DNY59/E+ via Getty Images

The market rewards, not the best stock, but the best behavior. – Manoj Arora

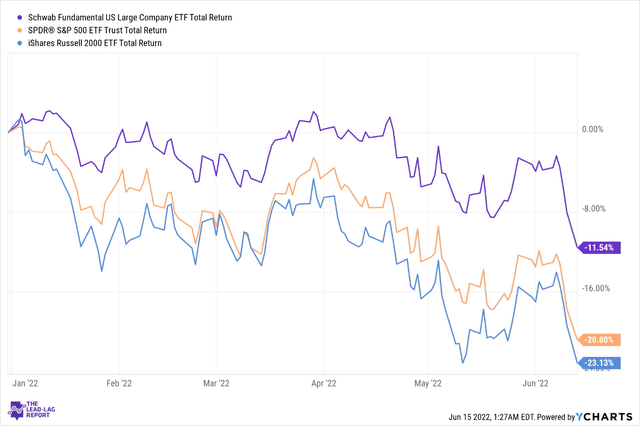

If you’ve been a long-standing patron of The Lead-Lag Report, you’d note that I’ve been urging members to adopt a defensive stance in the markets for a while now. Speaking of defense, note that the Schwab Fundamental U.S. Large Company Index ETF (NYSEARCA:FNDX) has managed to show some useful fire-fighting qualities in what has been a difficult year for global equities; on a YTD basis, note that both large-caps, as represented by the SPY, and small-caps, as represented by IWM, have both been battered by 21-23%; in light of this scenario, FNDX’s negative returns, within levels of early double digits, feels a lot more comforting.

Here are some additional reasons why you may pursue FNDX.

The case for FNDX

With a weighted average market-cap of over $352bn, FNDX no doubt appears to be tilted towards the mega-cap names, but this is not just a case of blindly loading up on these mammoth names; rather what you have is a carefully constructed methodology that seeks to incorporate diverse metrics to ascertain the fundamental quotient of the stock. Basically, the selection, ranks, and weights of the portfolio are driven by fundamental measures and are not market-cap weighted like most other portfolios.

What are these fundamental measures?

Well, firstly, you have an adjusted sales factor; FNDX doesn’t just measure companies based on one standalone sales year, but rather, takes into consideration average sales over the past 5 years; I feel this is a useful metric in weeding out companies that may have received one-off boosts in any particular year. However, the most crucial aspect of this factor is how they adjust it with financial leverage. At the start of this month, I had a fruitful discussion on Lead-Lag Live with Danny Moses, exploring the burgeoning financial risks in the system and how this was going to get trickier to manage as the noose gets tightened.

We are basically entering an era where companies with inordinate levels of financial leverage will be viewed with much stricter standards; one doesn’t have to be overly worried about that scenario when you consider the stocks within FNDX, as companies with excess financial leverage (as measured by equity as a function of total assets) receive a lower adjusted sales factor score.

The second fundamental metric that FNDX incorporates is the level of distributions; once again, the emphasis here is on the average level of dividends and buybacks over the past 5 years, rather than any one-off period (you could have instances where a certain company was able to announce a special dividend or an inordinately large accelerated buyback plan, simply because they disposed of a unit in that year, and not because these dividend or buyback programs are sustainable).

The last fundamental metric that FNDX incorporates is that of ‘Retained operating cash flow’ or operating cash flow post dividends and buybacks; once again, this is measured over a period of 5 years, rather than any solitary year. I also believe there’s much to admire about a company’s operating model, where it can not only generate ample free cash flow over 5 years but then afford to pay out a sizeable chunk of this via distributions and still have excess liquidity pending by way of retained operating cash flow. In an environment where liquidity conditions are getting tighter, companies with excess free cash in their books will likely be bid up.

Finally, also note that FNDX is a very well-diversified product offering useful exposure to a plethora of sectors; no single sector has a weight greater than 17%, and the top three sectors are a useful mix of cyclicals (financials), growth (tech), and defense (healthcare) highlighting the varied dimensions of this product.

Conclusion

Those who’ve followed my work over the years would note that I’ve always stressed the importance of buttressing your portfolio with defensive-themed assets that can help prevent drastic drawdowns; in fact too many novice investors get fixated over assets that typically do well only during risk-on environments, and get annihilated when risk-off periods return; that certainly isn’t a conducive way to build long-term wealth.

As repeated ad nauseam in The Lead-Lag Report and other investment portals, we may well be in the throes of an inflationary blitz, but over time, I expect conditions to transition towards a more somber deflationary terrain. In a prospective environment such as that, institutional investors will be very choosy about where they would deploy their funds and you’re likely to find stocks with deep fundamental merits (something that FNDX focuses on) come to the limelight.

Besides, in addition to that, also do consider that this ETF offers better yields, and is available at cheaper valuations relative to the S&P 500; just for some perspective, note that you can currently pocket a yield of 1.93% whilst the S&P 500 only offers you a figure of 1.55%. Crucially the forward P/E valuations of FNDX at 13.25x, makes it a real steal, compared to the corresponding multiple of SPY (18x).

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Be the first to comment