam/iStock via Getty Images

The stock of Four Corners Property Trust (NYSE:FCPT) has declined 19% this year, slightly less than the S&P 500, which has shed 25% during this period. Due to the decline of its stock price, the REIT is currently offering a 7-year high dividend yield of 5.6%. When a stock offers such a high yield, it usually signals that a dividend cut may be just around the corner. Many investors probably think that the dividend of FCPT is not safe, particularly given its elevated AFFO payout ratio of 82%. However, the dividend of this defensive REIT is safer than most investors think.

Business overview

FCPT was formed with the spin-off of Darden Restaurants (DRI) in late 2015. The REIT initially had only the restaurant properties of Darden Restaurants but it has now expanded to a few other property types, such as auto service stores and medical retail stores. The broader scope of FCPT has greatly increased its options in the acquisition of new properties and thus it has improved its growth prospects. It is also important to note that the non-restaurant properties of the trust are resistant to the threat of e-commerce.

FCPT has a triple-net structure and thus its tenants are responsible for property maintenance, taxes and insurance. As a result, the REIT enjoys much higher operating margins than most REITs. In addition, while many REITs were severely hurt by the coronavirus crisis in 2020, FCPT proved markedly resilient. In that year, the REIT grew its revenue and its funds from operations [FFO] per unit by 7% and 3%, respectively.

Most REITs are currently facing another strong headwind, namely the surge of inflation to a 40-year high. High inflation increases the operating costs of REITs and thus it hurts their operating margins. In addition, the Fed is currently raising interest rates aggressively in an effort to keep inflation under control. Consequently, some REITs are facing increased interest expenses.

FCPT seems to be fairly resilient to the double impact of inflation on the REIT sector. In the most recent quarter, FCPT grew its rental revenue by 14% and its adjusted FFO per unit by 8% over the prior year’s quarter, despite a 16% increase in depreciation, amortization and other expenses. Moreover, FCPT has secured 87.5% of its term loans of $400 million at fixed rates and hence it is protected from rising interest rates to a great extent. Thanks to its resilience in the highly inflationary environment prevailing right now, FCPT is expected by analysts to grow its FFO per unit by 4% this year, from $1.56 to a new all-time high of $1.62.

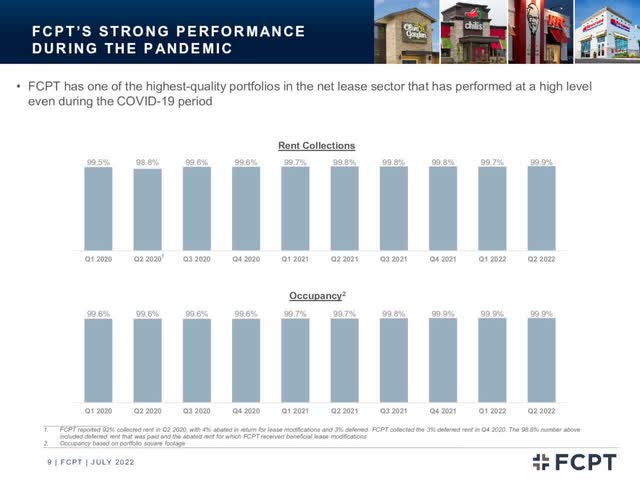

It is also important to realize that FCPT has one of the highest-quality asset portfolios in the REIT sector. To be sure, the trust has collected essentially all its rent every single quarter since the onset of the pandemic and has consistently posted occupancy rates in excess of 99.5%.

Four Corners Property Trust Performance (Investor Presentation)

There are extremely few REITs that have occupancy levels above 98%, let alone above 99.5%. The sustained occupancy rate of nearly 100% of FCPT is a testament to the quality of its business model and its solid business execution.

It is also worth noting that a great part of the asset portfolio of FCPT is located in the fast-growing regions of the Sun Belt, where the REIT generates approximately 49% of its annual revenue. The Sun Belt region is characterized by superior growth compared to the rest of the country. Texas and Florida, which represent more than 20% of the annual revenue of FCPT, were the two highest in-migration states in 2021.

On the other hand, investors should not expect high growth rates from FCPT. The REIT has grown its FFO per unit by 3.0% per year on average over the last five years. Thanks to the sustained economic growth in its markets and the ample room for acquisition of new properties, FCPT is likely to continue growing its bottom line at a similar pace in the upcoming years. Analysts seem to agree on this view, as they expect the REIT to grow its FFO per unit by 3.5% per year on average until at least 2024.

Dividend

FCPT is currently offering a 7-year high dividend yield of 5.6%, with a payout ratio of 82%. When a stock offers an abnormally high dividend yield, with an elevated payout ratio, most investors fear that a dividend cut is imminent. However, this is not the case for FCPT.

FCPT is on a reliable growth trajectory, as it has grown its FFO per unit every single year since its formation in 2015 and is expected by analysts to keep growing its bottom line at a similar pace in the upcoming years. Moreover, FCPT has proved its resilience to downturns, as it kept growing its FFO per unit and its dividend in the fierce recession caused by the pandemic in 2020. Given also the aforementioned quality of its asset portfolio, the REIT can be reasonably expected to maintain its defensive character.

Furthermore, FCPT has a healthy balance sheet. To be sure, its interest expense consumes only 28% of its operating income. Such a strong interest coverage ratio is rare in the REIT universe. In addition, its net debt (as per Buffett, net debt = total liabilities – cash – receivables) currently stands at $941 million, which is less than half of the market capitalization of the stock. This helps explain why the REIT has received investment grade ratings from Fitch (BBB) and Moody’s (Baa3). To cut a long story short, FCPT has a healthy balance sheet, which offers the company great financial flexibility in the event of a recession.

Risk

Inflation has remained high for much longer than initially expected by the Fed. If inflation remains excessive for years, it will exert great pressure on most REITs, including FCPT, as it will increase their operating costs and their interest expenses via high interest rates. As mentioned above, FCPT currently has most of its debt locked at fixed rates and hence it is protected from rising interest rates. However, if inflation persists for years, FCPT will eventually have to refinance a significant portion of its debt at higher interest rates.

Fortunately, this adverse scenario is unlikely to materialize. The Fed has prioritized restoring inflation to its long-term target of 2%, even at the expense of economic growth. Its aggressive interest rate hikes are likely to cool the economy and hence inflation is likely to begin to revert towards normal levels next year.

Final thoughts

The 7-year high dividend yield of 5.6% of FCPT is safer than most investors think. Nevertheless, due to the strong downtrend of the broad stock market amid extremely negative market sentiment, FCPT is likely to remain in a downtrend in the short run. Therefore, investors may soon be given the opportunity to purchase this high-quality REIT 5%-10% lower than its current price, close to $22. At that level, the stock will be offering a unique opportunity to purchase it with a 6.0% yield.

Be the first to comment