ArtistGNDphotography

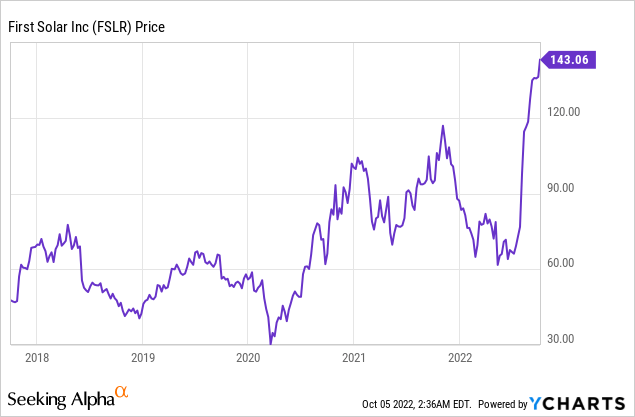

First Solar (NASDAQ:FSLR) is a leading solar energy company that offers best-in-class technology. It is the only US-headquartered solar energy company, among the 10 largest in the world, and plays on this fact in its marketing. Therefore, the business is poised to benefit from US green energy initiatives such as the Inflation Reduction Act recently signed by Biden, which includes a staggering $369 billion investment in domestic renewable energy production. The Paris Agreement also required installed solar energy modules to reach 5,200 GW by 2030 and a staggering 14,000 GW by 2050. Given these factors it is no surprise that First Solar’s stock price has recently gone vertical and more than doubled over the past couple of months, reaching an all-time high at the time of writing. I originally invested in the stock back in 2020 and covered it on my YouTube channel [Motivation 2 Invest], thus, I am pleased to see 120% gains in the position, and helped others to get similar. However, I must admit I was close to selling the stock at one point as its revenue growth was fairly slow relative to competitors such as Canadian Solar (CSIQ), so what’s changed? Well, the company has built out its manufacturing capacity in India, a huge solar energy market. In addition, they have recently scored a large deal in the region. Analysts have also revised their estimates for company revenue higher, which suggests strong orders. Therefore, in this post I’m going to breakdown the company’s business model, financials, valuation and buy points let’s dive in.

Shining Business Model

First Solar is a leading energy company that manufactures and sells state-of-the-art solar modules. In addition, the business constructs and develops solar power systems and provides maintenance of them as a service, which brings in recurring revenue.

The company’s technology uses a proprietary photovoltaic [PV] thin-film semiconductor module, which offers some of the highest efficiency in the industry. Developed at its R&D labs in Ohio and California, its solar modules have the “faster” energy payback time and lowest water use of any solar technology on the market, according to the company. Its technology offers these benefits over the traditional crystalline silicon PV panels used by the industry, up to 18.6% for its Series 6 module.

First Solar Projects (First Solar)

First Solar is also “vertically integrated” which means the company owns many parts of its supply/sales process. From sourcing the raw materials to manufacturing, selling, and even recycling old parts. This is a fantastic strategy as it gives them greater control of their supply chain and can result in higher margins than industry peers, such as Canadian Solar. The company also uses a “continuous flow” manufacturing process, which helps to keep costs down.

First Solar sells its panels with an “agile contracting strategy” which locks many customers into long-term “framework agreement”. Basically, this means as the business’s technology roadmap is realized, it can offer new products to customers and raise prices afterward. This is a spectacular strategy as a legacy issue for customers of solar companies has been the rapid pace of innovation in the industry. This may seem like a good thing, but if a business has solar panels installed and then more efficient panels come out, they will want those. First Solar handles this issue by upgrading the panels and taking the old panels away to recycle, which assists the customer and lowers First Solar’s manufacturing costs. I like to think of this as a smartphone upgrade program will a company like Apple, rather than selling your old phone you simply upgrade.

First Solar (Official website)

Solid Financials

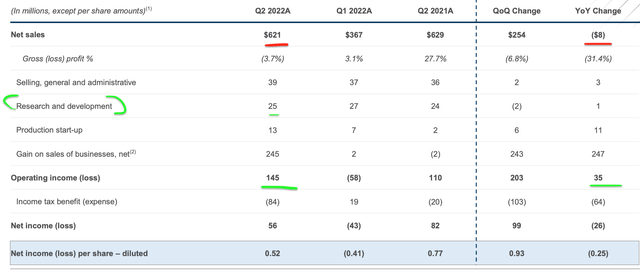

First Solar generated solid financial results for the second quarter of 2022. The company generated Net sales of $621 million, which popped by $254 million from the prior quarter but revenue did dip by $8 million YoY after an unusually strong prior year. This sequential growth was mainly driven by strong module sales as the business continues to benefit from industry tailwinds.

More recently (September 2022), First Solar has scored a 600MW deal to supply Azure Power (AZRE) with its new “Series 7” PV solar modules, from the fourth quarter of 2023 to 2025. The beautiful thing about this deal is the modules will be supplied from First Solar’s new manufacturing facility in India which is forecasted to come online in the second half of 2023. Located close to Chennai, the facility will have an annual capacity of 3.3 GW. India has the second largest population in the world with a staggering 1.4 billion people. In addition, the country is one of the fastest developing economies and is highly susceptible to climate change effects. Therefore, it’s no surprise that the Indian government has announced bold plans to have net zero emissions by 2070. In addition, India is aiming for 50% of its energy requirements from non-fossil fuels by 2030. In 2019, India had 134 GW of solar energy installed, and this is forecasted to increase to 280 GW to meet its target. First Solar will be poised to supply India will the solar panels it needs with its local facility in the country. Local manufacturing also tends to be favored extensively by the Indian government, as they tend to charge high tariffs on imports.

Back to the financials for the second quarter of 2022, First Solar generated a Gross margin of negative 4%, which was substantially worse than the positive 27.7% generated in the equivalent quarter last year. The good news is this was mainly driven by a one-off impairment related to its legacy Luz del Norte project. The company is continually innovating and invested $25 million in the R&D in the second quarter of 2022, which was fairly consistent with historic levels. SG&A expenses did rise by $6 million, but this was related to one of expense for the startup of its third Ohio factory.

First Solar (Investor Presentation Q2)

First Solar generated Operating Income of $145 million, which was a substantial improvement over the $58 million loss generated in the prior quarter. This was driven by strong module sales, but also included the sale of its Japan development platform, which did skew the numbers slightly.

First Solar generated earnings per share of $0.52, which beat analyst estimates by $0.49. However, again this was down from the $0.77 generated in the same quarter last year. This was mainly driven by an $84 million tax expense, which contrasted with a $19 million tax benefit previously.

The company has a solid balance sheet with cash, restricted cash and short term investments of $1.9 billion, which increased from $1.6 billion in the prior quarter thanks to the sale of its Japan platform. In addition, First Solar has total debt of $175 million, which declined by $77 million, as the company repaid its credit. As of the end of the quarter, First Solar had a record backlog of over 44 GWs.

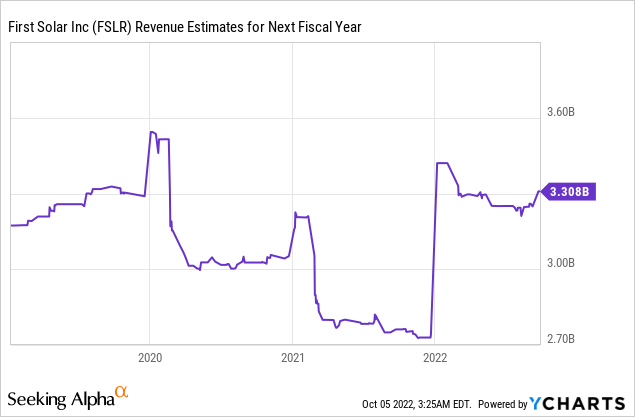

Advanced Valuation

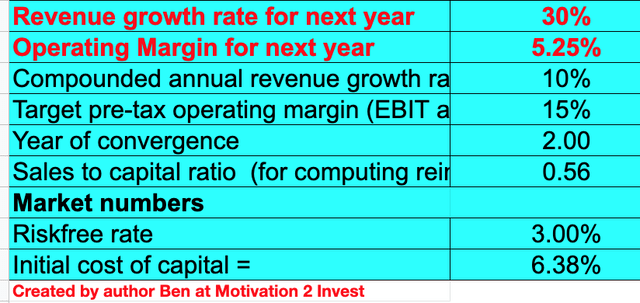

In order to value First Solar I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a substantial 30% revenue for next year, based on recently revised analysis estimates, which I believe has been one factor that has caused the stock price to pop. After which, I am forecasting a more conservative revenue growth rate of 10% per year, over the next 2 to 5 years.

First Solar stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have also forecasted operating margins to rebound back to 2021 levels of ~15% over the next 3 years. As the one-off expenses dissipate, and supply chain costs reduce over time.

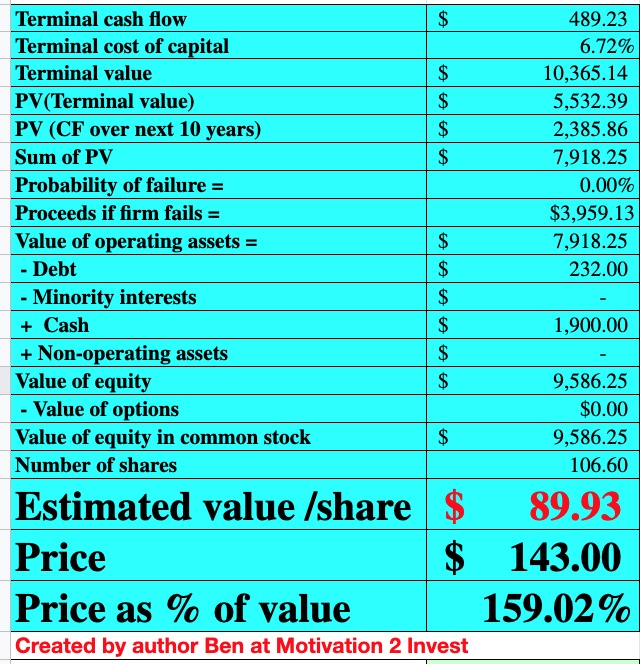

First Solar stock valuation (Created by author Ben at Motivation 2 invest)

Given these factors, I get a fair value of $89 per share, the stock is trading at just $143 per share, after the stock price recently increased by 120%, thus, it is not a surprise the business is 59% overvalued. However, I still deem this stock to be a “hold” given industry tailwinds and I suspect some strong pipeline activity for the next quarter.

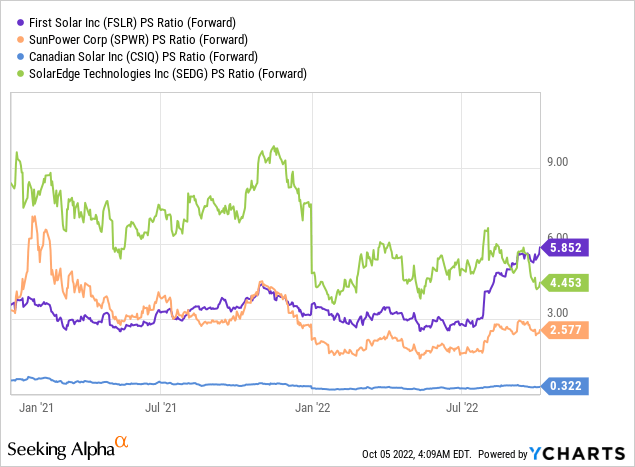

As an extra datapoint, Canadian Solar trades at a Price to Sales ratio of 5.59 which is ~15% more expensive than its 5-year average. Relative to other solar companies in the industry, First Solar has recently seen its valuation pop above others (purple line). Although, it should be noted that historically First Solar has much strong margins, profits, and reliable revenue than a company such as Canadian Solar (CSIQ) which has focused on a more aggressive revenue growth strategy.

Legendary Investor Buy Points

As an extra data point, I have analyzed the 13-F filings from the SEC for various Hedge funds run by legendary investors. The world’s largest hedge fund Bridgewater associates founded by Ray Dalio was buying shares at an average price of $71 per share in the second quarter. In addition, Value investing firm Gotham Capital ran by Joel Greenblatt also bought shares at a similar level. Therefore, given my valuation and these buy points, I like First Solar between $70 and $90 per share.

Risks

Stock Price has Doubled Recently

I first invested into First Solar back in 2020, and tend to prefer to buy “wonderful” stocks on bad news, which doesn’t impact the fundamentals. As I find jumping onto to momentum stocks, rarely works unless you are trading and analyzing the technicals. But this is all down to style preference there is no law that says stocks can’t go higher.

Supply Chain Constraints

In the earnings call for First Solar, management highlighted struggles with supply chains that have increased shipping costs. Here is an example;

“The queue of ships looking to berth at the Port of Savannah has recently increased to 30 vessels, up from zero in the previous quarter.”

Although the company admits that transit times between the US and Asia has improved, freight costs are still an issue. The good news is First solar has executed various “freight risk sharing” mechanisms in its customer contracts which should help to hedge the risk.

Final Thoughts

First Solar is a tremendous solar energy provider with best-in-class technology and flexible contracts. The business is poised to benefit from incentives and tailwinds in the US solar industry, as the largest Solar energy company headquartered in the US. FSLR stock price has recently increased by over 120% and now looks to be overvalued given known public information. Therefore, I deem it prudent to make note of my valuation and buy points in order to find an entry point. It would also make sense to stay up to date with the stock and see if further news comes out that justifies this massive spike in stock price.

Be the first to comment