Brett_Hondow

Four Corners Property Trust, Inc (NYSE:FCPT) is a real estate investment trust (“REIT”) with interests in properties that are leased to tenants in the restaurant and retail industries under net lease arrangements whereby the tenants are primarily responsible for ongoing costs relating to the properties. Examples of such costs include utilities, property taxes, and insurance, among others.

FCPT is a product of a 2015 spinoff from Darden Restaurants, Inc. (DRI), an owner and operator of nearly 2,000 restaurants through subsidiaries in the U.S. and Canada under well-known trademarks, such as the Olive Garden, LongHorn Steakhouse, and the Yard House, to name a few.

In addition to managing their existing properties, many of which were acquired through the spinoff, FCPT’s strategy includes investing in additional restaurant and retail properties to diverse away from their reliance on Darden and to gain exposure to non-restaurant retail properties over time.

As of June 30, 2022, FCPT’s portfolio included 960 properties located in 47 states with nearly 100% occupancy and an average remaining lease term of 8.8 years with annual rent escalation of 1.45% through December 2027.

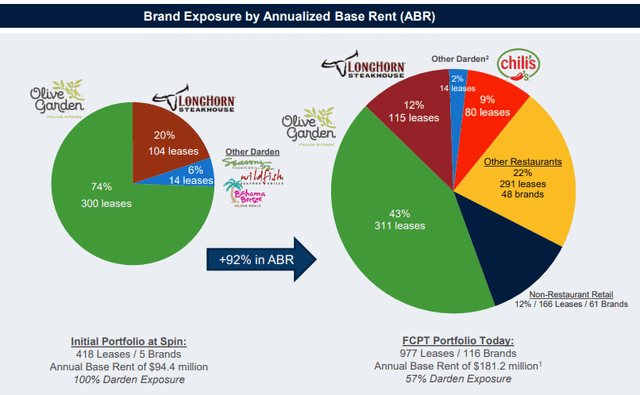

At the time of their spinoff, they had 5 brands in their portfolio with 100% exposure to DRI. That has since grown to 166 brands, with 57% exposure to Darden. Notably, Olive Garden, which previously represented 74% of annualized base rent (“ABR”) now represents 43%.

July 2022 Investor Presentation – Summary of FCPT’s Brand Exposure

Continued diversification is necessary to reduce exposure risk and to gain market share with other leading brands. To date, the company has made measurable progress in these efforts. Most recently, the company has targeted acquisitions in the auto service industry, which includes auto part retailers, and gas stations with large format convenience stores.

In addition, the company has also expanded further into the medical retail industry with their most recent acquisition of VCA Animal Hospital. With these industries generally being thought of as essential and recession resistant, FCPT is steadily building up a portfolio of assets to fall back on in the event of a prolonged downturn in the restaurant industry.

While there are a multitude of macro-related concerns affecting the consumer, service-related companies appear to be benefitting from the reallocation of discretionary spending from goods to services. YTD, shares in FCPT are down just over 1.5% versus a double-digit decline in the broader S&P over the same period.

At 18x forward funds from operations (“FFO”), shares do appear reasonably valued. But there is upside in carrying the stock as part of a diversified long-term portfolio. This includes a respectable dividend yield of 4.5% and a narrow 52-week trading range resulting from limited share-price volatility. For investors seeking a restaurant-specific net lease addition to their long-term portfolios, FCPT provides stability and predictability at a reasonable valuation.

Solid Quarterly Results

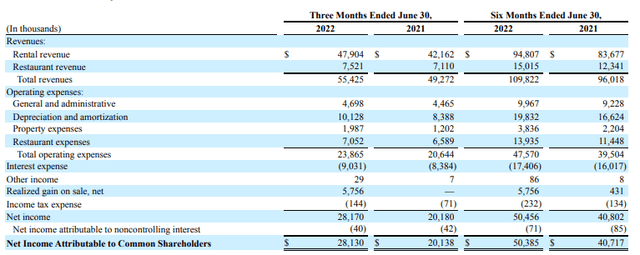

In the most recent filing period ended June 30, 2022, FCPT reported total revenues of +$55.4M. This was up 12.5% from last year and slightly better than expected. Furthermore, rental revenues, which accounted for 86% of total revenues, were up 13.6% compared to last year. Primarily driving the increase was the accretive effect of 130 additional leased properties during the comparative period, offset by the rental loss relating to the disposal of three properties during the quarter.

Total operating expenses over the three-month period were up 15.6% and are now up 20.4% over the first half of the year. While the growth rate in expenses is currently surpassing revenue growth, much of the increases are driven by depreciation and amortization (“D&A”), which are up 20.7% on a quarterly basis and 19.3% YOY. This is primarily due to the increase in the company’s number of properties in their portfolio.

While general and administration (“G&A”) and total restaurant expenses are up as well due to higher compensation and cost of foods, respectively, the increases are offset by higher rental revenues. Property expenses are also up, but they are reported gross of tenant reimbursements. Of the +$2.0M recorded in the current period, for example, +$1.8M was reimbursed by tenants.

Q2FY22 Form 10-Q – Summary of Operating Results

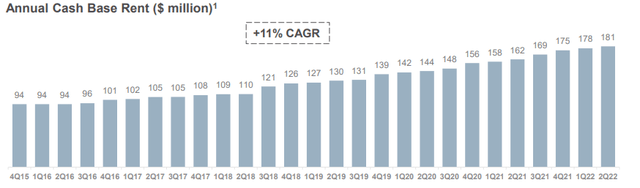

Overall, when excluding the effects of D&A, quarterly FFO came in at $0.40/diluted share. This was up 8.1% from Q1FY21 and 6.7% for the first half of the year, driven by strong YOY cash rental growth of 12.5%. This continues a strong streak of growth, with base rents now growing at a double-digit compound annual growth rate (“CAGR”) of 11%.

Q2FY22 Investor Presentation – CAGR of Annual Cash Base Rents

Investing in Diversification

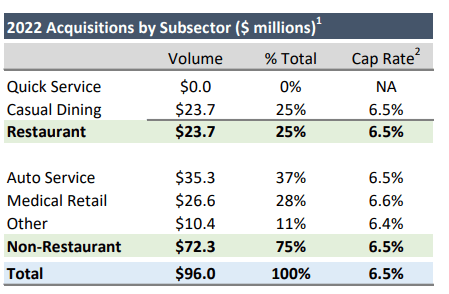

During the quarter, FCPT remained active in the market, acquiring 26 rental leases with a remaining lease term of 5.6 years and an average rent per square foot (“PSF”) of $19, representing an initial cash yield of 6.4%. In comparison, the three properties sold during the period were done at a weighted average cash cap rate of 4.7%.

Additionally, the company is experiencing increased engagement from mall and shopping center owners on outparcel transactions. An example of this is their agreement with Pennsylvania Real Estate Investment Trust (PEI) in June to purchase 11 outparcel properties for +$32.5M at a cap rate of 6.5%. The portfolio includes 8 single tenant restaurant properties and three non-restaurant properties.

FCPT also acquired a seven property outparcel portfolio in Texas for +$17M that included six restaurant properties. Together with the PEI transaction, the approximately +$50M in transactions are expected to close in the third quarter of the year.

Among their total investing activities during the quarter, auto service represented the highest share of interest at 62% of their activities, followed by medical retail at 23%. These two industries are also driving the total activity for the year, with the two accounting for approximately 65% of the company’s total activities.

July 2022 Investor Presentation – 2022 Acquisition Summary

Credit Rating Upgrades

At the end of end of June 30, 2022, FCPT had total assets of +$2.0B and total liabilities of +$1.0B, comprised principally of fixed-rate rate term loans and unsecured notes bearing interest at a weighted average interest rate of 3.37% and due on average in 5.2 years.

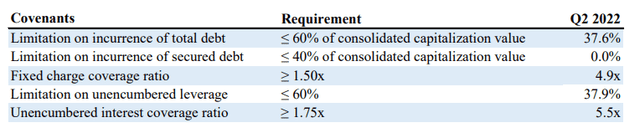

At about 31% of total capitalization, FCPT does not operate from an overly leveraged positioned. Furthermore, as a multiple of adjusted EBITDAre, net debt ended the period at 5.7x, which is within range of their target of 5.5x to 6x. The company is also comfortably in compliance with all requirements as stated within their covenant agreements.

Q2FY22 Investor Presentation – Summary of Compliance With Existing Debt Covenants

During the quarter, FCPT also received their second investment grade credit rating from Moody’s. This was in addition to an upgrade in Q1 from Fitch. As a result of the second rating, FCPT’s credit margin on their existing term loans and their revolver was reduced by 25 basis points (“bps”), leading to at least +$1M in annual interest expense savings on their term loan. At period end, they had full availability on their revolver, so the benefits on this will accrue in later periods, should they decide to draw on it.

Though there are no significant near-term debt maturities, approximately 45% of their total debt is due between 2024 and 2026. While a more laddered maturity schedule is preferable, there are limited concerns regarding their ability to roll over the debt when due. Two investment-grade ratings, in addition to a portfolio that is essentially fully occupied on net lease arrangements, which provides stable and predictable cash flows, should enable the company to receive the best possible terms on future refinancing activities.

In addition, FCPT has over +$267M in liquidity, consisting of +$70M in cash and availability on their existing credit facility. This handily exceeds the obligations that will mature in later periods.

Stable and Predictable Cash Flows

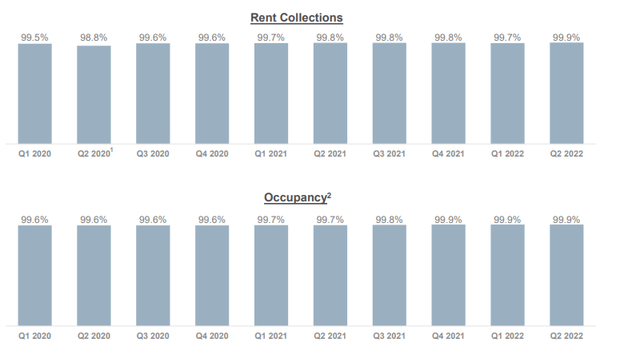

While the restaurant industry was among the worst affected during the worst months of the COVID-19 pandemic, FCPT has largely been immune from the setbacks to the industry. The most significant dip in collections occurred in Q2FY2020. And that dip was to 98.8%. Collections have since returned to 99.9%. Similarly, occupancy has remained full for every quarterly period throughout the pandemic.

Q2FY22 Investor Presentation – Summary of Rent Collections and Occupancy

Stable tenants on a fully occupied portfolio consistently provide the company with predictable and positive cash flows. Through the first six months of the year, for example, FCPT generated +$65.2M in operating cash. This was up over 10% from the same period last year. In addition, it represented dividend coverage of 1.22x, when excluding the effects of their investment activities. When including these activities, the company’s burn was +$22.6M, which is consistent with last year.

The greater emphasis on investment activities does require additional participation in the debt and equity funding markets. In the first half of the year, for example, they entered into equity forward agreements totaling +$61M at an average price of $27.28. Some would balk at the dilutive nature of these transactions and the price point, which is below their current trading levels. But the accretive benefits of these acquisitions are proving to be worth the costs.

A Good Fit For Any Portfolio

FCPT is a well-capitalized REIT with a strong portfolio of restaurant and retail-related assets. Despite being exposed to one of the worst industries throughout the COVID-19 pandemic, the company’s portfolio has remained essentially 100% occupied with cash collections never dipping below 98%.

As consumers divert more of their discretionary spending from goods to services, FCPT’s restaurant tenants are in prime position to benefit. In fact, in June, consumer spending at restaurants increased 1%, which marked their fifth consecutive month of increases. In addition, quick service restaurants are currently operating at over 100% capacity and casual dining is in-line with 2019 weekly sales levels.

Continued strength in the tenant base solidifies the predictability and stability of the company’s cash flows. While FCPT does face heightened tenant exposure risk due to the Olive Garden’s outsized weighting on ABR, there are no clear indications of an impending industry slowdown.

With shares trading near the top end of their 52-week range and at about 18x forward earnings, one can surmise that shares are fairly valued. However, there is still upside to carrying the stock in a diversified long-term portfolio.

A steadily growing 4.5% dividend along with limited share-price volatility are two such reasons. Another is their increasing exposure to growth sectors, such as the medical retail industry, which should support a higher pricing multiple. For investors seeking a quality net lease REIT, FCPT is one such name that can provide comfort food at a reasonable price.

Be the first to comment