Dave Kotinsky

Consumer staples remain one of my favorite asset classes for durable long-term returns. Valuation also matters, however, as I like to get income at a bargain. This brings me to Flowers Foods (NYSE:FLO), which has seen a strong run since hitting its share price trough in the middle of June. In this article, I highlight what makes FLO a worthy holding for any income portfolio, and at what valuation I would find appealing, so let’s get started.

Why FLO?

Flowers Foods is based in Thomasville, GA, and is one of the largest producers of packaged bakery foods in America, generating $4.5 billion in sales over the trailing 12 months. Its bakeries around the country produce a number of well-recognized brands, including Wonder Bread, Nature’s Own, Dave’s Killer Bread, Canyon Bakehouse, and Tastykake.

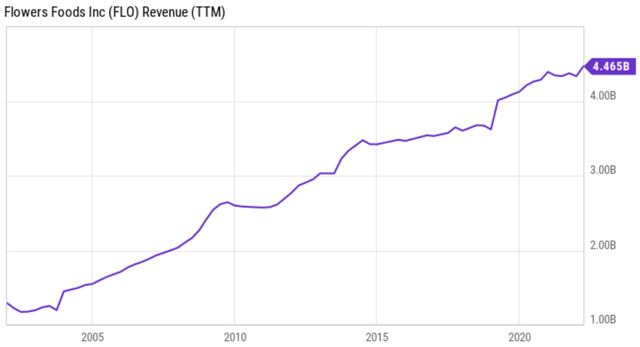

What makes FLO a durable company is its long track record of revenue growth in all economic environments, including through the Great Recession of 2008 and the COVID pandemic of 2020, as shown below.

This stability is in part due to the fact that people will continue to eat bread and other baked goods even during tough times. In addition, Flowers Foods has a diversified product mix that includes not just bread, but also buns, rolls, tortillas, snacks, and desserts. This diversification helps to insulate the company from fluctuations in any one particular product category.

What’s more, Flowers Foods has a number of competitive advantages that should allow it to continue growing in the future. These include its large scale, which allows it to achieve economies of scale in its manufacturing operations; its nationwide distribution footprint, which gives it superior reach compared to regional players; and its strong relationships with grocery store customers, which gives it shelf space stability. Moreover, FLO’s products have name-brand appeal.

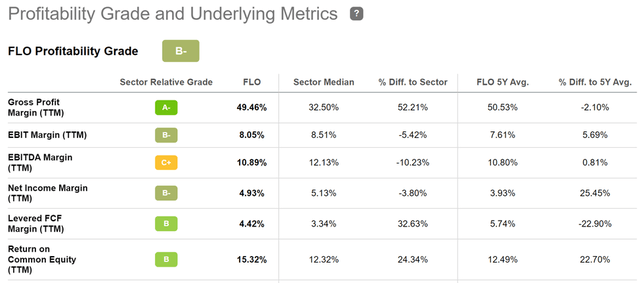

As shown below, it scores a B- score for overall profitability and an A- grade for gross margin, which sits at an impressive 49.5% compared to the 32.5% sector median. It also generates a strong 15.3% return on equity.

FLO Profitability (Seeking Alpha)

FLO has continued to impress with strong sales growth of 10.3% YoY to $1.44 billion in the fiscal first quarter (ended in April). This was driven by an impressive 13.5% overall price increase, due primarily to branded goods, which more than offset a 3.2% decline in volume. While the volume decline may be disheartening, it’s worth noting that this is against a difficult comparable, when stay-at-home products such as FLO’s bread and baked goods flourished during the spring of last year.

However, it appears that cost inflation is weighing on the company, as production costs including materials and labor were 50.5% of sales, a 110 basis point increase over the prior year period, and this flowed to the bottom line, as adjusted net income rose at a slower pace, at 6.3% YoY.

Looking forward, I see cost inflation pressures easing, as the recent July inflation report showed signs of easing. Moreover, I see FLO as being an all-weather company, as it’s demonstrated that it can simply pass along costs to consumers with low price inelasticity. This was reflected by management’s comments during the recent conference call:

Q: When we are looking at the price/mix that you have, would you be able to potentially do any some of what’s coming from pricing, what’s coming from mix? And then as you are thinking about consumer elasticities, they seem to have held up pretty well, the next waves of pricing and cost market are hitting a bit more of a pressured consumers. So if you would be able to offer any perspective on that, that would be great?

A: So far this year, we have been really encouraged by what we have seen. Our elasticities have been lower than even we anticipated. I think we called out in the prepared remarks that most encouraging is the fact that with significant amount of price increases in January, we actually grew our units as well with our top brands, Nature’s Own, Dave’s and Canyon. So, I see that as a really good sign going forward.

Meanwhile, FLO maintains a solid BBB-rated balance sheet and pays a 3.2% dividend yield that’s well covered by a 67% payout ratio. FLO has eight years of consecutive dividend growth under its belt and has a 5-year dividend CAGR of 5.5%.

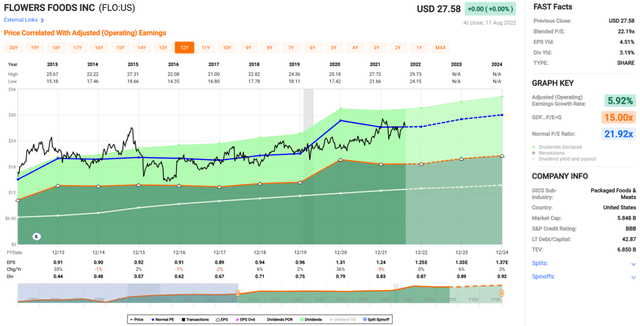

While FLO offers plenty of potential as a solid income grower, I see most of the strengths as having been baked into the current share price of $27.58 with a forward PE of 22.3. As shown below, this sits slightly above FLO’s normal PE of 21.9 over the past decade. As such, I would find FLO to be more appealing at a minimum 5% discount from the current price and ideally at a 10% discount.

Investor Takeaway

FLO is a high-quality company that has many things going for it. It has a strong track record of growth and its products enjoy price inelasticity. These factors make FLO recession and inflation resistant. However, with the shares currently trading at a slight premium to its long-term average PE, as it appears that many of the company’s strengths are currently baked into (pun intended) the price. That said, FLO would be worth revisiting if the shares were to pull back to attractively valued levels.

Be the first to comment