acinquantadue/iStock via Getty Images

The next carbon capture company I want to cover is Fluor Corporation (NYSE:FLR). Their primary business is as an engineering, procurement, and construction company (commonly referred to as an “EPC”). They design and build large refineries and other industrial facilities. Their carbon capture offering is referred to as the Econamine process. As you may have guessed from the name, it is an amine process. I have covered this in previous articles, but for the benefit of those who have not read them, I’ll quickly rehash here the basics of an amine process and my criteria for evaluating them.

Amine processes

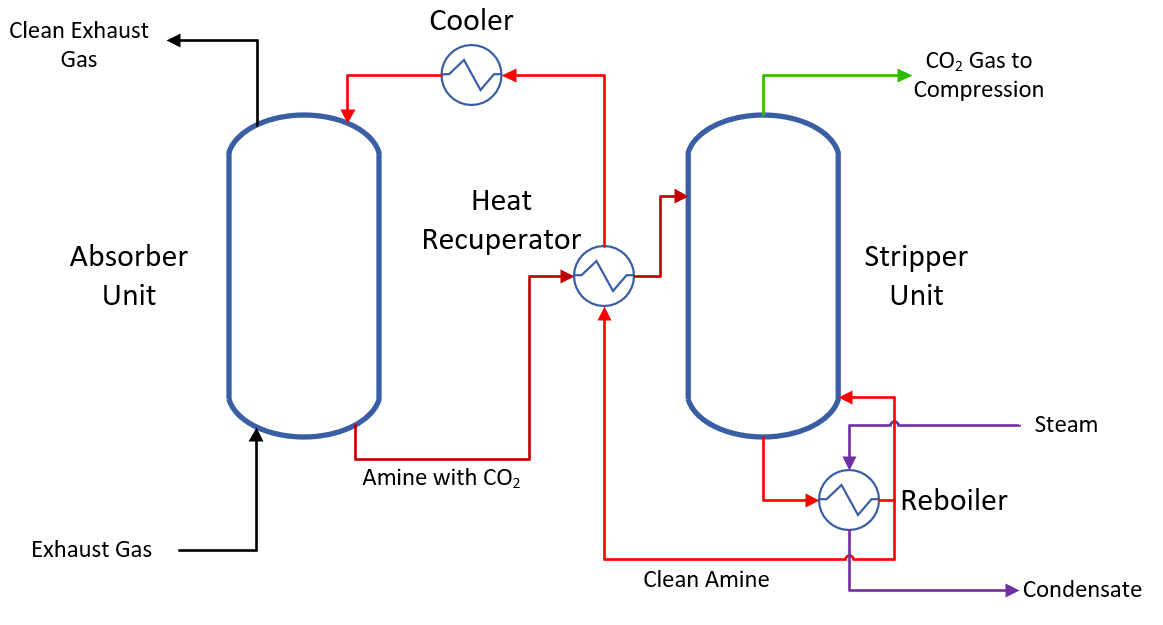

Mine technologies share common traits. They use a type of chemical, called an amine, that they dissolve into water. A gas containing CO2 enters an absorber tower where the gas comes into contact with the water-amine mixture. The dissolved amines chemically bind CO2. The water-amine-CO2 mixture is pumped into another tower, called a stripper unit, that heats up the mixture until the chemical bond between the amine and the CO2 breaks. This “strips” the CO2 from the amine. The CO2 leaves that unit as a gas with some water vapor and a very small amount of amine. The regenerated water-amine mixture is then ready to be cooled back down and put into the absorber unit and pick up more CO2. The gaseous CO2 must then be compressed to high pressure before it is put in a pipeline for transportation.

Simplified process flow diagram of a generic amine process (Author)

Absorption-based technologies use steam to provide the necessary heat to break the CO2-amine bond, so the CO2 can be released. Most of the energy used to run an amine process comes in the form of steam that could be otherwise be used to do work such as generating electricity. That steam is most almost always provided by some sort of combustion.

Investment criteria

As established in my previous article (read there for more details on why I chose these criteria), in order for carbon capture to impact a company’s stock, it’s going to have to hit on each of these criteria:

-

Market cap – The CO2 market will be in the tens of billions of dollars in this decade. A company needs a market cap small enough for this to make a meaningful impact on revenues and profits

-

Scale – Technology Readiness Level of 6 or higher or with a currently funded project to reach that scale

-

Economic viability with 45Q – Have to be able to produce CO2 at or under $85/tonne for point source capture, or $180/tonne for direct air capture.

The role of innovation in carbon capture

People are familiar with what innovation looks like in technology, but most don’t know what it looks like in carbon capture. Winning in carbon capture is kind of like winning a reverse beauty contest. Capturing CO2 is energy intensive and requires large capital outlay to make a product that, for all intents and purposes, is worthless. The goal is not necessarily to be the most attractive technology, but rather to be the least unattractive. Just be less ugly than the other contestants and you get to wear the crown. The biggest things that makes you unattractive are being unreliable and cost intensive.

Reliability

Most CO2 emissions come from large entrenched industrial sectors. These include power generation, cement kilns, steel mills, and refineries, among others. We’ve been making steel, cement, and burning coal and natural gas for electricity almost the same way for decades. Yes there have been some improvements made along the way, but these are mostly low-margin industries without significant competitive advantages between the different players. Also, these plants have been iterated on enough times that they usually run like clockwork.

Most of the margin comes from making sure that the process are running as smooth as possible with very little downtime. Combustion-based power plants boast availabilities of 85%+. That means they are running day and night for more than 310 days out of the year, and that typically includes about a month of scheduled maintenance every year. The rest of the year, you can only have about 25 cumulative days of cushion. If you have to shut off your cement kiln because the carbon capture process went offline, it’s a big deal.

Cost intensity

Depending on the industry, the age of the existing plant, and other factors, building a capture process at an existing facility could increase costs by anywhere from 30%-300%. The 45Q credit of $60-$85/tonne certainly helps, but you still have to convince a company to spend massive amounts in upfront capital costs and also increase operating spend to pay for extra personnel to operate the new plant, higher maintenance costs, more electricity, etc.

Innovation in the carbon capture space isn’t about more, it’s about less. The best technologies use less electricity, have lower steam requirements, minimize capital costs, and decrease downtime. Energy efficiency and robust operations are vital. With that in mind, let’s take a deep dive into the Econamine process.

Econamine’s Headstart

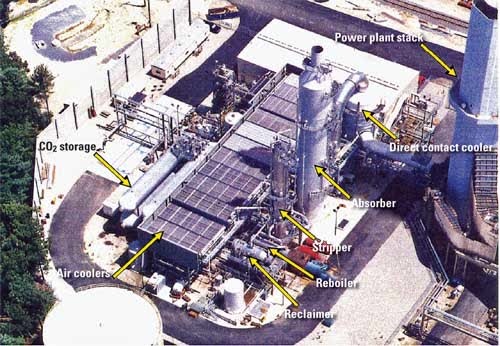

Fluor has the biggest first-mover advantage of any carbon capture technology. Before anyone was even really talking about climate change, they had a full-scale post-combustion carbon capture plant built and operational. The Bellingham commercial-scale natural gas-fired facility ran from 1991 to 2005. It was closed because the price of the CO2 was no longer worth the input costs to produce it. Even though the plant has not been in operation for nearly two decades, it still holds the record as the longest operated full-scale capture plant.

Fluor’s Econamine Facility in Bellingham Massachusetts (Courtesy of Fluor Corp)

Fluor was also one of the first to demonstrate on a coal-fired plant. The Kraftwerke Carbon Capture Technology Demonstration Plant in Wilhelmshaven, Germany started operation in 2012. While not a full-scale plant, they had the first shot at taking on the challenge of processing flue gas from coal combustion, which by nature has higher pollutants and particulates than cleaner-burning natural gas. Fluor had the opportunity to take their significant operational knowledge from a decade of experience in operating the Bellingham plant and accelerate ahead of the competition in the nascent carbon capture space.

Econamine falls behind the pack

Fluor was unable to capitalize on their advantage. The first ever full-scale coal-fired power plant capture plant was the Boundary Dam plant in Canada, which I covered in great detail in my article about Shell’s (SHEL) CANSOLV amine process.

Fluor’s opportunity came when the U.S. Department of Energy (DOE) decided to find a project at the Petra Nova plant in Texas. The Econamine process had the inside track and was among the final technologies under consideration. In the end, however, the contract went to Mitsubishi Heavy Industries competing amine process.

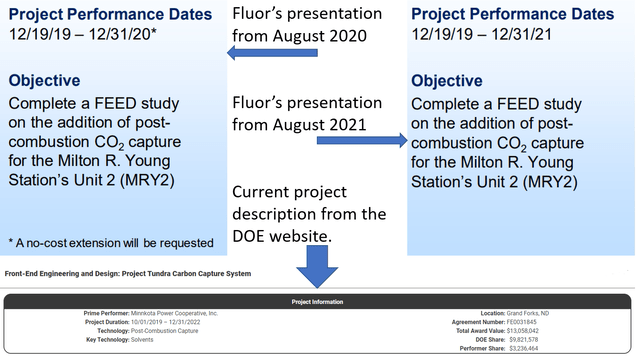

Fluor has not built any significant new facilities since their demonstration in Germany started operation a decade ago. Recently Fluor is in the process of completing its own front-end engineering and design (FEED) study for what they call Project Tundra, which would see their technology at a full-scale power plant. This effort received significant funding from the DOE. The FEED study was originally slated for completion by September 30, 2020 but has been delayed three times. The first delay was to December 31, 2020 because of delays signing the contracts with the DOE, which, based on my experience with similar contracts, was probably more the government being slow-moving than any issue with Fluor. Further delays to December 2021 and then December 2022 lie squarely on Fluor’s shoulders. The total cost for the FEED study was expected to be around $13M, with $9.8M of that coming from the DOE.

Timeline of setbacks for Fluor’s DOE FEED study (Department of Energy)

I recently attended the DOE’s Carbon Management conference. Fluor presented at the 2020 and 2021 conferences on the progress of the FEED study. At the 2021 presentation, they said they were on schedule reach to submitting a final report by December 2021. This year, they were conspicuously absent and have no updates on the project. The only information I can find is that the end date for the project has been moved to December of 2022.

Fluor failed in execution and innovation

The discussion above gives proper context for the lack of progress by the Econamine technology. While the reliability of their Bellingham facility was never in question, they ended up losing out on cost intensity. Shell, MHI, and others innovated on their amine processes. They put significant resources toward improving both the chemistry of their amines and the accompanying process. They found efficiency gains through detailed process improvements. They increased selectivity for CO2 and decreased the steam requirements to regenerate their amines with improved chemicals.

Fluor’s strength as an EPC does not lend itself well to that type of research and development. They are excellent at physical design and construction, and have a competitive advantage in taking a process that is drawn in paper and turning it into an operating plant. A completely different skill set is required to look at a process and creatively change it to create greater efficiency, to see where optimizations can be made and build a new process from the ground up to implement those optimizations. Fluor’s execution shows they lack that skill set, and it resulted in them squandering their poll position.

Criteria

Let’s return to the original criteria for investment to determine if Fluor’s carbon capture is a buy.

Market cap

Fluor’s market cap has recently hovered around the $4.7B range. They could significantly benefit from taking part in the emerging carbon capture space. It would have a big material impact on the company if they are awarded contracts for carbon capture plants.

In fact, Fluor would stand to gain more than most companies because any contract received would fuel their primary business. Not only would they get revenue from licensing their technology, but they would also act as the EPC, pocketing the extra revenue and profits from doing detailed physical design and construction of the actual plant. These are large projects. Even the smallest commercial-scale plants cost tens of millions of dollars. Full-scale plants will cost hundreds of millions of dollars or more. A recent full-scale FEED study that was presented at the Carbon Management conference had a price tag of $1.6B for a retrofit of a single coal-fired power plant.

Scale

Fluor was at scale long before anyone else, they get full marks here.

Economic Viability

Here is where Fluor falls short. It’s possible that they could at some point be economically viable with the 45Q credit. However, I have very little faith that their technology will outcompete the alternatives. The lack of actual physical projects and delays on a paper study lead me to believe that there is a weakness of the technology or execution relative to other competitors. They were so far ahead to start and have since fallen far behind. It is a shame, because translating Fluor Corporation’s first-mover advantage into success could have been transformational for the company. Their lack of execution and innovation lead me to believe that they will not become a major player in carbon capture. Fluor Corporation’s Econamine carbon capture technology is a sell for me.

Be the first to comment