jetcityimage/iStock Editorial via Getty Images

Introduction

Five Below reported its Q1 2022 earnings last week. Results were below expectations for the most part, but we believe that Five Below is different from most (if not all) retailers. The company is not immune to macroeconomic impacts and inflation. We go over these in the article and explain why there’s no reason to be worried long-term. There’s no sugarcoating it, though; results for the quarter were not good, especially on the topline.

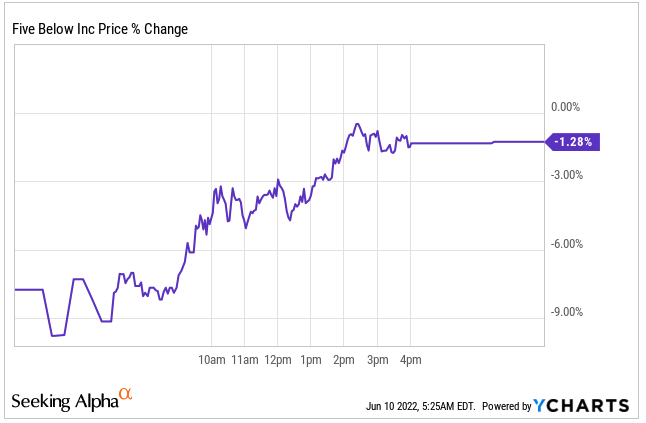

The market’s reaction

The initial reaction to the earnings was bad, and the stock dropped more than 9% in pre-market trading. However, during the day, and despite the indexes being in deep-red territory, the stock recovered quite well:

YCharts

This information is not really relevant for the long-term thesis, of course, but we think it illustrates perfectly how the markets swing without really looking at the earnings information right now. All the information necessary to judge the quarter was available since the day before, but this didn’t stop the stock from suffering significant volatility the day after. If you want to predict market movements, you need to predict how people will react when confronted with new information. Spoiler: it’s not easy.

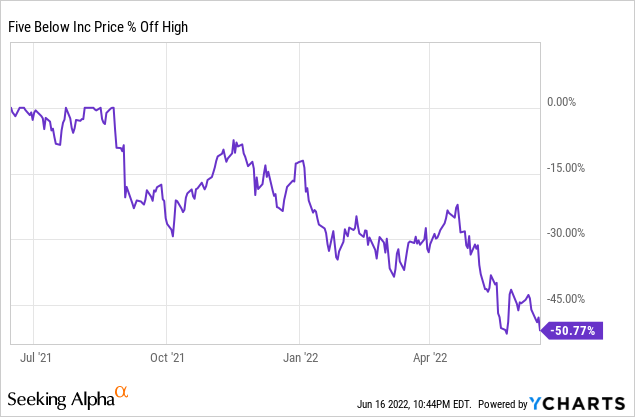

Of course, if we zoom out a bit, we can see that Five Below’s stock has performed very poorly during the last few months. It’s down more than 50% from its high now.

If we zoom out even a bit more and look at the historical P/E ratio of the company, we can see that it’s trading at its second-lowest level of the last decade, with the lowest point during the corona crash in March of 2020.

Ratios should not be looked at in isolation, but we think the company is fairly valued here (if not undervalued). We don’t expect you to come out of this article thinking earnings were impressive and the company is a bargain, but we’ll give you the context on why the quarterly results aren’t worrying either and why Five Below might be a compelling long-term investment.

The numbers

There are plenty of things to go over in this section. But, first, let’s quickly go over the headline numbers.

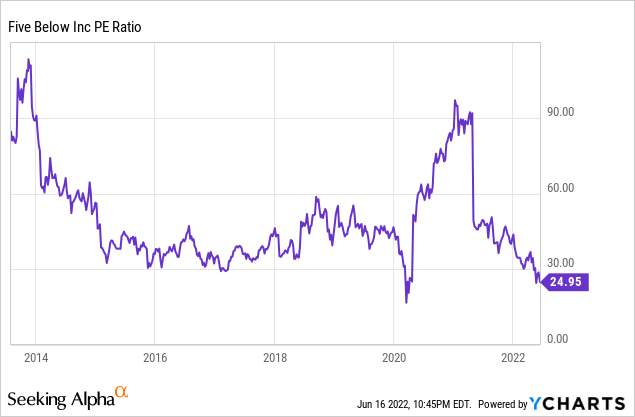

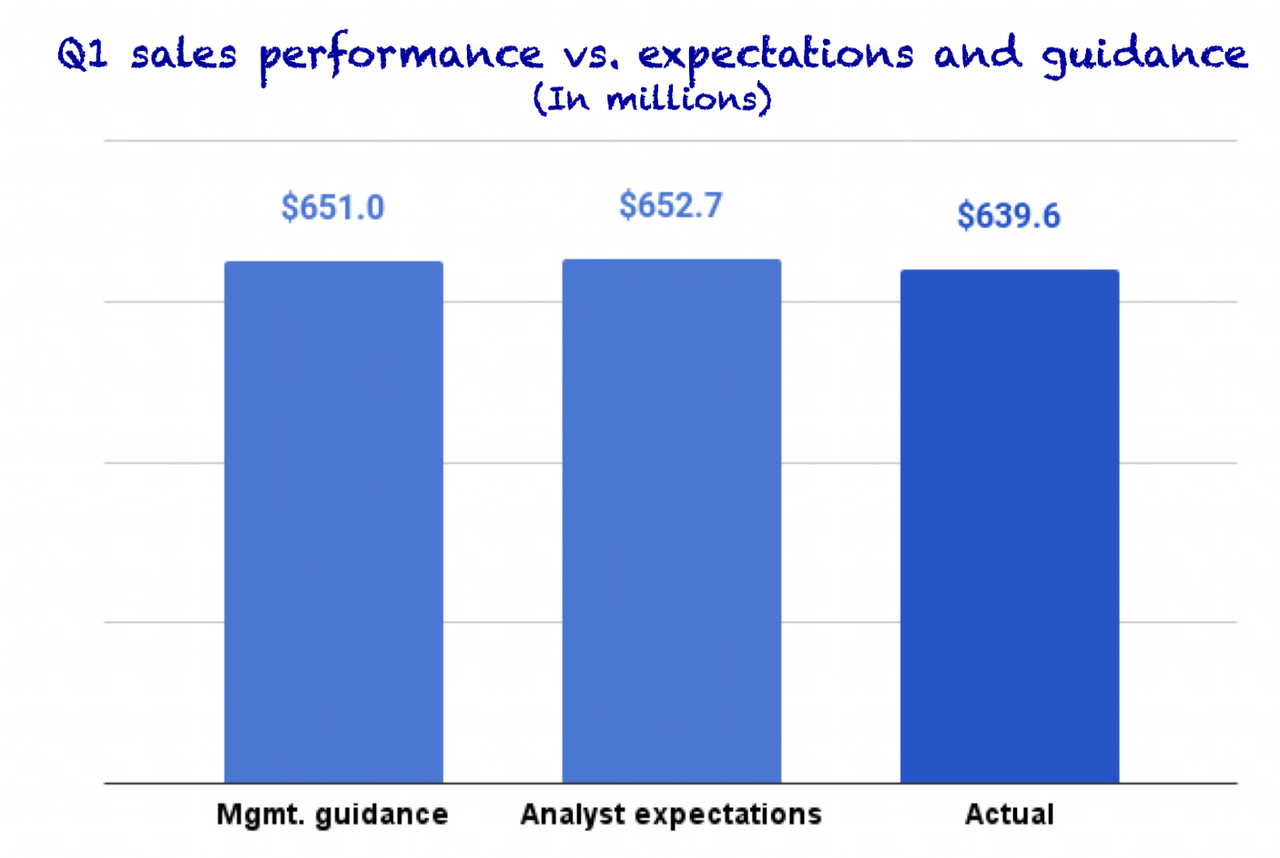

The headline numbers

Q1 sales came in at $639.6 million, up 7% Y/Y and missing both management’s and analysts’ expectations:

Made by Best Anchor Stocks

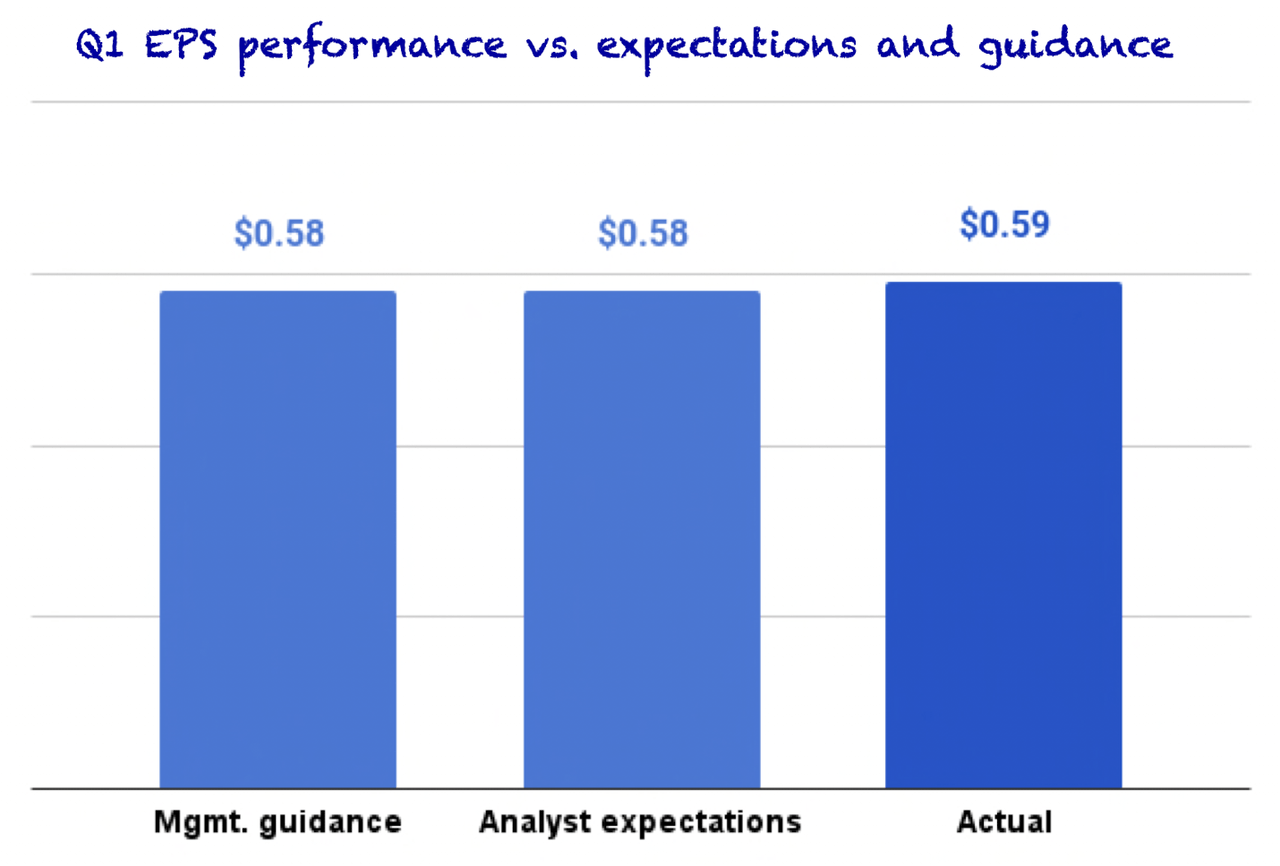

The good news is that, despite the lower sales, Five Below managed to come in its expected range in EPS and managed to beat analysts’ expectations slightly:

Made by Best Anchor Stocks

The fact that Five Below missed on the topline but managed to beat in the bottom line is quite surprising, considering that (almost?) all retailers have done just the opposite: a beat on the topline and miss on earnings. They ascribed this to supply-chain issues and inflation. Later in this article, we’ll go over why this might have been the case.

So, overall, the headline numbers were not great, but nothing to really worry about too much at first sight. However, we need to dig a bit deeper into these numbers to see what’s really going on here.

The topline drivers: comparable sales and new stores

Five Below has two main drivers of its topline: comparable sales and new store openings. Comparable sales refer to the increase or decrease in sales from stores that were already open in the comparable period. So, for example, comparable sales for Q1 2022 will be a calculation using only the changes in sales from those stores that were already open during Q1 2021. New store openings are self-explanatory.

So, which of these caused sales to come below expectations? The answer lies in comparable sales.

Comparable sales come in lower than expectations

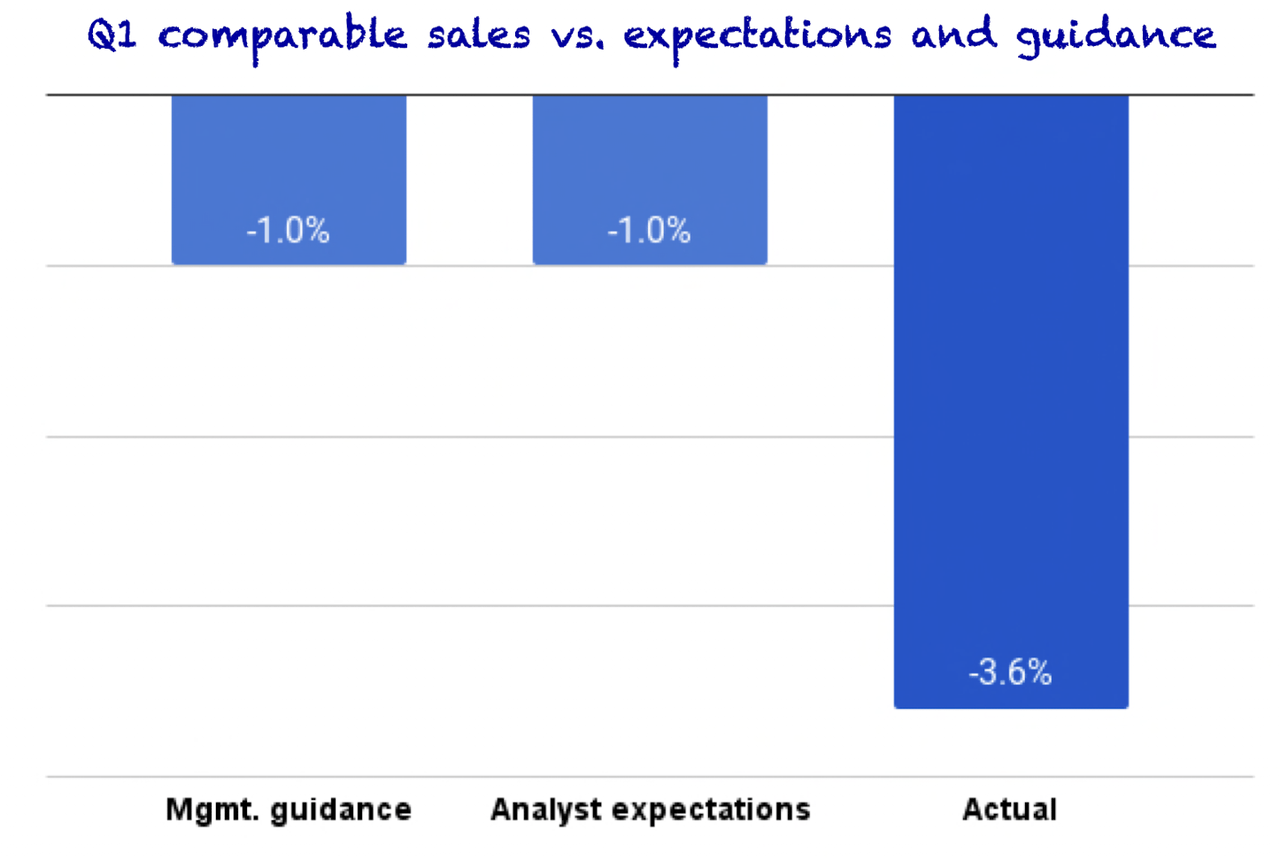

Comparable sales came in at -3.6%, lower than management’s and analysts’ expectations:

Made by Best Anchor Stocks

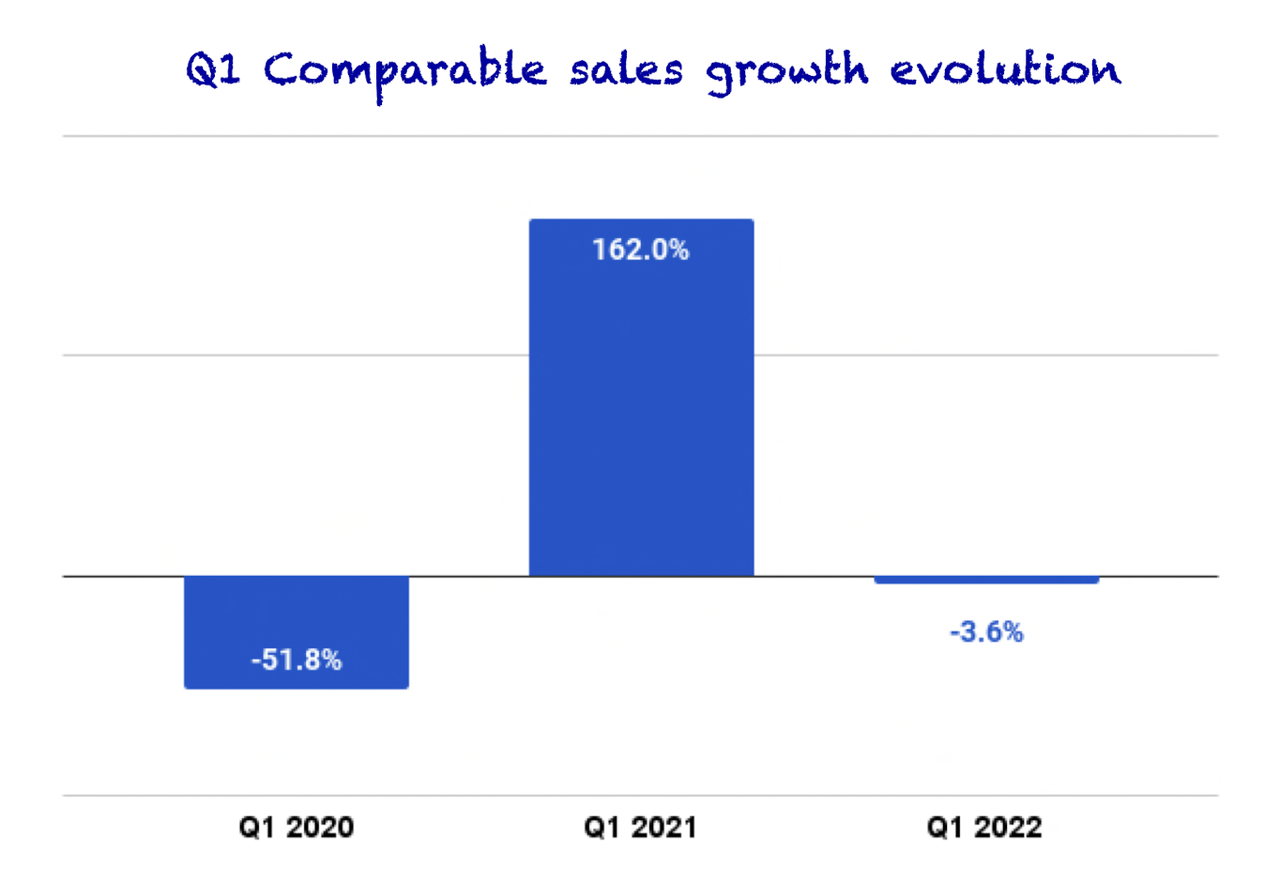

We need some context to interpret this number, though. At first sight, it might seem worrying to see it come out negative and significantly below expectations, but comps were very tough. During Q1 2021, comparable sales increased 162% Y/Y, so that’s a pretty tough comp to come up against. That 162% increase was posted on top of a very weak Q1 2020 comp (-51.8%) due to the impact of the pandemic. In short, it has been a while since there was a normal quarter.

If we plot it in a chart, we see the following comparable sales growth in Q1 for the last three years:

Made by Best Anchor Stocks

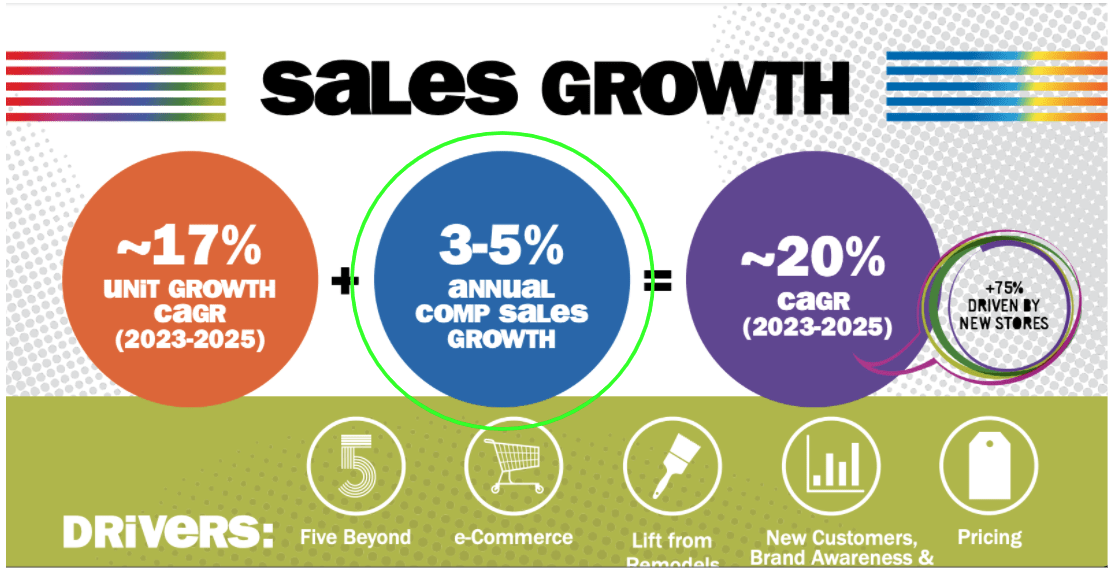

There’s a lot of volatility in this metric, so we must zoom out to really understand the trend. If we calculate comparable sales CAGR since 2019, we get to a 5.4% yearly growth, which is slightly above what management expects over the long term:

Five Below Investor Presentation

Of course, 162% Y/Y growth in Q1 2021 is not a realistic comp due to the pandemic, but the truth is that Five Below is facing tough comps regarding comparable sales due to the unlapping of stimulus.

To avoid a full-blown crisis during the pandemic, the US government gave money to its citizens to stimulate the economy, and some of this money ended up in Five Below’s stores. Now that this stimulus is no longer present, comparable sales are expected to come out lower for some time.

Our answer to volatility should always be zooming out and looking at the long-term trend. Unfortunately, we are not living in normal times (we just suffered a pandemic), so there’s little we can do to see smooth growth rates.

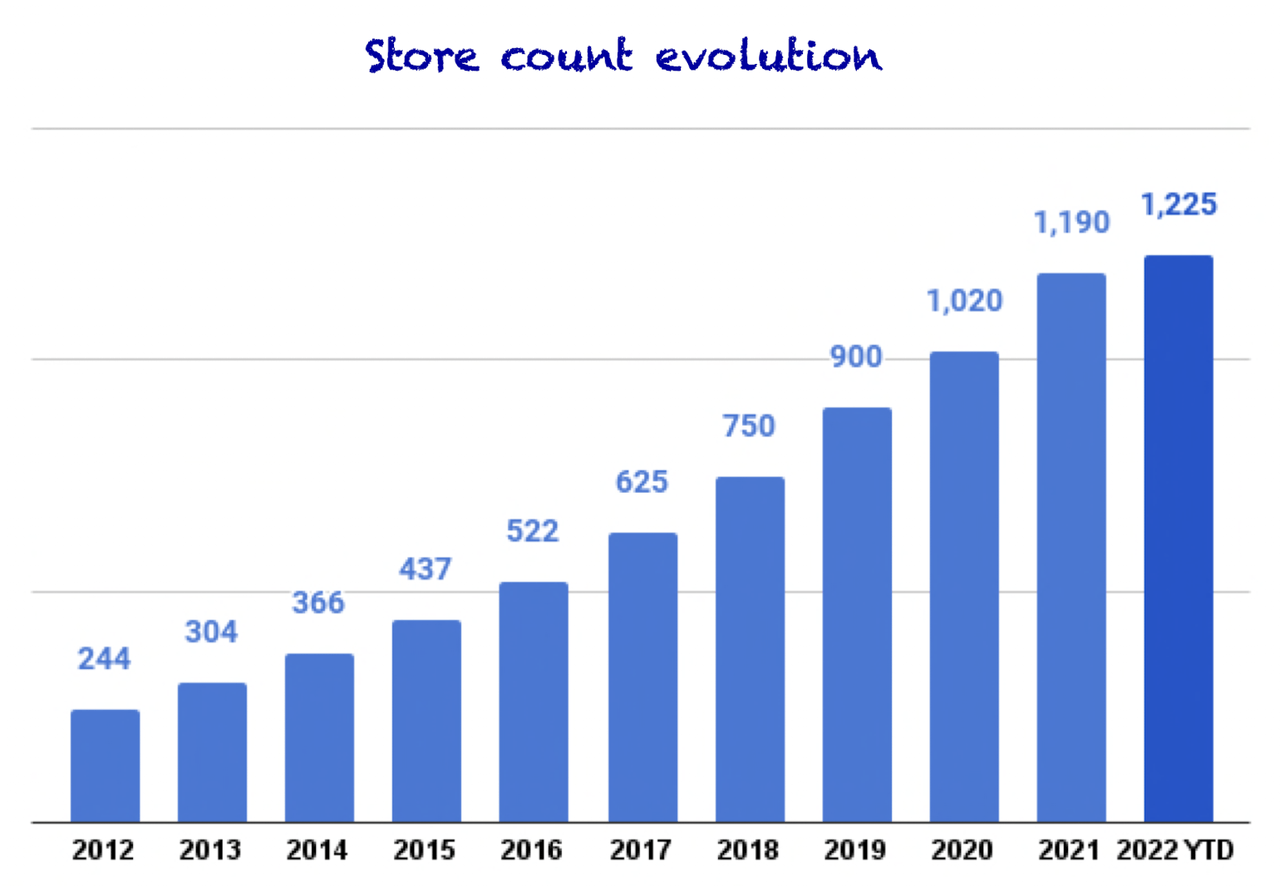

New store openings come out in line

Store opening, the other driver of sales, was in line with management’s expectations. Last quarter, management said they expected to open 35 new stores, which is exactly what they did. These stores were opened across 23 states, which brings the total store count to 1,225 (+12.7% Y/Y) in 40 states:

Made by Best Anchor Stocks

We don’t know when these stores were opened during the quarter, so it’s difficult to quantify their impact on this quarter’s sales. For example, if almost all stores were opened towards the end of the quarter, their impact would be deferred to Q2.

Digging into profitability

Against all odds, profitability was the highlight of the release. Why do we say “against all odds?” Because as we saw in “Why Five Below Dropped So Much,” most retailers were reporting solid sales but were missing profitability expectations.

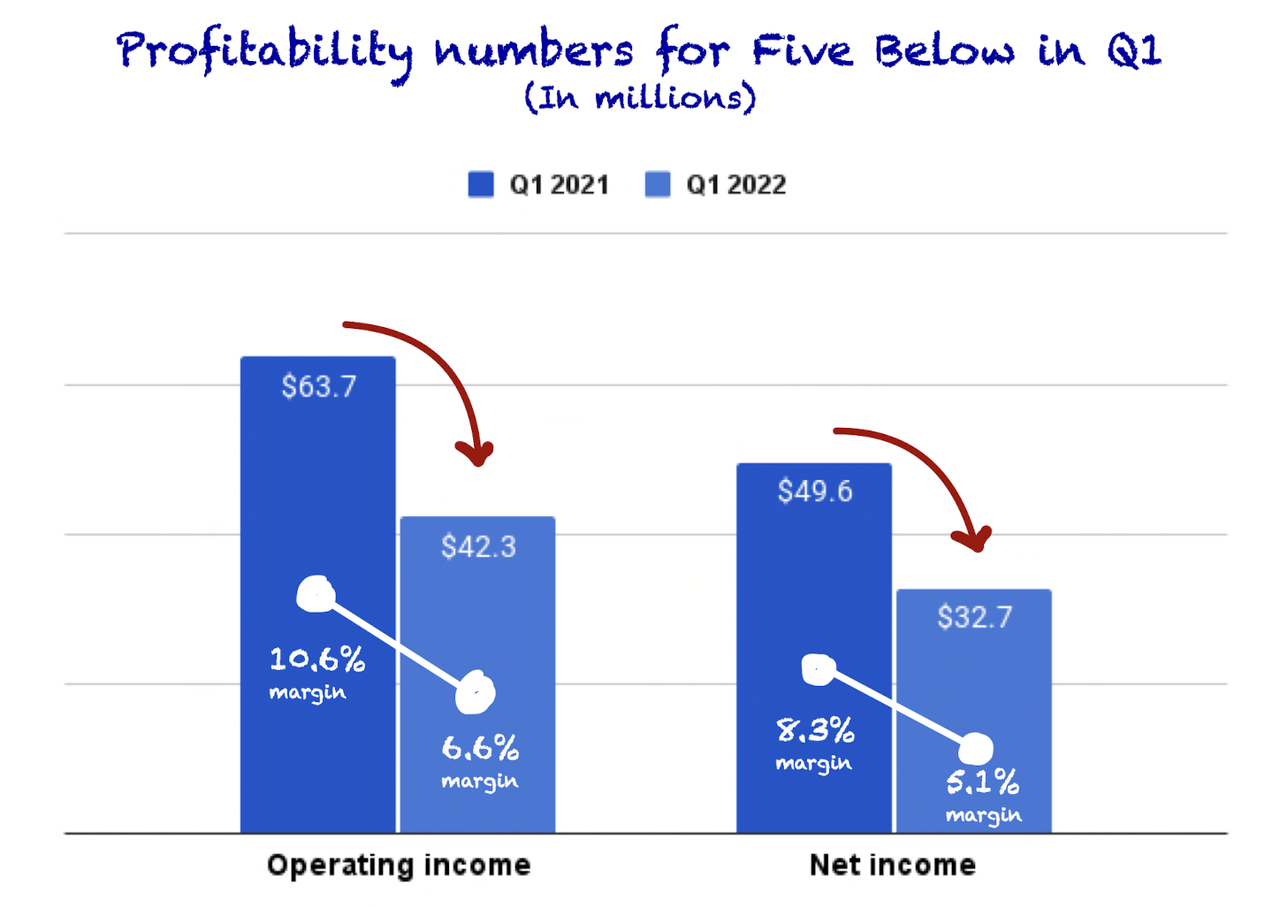

Now, the fact that Five Below managed to beat profitability expectations doesn’t mean that margins expanded. They actually contracted:

Made by Best Anchor Stocks

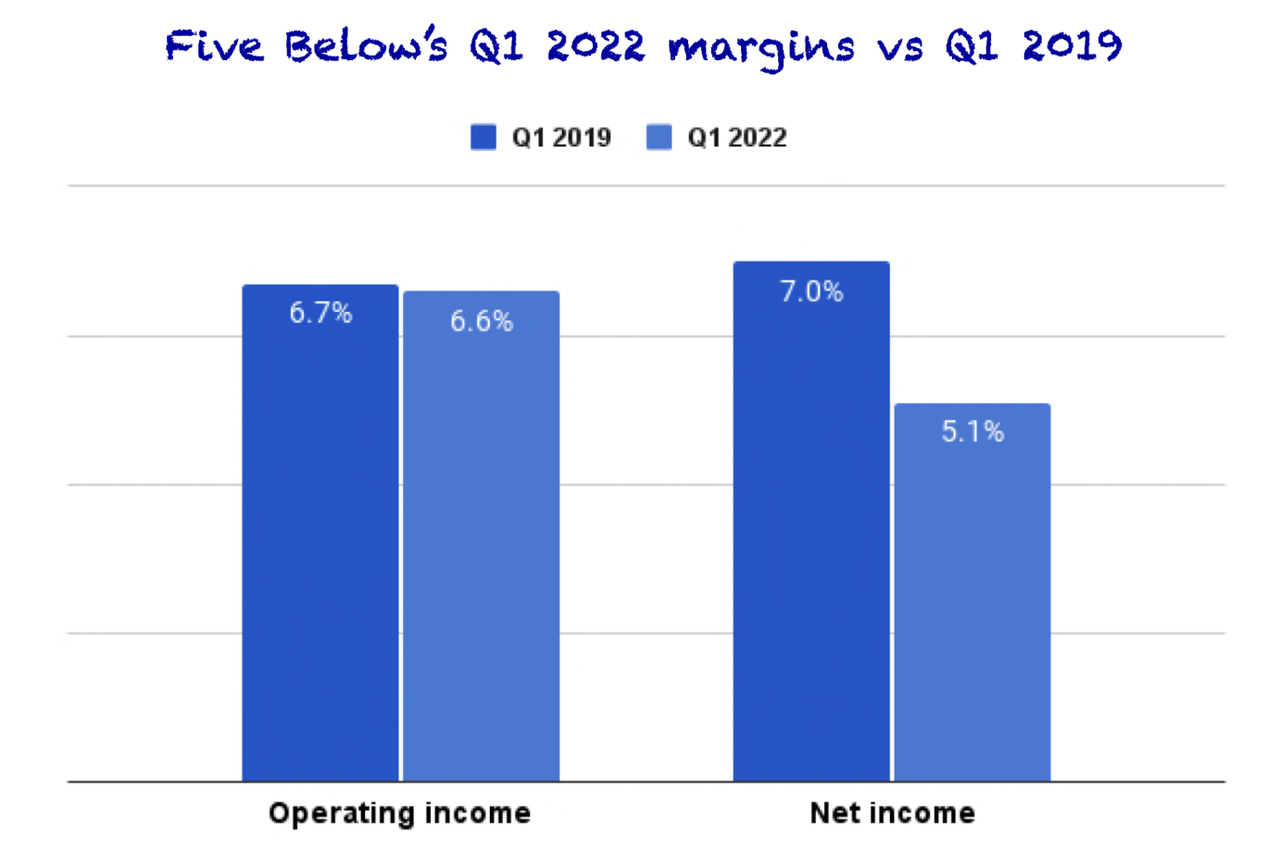

So, what happened? Basically, nothing. We just need context to understand this. As we have seen before, in 2021, Five Below’s top and bottom lines benefited from the government stimulus. The stimulus flowed directly into the topline, but such a huge boost was not met by increasing expenses, which made a great portion of this uplift flow into the bottom line too. If we zoom out a bit and compare Q1 2022 with Q1 2019, we can clearly see how this quarter’s margins were simply a return to the “mean” after a “special” 2021:

Made by Best Anchor Stocks

We still think there are significant opportunities for margin expansion, and this contraction should not take us by surprise, nor should it be seen as a red flag. Instead, we should look at the positive side: management showed great cost control amidst a very challenging environment where not even the best retailers managed to beat on the bottom line.

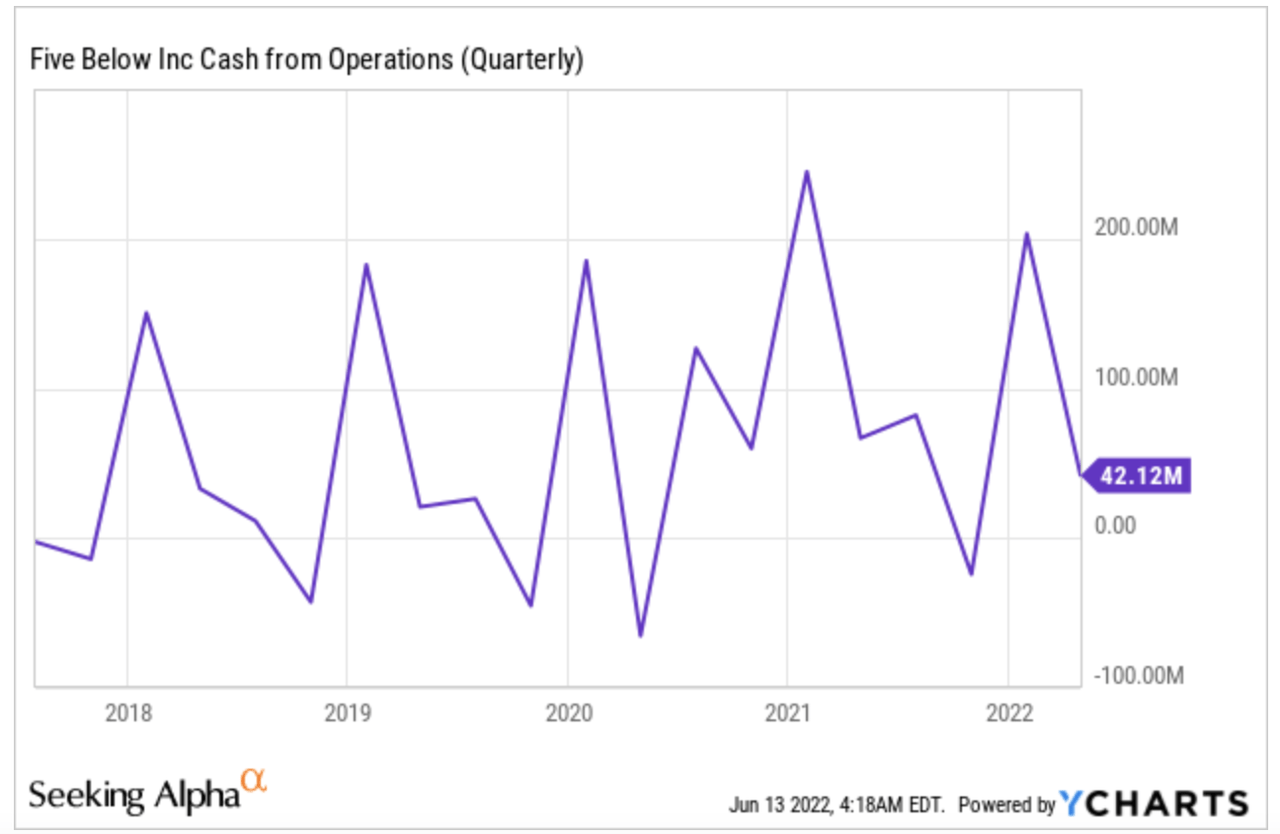

Solid cash flow and balance sheet

We also wanted to briefly go over the company’s cash flow and balance sheet. Operating Cash Flow came in at $42.1 million. This is lower than in the comparable period last year, but higher than in 2019 ($20.8M) and with a better margin than 2019 (5.7% (2019) vs. 6.4% (2022)).

YCharts

This graph is yet another visual indication that 2021 was not a typical year, as OCF experienced a different trend, and seasonality was muted.

When it comes to the balance sheet, Five Below reported $310 million in cash and short-term investments, it also has more than $500M in inventory, which is normal for a retailer. On the negative side, it has around $1.3 billion in liabilities which was related to leases. As “debt” is related to leases, it’s not really debt, but it is indeed an amount the company will need to pay going forward. All in all, the balance sheet is strong and puts the company in a solid position to weather any downturn in the economy.

Five Below’s numbers were okay. They were obviously not great because there was a miss on the topline, but the fact that management managed to beat earnings expectations in an inflationary environment was great. During the start of this year, execution is what’s really making a difference across retailers, and we have no reason to believe that management is not executing well.

Qualitative highlights

Behaving differently than the retail industry

We’ve already discussed this in some way when discussing the numbers, but we want to focus more on it here.

After Walmart’s (WMT) and Target’s (TGT) earnings, everyone thought that the retail industry, in general, would see significant margin contraction despite higher sales. In Five Below’s case, though, we saw exactly the opposite, as the company managed to beat the bottom line despite lower sales.

Ken Bull (Five Below’s CEO) explained it quite well during the earnings call:

We’re being impacted by things like fuel surcharges and increased fuel costs that other retailers are, but you didn’t hear us really talk about that in terms of the total impact for the year. So what’s going on embedded in our operations and results is cost mitigation strategies that we’re working on. So one of the things you’ve known us for a long time, this is where Joel has mentioned, we’re a nimble organization and we respond to these things.

So if you look at the assumed reduction in sales from our prior guidance for the back half of the year, you’re right, you would probably assume a larger negative flow through to earnings. But all that we’re doing internally here, it’s pretty significant in terms of cost mitigation strategies and other cost efficiencies that we’re using to offset that.

The takeaway is that execution matters, and no two companies are alike. Trying to make conclusions for one company based on another company’s earnings is perfectly fine as long as you keep in mind that it’s just a thought exercise and no certainty. It’s also important to see if these cost mitigation activities will impact growth in the future. It’s good to mitigate costs, but not if you are sacrificing future growth.

Investing for growth: Five Beyond, new stores, supply chain, digital initiatives…

It was pretty clear to us after the call that cost mitigation strategies are not impacting the growth roadmap. Management is still investing substantially in several growth areas:

-

Five Beyond: Five Beyond is a section in Five Below’s stores where items are priced above $5. This initiative is rather new as it started a couple of years ago as “Ten Below” and management has since evolved it into a store-within-store concept (Beyond store model). Of course, due to its “novelty”, not all stores are converted to the Five Beyond model yet, but management said it will convert 200 stores into this model in 2022 and is on track to convert 750 stores during the next 4 years. This year the company expects to end with 50% of the store base in the Beyond model, which is pretty important considering the improved economics these stores enjoy.

-

New stores: management will continue investing in new stores (which is the main growth driver for Five Below) and continues on track to meet what was guided during Investor Day.

-

Supply chain: a new distribution center is coming live in Indiana at the end of this year. No new distribution centers are expected in the coming years because the current distribution network has overcapacity to service the store roadmap. Once the distribution network works at full capacity, we should see an uplift in margins.

-

Digital initiatives: management announced they would be rolling out BOPUS (Buy Online Pickup In-Store) this summer. eCommerce is not a great value proposition for Five Below because most of its moat resides in people having to go physically to stores and fees would be too high in comparison to the value of the products, but BOPUS seems a great way of merging both: eCommerce and physical experience.

As you can see, despite the cost mitigation strategies, management is still executing on growth, and we don’t expect them to cut in these areas anytime soon.

The economy: the consumer is in frozen mode

Much of the discussion in earnings calls this quarter was about macro economy and consumer behavior. Five Below was no exception. We have previously said that Five Below should benefit from a recession due to its “discount” nature. So, why isn’t this happening? According to management, the consumer is still in frozen mode, but they expect to benefit from a tough period:

The consumer continues to face a lot of hurdles most recently being the formula shortage which, for families, it’s got to be something that’s front and center on their mind. So I think you can tell by our guide that we’re expecting Q2 relatively in line with Q1. And then, I think as the consumer gets out of their frozen mode, we’ll start to seek out value, and that’s where we start to do better.

Source: Joel Anderson (Five Below CEO) during Q1 2022 Earnings Call

Five Below was not publicly traded during the Global Financial Crisis, so we don’t really know how it did back then. There’s also no close comparable to the company, which makes it even more difficult to estimate. However, we agree with management here, and we think there’s another essential thing to consider when judging resiliency: its target customer.

From our days at Toys”R”Us, the last place the consumer will cut is for their kids.

Source: Joel Anderson (Five Below CEO) during Q1 2022 Earnings Call

Inventory levels are increasing

Inventory levels have been a concern for investors in the retail industry throughout this earnings season, and we can definitely understand why. If consumer demand is slowing and inventory is piling up, this can have two negative implications:

-

Margins contract because inventory expenses increase

-

There’s a higher inventory risk which might lead to write-downs in the future

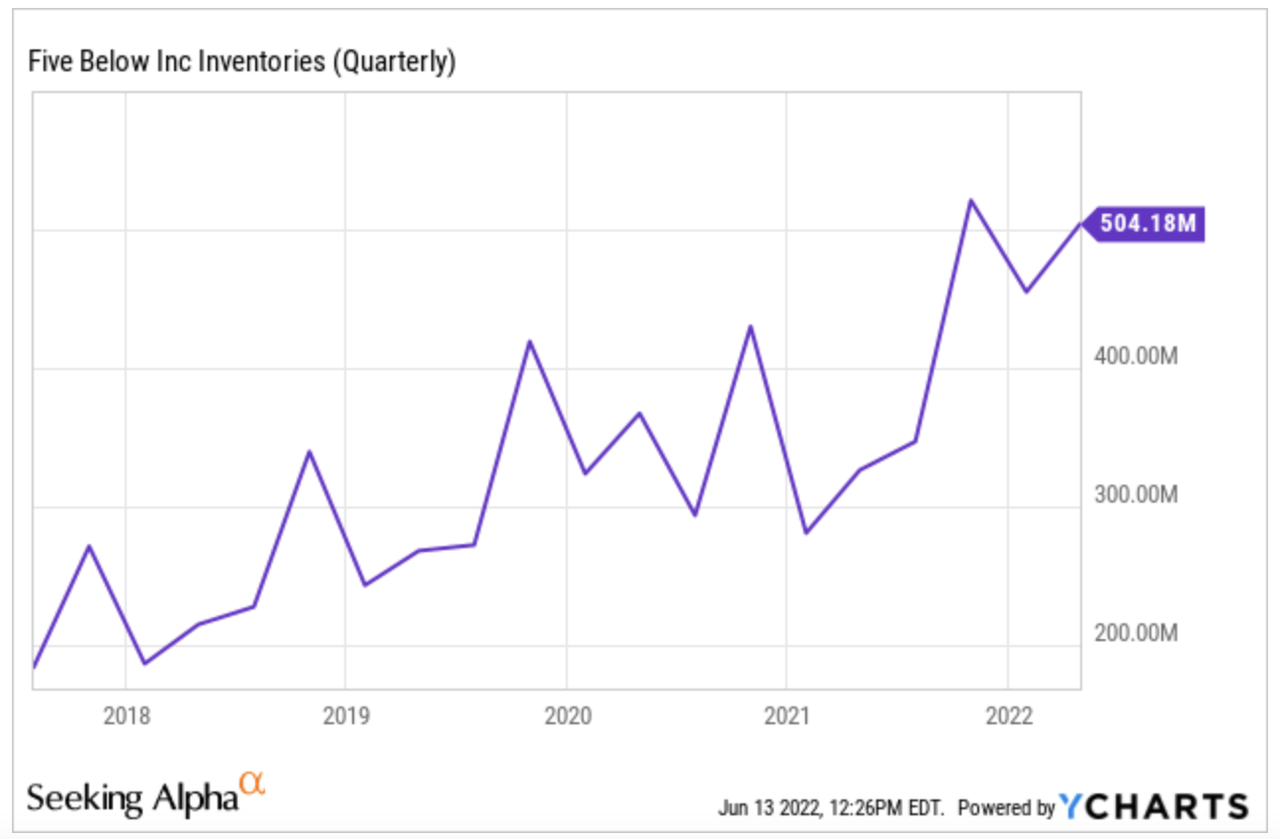

Most of the retail industry has been indeed posting higher inventory, and Five Below was no exception:

YCharts

However, there was a difference. Whereas in Target’s and Walmart’s case, management was not happy at all with the increase in inventory, Five Below’s management team seemed to be quite comfortable with its current level, claiming that it puts them in a strong position to capitalize on a strong back half of the year:

I mean maybe we should probably talked about it at the Investor Day, but I mean it was part of our plan to be up significantly year-over-year. Some of it was about just pulling forward, I mean we did not have the inventory levels we wanted in Q4 last year and we wanted to ensure we were ready for summer here a piece of it is inflation costs.

I mean our inventory levels, include all the added shipping costs, et cetera that’s all in it that wasn’t there a year ago. So, is it up a little bit more because of the sales mix, but sales mix is not much than that far materially off what we guided, so few percent, but overall, there’s really no concern from our end. In fact, I’ll tell you what’s clean inventory we’ve had since I’ve been here, in terms of newness and that should really bode well for the customer.

Source: Joel Anderson (Five Below CEO) during Q1 2022 Earnings Call, my bold.

Of course, we’ll only know if this is true in Q4 but the tone does seem quite different than in other cases.

Looking at inventory levels might be misleading, though. High inventories come from higher input costs (i.e., inflation) and also a larger store base to service. None of these reasons necessarily indicate lower demand and we trust management’s word.

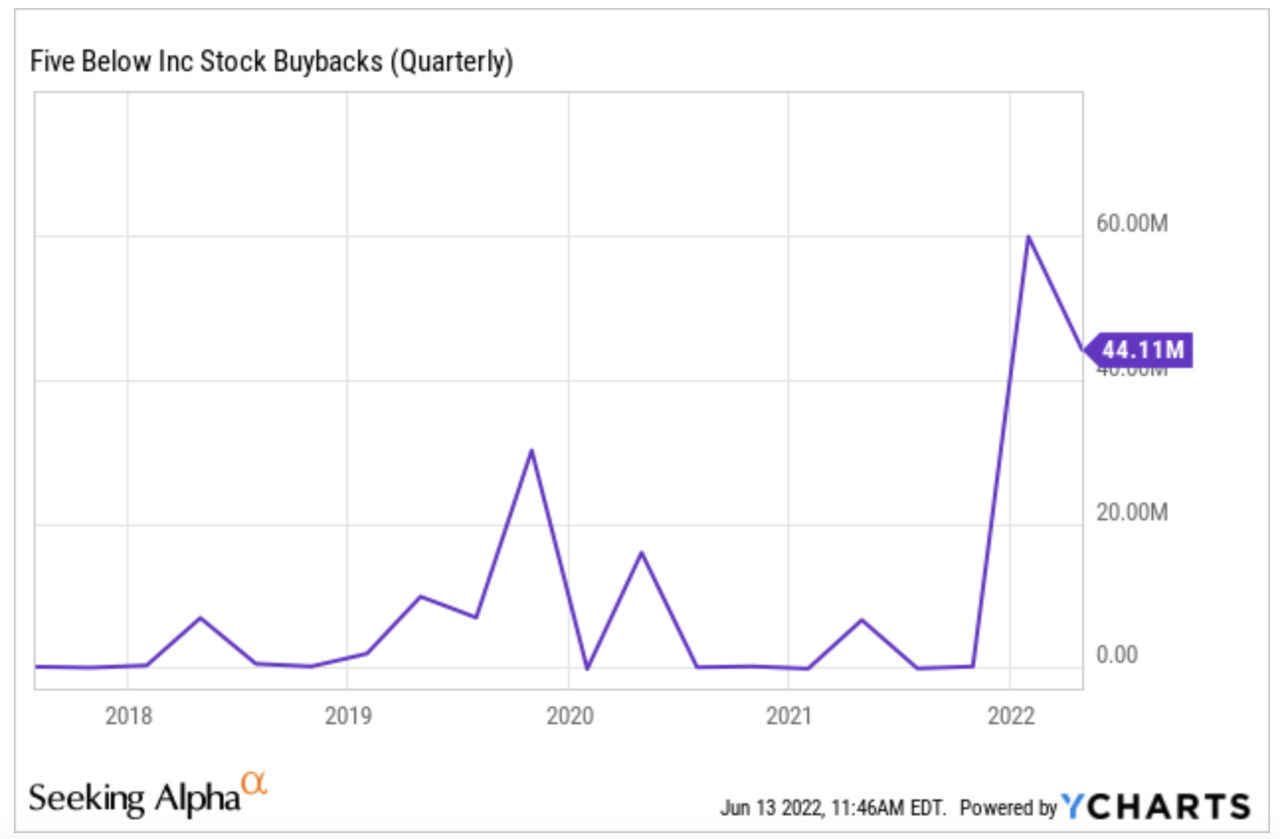

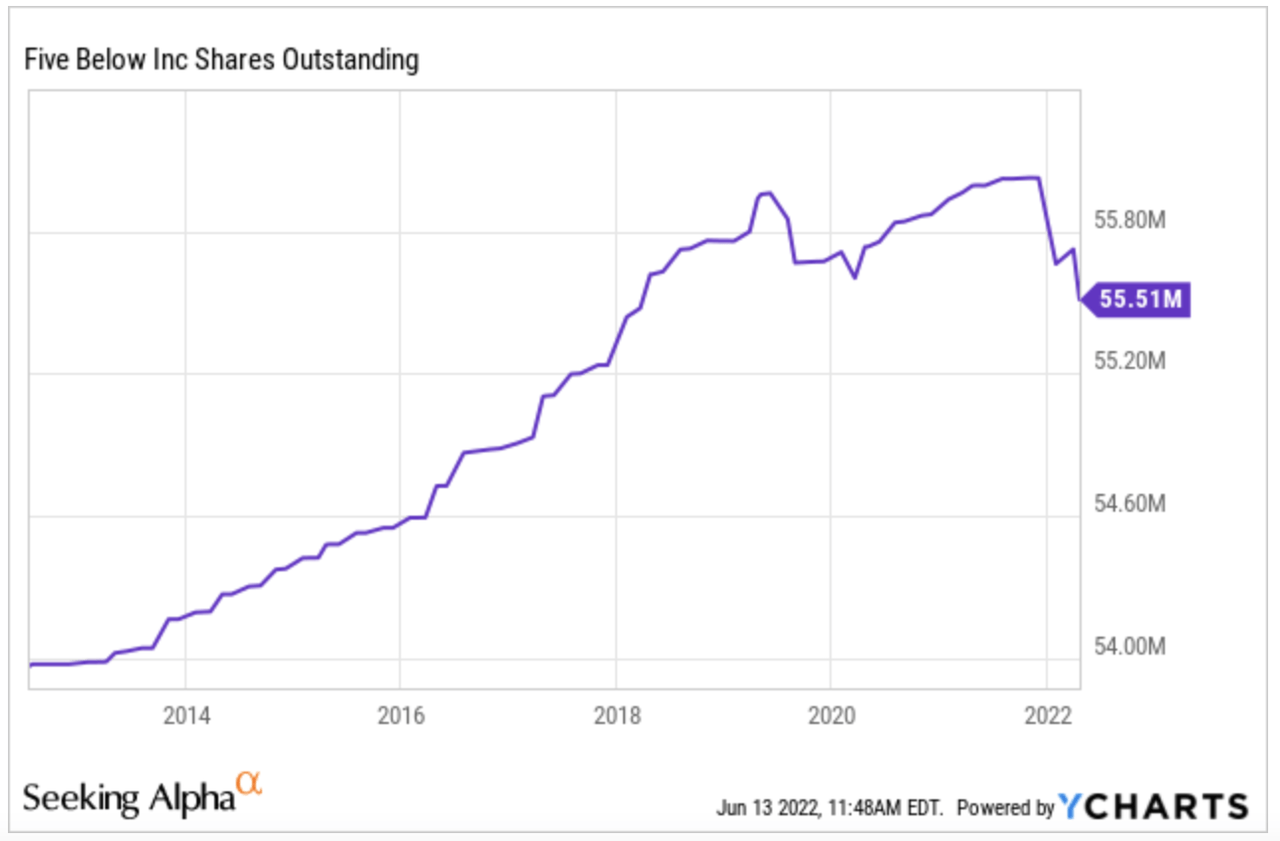

Five Below is ramping up buybacks

Management repurchased 247k shares this quarter for an aggregate amount of $40 million. This doesn’t seem much, but if we look at the long-term trend we can see that management has been ramping up buybacks lately:

YCharts

The company has barely repurchased 1% of the outstanding shares during the past months, but we could take this information (together with the fact that some insiders have been buying) as a signal:

YCharts

Recent insider buys

Five Below’s directors bought shares this week. These purchases do seem like a planned transaction, though.

Almost all of them bought exactly 1,367 shares or $160k worth of stock, but the highlight was Tom Vellios (one of the co-founders), who bought almost double (2,610 shares or 302k worth of stock), bringing his total ownership to 410,915 shares or a $48 million stake.

We’ll have to wait and see if executive managers follow the board and purchase Five Below’s shares, but nonetheless, it’s always great to see insiders buying, especially under the current market environment.

Guidance

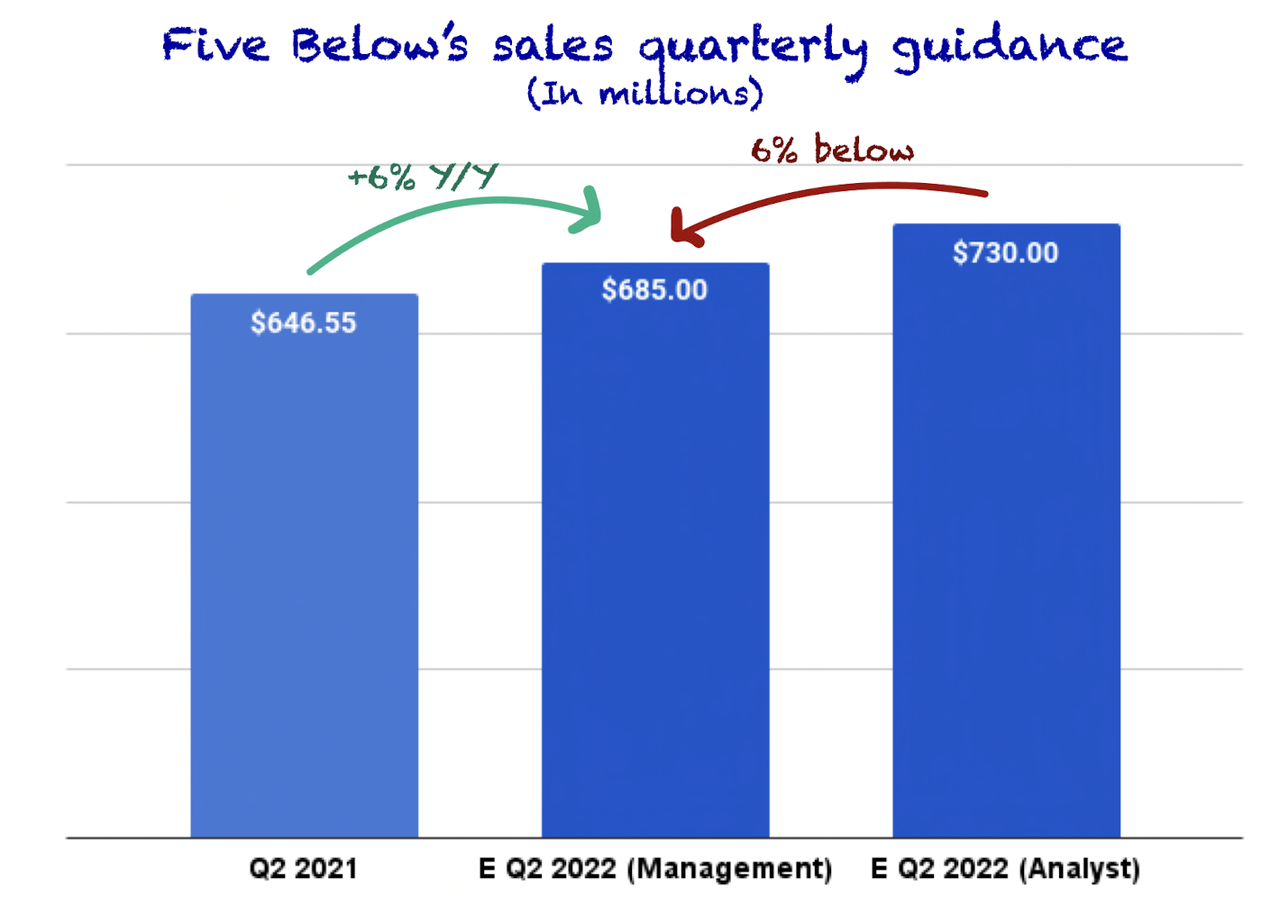

Guidance was not a bright spot, as management reduced its FY 2022 guidance and the second quarter’s guidance was weak.

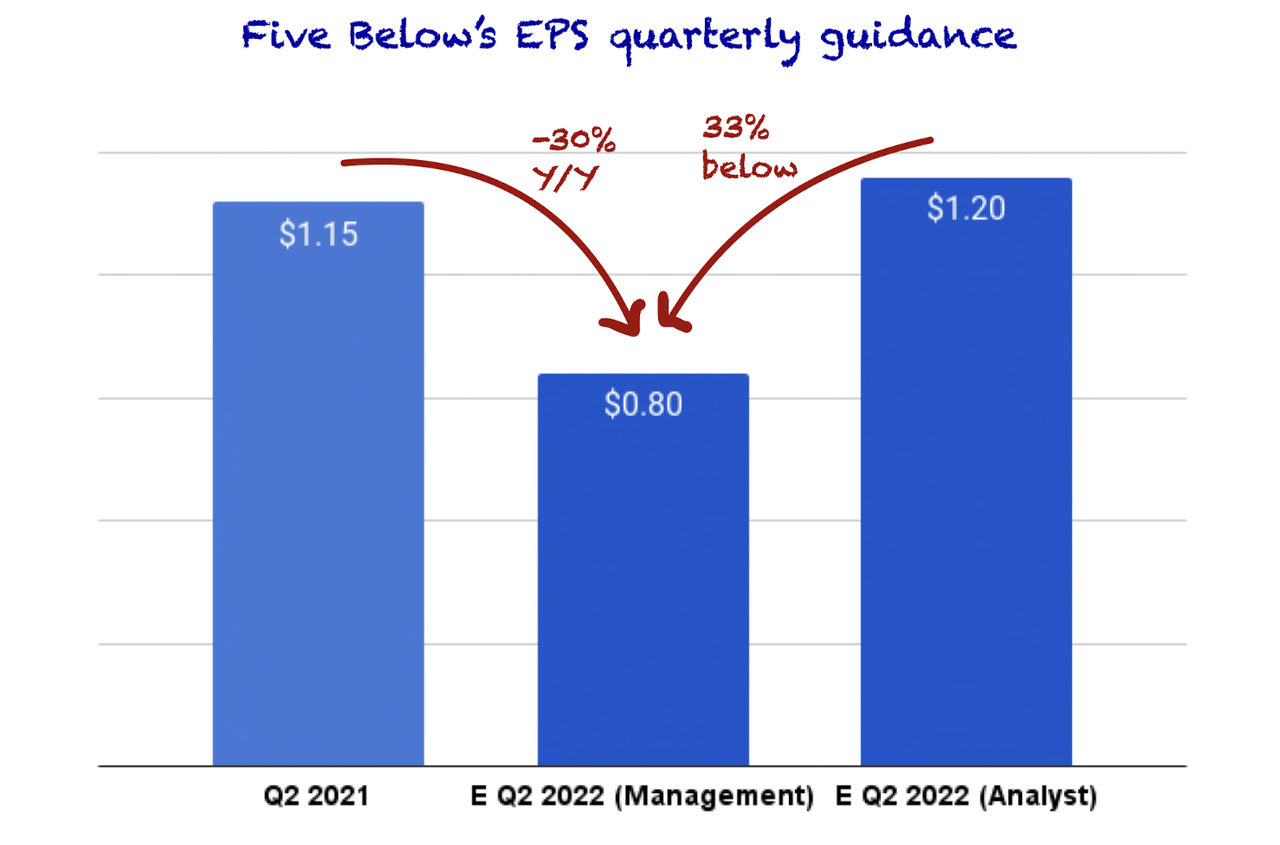

Quarterly guidance – Not great

Management expects sales to be between $675 to $695 million, which will suffer comparable sales headwinds (-2% to -5% Y/Y decrease). This guidance didn’t meet analyst expectations of $730 million and assumes a 6% Y/Y growth at midpoint. Far from impressive:

Made by Best Anchor Stocks

On the bottom line, management expects net income between $41-$48 million and diluted EPS between $0.74 and $0.86, which, similarly to Q1, is a year-over-year decrease in profitability. These estimates also came below analysts’ expectations of $1.2:

Made by Best Anchor Stocks

All in all, the quarterly guide was almost an exact copy of Q1’s performance: slower than expected sales and contracting margins. However, if we turn to the guide for the full year the landscape starts to change.

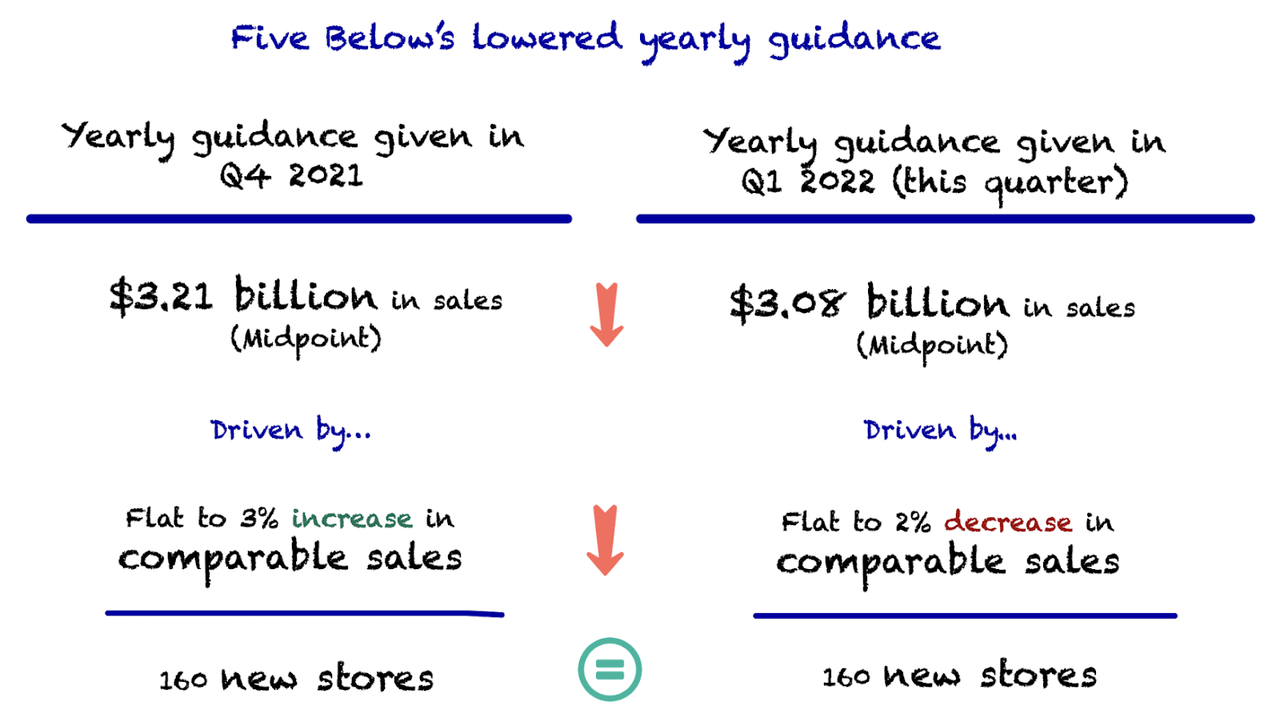

Full year guidance – a tide change

There’s no sugarcoating it because numbers don’t lie: the full-year guidance wasn’t good either. Management reduced its prior guidance and it didn’t meet analysts’ expectations.

Management now expects sales between $3.04 and $3.12 billion, driven by 160 new store openings and a flat to 2% decrease in comparable sales. In Q4 last year, management expected $3.21 billion at the midpoint:

Made by Best Anchor Stocks

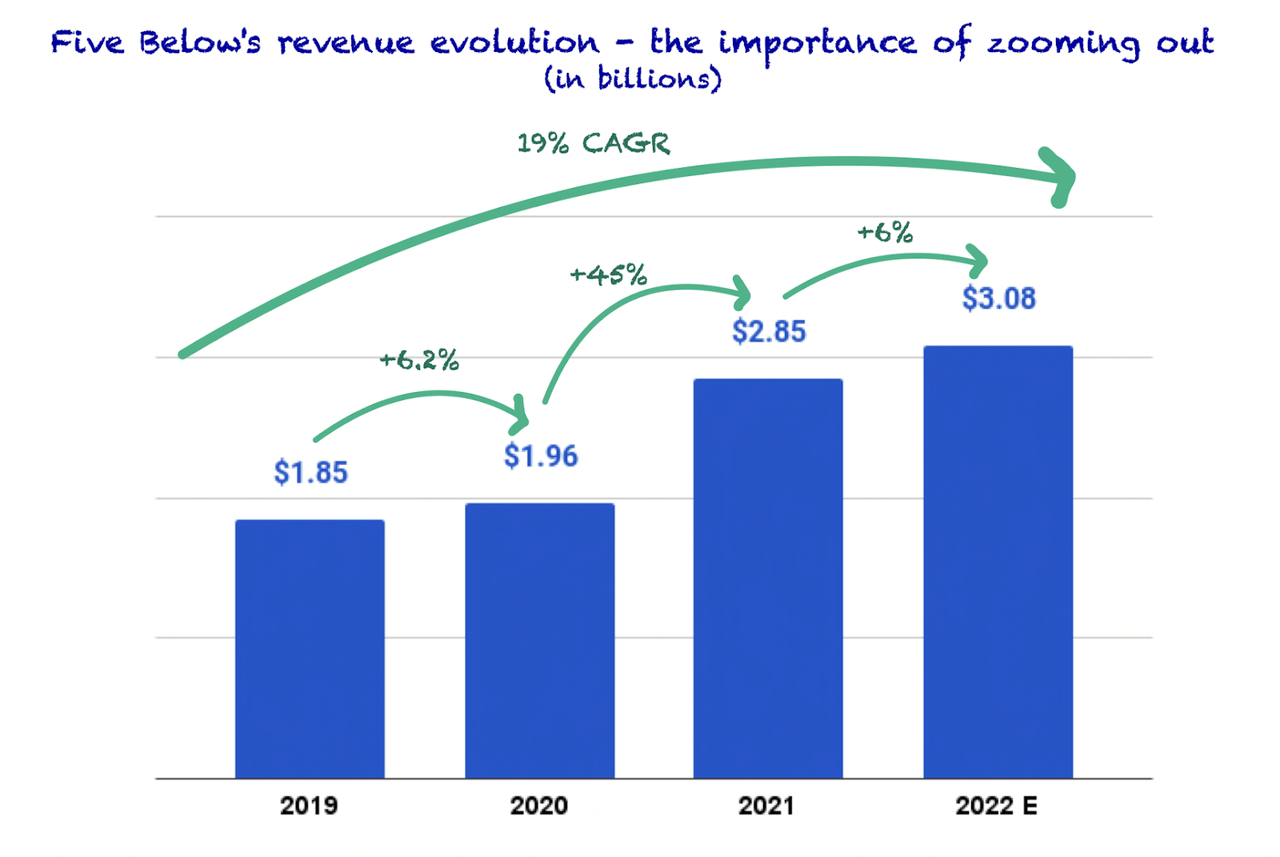

These numbers didn’t beat analyst expectations ($3.2 billion) and should yield a yearly growth in sales of around 8% at the midpoint. It’s not high, but we must zoom out.

First, this 8% growth would be posted on top of a 45% growth in sales in FY 2021. However, that 45% was posted on easy comps due to COVID, so it wouldn’t be fair to compare it with that either. The best thing we can do is zoom out until 2019, when “times were normal.” The FY2022 guidance assumes a 66% increase in sales from 2019 levels, which is a 19% CAGR:

Made by Best Anchor Stocks

19% CAGR is much closer to what we should expect for the company and is pretty impressive considering the COVID year and the tough times the economy seems to be weathering.

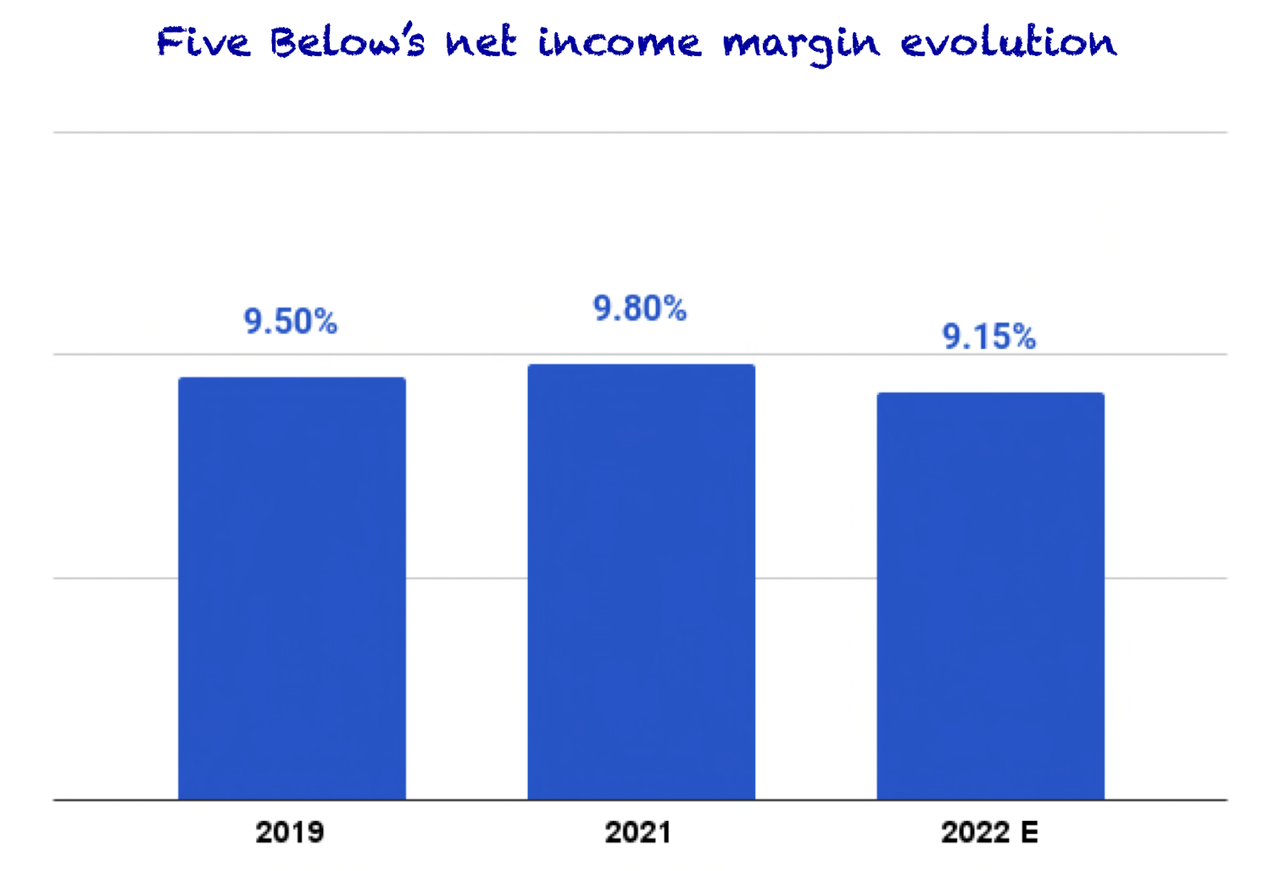

Looking at the bottom line, net income is expected to be between $271 and $293 million and diluted EPS is expected to be between $4.85 and $5.24. None of these numbers beat analysts’ expectations and they also show margin contraction compared to last year. However, this contraction is expected to be minimal considering the circumstances, more so when compared with 2019:

Made by Best Anchor Stocks

Performance is expected to improve throughout the year. As discussed, Q2 will be similar to Q1 while the strongest quarter of the year will be Q4.

All in all, guidance was not good, although it wasn’t too worrisome either. The highlight of the quarter and guidance has clearly been management’s ability to defend margins without cutting on growth ventures. Sales weakness comes primarily from lower comparable sales growth, which came from the headwinds from the unlapping of government stimulus and inflation.

Conclusion

Five Below’s quarterly earnings were not the best, but they were not thesis-changing either once we look at the context. The company is now optically cheap, but we wouldn’t rush building our position due to the negative sentiment that dominates the market. Adding slowly every now and then probably makes more sense in this environment.

In the meantime, keep growing!

Be the first to comment