GoodLifeStudio/iStock Unreleased via Getty Images

Fiverr (NYSE:FVRR) recently reported a good start to the year, with revenue growing 27% yoy and adjusted EBITDA reaching profitability for the first time in the company’s history of Q1.

However, the challenging macro environment caused the company to cut their revenue and adjusted EBITDA guidance for the full-year. With the high-end of the company’s guidance assuming an improvement in the macro environment, it seems that there could be additional downside risk to guidance being cut again.

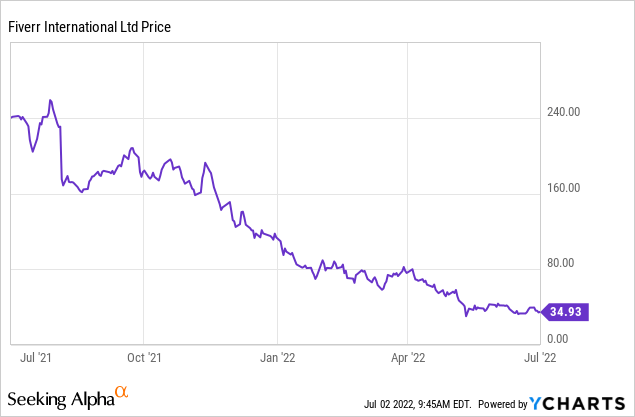

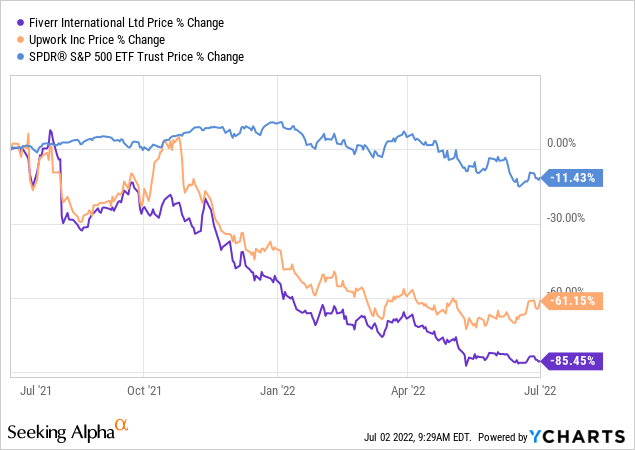

The stock is down around 70% so far this year as investors have moved away from high-valuation companies that struggled to generate consistent profitability. With Fiverr being exposed to the cyclicality of the macro environment, the company could experience significant revenue slowdown in the coming quarters. Around 30% of their revenue comes from Europe, which is currently experiencing a challenging macro environment and could give investors conviction in another guidance cut during the company’s next earnings report.

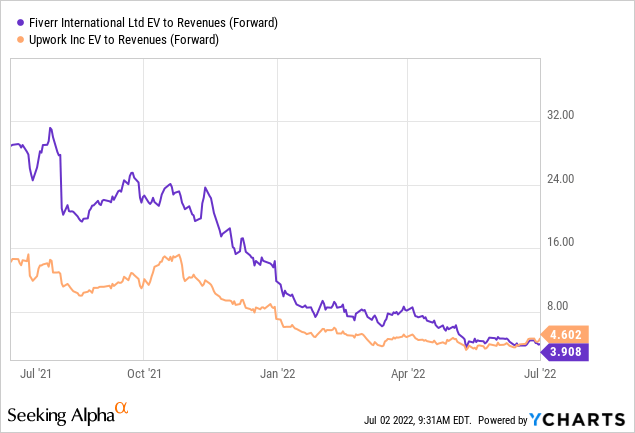

Also, valuation does not appear overly attractive at 4x forward revenue. Given the possibility of revenue growth slowing down, guidance being reduced, and profitability going lower, there seems to be continued downside risk to valuation.

For now, I continue to remain on the sidelines and will wait for a more clear macro picture before becoming constructive on this name. Given the challenged macro environment across Europe and fears of this spreading to North America, Fiverr could continue to see lower revenue growth and compressed profitability.

Earnings Review And Guidance

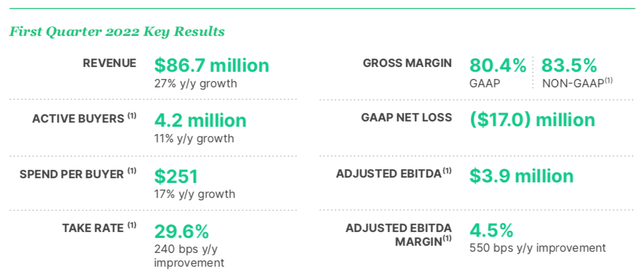

During the company’s most recent quarter, revenue grew 27% yoy to $86.7 million, which was in-line with expectations. Growth during the quarter was driven by both an increase in the number of active buyers and the spend per buyer.

While the number of active buyers grew 11% yoy to 4.2 million, the spend per buyer reached an impressive $251, growing 17% yoy. Despite the more challenging macroeconomic environment, Fiverr continues to see consistent yoy growth in their platform. However, one area of concern for me is that the number of active buyers was consistent with the prior quarter at 4.2 million. So despite the good yoy growth, sequentially growth has slowed down.

In addition, take rate during the quarter was near 30%, improving 260bps yoy.

Not surprisingly, non-GAAP gross margin came in at 83.5% and while down from 84.1% in the year-ago period, this still represents a very strong, consistent margin.

What impressed me the most during the quarter was the company reporting $3.9 million of adjusted EBITDA, marking the first time in company history they reported adjusted EBITDA profitability during their Q1.

However, going forward that is likely to be an embedded expectation of continued adjusted EBITDA improvement. While this is natural to see for a growing company, a challenging macro environment and potential slowdown could impact profitability, something investors would be disappointed in.

Despite a strong quarter to start the year with the company delivering adjusted EBITDA profitability, guidance was disappointing.

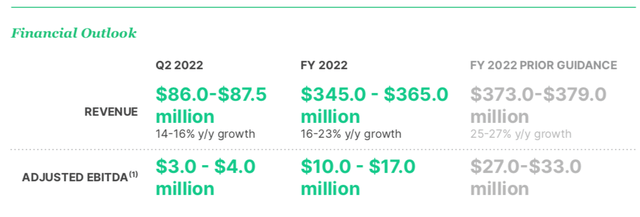

Q2 revenue is expected to be $86-87.5 million, well below prior expectations of $93 million. Adjusted EBITDA is expected to remain positive, albeit at just $3-4 million.

For the full-year, guidance was cut with revenue now expected to be $345-365 million, or 16-23% yoy growth, down from the prior guidance of 25-27% yoy growth. Not only was guidance reduced, but the range in guidance was widened to $20 million, which reflects management’s uncertainty for the remainder of the year. On the call, management talked about the moving pieces to their guidance.

We have reduced and widened our guidance range to reflect the higher variability in the changing macro landscape as Micha discussed at the start of the call. January and February were solid as expected. In March and April, our business was impacted by a mix of macro factors, with Europe being particularly vulnerable. Compared to what we expected at the beginning of the year, in March our European revenue was below trend by low double-digits and the U.S. by a few percentage points. In April, Europe revenue was further impacted although more moderately and the U.S. was stable. As a reminder, Europe contributed to just under 30% of our revenue and the U.S. approximately half.

The high-end of our guidance assumes an improvement in the macro environment that drives a rebound in consumer and business spending. The low end of our guidance contemplates a continued deterioration in Europe and moderate contagion to the rest of the world.

As we stand today, it’s been just over a month since guidance was provided, and the macro environment has not changed too much. Some could argue that fundamentals have deteriorated a bit, which could mean potential guidance reduction during their next earnings report.

It wouldn’t be surprising to see another guidance reduction, and adjusted EBITDA could be cut once again. Until the macro environment sees some improvement, there seems to be inherent risk to potential disappointing financial results and guidance.

Valuation

The week leading up to the company reporting earnings saw the stock pullback around 50%. So while the stock is up 15% since they reported earnings, the stock remains down almost 70% year-to-date. Fears over the economy slowing down, wages continuing to increase, and uncertainty over the company’s future profitability has caused negative sentiment to persist.

In fact, the stock has now pulled back to levels last seen prior to the onset of the pandemic in early 2020. Fiverr significantly benefited during the pandemic has the rise of the gig economy took hold, however, this company remains susceptible to the macro environment, which currently remains in a volatile state.

Not surprisingly, the company’s valuation has significantly pulled back this year. The stock had previously traded over 10x forward revenue, though the significant uncertainty has caused the stock to now trade at 4x forward revenue.

The company has a current market cap of $1.3 billion and $50 million of net cash, resulting in a current enterprise value of $1.25 billion. The company’s current revenue guidance for the full-year is $345-365 million, or 16-23% yoy growth, which implies a FY22 revenue multiple of around 3.5x.

However, with the low end of the company’s guidance factoring in continued deterioration in Europe and some contagion throughout the world, it’s not unreasonable to think that revenue could come in below the current guidance range. On top of that, adjusted EBITDA would likely be pressured in that scenario, which could cause further deterioration in the company’s valuation multiple.

For now, I continue to remain on the sidelines as the volatile macro environment has caused a significant slowdown in the company’s revenue growth. With visibility still a little uncertain, it’s difficult to be confident in the company’s outlook and with the potential for another guidance cut, I will continue to avoid this downside risk.

Be the first to comment