Fritz Jorgensen/iStock via Getty Images

“The most annoying pain is perceived when a man is living without a purpose.”― Amit Kalantri

Today, we take an in-depth look on an interesting name in the emerging and fast growing electric vehicle space. A full analysis follows below.

Company Overview:

Fisker Inc. (NYSE:FSR) is a Manhattan Beach, California based EV developer employing an asset-light business model that leverages its platform-agnostic design capabilities to outsource the production of its vehicles to third-party manufacturers. The company has one EV, Fisker Ocean, which is set to commence production in 4Q22. Fisker was formed in 2016 by Henrik Fisker, who is famous for his designs of the BMW Z8, as well as the Aston Martin DB9 and V8 Vantage. The company went public in October 2020 when it reverse merged with special purpose acquisition company (SPAC) Spartan Energy Acquisition Corp, which raised gross proceeds of $552 million on its IPO. Fisker’s first trade was executed at $9.25 on October 29, 2020; and it currently trades right around $21.00 a share, equating to a market cap a shade above $4.8 billion, after giving effect to 19.4 million pre-funded warrants.

The company is capitalized by two classes of stock: 163.8 million publicly traded Class A common shares bestow economic interest and one vote per, whereas each of the 132.4 million privately held Class B common shares confer economic interest and ten votes. Essentially, all of the Class B shares are held by Fisker and his wife, CFO and COO Dr. Geeta Gupta, who together control ~90% of the voting power.

Approach

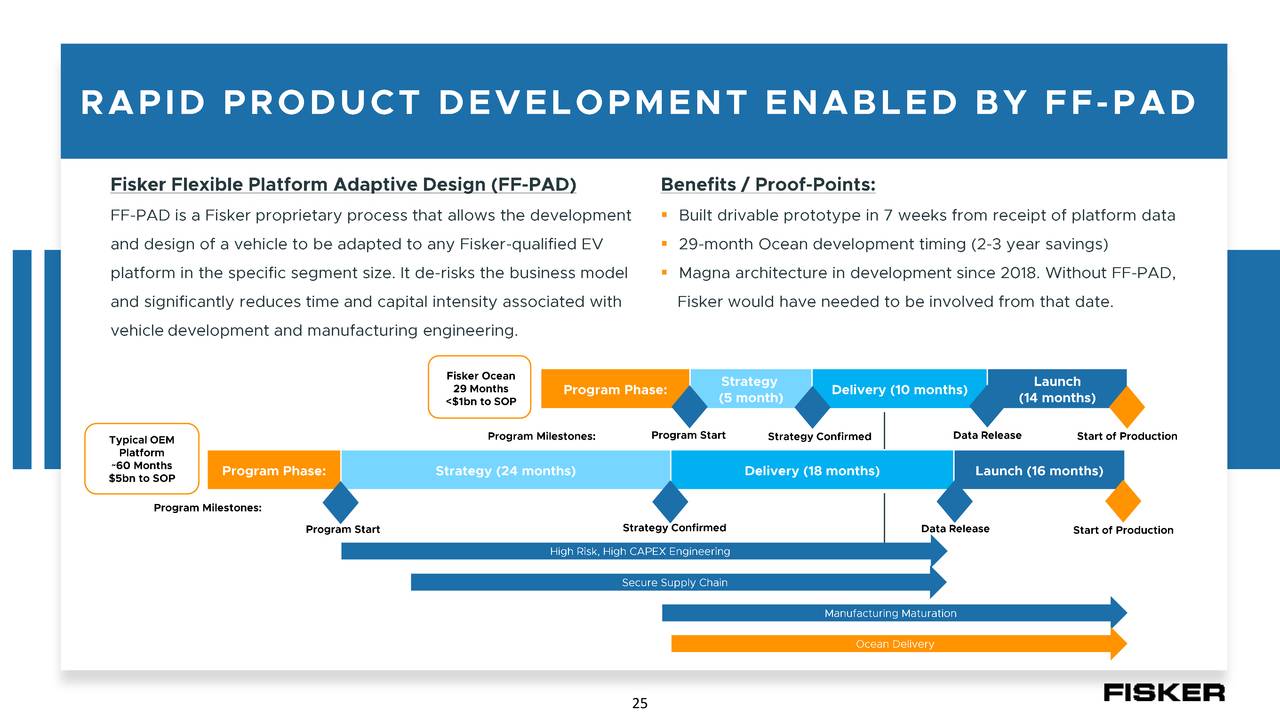

Development Model Seeking Alpha

Source: February Company Presentation

With vehicle designs that can be adapted to match hard points on a contracted EV manufacturer’s platform, Fisker believes it can scale significant volume, bring EVs to market in about half the time of a standard OEM, and do it all at a reduced cost versus a typical vehicle launch, which can be passed on to the customer – providing better quality at a lower price point. From this approach, Fisker has two projects in development.

Fisker Company Strategy Seeking Alpha

Source: February Company Presentation

Fisker Ocean

The company’s first vehicle is Fisker Ocean, a five-passenger SUV EV with three versions (Sport, Power, and Extreme) ranging in price from $37,499 to $69,900 with leases from $379 to $999 per month, which compare favorably to other SUV EV models. Ocean vehicles will have up to ~545 hp, a solar roof that can add up to 25 miles in driving range (contingent upon one’s geography), a state-of-the-art driver assistance system, and a cruising range (depending on the version) of 250 to 350 miles. The Ocean Extreme’s nearly 350-mile range will make it the category leader amongst all SUV EVs near its price point. Ocean will feature ‘California Mode’, which, with the push of a button, will open eight glass panels at once, providing a convertible feel in a fixed-roof setting. Management believes that Ocean will be the better value alternative to Tesla’s (NASDAQ:TSLA) Model Y.

Fisker Ocean Seeking Alpha

Source: February Company Presentation

To execute the production of the Ocean, the company has onboarded the services of contract manufacturer Magna Steyr, an affiliate of Magna International (NYSE:MGA), which produces automotive systems, assemblies, modules, and components for some of the world’s largest OEMs including General Motors (NYSE:GM), Ford (NYSE:F), and Tesla, amongst many others. With Magna Steyr, Fisker will circumvent having to build its own factory, which will speed up Ocean’s time to market at a significant cost savings to the consumer. Furthermore, Fisker will be able to monetize 100% of emission credits under its agreement that runs into 2029. In exchange, Magna Steyr receives prefunded warrants representing 6% ownership in Fisker. The first two tranches have vested with a third and final tranche vesting upon Ocean production initiation.

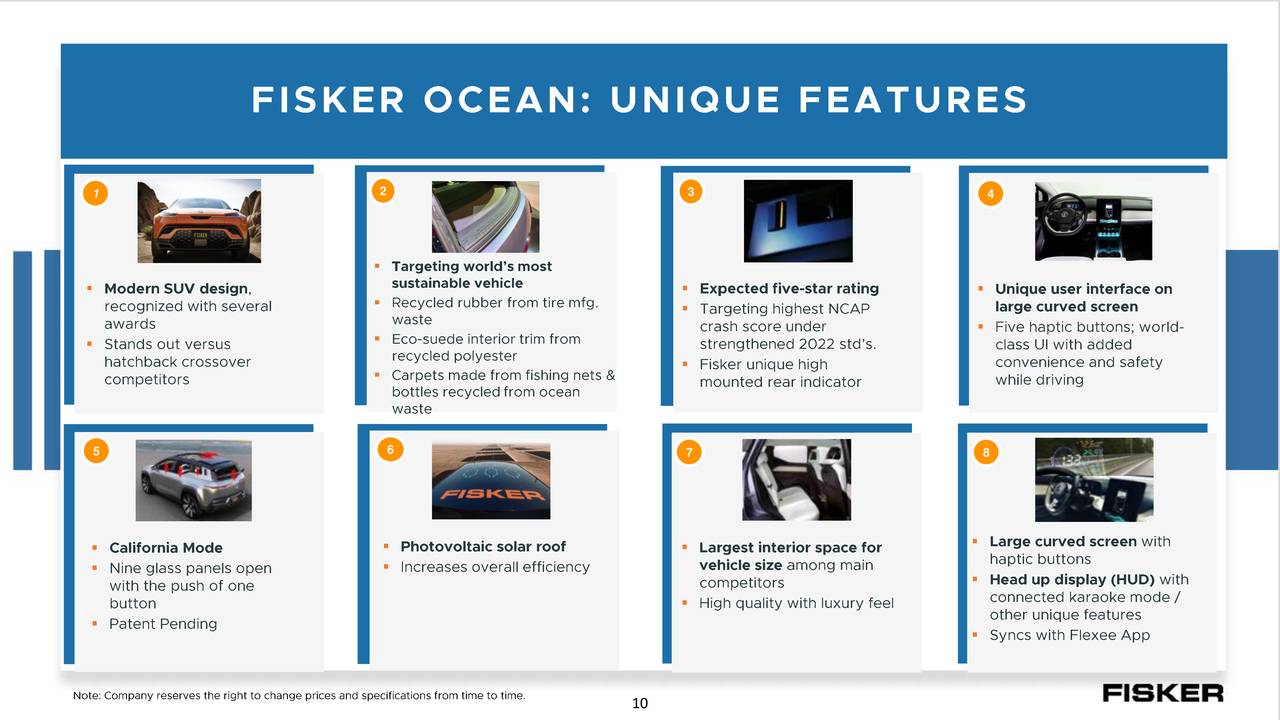

Fisker Ocean – Features Seeking Alpha

Source: February Company Presentation

In keeping with its asset-light model, on the service side, Fisker is outsourcing vehicle maintenance to Cox Automotive via its 100 plus Pivet and Manheim global locations. For batteries, the company just entered into an agreement with Contemporary Amperex Technology to supply over 5 gigawatt-hours of battery capacity from 2023 through 2025. On the charging side in America, the company has in place a non-exclusive agreement with Electrify America, which will provide package rates to Fisker customers. For Europe, Allego will provide Fisker owners, who take delivery between January 1, 2023 and March 31, 2024, with free charging for one year on its network. In exchange, Fisker has committed to a $10 million PIPE investment.

As of the last company update on January 5th, the company had 24,500 advance reservations. Fisker anticipates having 50,000 orders by the start of production, with Magna Steyr producing ~5,000 vehicles per month during 2023.

Project Pear:

The company’s second vehicle program is dubbed Project Pear, which is a collaboration between itself and Foxconn (OTC:FXCOF) to mass produce a sub-$30,000 compact EV. The initial goal of this enterprise is to initiate production stateside in 4Q23 with first deliveries in 1Q24. The ultimate endgame will entail annual manufacturing capacity of ~250,000 vehicles once production facilities in China, India, and Europe have been procured. Although details are still scant, Fisker promises a radical exterior design that will share many components with Ocean, which will further reduce production costs. In fact, Foxconn provides Fisker access to enough chips to reach its production objectives for Pear, alleviating one potential supply chain headache.

Overall, the company expects to be selling 200,000 to 250,000 units encompassing four models by FY25, including a second collaboration with Magna Steyr dubbed Project UFO.

Competitive Landscape

Fisker enters a vibrant market with EVs accounting for 3.5% of all automotive sales in the U.S. during 1H21 (291,933 units from 19 models). The global share is currently less than 3% (below 2 million units) but is expected to grow at a 29% CAGR to 25% of total volume (~25 million units) by 2030. When Ocean launches its first two offerings, management anticipates a total of only 10 to 20 total competitor EVs in its segments (SUV and compact). However, there are dozens of EVs hitting the market over the next three years and Tesla’s Model Y SUV has a stranglehold with ~132,000 units sold in 1H21.

Against this backdrop, there is still considerable restraint from many would-be EV consumers stemming from concerns over both cruising ranges and charging infrastructure that make longer trips challenging. The recently passed $1.2 trillion infrastructure bill does provide $7.5 billion for EV infrastructure buildout, which should help facilitate a more ubiquitous charging footprint.

Balance Sheet & Analyst Commentary:

In addition to the capital invested by the Spartan SPAC, Fisker raised net proceeds of $562.2 million in an August 2021 2.50% convertible senior note offering due September 2026 with an effective conversion price of $32.57, when giving effect to a capped call option purchase. It also received $89 million in warrant exercises. Owing to these fundings, Fisker held cash and equivalents of $1.4 billion as of September 30, 2021. Although it used only $160 million in operating activities and deployed $80 million for (primarily) capex during the first three quarters of 2021, it expects to spend an additional ~$100 million in capex for serial production tooling and equipment installation in 4Q21. Furthermore, it should experience a significant cash outflow in 2022 as it readies for initial production and commercialization of Ocean.

The Street leans positive on Fisker’s prospects, but a range of opinions do dot the landscape, with four buys and four outperforms against four holds and one sell (Goldman Sachs). Their price targets have a rather wide range from $10 to $40.

Three board members at Fisker seem bullish based on their late 2021 buying spree that saw them accumulate ~57,500 shares on November 15th-17th between $21 and $23 per share.

Verdict:

Placing a valuation on what a company expects to produce at its top line in 2023 when it hasn’t generated anything to date necessitates wide error bars. Based on its 5,000-vehicles-a-month outlook at an average selling price of $50,000 per vehicle, shares of FSR are trading at ~1.7x FY23E revenue.

Consolidation within the industry or a deep-pocketed technology company like Apple (NASDAQ:AAPL) looking to enter the market with a splash might provide Fisker investors with a big pay day but that is pure speculation.

That aside, despite employing a relatively unique asset-light business model, it is more of a talking point than a selling point at this juncture. Its model should result in a better value for the customer, but that assessment is in the eye of the beholder, and by the time Fisker launches Ocean, the beholder will have plenty of alternatives to contemplate. Its shares likely trade on quarterly reservation updates and on the whim of the prevailing attitudes regarding the EV industry until it starts generating revenue in approximately one year. As such, Fisker can’t really be considered for a large stake within one’s portfolio at this time.

That said, I find the name intriguing enough that I took a small watch item position in Fisker via covered call orders recently. Option premiums are lucrative and quite liquid.

“The man of ambition thinks to find his good in the operations of others; the man of pleasure in his own sensations; but the man of understanding in his own actions.”― Marcus Aurelius, Meditations

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment