gopixa

Thesis

In our post-earnings update on Ford Motor Company (NYSE:F), we urged investors to be cautious as we parsed that the summer rally in F was too fast and too furious. Coupled with unconstructive price action, we even highlighted that investors should expect downside volatility, which could offer a more compelling opportunity to add exposure.

Accordingly, F has fallen nearly 20% since our article, underperforming the broad market significantly. Of course, the recent decline can be pointed out to Ford’s revised Q3 guidance, which stunned the market, indicating near-term execution challenges.

Notwithstanding, it’s important to note that F’s momentum had already stalled in August, as we indicated. Therefore, it wouldn’t take much for it to pull back. Coupled with the broad market pullback and Ford’s untimely guidance revision, the battering is justified and deserved.

Given the pummeling, F’s valuation has improved dramatically, nearing the lows last seen in July. Moreover, it’s important to note that Ford has set itself up for a significant Q4 recovery as it maintained the conviction of its FY22 guidance, despite its near-term challenges.

Despite massive pessimism, we maintain our conviction that F bottomed out in July, which we highlighted in our July update. We parsed that the recent pullback is necessary to de-risk Ford’s execution risks (and lowered credibility in achieving them) amid a coming recession that could curb consumer spending on discretionary durable items further.

Notwithstanding, we must highlight that it’s still possible for F to re-test its July lows to force capitulation before staging a bullish reversal. Hence, investors are urged to layer in, leveraging downside volatility to average down their costs.

Accordingly, we revise our rating on F from Hold to Buy.

Ford’s Revised Q3 Guidance Impacted Its Credibility

Ford revised its Q3 adjusted EBIT guidance to $1.55B (midpoint) as it experienced significant supply chain challenges and unexpected cost headwinds of a further $1B.

Subsequent media reports highlighted that Ford even faced challenges in procuring sufficient blue oval badges, demonstrating the extent of its supply chain snarls.

Therefore, we believe the company did itself no favors here, as they executed poorly, with its guidance indicating a significant miss to management’s previous optimism.

We believe the market’s disappointment in Ford’s execution is warranted, as global supply chain headwinds have eased substantially. Notably, in August, global supply chain pressure reverted to levels last seen in early 2021. Notwithstanding, automotive chip supply remains tight, even though utilization in the consumer segment has fallen markedly due to weak end demand.

Therefore, we believe it’s possible that auto chip supply could improve further through FY23, as foundries and IDMs repurpose some of their fungible capacity to cater to automotive applications. In addition, DIGITIMES reported recently that capacity prices could also ease as auto OEMs and their tier-one suppliers renegotiate:

Automotive OEMs and tier-one suppliers are seeking to have foundry quotes return to pre-pandemic levels in 2023, as they have seen stress on short supply chains start being relieved, the sources noted. Many automotive IC categories are no longer in tight supply, with some chip inventories even approaching pre-pandemic levels, the sources said. – DIGITIMES

Therefore, despite Ford’s weak execution ahead of its Q3 release, we believe the supply chain headwinds that impacted its guidance are transitory and should ease further. The question is whether the market believes Ford could keep up to deliver its FY22 guidance.

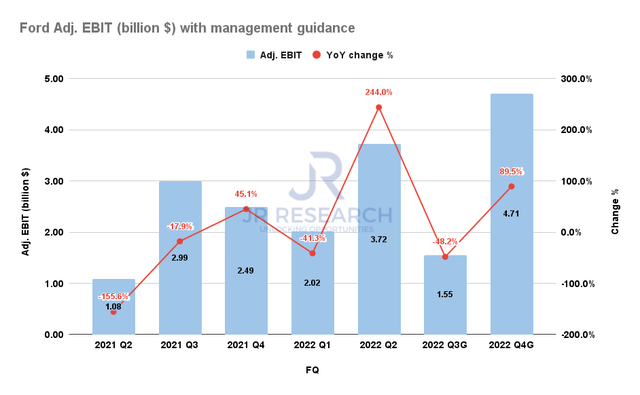

Ford Adjusted EBIT with management guidance (Company filings)

Given its Q3 adjusted EBIT revision to $1.55B, Ford needs to deliver $4.71B in adjusted EBIT (midpoint) for Q4’22, implying a record quarter over the past two years. It also implies an 89.5% YoY increase over a pretty remarkable Q4’21. Hence, we can understand why the market is concerned over Ford’s ability to execute its full-year guidance.

With the Fed moving further to accelerate its rate hikes to combat inflation effectively, it’s arguable that the market has been pricing in the impact of a recession.

Therefore, the market needed to de-risk F’s valuation further to account for macro risks (outside of its control), coupled with execution risks of needing a record Q4 to meet its guidance (not even talking about outperforming).

We believe the adjustment in the market’s expectations is justified, with the battering a warning to CEO Jim Farley & team to deliver this time or face more pain.

Is F Stock A Buy, Sell, Or Hold?

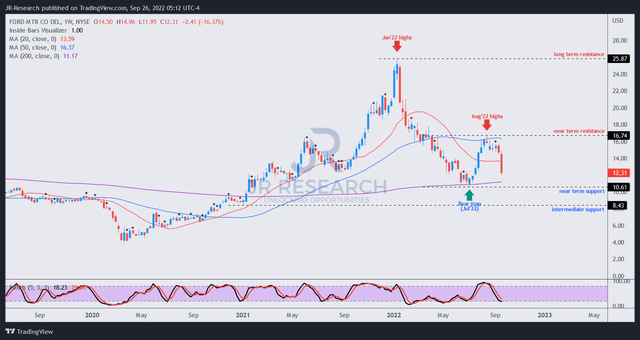

F price chart (weekly) (TradingView)

The rejection at its recent August highs came at a critical juncture, as seen above. It denied F the opportunity to retake its medium-term bullish bias, forcing it down toward its July lows and digesting most of the gains from its summer rally.

From a price action perspective, the move by the sellers drawing in buyers into the August highs before stemming the buying upside should remind investors never to chase sharp momentum spikes.

The move has sent F back into medium-term oversold zones, setting up the possibility of a bottoming process (potentially). However, we must caution that we have yet to observe constructive basing action, and therefore, further downside volatility to force out more weak hands cannot be ruled out.

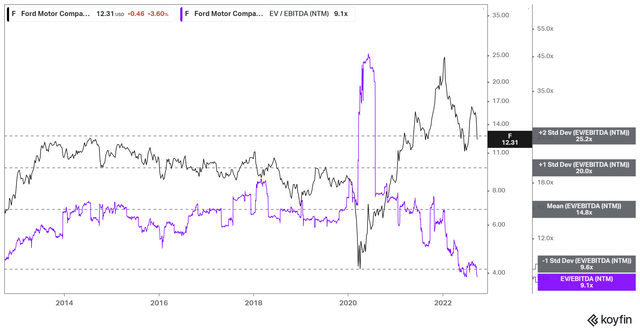

F NTM EBITDA multiples valuation trend (koyfin)

Notwithstanding, the battering sent F’s valuations back to their July lows, as seen from its NTM EBITDA multiples in the chart above. We believe the battering, while well-deserved, has also de-risked F’s execution risks markedly for a less aggressive entry level.

As such, we revise our rating on F from Hold to Buy and urge investors to use the downside volatility to layer in over time.

Be the first to comment