niphon

Investment Thesis

Energy security and energy independence are rapidly growing themes driven by the war in Ukraine, and they should continue to drive significant investment across Flowserve’s (NYSE:FLS) traditional end-markets, including Oil & Gas, LNG, and nuclear power. The strong demand and healthy backlog of the company should help its revenue in the near future. The company has raised its prices to help it maintain price-cost neutrality during the supply chain constrained environment which we have seen in the last couple of quarters. The stabilizing supply chain environment and the conversion of a higher-priced backlog should help the company’s margins in the second half of this year and beyond. While the recent headwind with the company’s new ERP system implementation in North America should have a considerable detrimental effect on its third-quarter earnings, I am not too worried about it and believe its impact should be largely limited in the near term only. In the long run, the company should benefit from increased investments in the energy segment, improvement in the labor market, easing supply chain constraints, and reduction in inflationary headwinds.

Strong Backlog To Drive Revenue Growth

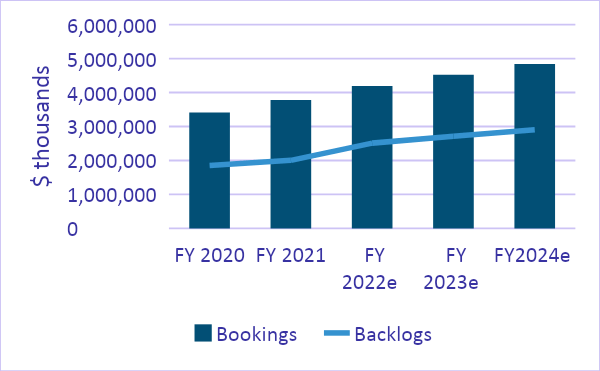

FLS Bookings and Backlogs (Company data, GS Analytics)

For the quarter ended June 2022 Flowserve reported bookings of $1.04 billion, up 10% despite the strengthening dollar. The aftermarket bookings for the second quarter were $526 million, and bookings for original equipment increased 21% from the prior year to $518 million. There was strength across the board, with the bookings for chemicals, oil and gas, and the water end-market was exceptionally strong. The backlog at Q2 end was $2.3 billion or up ~15.6% since the last year-end, driven by strong orders.

This surge in bookings and backlog didn’t convert into revenue due to supply chain constraints. Revenue for the second quarter was $822.2 million (down 1.8% Y/Y) which was below the consensus estimate of $886.5 million. I believe that as supply chain constraints ease, backlog conversion should improve and help the company’s revenue growth. There is a near term headwind, though. The recent implementation of a new ERP system at several of Flowserve’s high-volume manufacturing and QRC facilities in North America have caused some production disruptions. While most of the company’s ERP transitions since 2017 have gone live without causing operational disruption, this time, during the first two months of third quarter, the company had faced some difficulties which negatively impacted volumes. This caused the company to lose some revenue in the third quarter during the months of July and August. However, I am not too worried about it as it is likely as short term disruption. Management recently stated in a conference call that volumes are already ramping up sequentially in September (versus July and August) and I expect things to return back to normal by Q4 or early next year. So, the medium term outlook is still strong.

The company’s longer term growth prospects look good as well, with new opportunities in the energy segment driven by the Russia-Ukraine war. More and more countries are now realizing the importance of energy independence and, as a result, the investment in energy infrastructure is increasing across the geographies. Also, the 3D strategy launched by the company to Diversify, Decarbonize and Digitize should help the company to accelerate growth. In the diversification strategy, the company is focusing on diversifying from that of oil and gas markets to previously underserved regions and markets that have attractive long-term growth prospects like water, speciality chemical, and other general industries. Through decarbonization the company is reducing its CO2 footprint and working on hydrogen, recyclable products and biofuels. Through digitization, the company is focusing on the growth opportunities driven by the RedRaven IoT platform. The contribution from strong end-markets and 3D strategy is already getting reflected in the strong bookings and as supply chain constraints, labor market, and inflation improves, it will enable the company to further generate strong booking and revenues in the longer term.

Margin Outlook

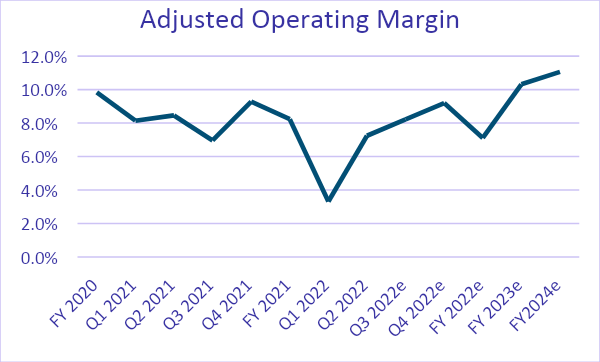

FLS Adjusted Operating Margin (Company data, GS Analytics)

Flowserve’s adjusted operating margin for the second quarter was 7.2%, down 130 bps Y/Y with FPD segment down 200 basis points and FCD segment down 80 basis points, primarily dragged by the decline in adjusted gross margin (down 300 bps Y/Y to 28.4%), which was partially offset by SG&A management. Adjusted SG&A for the quarter decreased by $18 million to $192 million, due to better cost management and currency benefit. As a percentage of sales, adjusted SG&A decreased 160 basis points to 21.7%.

There was some improvement in logistics costs in Q2, particularly in the valve space, which is expected to continue over the year. Two price increases implemented this year (5% at the beginning of the year and 11% implemented in May) should also help margins as the year progresses.

However, the recent ERP implementation issue will likely have a negative impact on the margins in the third quarter as it is impacting a sizable higher margin business. However, as discussed in the previous section, this is only a near term headwind and things have already started improving in September. So, I am not too worried about it.

Looking forward, in the medium to long term, the combination of the company’s strong pricing, growing backlog conversion, and the continued improvements in supply chain issues and inflation, should allow the company to increase margin.

Market Share Gain Opportunity

Flowserve operates in a fragmented market with an abundance of smaller competitors which present good opportunities for it to gain market share. For example, in the industrial valve business, the top 10 global valve manufacturers collectively comprise less than 15% of the total valve market. Flowserve, is the second largest industrial valve supplier in the world. So, the company is well positioned to gain share from smaller competitors. Similarly, the pump and mechanical seal industries in which the company operates are highly fragmented. Competition among the participants in this industry is generally driven by delivery times, application knowledge, experience, expertise, price, breadth of product offerings, reputation for quality, and Flowserve is well positioned in these categories. I believe this market share gain opportunity can support secular growth for the company in the years to come.

Valuations And Conclusion

Flowserve’s current year EPS is expected to be impacted by several headwinds which the company has seen so far this year like ERP implementation woes, supply chain issues, inflationary headwinds etc. But as we move into FY23 and these headwinds wane, the company should see a meaningful improvement in its earnings. According to consensus estimates, the company’s EPS is expected to grow ~48.80% Y/Y from $1.36 in FY22 to $2.02 in FY23. FLS stock is currently trading at 13.28x FY23 consensus EPS estimates, which is below its historical 5-year average P/E (forward) of 22.60x. Given the company’s good medium to long-term revenue and earnings growth prospects and attractive valuations, I believe the stock is a good buy at the current level.

Be the first to comment