cagkansayin/iStock via Getty Images

Tightening Cycle About To Start

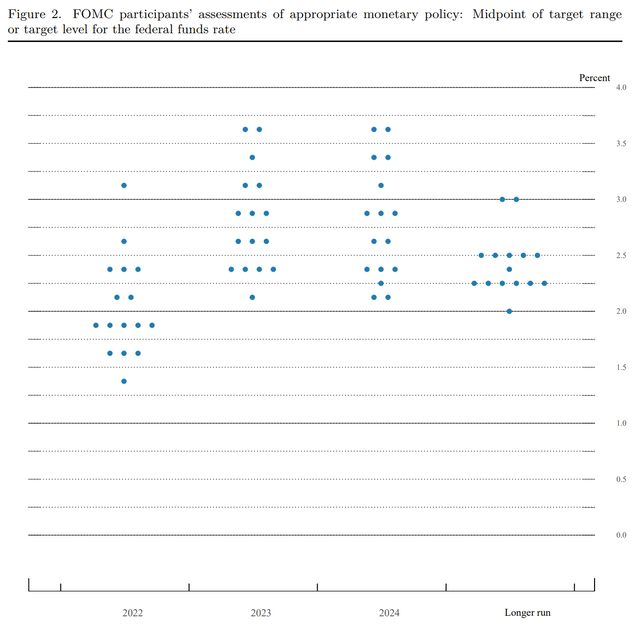

The Federal Reserve has embarked on a new rate hiking cycle with the first increase to the Federal Funds rate on 3/16/2022. The FOMC members are anticipating a faster progression of rate increases than the last couple cycles due to the higher inflation now present. The committee now sees the Fed Funds rate reaching a median projection of 2.75% by 2023 and staying there through 2024.

Many fixed income investments, including some high yield funds frequently discussed on Seeking Alpha, delivered a poor total return in the year leading up to the first rate hike. This was in spite of their high-single digit dividend yields. I anticipated this happening in my 4/2/2021 article on the PIMCO Income Strategy Fund (PFL). I reiterated on 9/14/2021 that it was too soon to buy PFL and other PIMCO closed-end funds despite the price drop following dividend cuts at several of them. Following my Sell rating in either of these articles would have avoided a negative 9-10% total return, even after factoring in dividends.

Some investors simply hold these funds for the long term regardless of the interest rate environment, as their lifetime performance has been satisfactory. Still, those who trimmed a year ago or those looking to start a new position will want to take into account how these funds perform in different parts of the interest rate cycle. If we look at the last tightening cycle, it turns out, perhaps counterintuitively, that high yield index funds and leveraged CEF’s outperformed safer bond funds more than they did during the easing part of the cycle.

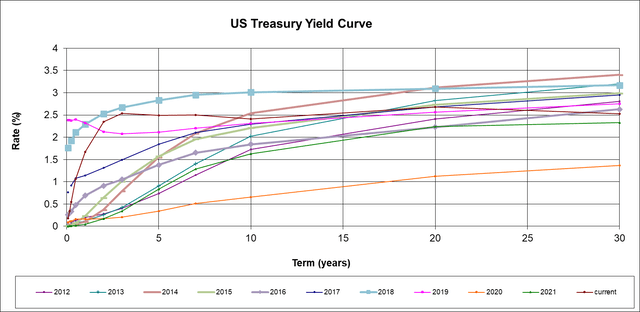

This is due in part to the fact that some rates anticipate the increases in the Fed Funds rate ahead of time. We see this in the current Treasury yield curve where 2-5-year rates are already around 2.5%, where the Fed expects the Funds rate to be well into the tightening cycle. This phenomenon has made some individual corporate bonds in the 2-5-year maturity window look attractive. Some bonds in this range on the border between junk and investment grade are available with a yield to maturity around 5%. These yields were impossible to find just a few months ago without taking on considerable credit risk.

While I started 2022 near an all time-low fixed income allocation in my portfolio of 12.6%, I have begun to increase my exposure by adding to my position in PIMCO Dynamic Income Opportunities Fund (PDO) as well as individual bonds from EQM Midstream (ETRN) and Las Vegas Sands (LVS) with 2 and 4-year maturities. I would still be cautious here about adding to a core bond fund or municipals as these underperform more in a tightening cycle.

What Happened Last Time?

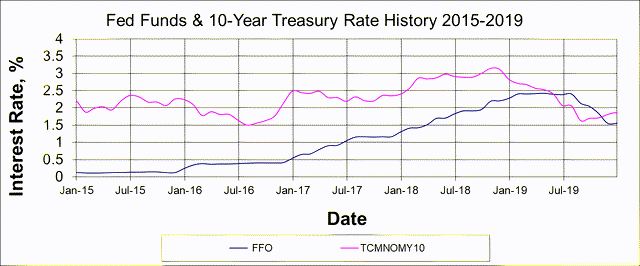

The last Fed Funds rate hiking cycle began in December 2015 and lasted until January 2019 when the Funds rate approached 2.5%. Unlike what we expect to happen this time, the Fed waited several months after the first rate hike to implement the second one. After that, the rate increases happened more frequently. The 10-year Treasury rate declined at the start of the Funds rate hiking cycle but eventually began increasing until the very end of the cycle when it fell again, inverting the yield curve.

Author Created (Data Source: Federal Reserve)

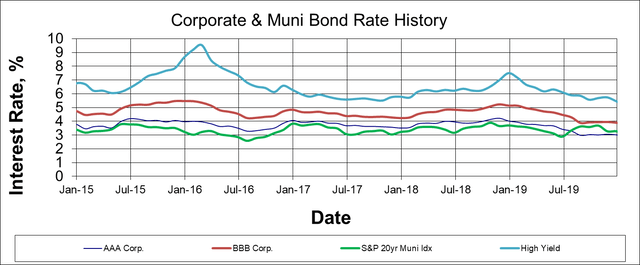

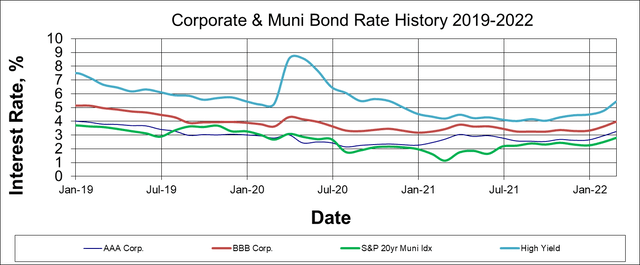

High yield interest rates anticipated the tightening cycle and peaked shortly after it began. High yield rates actually decreased during most of the time the Fed Funds rate was increasing. BBB corporates decreased slightly, while AAA corporates and muni rates didn’t move much.

Author Created (Data Source: Federal Reserve, S&P)

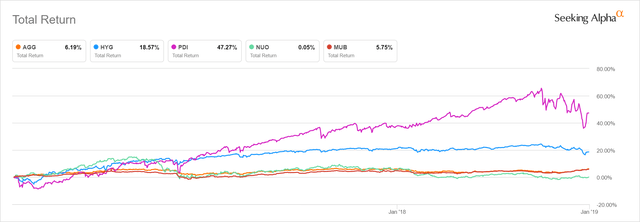

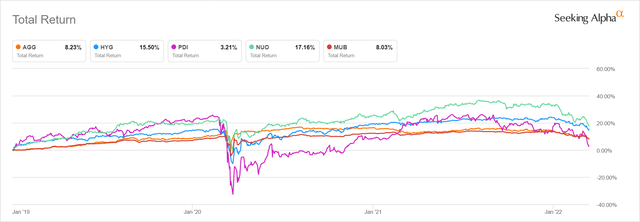

Fund performance during the actual tightening period of calendar 2016-2018 is shown on the chart below. We see that after a slight pullback during the first couple months of the tightening cycle, both the iShares High Yield Fund (HYG) and the PIMCO Dynamic Income Fund (PDI) both strongly outperformed, even after giving some back in the last quarter of 2018. The iShares Core Aggregate Bond Fund (AGG) returned only 6% total across 3 years, matched by the iShares Muni Fund (MUB). I also include a typical individual state leveraged muni fund, the Nuveen Ohio Quality Municipal Fund (NUO). It did well for about 6 months at the start of the cycle, then underperformed the rest of the way, returning zero over the 3-year period.

2016-2018 Performance (Seeking Alpha)

How Is The Current Setup?

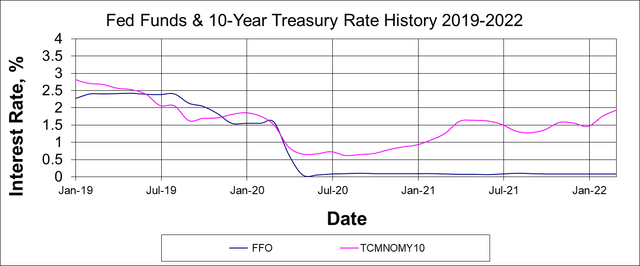

Moving on the neutral and loosening phases of the cycle, recall that the Fed Funds rate was cut about 1 percentage point in the second half of 2019 before the pandemic. It then fell all the way to near zero during March and April 2020. The 10-year fell quickly during the pandemic and bottomed in the summer of 2020, rising gradually since then. Corporate and muni rates trended down through the cycle, bottoming in the second half of 2021 (except for a spike in high yield rates at the start of the pandemic). These rates then started increasing, picking up speed in 2022 as the market priced in higher than expected inflation.

Author Created (Source: Federal Reserve) Author Created (Data Source: Federal Reserve, S&P)

While the loose part of the rate cycle produced some good returns for fixed income, the funds gave back a large chunk of these gains at the end. The non-leveraged funds (AGG, HYG, MUB) have been dropping since the start of the year, while the leveraged CEF’s have been falling since the summer of 2021. In the case of the CEF’s, they have been impacted not only by the interest rate fundamentals but also by declining premiums. PDI’s premium to NAV has fallen from 16% in June 2021 to 5% currently. NUO’s discount has widened from -7% in July 2021 to -13% currently.

2019-2022 Performance (Seeking Alpha)

Looking forward, the corporate and muni rates are still only about 1 percentage point above cycle lows, so it is possible they could continue rising for another couple of months before they start trending down or flattening as they did during the last Fed Funds hiking cycle. Also, CEF discounts have a little more room to widen before hitting historical lows. PDI discount bottomed at -11% in 2015 ahead of the last tightening cycle. NUO is close to its 2015 bottom of -14% however.

It’s hard to predict bottoms exactly, so with respect to the PIMCO CEF’s, I am not going to be like the High Dividend guys and tell you to buy them “before they soar“. Nevertheless, if I were building a new position I would start scaling in here, buying gradually over the next 3 months, especially on dips caused by global events or fed meetings. Yield isn’t everything, but the high yields to tend to compensate you if you buy in a bit early before the absolute bottom. My favorite one from the PIMCO family is now PIMCO Dynamic Income Opportunities Fund. It has the widest discount to NAV, currently at -8.8%. It also has the most undistributed investment income and the best distribution coverage at 125% for the most recent 3 months. The forward yield based on $0.1184 monthly distributions is low for the PIMCO family at 8.6%, but the UNII suggests that the fund could have a large year-end special distribution as it did in 2021.

It’s tougher to make a buy recommendation on the muni side right now. There is a much smaller spread between the cost of leverage and the bond yields than there is in the taxable space, especially now that 1-2-year rates have already come up so much. Looking at the Nuveen family for example, a lot of the funds have less than 100% distribution coverage and are burning through the UNII built up over the last cycle. If I had to pick one, I would go with their Taxable Muni fund (NBB) or just settle for the non-leveraged iShares ETF (MUB). Looking back at the 2016-2018 Fed Funds tightening cycle discussed above, the leverage did not help during that period.

Some Individual Bond Ideas

Intermediate term (2-5 year) corporate bonds have quickly become more attractive with the big rise in that part of the yield curve. The 2-year Treasury is now at 2.35% and the 3 and 5-year are around 2.5%. This is near the target Fed Funds rate for this hiking cycle, so further Fed Funds rate increases may have little impact on this maturity range. The 2 and 3-year rates are already very near the levels reached in 2018 toward the end of the last tightening cycle.

Author Created (Federal Reserve – Prior years are snapshots taken May 23 of each year.)

As a result, many corporate bonds in the 2-5-year maturity range are now available below par and with yields to maturity around 5% for those on the border between junk and investment grade. I suggest using your broker’s search tool and specifying the 2-5-year maturity range and as low of a credit rating as you are comfortable with. For these shorter maturities, I do not mind dipping into BB (Moody’s Ba) territory if the issuer’s stock does not look too distressed. For example, if the stock is still paying a dividend they can cut it if needed to help pay the debt.

I recently purchased two of these bonds. The first is EQM Midstream Partners (ETRN) 4%, due 8/1/2024 (CUSIP: 26885BAA8). The issuer is a formerly publicly traded MLP now fully owned by Equitrans Midstream Corporation. This midstream company is located in the Appalachian basin of OH/PA/WV and its main customer is EQT Corp. (EQT) with which it has minimum volume commitment contracts. The company has had some setbacks completing the Mountain Valley Pipeline but is expected to have EBITDA around $1.4 billion this year, covering interest expense by around 3x. The bond is rated BB- by S&P and Ba3 by Moody’s but I expect the company to pay off this $500 million debt on schedule in 2024.

The other bond is Las Vegas Sands 3.5%, due 8/18/2026 (CUSIP: 517834AE7). It is rated a low investment grade Baa3 by Moody’s but was recently downgraded to the highest junk level BB+ by S&P. The company has Covid lockdown issues with its Macao properties, and now that it has sold off its Las Vegas properties only has Singapore as its other main source of business. The good news is that the sale of the Las Vegas assets recently closed, providing $6.25 billion in cash to the company. LVS burned considerable cash in 2020 but was operating cash breakeven in 2021 before $828 million in capex. Pre-Covid, the company made $2-$3 billion per year of FCF. With a post-pandemic recovery and the cash on hand from the Vegas sale, the company should be able to pay off or refinance this $1 billion of debt in 2026.

I chose these maturities as they fit holes in my 1-5-year bond ladder where my prior holdings were called early in a lower interest rate environment. I paid below par for them so that the yield to maturity is around 5% for each. For investors worried about default risk, they can consider higher rated issues. The yields will be lower than 5% but still better than what was available a few months ago.

Risks

Every cycle has some differences from the last one, so history can be a guide but not a guarantee. Inflation is much higher now than it was at the start of the last several rate hiking cycles. This could shift the entire yield curve upward, rather than just the short end rising to meet the current 2-5-year rates. That would have a bigger impact on the funds than what we saw in the last cycle. Muni funds would be impacted the most because of their relatively longer durations. The taxable CEF’s like the PIMCO funds maintain a low effective duration, more in the 3-4-year range. Individual bonds bought below par don’t lose money if they are held to maturity without defaulting. That’s why I concentrate on shorter term individual bonds.

On the other hand, the tightening cycle could push the economy into recession, inverting the yield curve sooner than expected. This would likely not hit munis or non-leveraged index funds as hard but would increase default risk. Investors worried about this outcome should consider higher than BBB (or Baa) rated bonds.

Conclusion

Worries about fixed income investments have been on the rise with the prospect of Fed Funds rate increases starting, but history shows that a lot of the decline is probably priced in by the first rate hike, especially for higher-yielding leveraged closed-end funds. These funds have actually done better in the tightening part of the cycle rather than the easing phase. Leveraged muni funds have not done as well in this environment with a lower spread between leverage costs and bond yields. With 2-5-year Treasuries also already pricing in the rate hikes, now is a good time to look for individual bonds in that maturity range.

My fixed income allocation was near a historic low of 12.6% to start 2022 but with recent purchases including PDO and individual bonds, it has inched upward to 13%. It’s never time to bail out of all stocks or go all in on fixed income but the beginning of the Fed Funds rate hiking cycle is counterintuitively a good time to begin scaling into some fixed income.

Be the first to comment