niphon

Investment Thesis

Fortune Brands Home & Security (NYSE:FBHS) is witnessing softness in the U.S. new construction and Repair & Remodel (R&R) industries. This has led to inventory destocking at its channel partners. The company is working with its channel partners to rightsize the inventory levels which should benefit revenue once completed by early 2023. For the Cabinets segment, the company should benefit from an excess backlog entering the fourth quarter of 2022. Further, the separation of the Cabinets segment from the rest of the businesses (to be complete by December 14, 2022) should provide growth opportunities in the years ahead. In the long run, the company should benefit from aging homes, lower housing inventory, demographic trends, and higher levels of home equity.

Revenue Outlook

The U.S. Point of Sale (POS) was up 5% Y/Y in the third quarter of 2022 due to the innovative product offerings from the Moen and House of Rohl brands. However, inventory destocking has begun at FBHS’s channel partners due to the concerns of a slowdown in consumer demand from rate hikes and inflation. The company reported 3% Y/Y sales growth in Q3 FY22, reflecting strong price realization, partially offset by continued normalization in channel inventory.

The sales in the Water Innovations segment were down 14% Y/Y due to channel destocking in the North American channels, softness in the Chinese market, changes in new construction and R&R activity in the U.S., and the acquisition of Aqualisa. The Outdoors & Security segment’s sales were up 6% Y/Y in the quarter, driven by higher price realization across LARSON and Therma-Tru brands. The sales of the decking business decreased by low-double digits Y/Y due to inventory destocking in the wholesale channels. However, the retail POS remained positive in the quarter. Security sales were down mid-single digits Y/Y due to retail destocking and softening demand for safes, partially offset by healthy commercial and connected product sales. The Cabinet segment’s sales increased 20% Y/Y, driven by price and a strong backlog and order book.

Looking forward, in the Water Innovations segment, channel destocking in the core U.S. market and economic and pandemic headwinds in China are expected to continue in Q4 FY22. The inventory destocking dynamic in the U.S. is expected to normalize in early 2023, which should benefit its sales in the back half of next year. The segment’s sales should also benefit from the recent Aqualisa acquisition. The acquisition of Aqualisa in Q3 FY22 reflects FBHS’s commitment to invest in an innovative company and continue above-market growth. Aqualisa is a leading U.K. manufacturer of shower products known for premium, innovative, and smart digital shower systems. Aqualisa is a great complement to FBHS’ smart water management offerings from the Moen and House of Rohl brands.

Within the Outdoors & Security segment, the decking business is getting impacted due to channel destocking, and the company is working with its channel partners to rightsize the inventories. The wholesale inventory adjustment should be complete by early 2023. In the long run, the decking business should benefit from the secular growth in composite decking.

In Q4 FY22, the sales in the Cabinets segment should be driven by the excess backlog. The company also announced recently that it will separate its Cabinets business, MasterBrand by December 14, 2022, via a tax-free spin-off. Following this separation, there are plenty of opportunities for both the new Fortune Brands and MasterBrand to pursue value creation. The Cabinets segment is continuing to better align its products around its customers and channels, which has improved service levels and increased customer satisfaction. This strategic transformation provides better flexibility for the Cabinet business to react in anticipation of the future demand environment and market condition changes. This flexibility should help preserve financial performance and allow it to continue investing in strategic initiatives, including in areas such as digital and e-commerce.

For 2022, the company expects sales growth to be within the 4.5% to 5.5% range, which is lower than the earlier forecast of 5.5% to 7.5%. The revised projection reflects the impact of a softening market environment, partially offset by healthy year-to-date results. The company is preparing itself for a global market decline of low to mid-single digits in FY23, with the first half being more challenging compared to the second half. However, the good thing is FBHS generates the majority of its revenue (i.e., approximately 65–75%) from the R&R industry which is relatively less cyclical compared to new construction and should provide some downside support. The new construction market is expected to decline by 10%, whereas the R&R industry should be flat to down low single digits. In the long run, the company should benefit from aging homes, lower housing inventory, demographic trends, and higher levels of home equity.

Margins

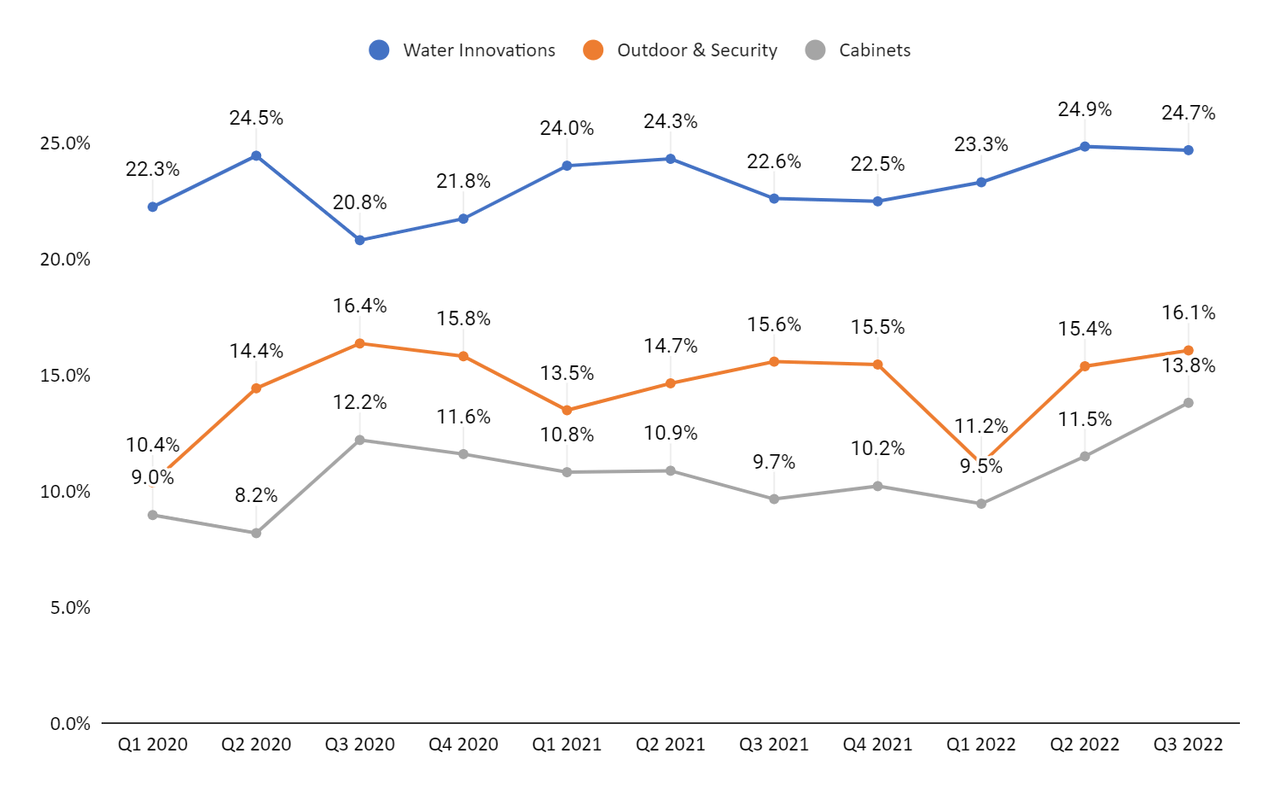

Despite the macroeconomic headwinds, FBHS was able to improve its adjusted operating margin in Q3 FY22 compared to the prior year’s same quarter. The adjusted operating margin grew 150 bps Y/Y to 16.3% due to higher price realization and investments in digital transformation. The digital initiatives taken by the company led to increased e-commerce sales and accelerated procurement savings. In the Water Innovations segment, the adjusted operating margin was up 210 bps Y/Y to 24.7% due to higher price realization and proactive expense management in North America and China. The business proactively managed costs to deliver a 10.2% decremental adjusted operating margin in the quarter, driven by control of discretionary SG&A spending.

The Outdoor & Security segment’s adjusted operating margin improved by 50 bps Y/Y to 16.1% due to higher sales and productivity improvements. The Cabinets segment’s adjusted operating margin was up 410 bps Y/Y to 13.8%, driven by the transformation efforts taken by the company.

FBHS segment-wise adjusted operating margin (Company data, GS Analytics Research)

Looking forward, deleverage due to lower volumes is a concern but it should be offset by the higher price realization, operational efficiency, and digital transformation in Q4 2022. For the full year 2022, management is expecting the adjusted operating margin for the Water Innovations segment, Outdoors & Security segment, and Cabinets segment to be around ~24%, between 14% and 15%, and between 11.5% and 12%, respectively. For FY2023, the margins should see a decline given the expectations around volume deleverage. However, FBHS is a well-run business and margins should quickly recover once the volume headwinds recede over the next couple of years.

Valuation & Conclusion

The stock is currently trading at 11.16x P/E FY22 consensus EPS estimate of $5.81 and 11.38x P/E FY23 consensus EPS estimate of $5.70, both lower than its five-year average forward P/E of 15.94x. While I understand the near-term cyclical slowdown concerns, these are not something new for the housing industry. A good way to make money in the long term is by buying cyclical stock cheap during the slowdown. I believe FBHS stock offers one such opportunity. FBHS should be able to manage the near-term headwinds well and should benefit from the lower housing inventory levels, demographic trends, and higher home-equity levels in the long run. Hence, I have a buy rating on the stock.

Be the first to comment