DNY59

By Kevin Flanagan

While 2022 was arguably one of the worst, if not actually the worst, years for the U.S. bond market in modern history, a silver lining has emerged. Indeed, with yield levels surging across the asset class spectrum, one could conclude that a semblance of ‘normalcy’ has returned to the fixed income arena.

Up until this year, the one major question I was always asked was: Where can I find yield in the bond market? To be sure, with U.S. rates being dragged down by zero interest rate (ZIRP) central bank policies, negative sovereign debt yields abroad, and a lack of inflation, to name a few key factors, investors had been left with historically low yield levels, a new normal for the bond market.

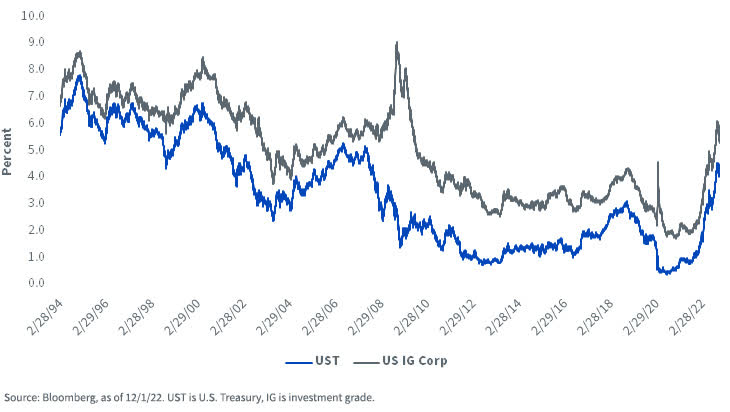

UST & U.S. IG Corporate: Yield to Worst

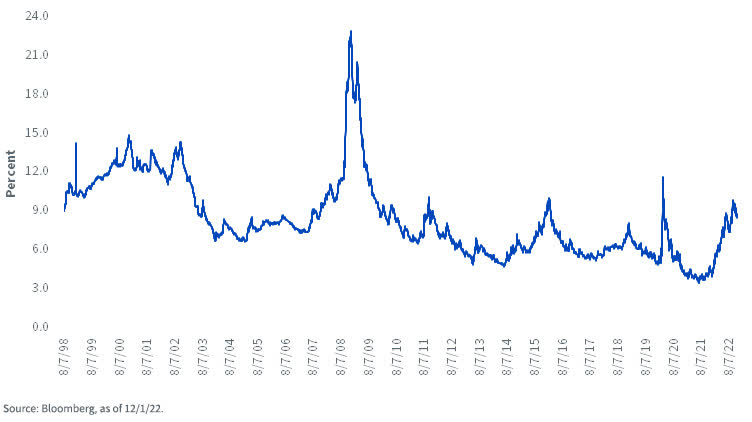

U.S. High Yield: Yield to Worst

As we are about to embark on a new calendar year, the fixed income landscape has changed dramatically. As I mentioned in a prior blog post, I would argue that the historically low yield levels of the last 10 to 15 years were “abby normal,” to quote the movie Young Frankenstein, and that investors are now witnessing what normal looks like when central banks are no longer pursuing ZIRP and are actually tightening monetary policy because of inflation.

This new rate regimen has brought Treasuries (UST), investment-grade (IG) corporates, and high-yield (HY) corporates all back to familiar pre-global financial crisis territory, arguably the genesis of the abnormal yield structure for the last decade or so (see graphs). For Treasuries, that means a yield to worst reading at or around 4%, and for U.S. IG corps, levels over the 5% threshold. Perhaps one of the more intriguing developments has been the rise in HY into the 8%-9% range. Compare these readings to where they were just a year ago: UST 1.12%, U.S. IG corps 2.29%, and HY 4.74%.

Conclusion

From an investment backdrop, investors now have some definitive options within the fixed income arena. In fact, even though Fed Chairman Powell has signaled the potential for some slowing in the pace of rate hikes, perhaps as soon as next week’s FOMC meeting, he also emphasized that rates could be heading higher for longer, with no apparent appetite to reverse course anytime soon. So, if I was asked the aforementioned question about where to find yield in the bond market now, my answer has now become a much easier one.

Indexes:

- Treasuries: Bloomberg U.S. AGG Treasury Yield to Worst

- IG Corps: Bloomberg U.S. AGG Corporate Yield to Worst

- High Yield: Bloomberg U.S. Corporate High Yield Yield to Worst

Kevin Flanagan, Head of Fixed Income Strategy

As part of WisdomTree’s Investment Strategy group, Kevin serves as Head of Fixed Income Strategy. In this role, he contributes to the asset allocation team, writes fixed income-related content and travels with the sales team, conducting client-facing meetings and providing expertise on WisdomTree’s existing and future bond ETFs. In addition, Kevin works closely with the fixed income team. Prior to joining WisdomTree, Kevin spent 30 years at Morgan Stanley, where he was most recently a Managing Director. He was responsible for tactical and strategic recommendations and created asset allocation models for fixed income securities. He was a contributor to the Morgan Stanley Wealth Management Global Investment Committee, primary author of Morgan Stanley Wealth Management’s monthly and weekly fixed income publications, and collaborated with the firm’s Research and Consulting Group Divisions to build ETF and fund manager asset allocation models. Kevin has an MBA from Pace University’s Lubin Graduate School of Business, and a B.S in Finance from Fairfield University.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment