fredrocko

What happened?

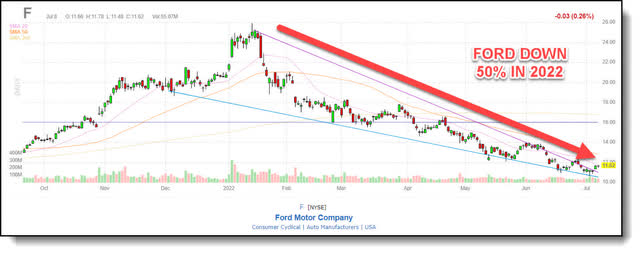

I wrote an article on July 9 stating Ford (NYSE:F) was destined to double. The thesis was Ford’s stock price had plummeted 50% over the past six months. Furthermore, there were little to no upside breakouts along the way.

Even so, the stock was up 4% for the week and just recently broke out above the top of the downtrend channel. This is the first sign a trend reversal is underway.

Initial Breakout (Finviz)

The recent upside push in the stock had actually occurred in the face of some negative news breaking as well showing the move had solid relative strength. As reported by Seeking Alpha news:

“During the second quarter, Ford sold a mere 120,000 vehicles in Greater China marking a ~22% year-over-year decline led by rising COVID cases and ongoing global supply chain problems. The sales indicated the worst since Q1 of 2020 (89K units) when government COVID restrictions halted the production in the country.”

Even so, I saw the selloff of the stock based on macro factors, such as the China COVID shutdowns and supply chain issues as temporary. Often these types of transitory issues create an opportunity to buy stock in a solid company with sound prospects. Let me explain.

Invest at the point of maximum pessimism

One of my favorite quotes from investing icon Sir John Templeton is the following:

“Invest at the point of maximum pessimism.”

Templeton is known as a contrarian investor. He referred to his investment philosophy as “bargain hunting.” Templeton’s guiding principle was:

“Search for companies that offered low prices and an excellent long-term outlook.”

I feel this statement perfectly illustrates where Ford’s stock was at the beginning of July. The reward far outweighed the risk with the stock down 50% on factors that are bound to improve over time. The end of the downtrend is here!

Ford Stock Performance Since Initial Buy Call (Seeking Alpha)

Even with the stock up over 30% since the time of the writing, I still feel this is an excellent time to start a position in Ford. In the following sections I make my case. This only works if you have courage in your convictions and can sleep well at night. I can with Ford. Nonetheless, a mistake I made many times in my younger days was to plunk down the entire allocation for a new position in one buy. I felt so confident the stock had seen the low, I wanted to be sure and maximize my upside. This was a huge mistake.

Patience Equals Profits always layer in

I have learned to be patient over the years when building a new position. You must layer into new positions over time. Moreover, the higher the level of macro market volatility, the greater the number of tranches you should use to create a position. Always layer into new positions over time to reduce risk, especially if they are up 30% in short order. yet, the bottom line is, Ford is well positioned for growth. Let’s dive in!

Ford well positioned for growth

Ford shares popped after the auto manufacturer posted a stronger-than-expected earnings result and reaffirmed full-year targets.

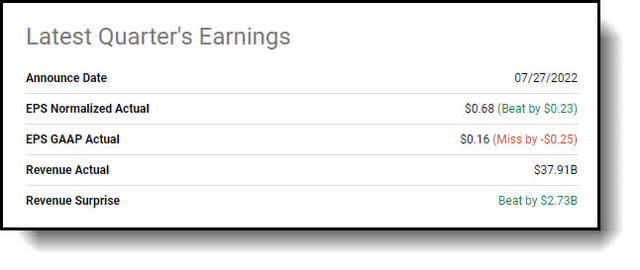

Ford Earnings Results (Seeking Alpha)

For its fiscal third quarter, the automaker reported non-GAAP EPS of $0.68 and $37.9B in automotive revenue. Analysts had anticipated EPS to reach $0.44 and revenue to reach $35.17B, both of which were surpassed by a wide margin. Cash flow from operations rose to $2.9B for the quarter, up from $756M in 2021. The beat on top and bottom lines came despite slowing sales and supply chain problems in China, where sales dropped 22% during the quarter, and inflationary impacts pressuring the bottom line. CEO Jim Farley stated:

“We’re moving with purpose and speed into the most promising period for growth in Ford’s history – to innovate and deliver great products and connected services, raise quality and lower costs. We’re giving customers great experiences and value, improving our profitability and making Ford the next-generation transportation leader.”

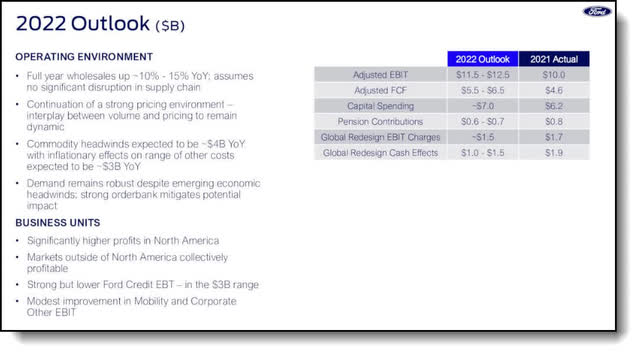

Ford reaffirms guidance

Moving forward, the company reaffirmed earnings guidance that includes a full-year profit based upon “continued strong pricing” and cost-cutting efforts.

The company anticipates adjusted EBIT to range from $11.5B to $12.5B, up 15% to 25% from 2021 while adjusted free cash flow is expected to reach a range of $5.5B to $6.5B.

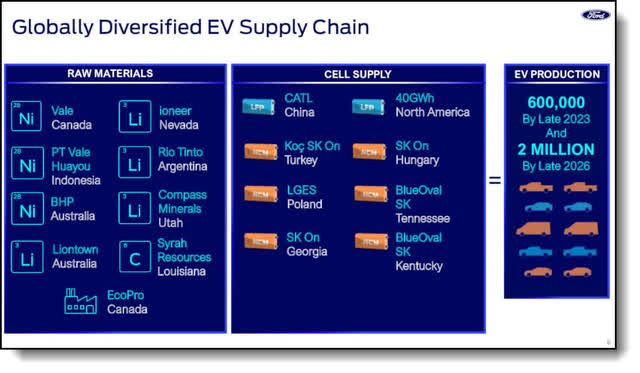

600,000 EVs produced globally by late 2023

The automaker also affirmed its intention to produce electric vehicles at a rate of 600K globally per year by late in 2023, first announced only a week prior to earnings.

Globally Diversified EV Supply Chain (Ford.com)

The Ford+ Plan

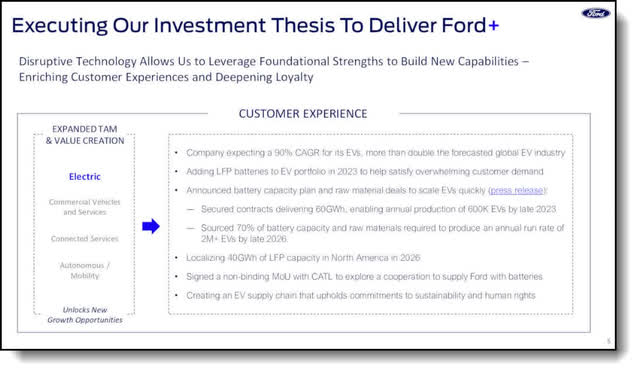

The bottom line is the Ford team delivered a very solid second quarter in a challenging environment where the company saw supply chain disruptions, new economic headwinds, and increased uncertainty. CEO Farley emphasized Ford achieved these results by advancing the Ford+ plan, which Farley stated was the biggest opportunity to create value at Ford since the company scaled the Model T.

Ford+ 3 fundamental promises to customers

At the core of Ford+ are three fundamental promises to customers: Distinctive and breakthrough products and experiences, an always on relationship with Ford, and an ever-improving post-purchase user experience powered by software.

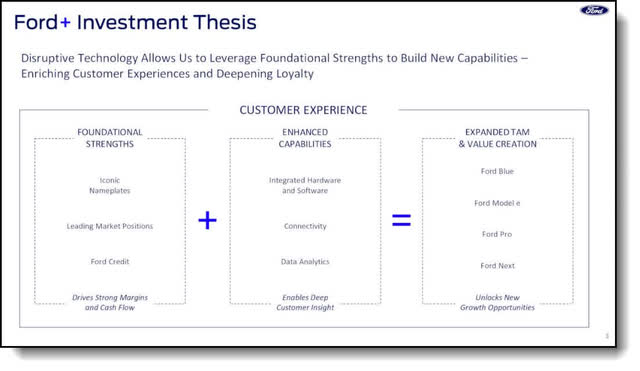

Ford+ Investment Thesis (Ford.com)

Disruptive technology leveraging strengths

Ford+ Investment Thesis (Ford.com)

The two primary drivers of Ford’s growth will be the Ford+ program and the fact the company has decided to reorganize into three distinct segments Model E, Ford Blue, and Ford Pro. I see this as a huge positive for the stock and company. By splitting the company into three distinct segments, the clarity of purpose and focus for each of the teams should increase drastically. The distinct mission focus of each group should drive a much quicker clock speed allowing Ford to make decisions much faster creating a more efficient design and cost structure. Ford Credit is showing no signs of weakness at present either.

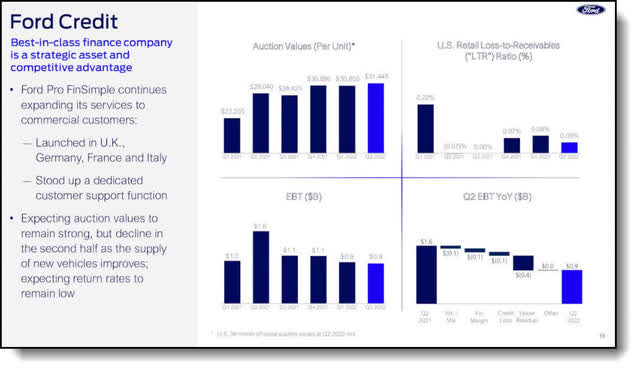

Ford Credit

The company stated they continue to expect strong auctions values and low return rates based on current data available. Now let’s review Ford’s current fundamental status.

Ford’s solid fundamentals

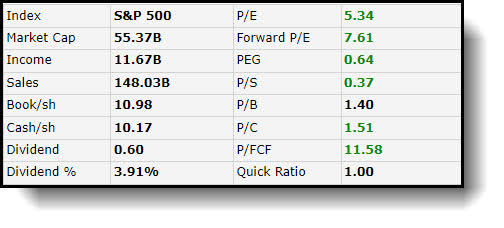

Even with the stock up 37% just this month, the fundamentals are still quite compelling. Ford’s forward P/E of 7.61 is approximately half of the current S&P 500 forward P/E of 17.5.

Ford Fundamentals (Finviz)

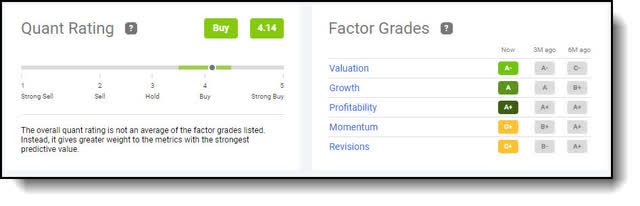

The stock is incredibly trading for a PEG ratio of 0.64 where anything less than 1 is considered vastly undervalued. What’s more, Ford is trading for a P/FCF ratio of 11.58 where less than 15 is consider cheap, talk about margin of safety. Moreover Seeking Alpha’s Quant analysis rates Ford a Buy with A scores for valuation, growth, and profitability.

Ford Quant rating (Seeking Alpha)

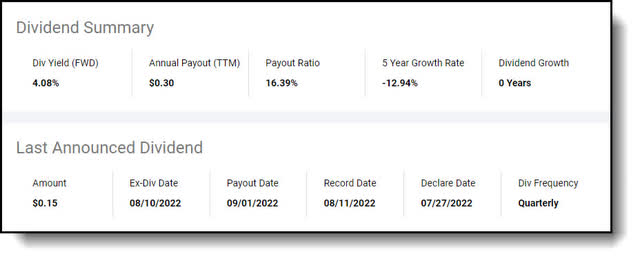

If ever there was a bargain basement buying opportunity in Ford with solid fundamentals and a strong growth story to boot, this is it. On top of all this, the most important and enlightening action taken by Ford was the company increased the dividend by 50%! That’s right I said 50%!

Ford is once again a dividend growth play

This is actually kind of funny due to the fact there was a big debate on my previous article that Ford may not even pay a dividend this quarter! Ha! Well, as Gomer Pile would say, surprise, surprise, surprise! Ford Motor raised the dividend by 50% to $0.15 quarterly. Ford Motor declared $0.15/share quarterly dividend, a 50% increase from prior dividend of $0.10.

Ford Dividend Increase (Seeking Alpha)

This is basically the icing on the cake ladies and gentlemen. With a forward yield of 4.55% presently payable Sept. 1 for shareholders of record Aug. 11th, ex-div Aug. 10. The stock is a solid buy right now. Now I’d like to turn the attention to the current macro state of affairs.

The Bottom is in

After doing due diligence on past recessionary cycles and the respective effects on the markets in general, I surmise the potential coming recession will be a short and shallow one, even with a hard landing, for several reasons. Firstly, the average drop in the S&P 500 during the past 12 recessions since World War ll was 30%. We’re currently down 20% already, so about two thirds of the recession’s potential downside effect on the market is already priced in by historical standards. Furthermore, The S&P 500 appears to have put in a bottom and is on its way to performing a full-fledged trend reversal.

S&P 500 Performance (Personal)

I posit the S&P 500 may not have enough left in the tank to break out above strong resistance at the 100 day sma, yet will not break below the low of June either. This is positive. Can anyone guess how many times the market has bounced back after a steep sell off such as the one happening now? The answer is every time. Nonetheless, there are always downside risks.

Potential Downside Risks

It would be remiss of me not to include the positional downside risks as no investment comes without risk. Even so, the higher the risk the higher the reward. The following is a list of downside risks as I see them.

- A decline in Ford’s market share.

- Lower-than-anticipated market acceptance of Ford’s new or existing products.

- Further issues with chip supply.

- China’s economy not coming back online.

- Fluctuations in foreign currency exchange rates, commodity prices, and interest rates.

- Inflation continuing to rise causing a recession leading to a further selloff.

- Increased recessionary pressures causing people to default on their payments.

The Bottom Line

Our innate instincts encourage us to depart a sinking ship. This survival tactic impacts the way we invest. The herd running for the door is what creates the opportunity to buy a fundamentally solid company like Ford with sound prospects at a discount. Hopefully, you have some dry powder and a long-term time horizon and take advantage. Moreover, after years of diligent work, Ford is being overwhelmed with the demand for the Model T makers first-generation EVs, the Mustang Mach-E, the Lightning, and the E-Transit. These products are in the market now, and the company has strong multi-year order banks. Ford is selling them as fast as they can make them, you can’t do much better than that. On top of this, the company has obtained a fortress balance sheet and growing free cash flows. Those are my thoughts on the matter I look forward to reading yours.

Your input is required!

The true value of my articles is provided by the prescient remarks from Seeking Alpha members in the comments section below. Do you think Ford is a Buy at current levels? Why or why not? Thank you in advance for your participation.

Be the first to comment