Bill Pugliano/Getty Images News

The Thesis

At first glance, Ford (NYSE:F) stock looks cheap. It’s easy to get excited by the company’s transformation into the EV space and assign a “strong buy” rating. But, in this article, we will attempt to give investors a more nuanced view of the risk and reward. In the decade ahead, we project returns of 11% per annum. But, this is a cyclical investment. Investors should ask themselves, “How well do I understand Ford’s leverage?” And, “What will I do if Ford reports negative earnings in the next recession?” So long as you have a plan for the downside, we think now is an okay time to “Buy the lightning.”

Lightning In A Bottle

Ford has always had an iconic brand. Many rural consumers in North America live and breathe the Ford brand, especially when it comes to the Ford F-150.

The F-150 has been a best seller for many years, and Ford is not only introducing hybrid versions of the truck, but also, fully electric versions. This will obviously be met with consumer demand as oil prices remain elevated and government credits are still available. We believe Ford has incredibly loyal customers, entrenched over decades, which companies like Tesla (TSLA) cannot match, especially within the pickup space. All of this is lightning in a bottle for the 2022 Ford F-150 Lighting:

2022 Ford F-150 Lightning (Ford)

Cyclicality Is A Constant

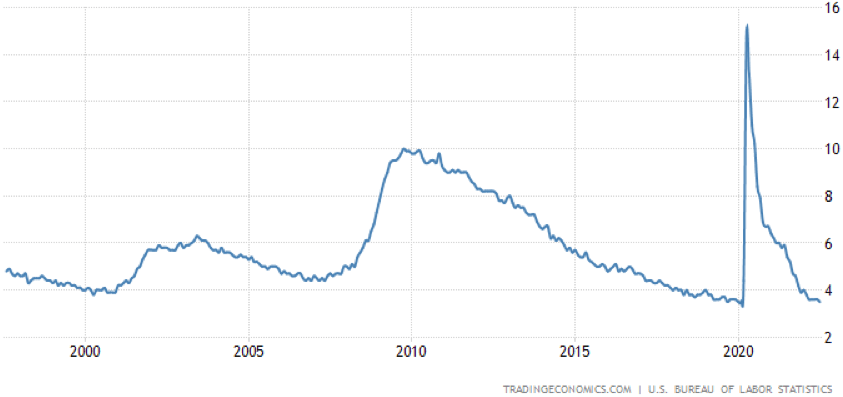

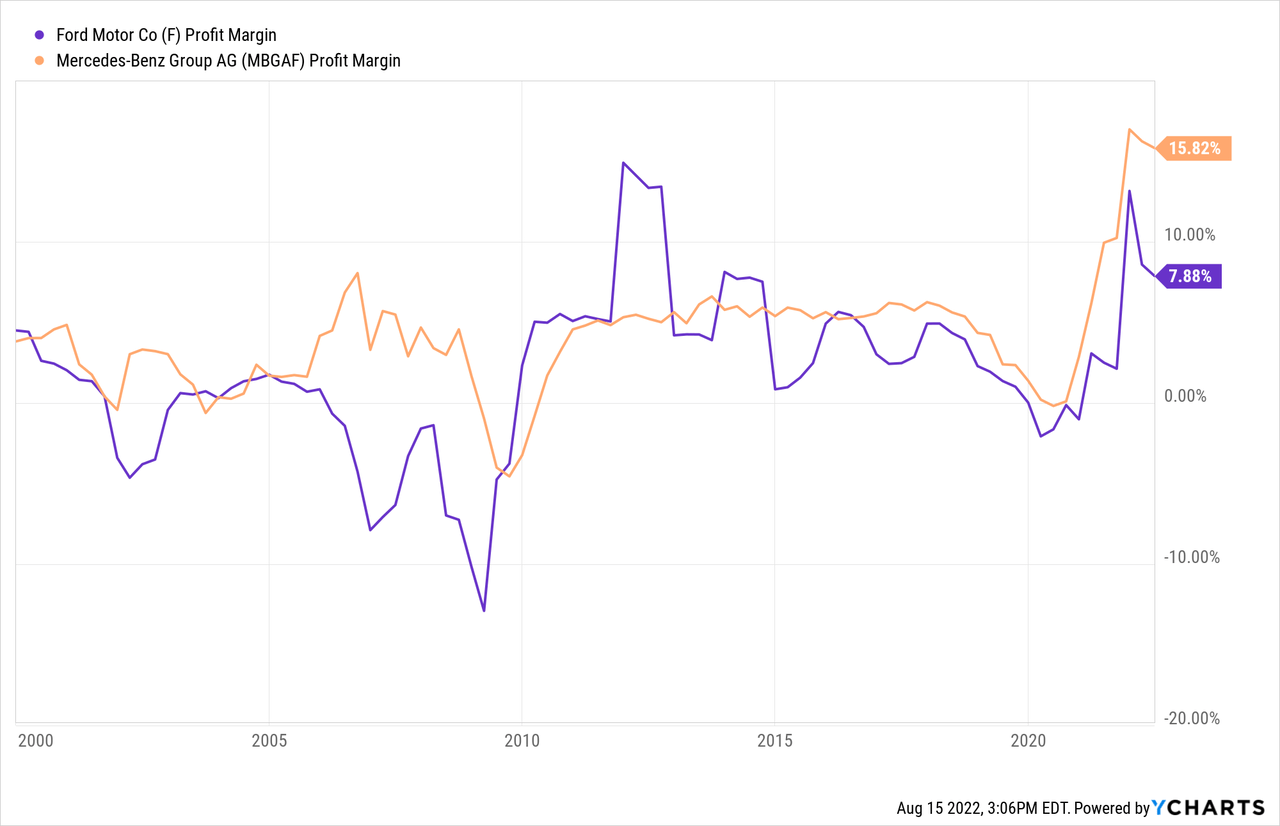

The auto industry is a very crowded space, with what seems like a hundred different brands competing for viability. This lends itself to swings in the margins of these businesses, especially as the economy goes through booms and busts. It’s not unusual for even the most dominant brands to see their earnings turn negative in a recession. Companies like Ford and Mercedes-Benz (OTCPK:MBGAF) saw negative to no net income in 2002, 2009, and 2020. Since 2020, the economy has been awash with stimulus cash. We still have some of the lowest interest rates in 5000 years, and the lowest unemployment numbers in recent history:

U.S. Unemployment Rate (Trading Economics)

All this good economic news means decent profits for automakers, but their profit margins are now hovering around all time highs:

In recent history, every time unemployment reached 4%, it was followed by recession. We could see margin compression ahead.

Ford’s 2022 Investor Day

After listening to the 2022 investor day, we have a few key takeaways. Ford has a number of exciting new products, including the Ford F-150 Lighting EV. Management said electric vehicle sales could make up 50% of the company’s revenue by 2030, and they believe they can attract new customers using this strategy. We believe this is both what the market wants, as well as what the future consumer needs. The market is still exceptionally exuberant about EV companies like Tesla and BYD (OTCPK:BYDDF). It looks like Ford wants in on the action. When asked about weakness in the stock price, management made reference to the company’s new offerings and their confidence in Ford’s future.

Debt Doesn’t Matter, Until It Does

When earnings are booming along, the market tends to get exuberant and ignore fundamentals, such as the balance sheet. This was the case for Ford, up until January 14th, 2022. Following that, the market’s focus shifted to inflation and the possibility of recession. This caused Ford’s stock to plummet as the fundamentals came back into focus again.

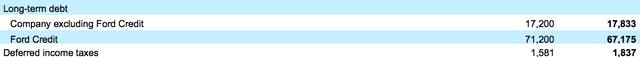

Ford has a monstrous pile of long-term debt, totaling $86 billion. However, this may not be as bad as it first appears. Much of Ford’s long-term debt is attributable to its “Ford Credit” segment that provides financing to customers. Ford reported:

“Ford Credit sponsors securitization programs that sponsor short-term and long-term asset-backed financing through institutional investors.”

Composition of Ford’s Long-term Debt (Q2 Filing)

We like Ford’s new CEO, Jim Farley, who took charge in 2020. He’s been de-risking the company, paying down debt at a rapid pace.

If you dig into the notes of Ford’s financial statements, as we did, you will see that this debt gets very complex. To assess Ford’s balance sheet risk, we’ll simply defer to the experts at Moody’s, S&P, and Fitch. FitchRatings has Ford at a BB+ bond rating, which is in the junk bond category, but on the verge of being investment grade.

We think Ford will be fine, barring very severe economic conditions. But, if said earnings turn negative in the next recession, investors could start focusing on the downside again. Ford traded for $4 per share in the depths of 2020.

Long-term Returns

We believe Ford’s normalized earnings are around $1.70 per share.

- To arrive at this number, we analyzed the following figures: Adjusted net income, adjusted free cash flow, average profit margin, average operating margin, and average return on assets. This gives Ford a normalized P/E of 9.7x.

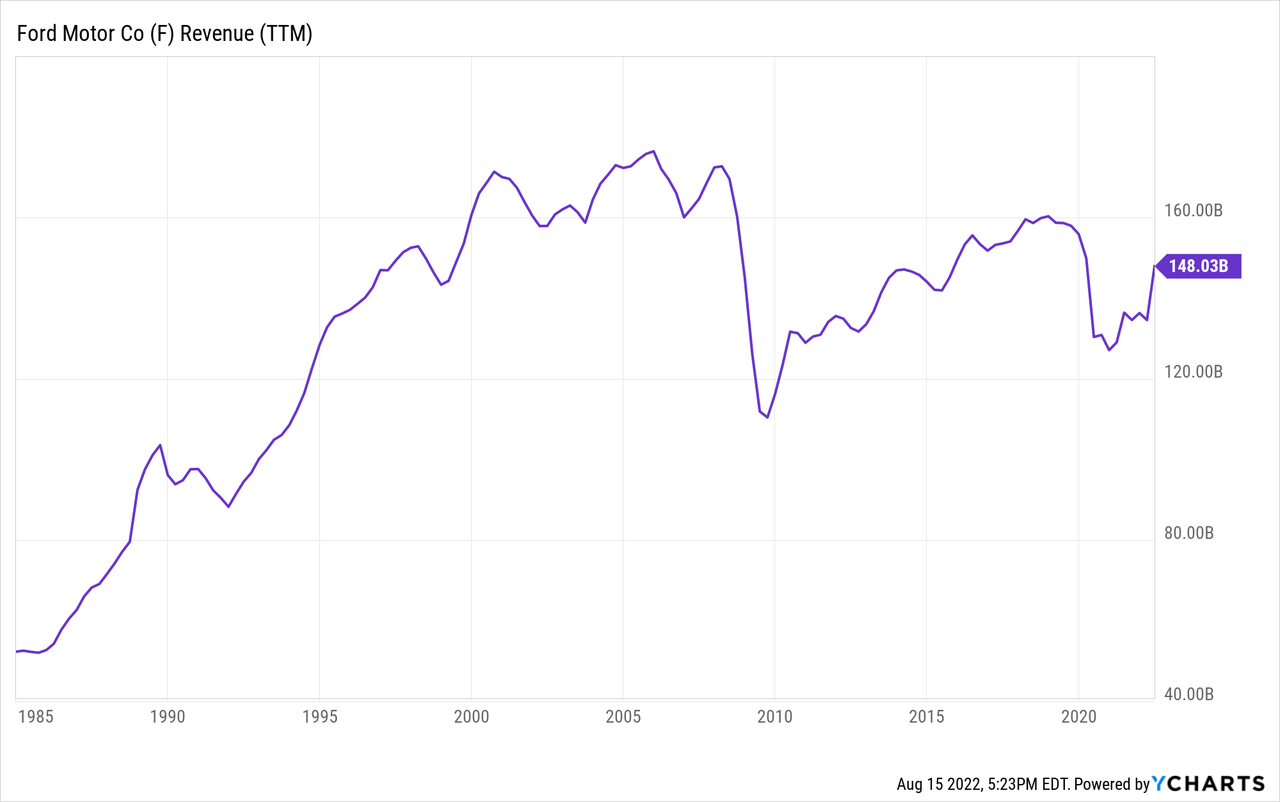

Ford’s revenue has stagnated since 1999, but we believe its revenue growth may pick up again. Given the developments with its EV and hybrid offerings, the company is expected to gain market share. While Statista is projecting revenue growth of just 2.2% per annum, we believe Ford can grow its revenue by 3.5% per annum through to 2032.

Our 2032 price target is $30.5 per share, implying returns of 11% per annum with dividends reinvested.

- We project Ford to grow its dividend by 9.5% per annum through to 2032.

- Moving on to EPS, Ford should be able to grow its normalized earnings per share at 5.0% per annum, reaching $2.77 by 2032. This is possible on the back of slow revenue growth, modest increases in efficiency, and incremental investment gains. There’s certainly room for Ford to see multiple expansion. We’ve assigned a terminal multiple of 11x.

Conclusion

Ford offers market beating returns if the economic cycle is kind and the company is managed prudently. Cyclicality can be brutal for automakers, and investors in Ford should have detailed knowledge of accounting, especially when it comes to balance sheet leverage. Ford has an exceptional brand and exciting new offerings in the hybrid and EV space, which should lead it to resume revenue growth after a long period of stagnation. We project returns of 11% per annum, but is the risk worth the reward? Looking at the balance of probabilities, we have a “buy” rating on the shares.

Be the first to comment