GoodLifeStudio/iStock Unreleased via Getty Images

It’s official: the NASDAQ has officially entered correction territory for the first time in what seems like a long time. And while it took some time for the benchmark tech-heavy index to hit these levels, many tech stocks have been in free fall and in deep bear market mode for months.

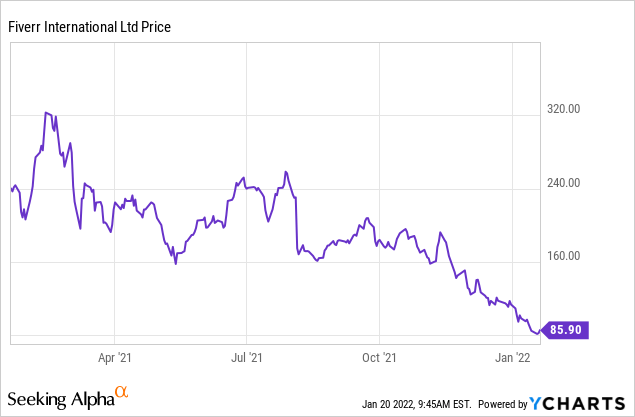

In very few stocks has the sting been as deep as in Fiverr (FVRR). This freelancer platform, which took off in the post-pandemic period and is a serious rival to Upwork (UPWK), has shed 75% of its value relative to highs above $330 notched last February. Since November alone, Fiverr has shed 50%. The stock price chart for Fiverr looks like a falling knife with no respite:

I myself had issued a word of caution on Fiverr back in October, when the stock was trading closer to $190. At the time, I warned that Fiverr’s valuation would not stand up to cheaper rivals like Upwork that made for far safer investments (the thesis proved true: Upwork is also down since November, but less so than Fiverr) – and in a rising interest rate environment, richly valued stocks like Fiverr get the hammer.

At some point, however, investors will have to reconcile the message of Fiverr’s strong fundamental performance versus its cratering share price. In my view, Fiverr’s stock has dropped enough to a point where investors should consider monitoring the company for a buy point.

In particular, there are several fundamental and secular merits to Fiverr that are worth mentioning:

- The gig economy is growing. Americans are quitting their jobs at a greater rate than ever, and more people are supporting themselves through means of gig-based or freelance jobs.

- Employers are taking note of the shifts. Widespread labor shortages have been well-documented across industries. While some employers are sweetening their employees’ packages to reduce churn, many employers are also shifting their hiring mindset and filing many positions with contract-based or gig-based roles.

- Fiverr’s clout is growing. The company is expanding upmarket into more business-oriented service buyers, growing its take rates, and expanding its geographical presence.

- Profitability. Fiverr generates positive and growing adjusted EBITDA, which is a relative rarity for a stock of Fiverr’s scale.

Meanwhile, the company’s valuation has sunk to much more reasonable levels. At current share prices near $86, Fiverr trades at a market cap of $3.14 billion. After we net off the $588.2 million of cash and $369.7 million of debt on the company’s most recent balance sheet, Fiverr’s resulting enterprise value is $2.92 billion.

For the current fiscal year FY22, meanwhile, Wall Street analysts are projecting Fiverr to generate $372.8 million in revenue, representing 27% y/y growth (data from Yahoo Finance). Against this revenue estimate, Fiverr trades at just 7.8x EV/FY22 revenue – a far cry from the past, when the stock routinely traded at a >20x multiple of forward revenue as recently as mid-last year. In my view, Fiverr has fallen to what we can consider bargain levels, considering its current >40% y/y revenue growth, its adjusted EBITDA margin gains, and its high mid-80s gross margins.

There should be a price for every company at which prudent investors will turn from cautious to opportunity-seeking, and I think that point has been reached for Fiverr. Take advantage of the recent dip to build up a position in this stock.

Q3 download

While Fiverr’s stock has been crumbling, its fundamental business has actually been firing on all cylinders, driven by the extension of the pandemic situation and the continued closure of schools and offices, feeding more fuel to the gig-economy trend.

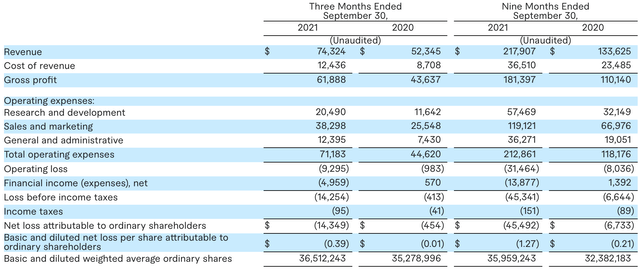

Let’s now dive deeper into the company’s latest Q3 results. The earnings summary is shown in the table below:

Fiverr Q3 results Fiverr Q3 earnings release

In Q3, Fiverr grew its revenue at a blazing 42% y/y pace to $74.3 million in revenue, outpacing Wall Street’s expectations of $71.1 million (+36% y/y) by a huge six-point margin.

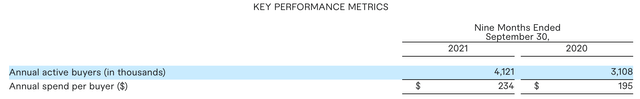

There were a number of drivers that fueled the growth here. For one, the company’s base of active buyers have grown, driven by the expanding gig economy. The number of annual active buyers grew to 4.1 million in the quarter, representing a 33% rise year over year.

Fiverr buyer metrics Fiverr Q3 earnings release

As shown in the chart above, Fiverr has also expanded its annual average spend per buyer to $234, representing a 20% y/y rise. This illustrated Fiverr’s success in driving its business upmarket, which is a major focus for the company’s growth in 2022. Key here has been its recent acquisition of a company called Stoke, which provides a “managed services” approach to Fiverr’s services and takes care of the hiring process end-to-end. In addition, Fiverr has expanded its internal Fiverr Business team with the goal of improving its go-to-market performance among bigger-ticket buyers.

Here’s some additional anecdotal color on Fiverr’s recent strength from CFO Ofer Katz during his prepared remarks on the Q3 earnings call:

We continue to move up market with high-value buyers, now representing 62% of coal marketplace revenue up from 57% in Q3 last year.

The growth contribution from high-value buyers is driven by two factors. First, the number of high-value buyers grew significantly faster than the overall buyer growth. Second, the average spend per buyer for high-value buyers is many times more than average marketplace than per buyer. Repeat buyers those who joined Fiverr over a year ago, contributed to 58% of revenue and core marketplace, up from 55% in 2020. Our older cohorts continue to spend at elevated levels compared to pre -pandemic. And we continue to see recent cohort in 2020 and 2021 to form better than a typical cohort in previous years.”

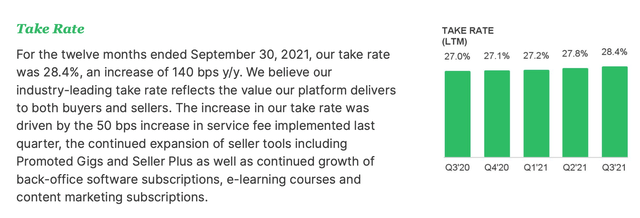

Fiverr take rates Fiverr Q3 investor letter

In addition to this, Fiverr’s revenue has also been boosted by its rising take rates, or the amount of revenue that Fiverr actually earns per dollar of transaction on its platform. Take rates hit 28.4% in the quarter, up 140bps y/y and enjoying a nice constant expansion, driven by increased service fees and an expansion of seller tools. This take rate expansion also helped Fiverr retain its high gross margins of 84.4%, flat versus the prior year.

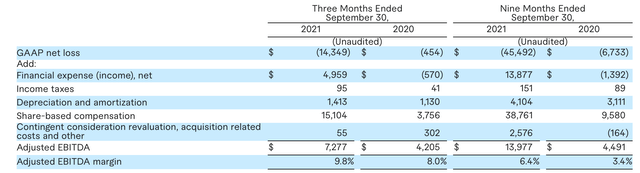

Fiverr adjusted EBITDA Fiverr Q3 earnings release

The company also grew its adjusted EBITDA to $7.3 million, up 73% y/y and representing a respectable 9.8% margin, up 180bps from 8.0% in the year-ago quarter.

Key takeaways

Fiverr’s fundamental strengths are undeniable – rapid growth rates, a growing buyer base and expanding take rates, on top of sky-high gross margins and profitability on an adjusted EBITDA basis. With the recent and sharp plummeting in Fiverr’s stock, investors have a well-timed buying opportunity here.

Be the first to comment