JasonBatterham/iStock Editorial via Getty Images

Investment Thesis

The long-term secular trends such as the casualization of work uniforms and growing interest in workouts will give Foot Locker, Inc. (NYSE:FL) solid growth opportunities. The company is well-equipped with competitive advantages to benefit from such growth opportunities by implementing a transition to an off-mall large format store strategy. With the ability to generate predictable cash flows and a strong balance sheet, the company is well-positioned to withstand economic shocks.

Nevertheless, I think the market is underestimating the value of the company. The company’s share price was negatively affected by the announcement of a reduction in dependence on Nike (NKE). However, although it is true that the company has a high weight on Nike, its true identity is a multi-brand shop, not Nike’s second store. Because multi-brand shops provide convenience and more choices that a single brand cannot provide, its value proposition is still unique and, in my opinion, undamaged.

Therefore, the company’s stock price incorrectly reflects the company’s fundamentals, providing an attractive double-digit earnings yield. The company also pays an above 5% dividend yield backed by positive strong cash flows that will limit the downside risk, providing an asymmetric risk-return profile.

Company Overview

The company has competitively positioned distribution channels worldwide.

It operates over 2,800 retail stores in 28 countries across the United States, Canada, Europe, Australia, New Zealand, and Asia and 142 franchised Foot Locker stores located in the Middle East and Asia. Overseas sales excluding the US account for about 30% and geographic market expansion plays a key role in the company’s growth. As a part of that, the company acquired a Japan-based brand, atmos to expand its presence in Asia. The reason I became interested in it is that its stores in Seoul are starting to show up noticeably.

Competitive Advantages

The company’s store strategy is also changing significantly to take advantage of growth opportunities

In addition to atmos, the company also acquired WSS. WSS targets the growing Hispanic community in the United States. However, the biggest advantage of the acquisition is that it allows the off-mall store strategy to be deployed more effectively. It focuses on large-scale, fewer stores, rather than small-scale, many stores. By implementing it, the company can give customers more choices. As I said earlier, its value proposition is to offer more options.

The company’s handling brands are not only Nike but also adidas (OTCQX:ADDYY), New Balance, Vans, Converse, Crocs (CROX), as well as private-label ones. It can effectively provide various options of these brands by operating a large store. In other words, the off-mall strategy will maximize the value of the company in the long run.

The focus on off-mall stores can contribute to the success of the company by increasing and diversifying product mixes. From the perspective of giving consumers more choices, larger stores can sell more products to people of all ages. In addition, not only shoes but also accessories and apparel can be sold together.

Capital allocation is consistent with shareholder value

The company has entered the maturity stage. Rather than actively seeking growth opportunities and making large-scale investments, matured companies need to focus on cash flow distribution.

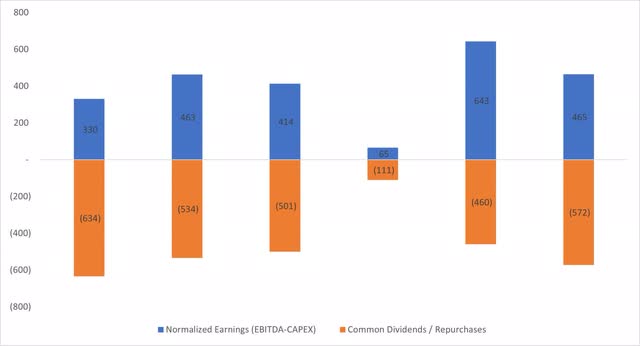

The company’s average EBITDA over the past five years is approximately $800M and its average capital expenditure over the same period including recent mergers and acquisitions is approximately $414M, resulting in normalized earnings of about $383M.

On the other hand, the average amount of cash distributed to shareholders, including cash dividends and stock buybacks, is approximately $450M. The number of outstanding shares has decreased by more than 20% from 119.8M five years ago to 93.3M now. By distributing most of the company’s profits to shareholders, the company implements a capital allocation policy aligned with shareholder value.

Foot Locker’s capital allocation (Created by the author using annual reports)

Valuation

Double-digit earnings yields are attractive even in a current high-interest rate environment

The company’s current earnings yield is about 11.5%, calculated by EBIT for the last twelve months and the current enterprise value. Forward earnings yield calculated using normalized earnings is approximately 8.9% and is expected to increase to 10.9% over the next five years. I am confident that this level of earnings yield is a good valuation to own the stock in the long term. And the dividend yield of above 5.0% provides attractive income returns and the protection from the downside for long-term investors.

My assumptions to forecast normalized earnings are as follows.

The number of stores is currently about 2,800, and it is expected to decrease with -2.0% of CAGR. The company historically reduced the number of stores by -3.6% per year from 2017 to 2021. I estimated the trend would last because of the company’s large-scale off-mall strategy.

Revenues per store are expected to grow by around 5.5% per annum, reflecting that the company’s off-mall strategy will enhance a product mix, resulting in improved per-store sales.

Total store sales, which combine the effect of decreasing stores and increasing sales per store, are projected to grow by 3.4% per annum over the next five years.

The growth rate of DTC sales is expected to be low at 3% as outdoor activities are expected to increase and online sales, which have been abnormally driven up by the pandemic, normalize.

The total sales growth rate is expected to be 3.3%, a conservative assumption compared to the previous 3.6%.

Finally, I assumed the cost of sales and operating expenses at pre-pandemic levels. Capital expenditures are expected to be an average, including mergers and acquisitions in the last five years.

Risks

Nike is just one of many, not the only one

The market is taking the loss of Nike seriously. It is true that Nike has a high proportion of sales, but it does not permanently damage the company’s competitive advantages. Also, the company has alternatives. The company soon announced that it would strengthen its partnership with adidas, a global sports brand that rivals Nike. Rather, the decline in Nike’s weight will strengthen the company’s strategic position.

Excess demand for premium products such as Nike’s was due to external factors such as increased fiscal spending and supply chain disruptions, giving Nike a stronger position compared to retailers. In addition, retailers experienced serious difficulties in operation due to the government’s quarantine policies such as social distancing. So, they were forced to accept whatever was given.

But now things have changed 180 degrees. The supply chain is getting normalized, and the consumption capacity has decreased due to inflation. Nike now needs distribution channels from big retailers like Foot Locker. Coming to the end of the pandemic, people will increase outdoor activities and retail store traffic will also normalize. According to the company’s Q2 2022 earnings conference call, the management said it was seeing favorable terms and conditions from vendors.

Foot Locker’s value proposition is to offer more options (Foot Locker, Inc. 2022 Q1 – Results – Earnings Call Presentation)

And the company’s competitive advantage is sustainable because it offers excellent value to consumers who want multiple options. According to the company presentation, 80% of frequent customers buy multiple brands. Customers who have purchased products four or more times in the past two years have mostly purchased three different brands, which account for more than 50% of sales. As long as such customers exist, the company’s position will likely remain stable.

Conclusions

This is not a company that offers significant growth opportunities, but it is a value stock with a mature business model. So, I strongly believe that investing at the current valuation level will provide stable long-term returns.

Be the first to comment