PonyWang

The Oil Of The 21st Century

By many considered to be the new oil together with data, semiconductors are the building blocks of the 21st century. Cutting-edge technology solutions costing thousands of dollars come to mind, but that’s just the tip of the iceberg. In this article, I’ll compare one of the growth stock darlings of the last decade, NVIDIA Corporation (NASDAQ:NASDAQ:NVDA), with my personal investment, boring old Texas Instruments Incorporated (NASDAQ:NASDAQ:TXN) (“TI”). I prefer TXN because it is a more stable business with deeply integrated manufacturing in an industry with high switching costs, while NVDA has a much more volatile business with much less certainty.

Throughout the article, I’ll also refer to Texas Instruments as TXN or TI and to Nvidia as NVDA.

Digital Chips NEED Analog Chips

Semiconductors can be grouped into two areas: analog and digital chips. Digital chips are big, highly sophisticated marvels of engineering that can calculate incredible things via the binary system of ones and zeros. The problem is, they can’t do anything by themselves. Our real world does not consist of ones and zeroes but of temperatures, altitudes, velocities, smells and much more. To get these real-world signals into the digital world we need analog chips to convert from real-world to binary and back to real-world signals.

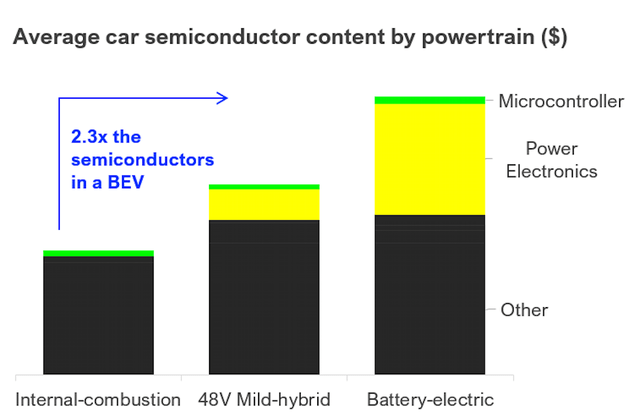

I’ll use the automotive industry as an example, which is changing rapidly in a few different directions. First, we have the switch from internal-combustion engine (ICE) vehicles to electric vehicles ((EVs)). According to idTechEx, an EV will require around 2.3 times as many semiconductors as an ICE (see picture below). This tailwind gets amplified if we look at the market trends in autonomous vehicles, which are expected to grow from $94 billion in 2021 to $1808 billion in 2030, an incredible 38% CAGR.

Cars are turning more and more into giant supercomputers, and while this means that they require very powerful digital computing chips, it also means that they need an exponentially higher amount of sensors, switches, and power management chips as well. If we add that on top of the 2.3x from the ICE to EV transition we can easily see the semiconductor contents of 2030 being 3x-5x of a 2022 car.

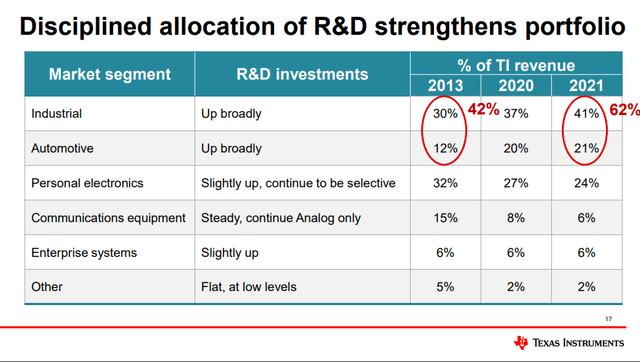

Texas Instruments is focused on analog chips (77% of revenue) and continues to switch its sales mix to the more favorable end markets of automotive (21%, up from 12% in 2013) and industrial (41%, up from 30% in 2013). Nvidia is also supplying the automotive sector, but from another angle: infotainment and autonomous driving hardware and software. This segment is an interesting business for Nvidia, but unfortunately only accounts for 2% of revenues currently.

Semiconductor content by car type (idTechEx/Infineon)

Product Longevity And Earnings Stability

I already mentioned the great longevity most of TI’s products have, generating sales for decades in many cases. TI over the years has also focused its portfolio to address the attractive end markets of industrial and automotive, which now account for over 62% of revenues. Industrial benefits from similar trends to the above-discussed automotive sector. Other, less lucrative, market segments have been systematically reduced over the last 8 years. In this time frame, personal electronics declined from 32% to 24% of sales, communications equipment from 15% to 6%, enterprise systems have been flat at 6%, and other products like calculators declined from 5% to 2% of sales. This enabled Texas Instruments to have predictable earnings without many surprises waiting for investors.

Texas Instruments product portfolio (TXN IR)

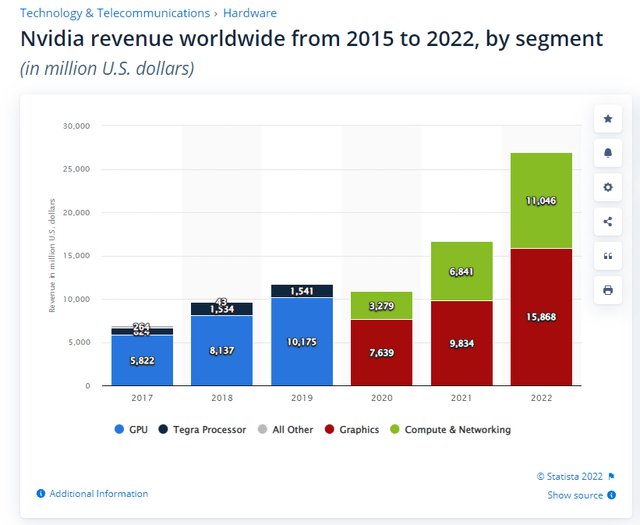

Nvidia is focused on the gaming segment (46% of revenue), a volatile part of the consumer electronics segment, which Texas Instruments systematically reduces in its sales mix. The company shocked investors with its Q2 earnings, seeing gaming revenues plunge 33% year-over-year.

I do like Nvidia’s other segments. Data Center (40% of revenue) is a great space to be in, where hyperscaler like Amazon and Microsoft are continually investing in new hardware. Professional Visualization (8%) and Automotive (2%) are also interesting markets, but after all their largest segment remains Gaming for the moment. Nvidia should focus more on its data center business, which is growing fast, but so is gaming. Data centers should be a much less cyclical business for the next 5+ years due to hyperscalers building out their cloud infrastructure, while Gaming depends a lot on the consumer, as the 33% plunge in this past quarter illustrates well. I much prefer the way TI allocates its product portfolio, away from the cyclical consumer electronics segment to more lucrative segments (automotive and industrial).

Nvidia revenue by segments (statista)

Track Record In Past Recessions

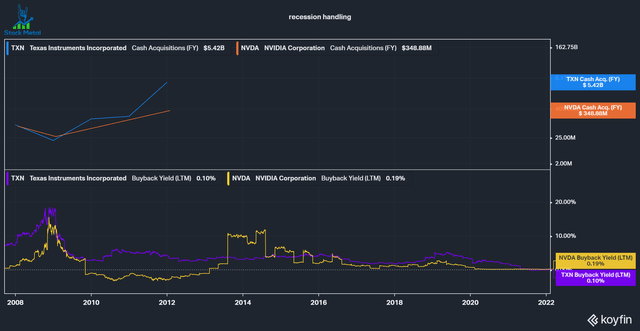

The consensus is that we are currently in a recession and both companies have handled the last recession (GFC 2008) very well, using the downturn to purchase massive amounts of shares outstanding (17% for TXN, 15% for NVDA) and acquire struggling assets. TXN went on an acquisition spree in the years following the crash and purchased a dozen struggling assets for pennies on the dollar. Great companies emerge from a crisis stronger than they entered it.

Past recession handling (koyfin)

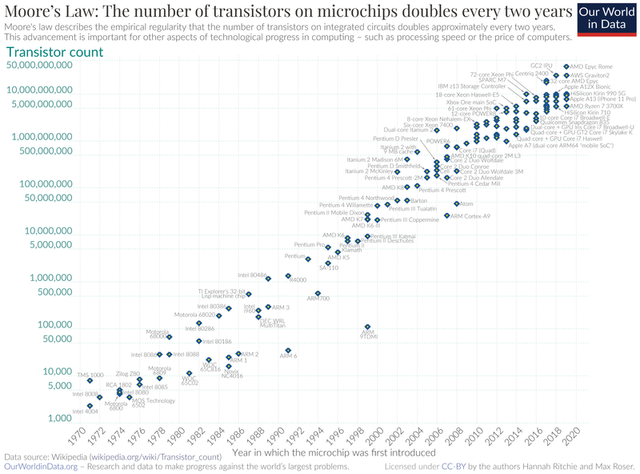

The Continuous Arms Race Of Digital

Moore’s Law is an industry observation dating back to the 60s. It says that the number of transistors on a semi roughly doubles every two years. For the last 60 years, this has come true, and this arms race is built on trillions of dollars of capital expenditures and research efforts to print smaller chips with higher compute power. This means that cutting edge doesn’t remain cutting edge for long – if you want to find out how digital advances I encourage you to read my recent article on ASML (ASML). Research needs to be continued to keep at the edge and be able to sell your product. If you can’t do that you will lose market share, as we can see with the example of Intel (INTC) right now.

Nvidia, like all digital chip companies, needs to stay on top and invest in R&D without certainty of a payoff. Analog on the other hand has not followed Moore’s law in the past and won’t in the future. While cutting-edge chips are manufactured by TSMC (TSM) with 3-nanometer technology, analog chips are still being produced on the much larger size of 130-180 nm. Texas Instruments still is selling chips that they designed 30 years ago at a gross margin of 90%! Talk about return on R&D investment! Due to its slower pace of innovation (there is not the same necessity for it), analog manufacturing is much less capital intensive, leading to more cash to be returned to shareholders.

High Switching Costs In Analog

Analog chips have higher switching costs due to the low price advantage they have. According to electronics sourcing, an average analog chip costs around 35 cents. Let’s compare that to the average of $40 it takes to produce digital chips, for example from Intel. Let’s assume a gross margin of 50% for easy math, and we land at $80 per digital chip as a listing price. Nvidia’s products are roughly comparable from a pricing perspective to Intel’s for the sake of the argument. We have a factor of over 200 times the price of a digital chip compared to an analog one.

If you want to produce a new phone, you can be sure that there will be significant research into the best product and that it makes sense to change the supplier if a better product comes out. After all, it is likely to be one of the highest costing parts of your application. Meanwhile, analog chips often cost a fraction of the total price to produce a product. If you know that this product works with your application and that your supplier is reliable, do you really want to change the production process to go from a $0.35 chip to a $0.33 chip? This leads to much higher switching costs in analog.

In-House Manufacturing Versus Fabless

Nvidia is a fabless company, meaning that they only design the chips and have a manufacturer produce them. This has advantages, like no need for capital expenditures and to build infrastructure, but it also leaves you dependent on your manufacturer.

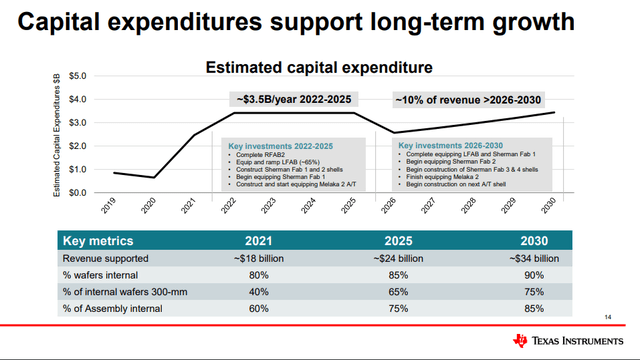

Texas Instruments does both the design and the manufacturing of its chips. Due to the above-discussed reasons, they can build a fab and run it for decades. They are committed to further increasing their manufacturing advantage through the investment cycle they are entering, driving margins up and gaining even more control over their supply chain. In March of 2020, while most manufacturers were panicking, TI decided to keep producing chips. After all, they have thousands of different customers and can sell most of their chips to different customers even decades later. These decisions are not in your control without control over your manufacturing and supply chain.

Texas Instruments capital management presentation (TXN IR)

American Manufacturing Or Taiwan Outsourcing?

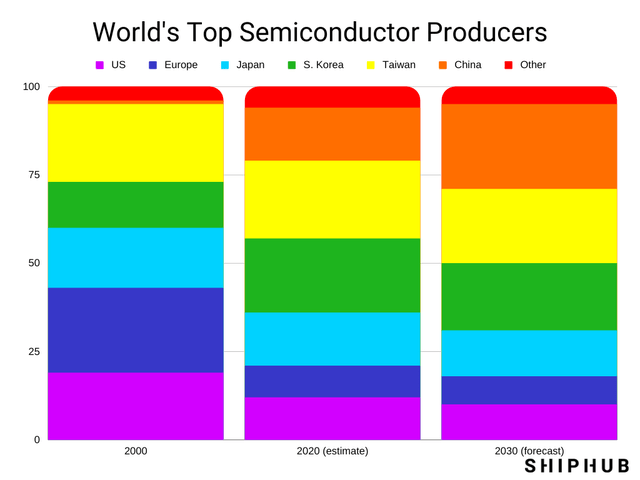

Another component related to being fabless is the geopolitical risk. Manufacturing currently is dominated by Asia, with Taiwan being the market leader. Looking at the tensions with China and the related market uncertainty, this leaves a risk of your manufacturer not being able to supply you due to macroeconomic events. The situation might get better with the U.S. Chips act and similar acts in Europe, but Texas Instruments has been building out its manufacturing capacity in the U.S. for decades. I personally sleep better at night when my company produces chips in Texas than if they get shipped in from Taiwan.

World’s top semiconductor producers (Shiphub)

Valuation – Multiples

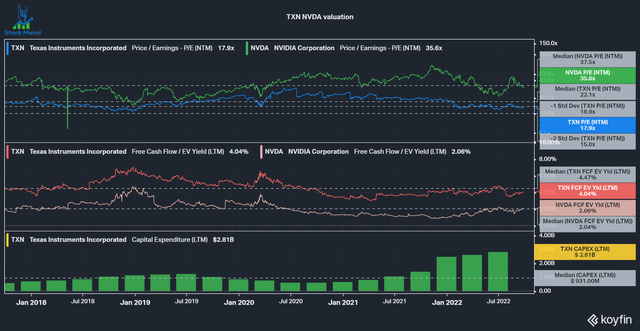

If we look at the valuation, we can see that Nvidia still remains expensive at a 35 forward P/E, in line with its 5-year median. TI, on the other hand, trades around 1.5 standard deviations below its 5-year median forward P/E. On a free cash flow (“FCF”) yield basis, the story reverses. TI is below its historical FCF yield, mainly due to increased Capex, which is 3x above its median. Still, Nvidia remains highly priced at a 2% FCF yield, while TXN is more reasonably priced, especially with Nvidia’s expected growth rate tampering down.

In 2021, both companies were pretty expensive trading at over 45 times (NVDA) and over 25 times (TXN). Luckily, these exaggerations have mostly come back again.

Valuation – Inverse DCF

With an inverse DCF the goal is to find out how much free cash flow growth the market is pricing into the stock price. I use 10% as my discount rate, my required rate of return and 3% as the perpetual growth rate.

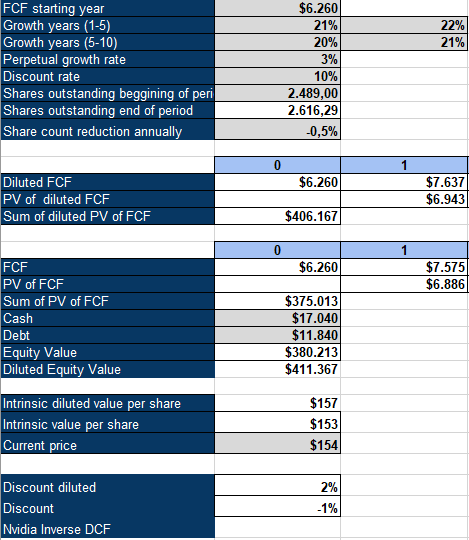

Below you can see the DCF for Nvidia. I assumed an annual dilution of 0.5%, based on the last 5 years. To justify its current valuation for a 10% return, Nvidia needs to grow its free cash flows over the next decade by a 20 CAGR. In my opinion, that is a tough task given the size of Nvidia and its reliance on the cyclical gaming segment. It certainly can be done, but they need to execute very well to justify this price.

Nvidia inverse DCF (authors model)

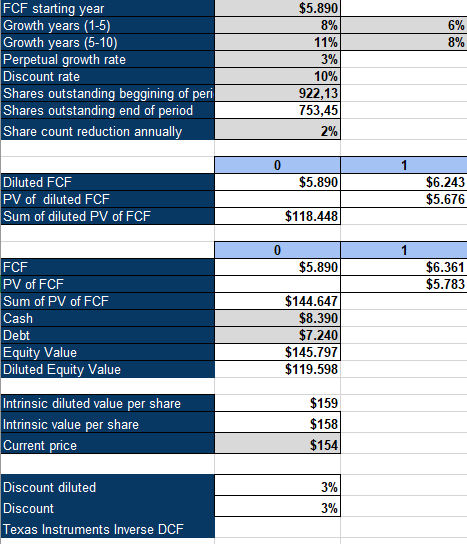

The inverse DCF for Texas Instruments assumes a 2% reduction in shares outstanding, based on its previous trends. To generate a 10% return, TXN is expected to grow its free cash flows by 6-8% over the next decade. I normally have a higher growth rate in years 1-5 than in the last 5 years, but for TXN I reversed this due to the current investment cycle, which will put pressure on near-term FCF. I believe that 6-8% is a very reasonable expected growth rate, below the expected 9.2% CAGR for the whole semiconductor industry.

Texas Instruments Inverse DCF (Authors model)

Conclusion

I personally hold around 9% of my portfolio in Texas Instruments (#4 position), due to the reasons explained in this article. I prefer the analog market over the digital market, and I consider TI one of the highest quality companies in the world. Nvidia has good business segments, but I dislike the gaming one. In an event of a further sliding market, I also expect TI to hold up better than Nvidia.

I continue to DCA into TI monthly and would love to do more larger lump sum investments if the market declines further. Nvidia can certainly be a good investment if they manage to meet the high expectations and the cyclical gaming segment holds up well. I prefer a steady compounder like Texas Instruments, with its stable business and modest priced in growth expectations.

Be the first to comment