Marina113/iStock Editorial via Getty Images

Investment Thesis

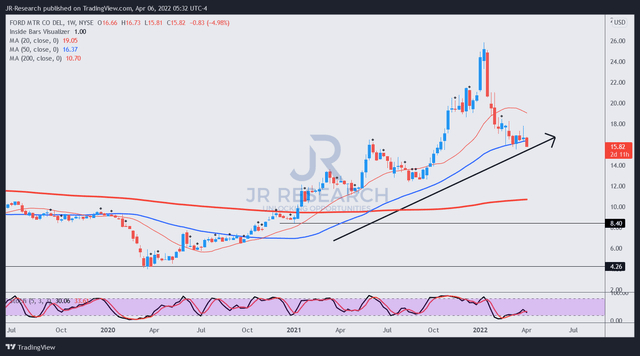

Ford Motor Company (NYSE:F) delivered an underwhelming Q1 sales report card, but we think it had been priced in. The stock was down about 40% (as of April 5) from its January highs. Notably, it has also collapsed almost 34% from our previous article, as we implored investors to bide their time.

We think the time has arrived for investors to add exposure, as F stock has also reverted to a critical support level and consolidating. While we expect Ford to report a rather tepid Q1 earnings card, we believe momentum would return in Q2 with easier comps.

We discuss why Ford investors can consider buying now.

Ford Has Learnt Its Supply Chain Lessons From Last Year

Ford reported a marked decline in sales in its Q1 sales report. It sold 432K of vehicles in the US, down 17.1% YoY. Therefore, Ford has also been affected by supply chain challenges and high oil prices exacerbated by the Russia-Ukraine conflict.

However, Ford added that it has been building up its inventory, as “inventory in transit rose 73.5% from February, including up 127% for the crucial F-Series line.”

Therefore, the company wanted to assure investors that it doesn’t expect structural issues relating to its supply chain to persist. Nonetheless, the automotive supply chain remains tight, particularly for semiconductors. Given Ford’s massive production footprint, it needs to ensure that it doesn’t repeat the mistakes of the previous year.

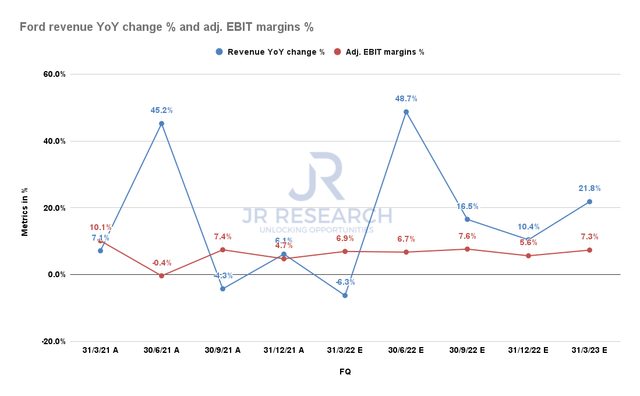

Ford revenue YoY change % and adjusted EBIT margins % (S&P Capital IQ)

Notably, Street’s estimates had also been revised accordingly to reflect Q1’s weakness. Therefore, it strengthened our conviction that the market had already priced in a relatively weak performance by Ford for Q1’s earnings.

Still, its adjusted EBIT margins are expected to remain resilient, as seen above. Moreover, its price leadership has also been constructive in shielding its margins from the surge in production costs.

However, investors should also be assuaged that Ford is expected to recover from its momentary slump from Q2 as comps could ease. Therefore, we should not expect the blip in Q1 to be a persistent headwind moving forward.

EV Restructuring Brings Focus To Ford Model e

CEO Jim Farley telegraphed the company’s ambitious plans to restructure its business into ICE (Ford Blue) and EV (Ford Model e) in early March. We had hoped for a spin-off as we thought that would help Ford to unlock significant value from its EV venture. Nonetheless, we consider the restructuring meaningful.

Investors should continue monitoring the company’s hiring ramp under the watchful eyes of its Chief EV and Digital Systems Officer Doug Field. We believe the restructuring can help Ford recruit and retain the much-needed talent better. Furthermore, it can also help the company leverage green bonds financing to further its EV expansion plans. Bloomberg Intelligence also weighed in (edited):

We assume that a potential separation wouldn’t happen until after 2026, making longer-dated issues at Ford Motor the most exposed. But Ford could consider a variety of mechanisms, including another debt tender or raising debt at the new company, as a tool to eliminate longer-term debt. – Bloomberg

In addition, Ford also communicated a massive 2M EV production plan by 2026. However, Tesla (TSLA) could potentially meet the 2M mark by the end of 2022. Therefore, Ford’s production roadmap is unlikely sufficient to help it garner EV market leadership. Nonetheless, it’s a step closer for Ford as it competes in the burgeoning US market.

The company has also instituted massive battery capacity expansion plans to support its grand ambitions. The company is working with its critical battery partner SK Innovation, to build 140 GWh in capacity by 2030 in the US. In addition, Ford has also planned for 100 GWh of capacity from Europe and China. Therefore, it’s critical for investors to continue monitoring the progress of its battery expansion plans moving forward.

Furthermore, the world’s largest battery supplier CATL reportedly planned to build a massive 80 GWh plant in North America. Hence, we think battery makers are starting to put in place long-term plans in the US, as EV adoption continues in earnest.

Nonetheless, the Street’s most bearish analysts expect Ford to fall well short of its ambitious plans. For instance, Morgan Stanley (MS) estimates that Ford could produce only about 500K units by 2026, well below the company’s 2M guidance.

It doesn’t believe that Ford can execute its ambitious plans to scale up. Therefore, investors must consider the execution risk of Ford’s EV manufacturing ramp. While the company has proven its ICE ramp, it has yet to prove its EV ramp. Furthermore, the ICE business would likely be worth lesser over time as we move rapidly towards EV adoption, impacting its valuation.

Is Ford Stock, A Buy, Sell, Or Hold?

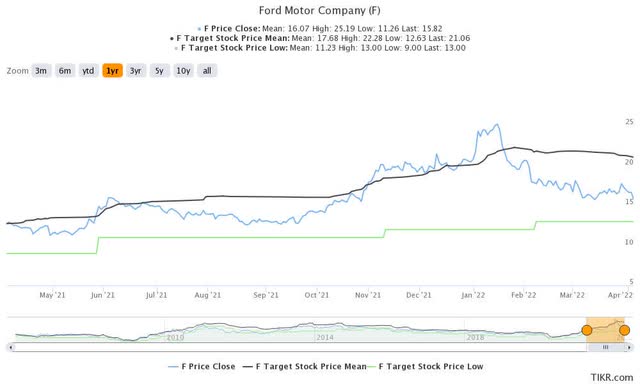

F stock consensus price targets Vs. stock performance (TIKR) F stock price chart (TradingView)

We think Ford’s fundamental thesis is constructive. Under Farley’s leadership, we believe that it’s well-placed to take on EV leader Tesla.

We revise F stock rating from Hold to Buy. It has fallen markedly below the average consensus price targets (PTs). Furthermore, its stock’s price action is also constructive, as it attempts to consolidate along its critical 50-week moving average support level.

Be the first to comment