GoodLifeStudio

Appetite for a rebound seems to be heating up, and the stocks that are best-positioned to bounce are those high-quality names that have shed the most value since the start of the year. The best move for investors now, in my view, is to shift more allocation away from cash and defensive plays and start banking on growth again.

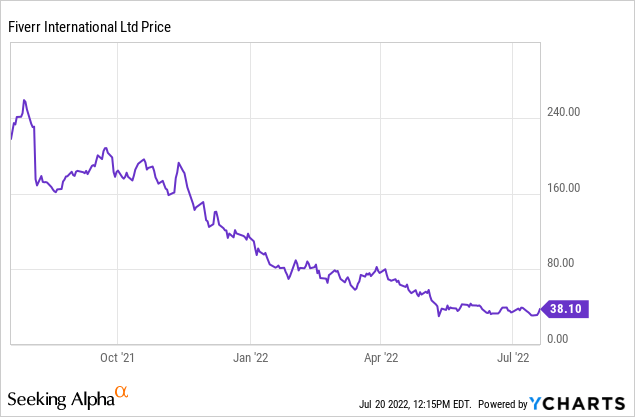

Fiverr (NYSE:FVRR), in particular, is an excellent choice for a rebound play. This gig-work marketplace has shed two-thirds of its market value since the start of the year. Part of this drop, of course, has been driven by deceleration – both natural deceleration as the business scales as well as fading tailwinds from the pandemic as workplace routines normalize. But the overwhelming majority of the decline, to me, owed exclusively to weakened sentiment, and Fiverr is now trading at incredibly attractive valuation multiples.

I remain bullish on Fiverr, in keeping with my prior view on the stock back in March. Though I did not anticipate the guidance cut that sent the stock spiraling in May, I think Fiverr’s risk-reward profile has now tilted heavily in favor of bulls. Yes, the company is no longer growing or performing as well as it did in 2021 – but it is still an expanding business, and one that is padding its margins – as well as trading at an incredibly new low price.

The bullish thesis for Fiverr

As a reminder for investors who are not fully familiar with Fiverr, the key reasons to be bullish on Fiverr are:

- The gig economy is growing; Fiverr is expanding the types of gigs available on its marketplace. Americans are quitting their jobs at a greater rate than ever, and more people are supporting themselves through means of gig-based or freelance jobs. In addition, Fiverr itself is acknowledging the wider diversity of skills and gigs and is adding/featuring more services on its site (in its most recent quarter, one of the biggest growth areas was 3D animation).

- Employers are taking note of the shifts. Widespread labor shortages have been well-documented across industries. While some employers are sweetening their employees’ packages to reduce churn, many employers are also shifting their hiring mindset and filing many positions with contract-based or gig-based roles.

- Fiverr’s clout is growing. The company is expanding upmarket into more business-oriented service buyers, growing its take rates, and expanding its geographical presence.

- Subscriptions. Though the majority of Fiverr’s gigs are done on a one-time contract basis, for its larger buyers, the company has introduced the concept of subscriptions, or being able to order the same recurring service on a set schedule.

- Profitability expansion made possible by huge growth margins. Fiverr generates positive and growing adjusted EBITDA, which is a relative rarity for a stock of Fiverr’s scale. Fiverr also carries a very high mid-80s pro forma gross margin. When a company is still growing revenue at a mid-20s pace, at that gross margin profile, the opportunities for operating leverage are dramatic.

Incredibly cheap valuation compensates for reduced guidance

Despite these strengths, the dramatic slide in Fiverr’s share price has rendered its valuation more attractive than ever. Yes, the company cut its guidance for the year – but this is more than compensated for by the lower price.

At current share prices near $38, Fiverr trades at a market cap of just $1.41 billion. After we net off the $504.0 million of cash and $450.9 million of debt on Fiverr’s most recent balance sheet, the company’s resulting enterprise value is $1.36 billion.

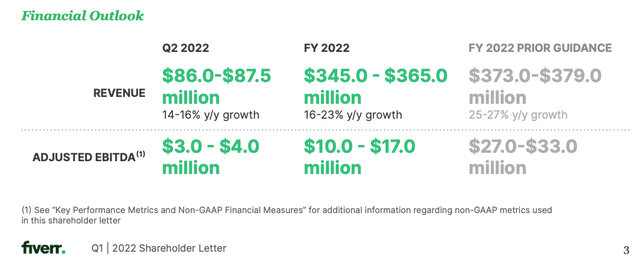

Fiverr’s updated guidance calls for $345-$365 million in revenue, representing 16-23% y/y growth – a huge comedown from 25-27% y/y growth in its prior outlook.

Fiverr guidance (Fiverr Q1 shareholder letter)

The company cited primarily macro factors as the driver. Per CEO Ofer Katz’s prepared remarks on the Q1 earnings call:

In March we started to see the impact of the shifting macro landscape within our marketplace, particularly in Europe […]

We have reduced and widened our guidance range to reflect the higher variability in the changing macro landscape as Micha discussed at the start of the call. January and February were solid as expected. In March and April, our business was impacted by a mix of macro factors, with Europe being particularly vulnerable. Compared to what we expected at the beginning of the year, in March our European revenue was below trend by low double-digits and the U.S. by a few percentage points. In April, Europe revenue was further impacted although more moderately and the U.S. was stable. As a reminder, Europe contributed to just under 30% of our revenue and the U.S. approximately half. Our direct exposure to Russia and Ukraine was less than 1%.”

My point here, however, is that even against this lower range, Fiverr trades at incredibly attractive multiples of 3.8x EV/FY22 revenue – which is very cheap for a company that A) is still growing in the mid-20s, B) has 80%+ gross margins, and C) is capable of pulling off adjusted EBITDA profitability.

Q1 results

Now, obviously, Fiverr’s business started slowing down in Q1, particularly in March. That being said, there were still positive highlights from the company’s Q1 earnings print.

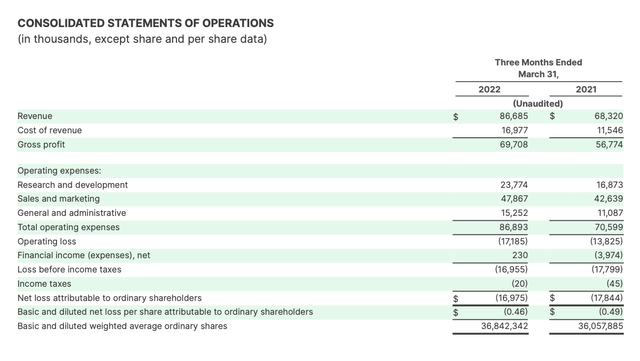

Take a look at the Q1 earnings summary below:

Fiverr Q1 results (Fiverr Q1 shareholder letter)

Fiverr’s revenue grew 27% y/y to $86.7 million in the quarter, basically in line with Wall Street’s $86.8 million expectations – but decelerating sharply from 43% y/y growth in Q4. Again, the primary factor here was a slowdown in business confidence and spend that hit in the back half of Q1. A lot of gig workers make up non-core, discretionary project activity, and hence spending for these types of jobs can be quickly cut to pare down a budget.

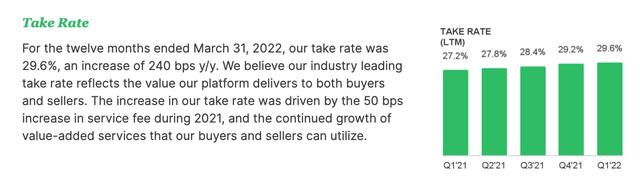

That being said, there are positive highlights here. In particular, note that Fiverr’s take rate improved to 29.6%, 240bps better than 27.2% in the prior-year Q1 (take rate represents the revenue cut that Fiverr takes on its marketplace transactions). This was driven by a fee hike as well as greater attach on additional services that Fiverr’s buyers are gravitating toward.

Fiverr take rate (Fiverr Q1 shareholder letter)

The company also boosted its active buyer base by 11% y/y to 4.2 million buyers while average spend per buyer also grew 17% y/y to $251. The company cited that buyers are trending toward purchasing services in multiple categories, increasing their reliance on the Fiverr platform.

Operating spend also showed a decent story in Q1. In particular, the company was able to achieve plenty of leverage on its marketing spend, and total sales and marketing costs fell to just 49% of revenue in Q1, eight points lower than 57%.

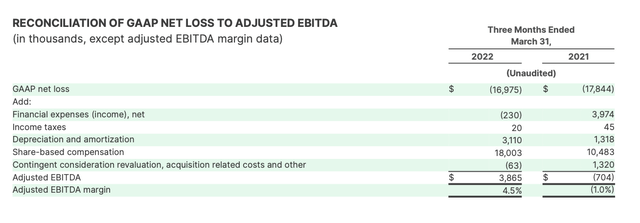

Adjusted EBITDA, meanwhile, swung to a profit of $3.9 million – the first time ever in Q1 that the company has posted a positive adjusted EBITDA, driven by the marketing efficiencies stated above. Adjusted EBITDA margins also soared to 4.5%, 550 bps better than a -1.0% loss in the prior-year quarter.

Fiverr adjusted EBITDA (Fiverr Q1 shareholder letter)

Key takeaways

Don’t write Fiverr off just yet. Though the company is entering into a rough macro patch with a slowdown of business spend, it’s primarily impacted by the same macro concerns that every other company is citing. Longer term, the company still operates a fantastic, high-margin technology platform that is perfectly matched to today’s more flexible, distributed workplace. Stay long here.

Be the first to comment