Thurtell/E+ via Getty Images

Introduction

The ebb and flow of sentiment in solar names continue to be highly volatile and news driven. For example, Russia’s war with Ukraine has been seen as energizing interest in the sector given the need to reduce dependence on Russia’s energy supply based on hydrocarbons. Now and then, climate change concerns have also added to the rising interest in solar players which has benefitted from the general renewables energy space.

However, the financial position and fundamental valuation ratios of the news driven solar sector can be notoriously difficult to judge, and this article takes an objective look at the fundamental drivers of First Solar Inc. (NASDAQ:FSLR).

Solar industry growth is very strong

The solar energy industry is not merely facing strong organic consumer demand growth, but the type of growth that is supported by structural changes in how the supply of energy is approached. Essentially, the United Nation’s majority of Sustainable Development Goals and the Paris Climate Accords were developed to address climate change issues, and hence, that has resulted in government lobbying for renewable energy use.

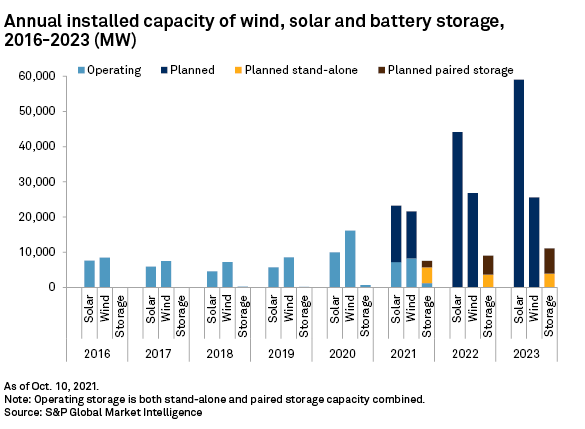

Of note, more than 44GW of solar power will be installed in the US, compared to 27W of winder energy projects, implying a priority on solar power. As shown in the below chart from S&P Global Market Intelligence, solar energy installed capacity is expected to rise rapidly for solar energy, relative to wind, and the growth rate of planned capacity should exceed 25%.

Looking forward, Allied Market Research expects an annual growth rate of more than 20% up till 2026, suggesting that the industry growth will extend beyond the short term and that there is plenty of scope for sales growth upgrades for FSLR.

Exhibit 1: The growth rate of solar energy from 2021 to 2023 will exceed prior years significantly

S&P Global Market Intelligence

FSLR is expanding capacity, which will raise future revenues

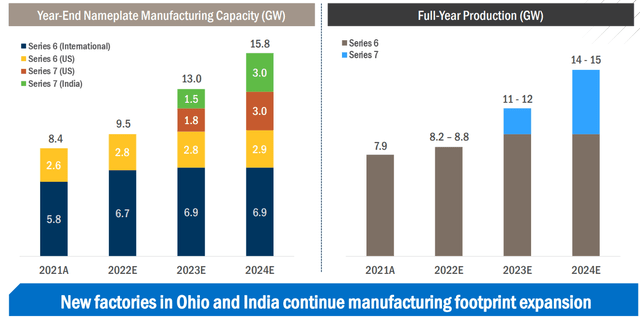

In line with the rising industry growth rate, FSLR has been expanding capacity. Of note, the industry expansion has now reached India, with a sunny climate that makes solar energy suitable for domestic use and a cost base that is low enough to support competitive exports. In fact, as a fast growing emerging market, solar energy has tremendous potential in India which is also the second most populous country in the world.

Globally, climate change goals developed by the United Nations are also changing patterns of energy supply in developing countries, and India would also serve as a good export base to serve the rapid growth of infrastructure needs in Asia. Of course, the US remains the dominant market but First Solar has suffered from low sales growth forecasts, hence the growth in capacity may prove analysts’ sales estimates incorrect. In fact, revenue growth forecasts are in the single digit growth rate, as compared to more than 30% capacity growth for First Solar through 2023, suggesting that sales growth for the company is currently being underestimated.

Exhibit 2: Bumping up production – Ohio and India are new manufacturing bases for First Solar, while new series 7 modules are incoming in 2023

First Solar investor presentation

Source: FSLR 4Q2021 results presentation from Seeking Alpha

Valuations of First Solar are attractive

As a whole, the valuations of solar names have been doing quite well since the beginning of this year. Valuation metrics tend to be difficult to explain for the solar sector since some of their levels can be quite stratospheric, due to the news driven nature of the sector. However, it appears that First Solar is one of those names where the valuation is at least relatively down-to-earth against its peers.

Based on the 6-month total return, FSLR has underperformed, while it is also trading at a steep discount to peers based on P/S, P/E, and EV/Sales, making the valuation of FSLR attractive. This is likely a function of the fact that forward sales growth compared to peers is expected to be low, based on analysts’ consensus, although the capacity increases at First Solar paints a more optimistic picture. This also suggests that there is potential for positive surprises if analysts’ forecast are lagging the latest developments in FSLR’s expansion plans in India and Ohio as abovementioned.

Furthermore, based on quarterly earnings, analysts’ estimates have not consistently overestimated the earnings of FSLR and there is not bias towards positive or negative earnings surprises. In 4Q2021, FSLR beat consensus EPS estimates by 16%, and 4Q2021 earnings growth was a positive trend change compared to the quarterly declines over the last year. The 6% cost reduction on a per watt basis also suggests that the company is reaping economies of scale which will reflect in future earnings announcements.

On the balance sheet, FSLR is in a strong position as net cash for the company was $1.4 billion in 4Q2021, compared to $1.3 billion in 4Q2020. The company has $1.8 billion in cash and short term investments.

Exhibit 3: First Solar’s valuation appears attractive compared to peers

|

6-month total return |

TTM P/S |

TTM P/E |

TTM EV/sales |

FWD EPS % growth |

FWD sales % growth |

|

|

-12.6% |

2.9 |

18.18 |

2.41 |

-15.84 |

6.7 |

|

|

-27.2% |

4.0 |

NM |

8.87 |

NM |

31.0 |

|

|

26.1% |

18.8 |

190.2 |

18.81 |

44.3 |

50.0 |

|

|

-5.3% |

2.7 |

NM |

2.82 |

NM |

19.3 |

|

|

21.8% |

8.9 |

109.5 |

9.17 |

30.8 |

33.9 |

|

|

Average |

3.8% |

8.6 |

149.9 |

9.92 |

37.5 |

33.6 |

|

FSLR’s discount to average |

-66% |

-88% |

-76% |

NM |

NM |

|

Source: Seeking Alpha, author’s compilation

Positive technical signals

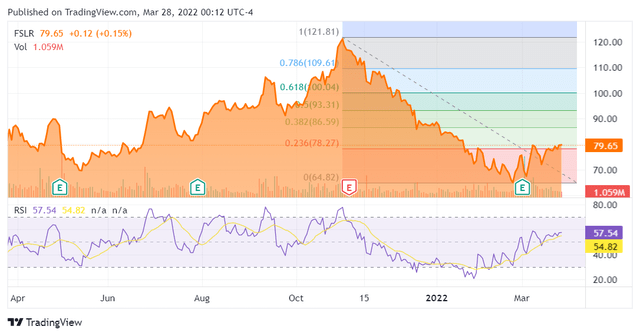

FSLR had a trend change in early March this year, as shown by FSLR exiting the dotted trendline in the chart below. This positive trend change is additionally supported by its price staying above the 78.27 Fibonacci level, suggesting the next Fibonacci target level at 86.59 is in sight. The trough of the base appears to have formed in February, while the rising RSI has yet to reach an overbought level, suggesting there is scope for further upside. In the short term, the slight fading of momentum could suggest a better entry point or a consolidation around the 78.27 Fibonacci level.

Exhibit 4: Momentum on First Solar has improved from the trough

Conclusion

FSLR is in a growth industry, but analyst estimates appear quite conservative on the company. The capacity expansion coupled with the factory in India are concrete drivers for further upside. The solid balance sheet and high cash level also indicate the financial capacity of FSLR to pursue its expansion in the growing solar industry. The industry’s growth is estimated at more than 30% over the next year and in the medium-term the growth rate is expected to read above 20%, driven by the decommissioning of older polluting power plants, the general drive towards green investing caused by green investment mandates and the global movement towards meeting the Paris Accord climate change targets.

The valuation of FSLR is attractive on several bases, including steep discounts on its P/S, EV/S and reasonable P/E ratio. The below industry earnings and sales growth forecasts also suggest that pessimistic expectations are already baked in, which leaves plenty of scope for positive earnings surprises and expansion of valuation multiples. Right now, the technicals suggest some scope for a further increase in price although there are some hints that a better entry point could be forthcoming. Overall, the positive momentum indicates that accumulation on FSLR has begun and the price trough was likely reached in February.

Be the first to comment