dgdimension

FET Is On A Steady Path

Forum Energy Technologies (NYSE:FET) will likely benefit from increased demand for completions equipment, including flexible hoses and a single-line manifold system. It aims to realize net price benefit, mitigating the inflationary pressures. Over the medium-to-long term, it plans to weigh in on low carbon energies like offshore wind. New rigs in Latin America and the Middle East have also led to higher international awards for the company.

The stock is reasonably valued versus its peers. However, supply chain constraints can lower the operating margin expansion. Plus, earnings growth can significantly outperform the operating income growth and help de-lever the balance sheet. Investors might want to hold on to the stock with expectations of steady returns in the medium term.

Completions Business And Long-Term Drivers

You may read about Forum Energy Technologies strategy in my previous article here. Before we dig deep into that, let us look at the current drilling industry environment. The US onshore rig count has increased 12% since Q1. According to the EIA, the drilled well count increased by 28% year-to-date. On the other hand, the DUC wells have gone down by 11% during this period.

FET’s management estimates that the current growth of drilled and completed wells will require upgrades of critical components like iron roughnecks. As a result, the company’s FR120 solution, which handles large diameter drill pipes, will see increased demand. Its Serpent Series flexible hose and the single-line manifold system can be more efficient in the current completions work scenario in hydraulic fracturing. In low carbon energies like offshore wind, the company can leverage its engineering, designing, and manufacturing capabilities in the subsea remotely operated vehicles (ROVs) and trencher. The demand for offshore wind can exceed supply and become more profitable in the future.

Explaining The Long-Term Strategy

FET’s current strategy involved creating an asset-light, scalable base with operating leverage, mitigating the inflationary pressures, and realizing net price benefit by focusing on products where demand outstrips supply. It aims to dramatically increase revenue and be in a position where it can generate 25% to 40% of incremental EBITDA margin.

Q2 2022 Guidance

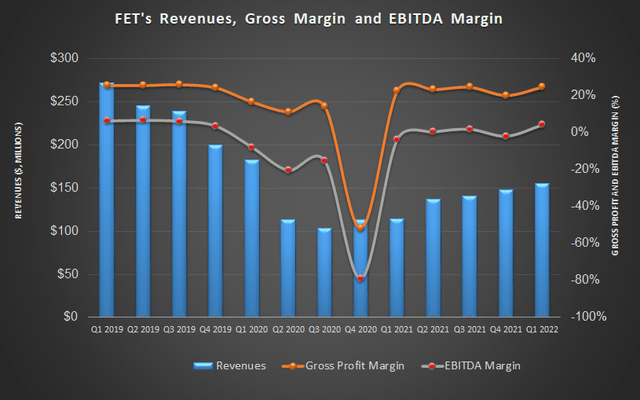

The steadily increasing rig count will likely impact the demand for FET’s products and services. So, the management expects its Q2 revenues to increase by 6% (at the guidance midpoint) compared to Q1. Adjusted EBITDA can inflate by 39% in Q2.

In FY2022, the management expects the overall cost structure to lower significantly and improve profitability. So, the management kept its annual EBITDA estimates unchanged at $50 million to $60 million, or 175% higher than in FY2021. The net income growth, however, can exceed the operating margin expansion. Since the company looks to convert half of its debt to equity, earnings growth can significantly de-lever the company.

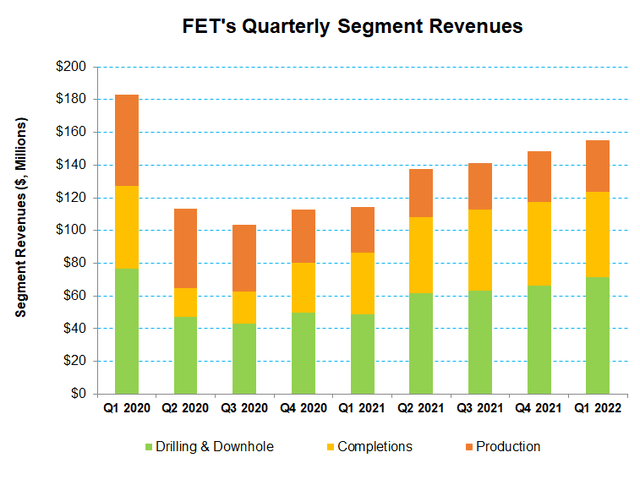

Segment Value Drivers In Q1

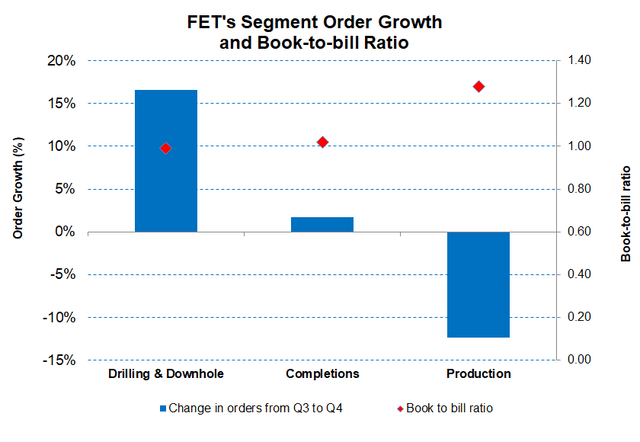

Drilling & Downhole segment: The Drilling & Downhole segment revenues increased by 7% in Q1 2022 compared to Q4 2021. Increased demand for onshore and offshore drilling, well construction equipment, and accelerated international spending led to the topline improvement. Quarter-over-quarter, the segment order decreased by ~17% as it received an award for tool packages in Latin America and the Middle East. In early Q2, it received another five-year contract in the Middle East, propelling the top line in the near term.

Completions segment: The Completions segment revenue growth was modest (3% up quarter-over-quarter) in Q1. The supply chain delays affected the company’s customers adversely, while a low inventory of drilled but uncompleted (or DUC) wells also reduced demand. On the other hand, an increased need for cables from quality wireline can mitigate the pressure partially. The segment order growth was also moderate in Q1 (~2% up), which may hold product delivery steady over the next few months.

Production segment: This segment witnessed the lowest revenue growth (by 1.9%) in Q1 compared to the previous quarter. Despite that, a favorable product mix and higher demand for the valve product line expanded the margin. The order book declined (12.4% down) during this period.

Cash Flows And Debt

Forum’s cash flow from operations (or CFO) went deeper into the red (-$25 million) in Q1 2022 versus a year ago. In Q1, it increased inventory to meet customer demand, leading to higher working capital requirements. Although year-over-year revenues increased, the adverse changes in working capital contributed to the fall. Given the uncertainty in global logistics supply, its inventory balance may rise again in Q2. So, the free cash flow can deteriorate more.

FET’s liquidity stood at $162 million as of March 31, 2022. Its debt-to-equity was 0.75x as of that date. A significant part of its total debt (nearly 50%) is convertible to equity. A conversion can significantly de-lever the balance sheet and increase enterprise value.

Linear Regression Based Forecast

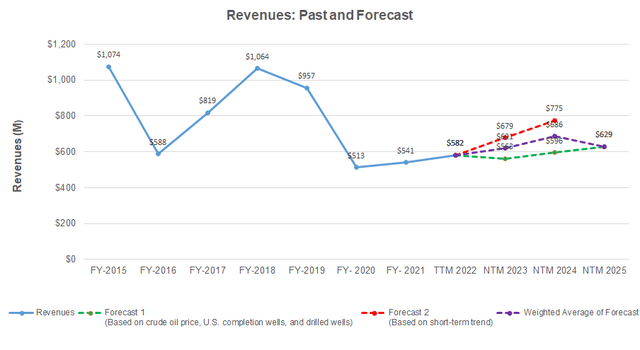

Author created, Seeking Alpha, and EIA

Based on a regression equation between crude oil price, US completion wells, and drilled wells, and FET’s revenues for the past seven years and the previous four quarters, I expect its revenues to remain steady in the next two years but may decrease in the year after that.

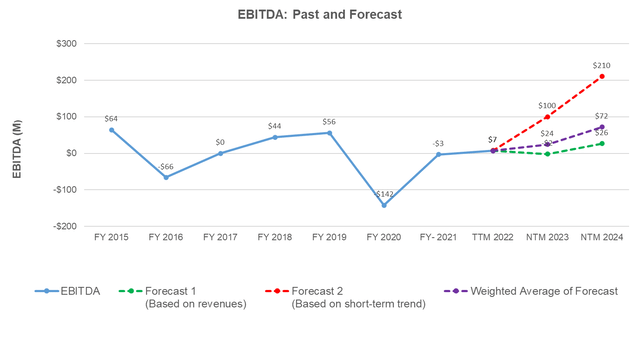

Author created and Seeking Alpha

A regression model using the forecast revenues suggests that the company’s EBITDA can turn around and increase sharply in the next 12 months (or NTM 2023). It may continue to recover at a fast clip in NTM 2024.

Target Price And Relative Valuation

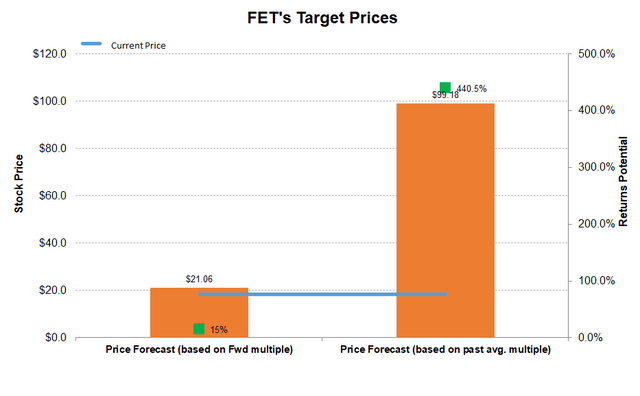

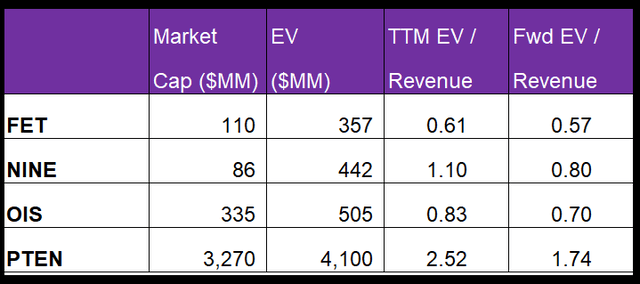

Author Created, TIKR.com, and Seeking Alpha

Returns potential using the past average EV/Revenue multiple (~440% upside) is much higher than the returns potential using the forward EV/Revenue multiple (0.57x) (15% upside) from the stock.

FET’s current to forward EV/Revenue multiple contraction implies higher revenue in the next four quarters. Because the contraction is less steep than its peers (NINE, OIS, and PTEN) it typically results in a lower multiple than peers. As the stock’s current EV/Revenue multiple is lower I think the stock is reasonably valued versus its peers at the current level.

What’s The Take On FET?

Following momentum in drilled and completed wells growth, there is an increased need for upgrades of critical components in the completions market, including flexible hose and single-line manifold systems. With the tailwinds in the topline, FET now focuses on creating an asset-light, scalable base, mitigating the inflationary pressures, and realizing net price benefits. The demand for offshore wind is estimated to exceed supply and become more profitable in the future, which should benefit FET’s long-term energy diversification goals.

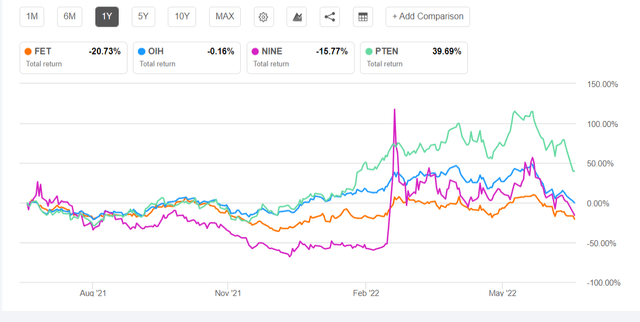

However, the Production segment saw lower revenues while negative cash flows were concerning in Q1. The stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. Nonetheless, earnings growth can significantly de-lever the company since it looks to convert half of its debt to equity. Investors can expect steady returns if they decide to hold the stock.

Be the first to comment