tdub303

flatexDEGIRO (OTCPK:FNNTF) has a great business model and some competitive advantages to peers, while its valuation is cheap due to stock market weakness, providing a good buying opportunity for long-term investors.

Company Overview

flatexDEGIRO is a German financial services company, operating in the banking business and execution of financial transactions. It has a market value of about $1.1 billion, being therefore a relatively small company, being traded in the U.S. on the over-the-counter market. Its shareholder structure is a mix of its founders and management, which hold some 28.8% of its capital, while the rest trades as free-float.

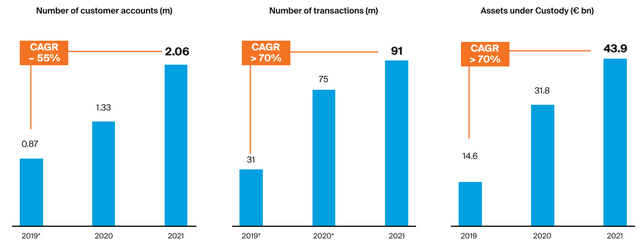

The current group was formed in 2020 through the merger of German online bank flatex, which bought the Dutch online retail brokerage DEGIRO. Through this acquisition, flatexDEGIRO become the largest pan-European online brokerage company, being present in about 18 countries, has more than two million customers and €44 billion of assets under custody, handling more than €350 billion of executed trading volume per year.

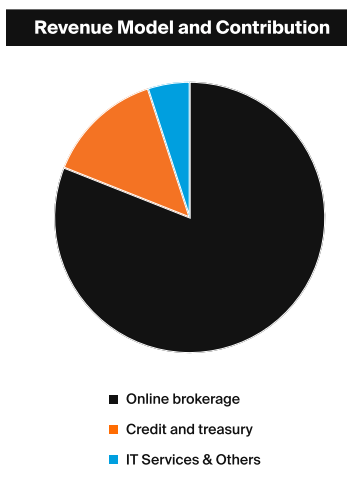

Its business is performed through two main brands, namely flatex in the banking business and DEGIRO in the brokerage operations. As shown in the next graph, the vast majority of its revenue is generated by online brokerage, while banking business has some weight on revenues, and IT Services & Others have a smaller weight on total revenue.

Revenue model (flatexDEGIRO)

While there are many online brokerage firms, offering cheap transaction costs for clients, flatexDEGIRO holds a banking license in Germany, being a competitive advantage to peers operating in Europe. Indeed, most of its competitors in the brokerage business are usually based in offshore jurisdictions due to tax reasons, such as Bermuda for instance, offering less protection of clients’ assets.

On the other hand, considering that flatexDEGIRO holds a banking license in Germany, this means that each client holds a German bank account, which is protected by the German deposit fund until €100,000. This didn’t happen before the merger, given that DEGIRO customers’ cash balances were invested in a money market fund, as DEGIRO was a brokerage firm and could not accept deposits. Therefore, the merger was quite positive for DEGIRO’s customers, which were more protected afterwards than they were previously. Beyond low trading costs, investors asset protection is usually an important factor to choose between brokerage firms, and being protected by the German deposit fund is the best protection investors can get in Europe.

Business Model & Growth

As an online brokerage bank, flatexDEGIRO is not comparable to traditional banks, as it doesn’t hold branches or perform most lending activities. Instead, its business model is based on retail online brokerage and IT capabilities, while its technological platform is another differentiating factor to competitors. Indeed, flatexDEGIRO has developed in-house, and through the acquisition of XCOM, a proprietary trading platform that is used by itself, but can also be used by other banks or brokerage companies that lack these capabilities for a fee.

flatexDEGIRO evolved its business profile mainly through acquisitions (in the banking, IT, and brokerage businesses) over the past few years, which means that its business profile is now different than it was in the past and compared to other brokerage firms. It has an integrated business model, due to its combination of bank-brokerage-IT capabilities, being quite unique in Europe in this respect.

Regarding its growth, flatexDEGIRO has had a very good growth history in recent years, boosted by the DEGIRO acquisition in 2020 as can be seen in the next graph, being now in the growth phase of its business strategy.

While historically flatexDEGIRO has grown through acquisitions, going forward the firm’s growth strategy is mainly organic, through the expansion of products and venues offered in both brands, such as cryptocurrencies or digital wealth management, aiming to enlarge its total addressable market.

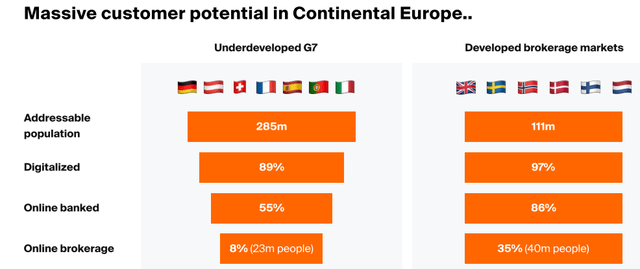

Reflecting its strong growth prospects ahead, supported by digitalization and product expansion, flatexDEGIRO aims to serve 7-8 million customers by 2026, execute at least €250-300 million transactions per year (vs. 91 million in 2021), and generate up to €1.5 billion in revenue. This is also possible to reach as several European markets are largely underdeveloped regarding online market share, which means the potential to gain customers in flatexDEGIRO’s current markets is quite significant, supporting the company’s growth for many years ahead.

Customer growth (flatexDEGIRO)

Financial Overview

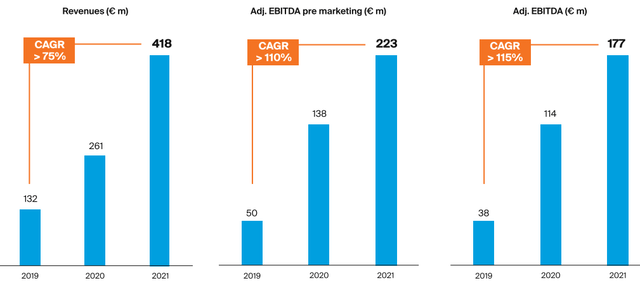

Regarding its financial performance, flatexDEGIRO has a very good track record, delivering impressive revenue and earnings growth in recent years, which have been above its customer and transactions growth, due to expanding margins and positive operating leverage. Indeed, its cost per trade has consistently declined over the past few years as the company invested in technology and grew its customer base, showing that its business benefited from economies of scale. As shown in the next graph, its total revenue amounted to €418 million in 2021, while its adjusted EBITDA was €177 million, representing a margin of 42%.

Financial performance (flatexDEGIRO)

Regarding its revenue sources, about 81% of total revenue comes from commissions originated by the brokerage business, while 19% is generated from interest income. This last part is generated by the bank’s liquidity portfolio (which amounts to about €1.5 billion, or about 3.4% of total assets under custody), and the rest comes from the credit portfolio, which mainly relates to margin lending.

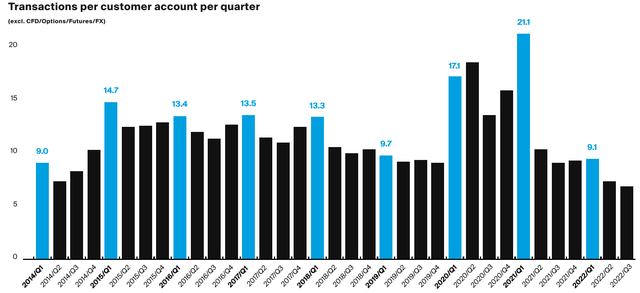

This means that flatexDEGIRO’s revenue and earnings pool are highly exposed to capital markets and customers’ activity, which is not particularly good during bear markets like the one experienced over the past few months. Indeed, not surprisingly, after two strong years regarding customer activity, flatexDEGIRO’s customers have been much less active in 2022, reflecting the weaker stock market globally.

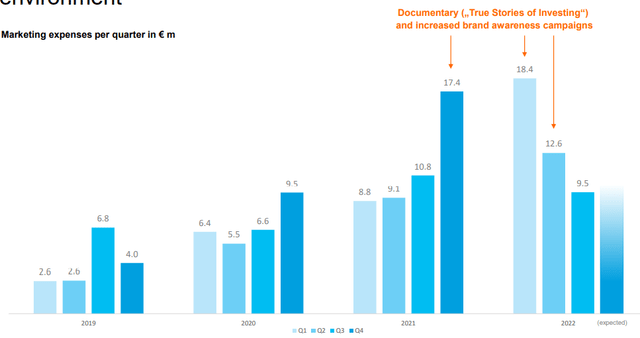

This largely explains why revenue growth has been muted in the first nine months of 2022, even though customer growth was able to offset some weakness in activity. In Q3 2022, the company’s revenue was €91.9 million (up by 4% YoY), still a resilient performance considering the tough market backdrop. On the other hand, as the company invested significantly in marketing expenses and financial awareness during Q4 2021 to Q2 2022, its adjusted EBITDA declined by 27.5% YoY during the first nine months of 2022 compared to the same period of last year, a trend that is expected to normalize in the coming quarters.

Marketing expenses (flatexDEGIRO)

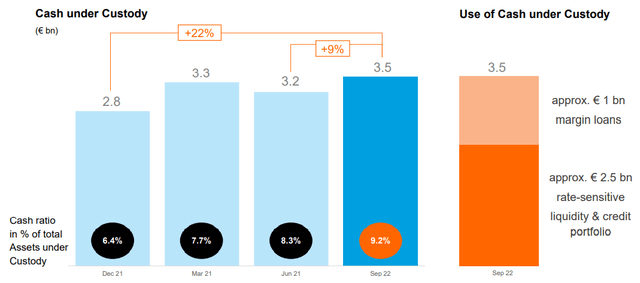

Despite the setback from weaker equities markets, flatexDEGIRO continues to gain new customers, which increased by some net new 342,000 during the first nine months of 2022, boding well for future revenue and earnings growth. Additionally, during this period the company had net inflows of €5 billion, of which some €600 million remained in deposits, which flatexDEGIRO used in its balance sheet to also increase its liquidity position to €3.5 billion (vs. €2.8 billion at the end of 2021).

This seems like a good move by management, which is pursuing a conservative approach to manage flatexDEGIRO’s balance sheet and also monetize higher interest rates in Europe, by increasing its cash ratio during a period of increased market volatility. According to the company, its annual benefit of higher interest rates in Europe is about €37.5 million considering the current ECB’s 1.5% deposit rate, showing that its business is also geared to higher interest rates and this can, to some extent, offset weakness in earnings from lower commission income.

Investors should note that despite being mainly a brokerage business, flatexDEGIRO has a banking license and therefore has to comply with banking regulations in Europe. This means that flatexDEGIRO reports a core tier one (CET1) equity ratio, even though its business is not really comparable to other traditional banks. Nevertheless, its CET1 ratio was 21.5% at the end of June, comfortably above its capital requirement of 17%.

This means that flatexDEGIRO’s capital requirement was €193 million, while it had a surplus position of some €40 million. Moreover, its leverage ratio of 5.48% was also well above its requirement of 3%, which means that flatexDEGIRO has a solid financial position and does not need to retain much earnings for capital purposes in the near future, enabling it to reinvest earnings in business growth both organically and through potential acquisitions. Additionally, flatexDEGIRO may also pursue share buybacks, if its excess capital position continues to increase in the future.

Conclusion

flatexDEGIRO is a great growth company in the fintech European market, having strong growth prospects over the medium to long term, supported by its strong market position and sound business based on the bank-brokerage-IT model.

Despite that, its business is highly geared to capital markets, which have been weak in recent months, justifying its share price decline of about 51% year-to-date. Its stock is currently trading at only 12x forward earnings, which seems to be relatively low for a growth company like flatexDEGIRO.

Thus, this seems to be a great opportunity for long-term investors to buy a great fintech company at a low price, considering that some of its peers trade between 15-20x forward earnings, and historically flatexDEGIRO has traded at some 16x forward earnings, which means that flatexDEGIRO is currently undervalued.

Be the first to comment