Bilanol/iStock via Getty Images

Green energy companies have risen dramatically in value over recent months as the recent fiscal spending bill pledged to substantially increase clean energy investments and subsidies over the coming years. The vertically integrated solar company, First Solar (NASDAQ:FSLR), is seen as among the “biggest beneficiaries” of the bill and is hoped to increase demand for solar dramatically. This change caused the stock to double in value over recent months, despite widespread declines in most other stocks. The stock’s valuation is much higher, with a market capitalization of nearly $14B and very thin earnings. Given how quickly it has risen, investors may want to consider whether or not the stock is in a speculative bubble or is genuinely on the verge of fundamental change.

On the one hand, government spending programs and the rising cost of electricity should drive demand for solar. On the other hand, the sharp rise in interest rates decreases the payback of solar investments. Additionally, First Solar has not seen any sales, earnings, or cash-flow growth (per share) in recent years and has seen its negative profits decline this year. The company also faces critical headwinds, such as a skilled labor shortage and a lack of materials, making it very difficult to turn a profit. While the firm has made some efforts to mitigate these risks, the precarious position of global trade (and transport costs) may further exacerbate its difficulty in generating earnings.

I believe these risks largely offset First Solar’s bullish potential and make FSLR a risky investment. The macroeconomic picture for solar has positive and negative factors but appears strong overall. However, after accounting for First Solar’s high-cost business fundamentals, I doubt it will fulfill investors’ current earnings expectations. That said, FSLR may still have long-term investment potential due to the industry’s growth outlook. Let’s take a closer look.

First Solar Will Benefit From Macro Landscape

Solar is undoubtedly a rapidly growing energy industry segment and is an excellent means of offsetting rising electricity costs. Solar adoption in the US has increased during the past two decades to a capacity of around 94 GW (or the equivalent of ~94 nuclear reactors), up dramatically from only around 3 GW in 2010. The generous government tax credit program and the Department of Energy’s guaranteed solar loan program keep solar financing rates near those of Treasury bonds – a program First Solar has benefited from.

The government’s most recent program, a part of the Inflation Reduction Act, aims to increase US solar production by allowing manufacturers to tax subsidies based on their domestic production. With four US factories, First Solar is among the few domestic solar producers and is the largest, with around 6 GW in domestic power capacity production per year. First Solar also has a record 44 GW backlog through 2026 and aims to expand production further both domestically and abroad.

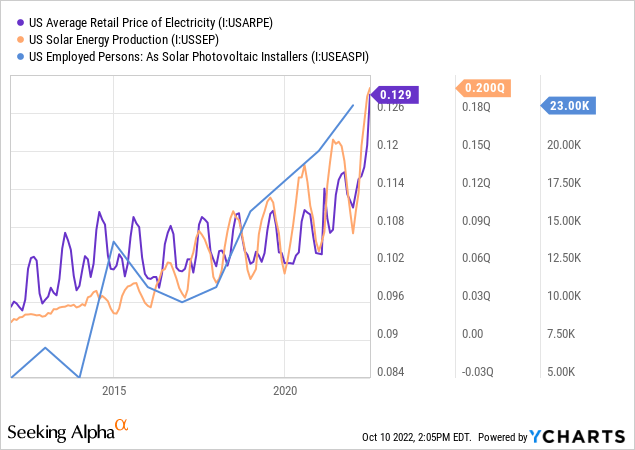

First Solar is in a great position to take advantage of existing and upcoming government green energy programs, particularly considering its dominance in domestic manufacturing. Demand for solar is also rising due to subsidies and the sharp rise in US electricity costs. In my view, rising power costs, led by the natural gas shortage, constitute a significant factor that will likely increase domestic roof-top solar demand over the coming years. See below:

The solar industry is growing at an exponential pace. In my opinion, it appears the market is transitioning toward rapid growth that verges on mass adoption. Two major demand drivers are government subsidies (for producers, consumers, and financiers) and rising electricity costs. Power costs are rising faster than inflation due to the growing natural gas shortage, utility plant issues, and labor shortages. While a change in legislative power is a risk to government solar programs, I believe a Republican government would likely maintain these subsidies due to the trouble of rising electricity costs.

Roof-top solar is advantageous to traditional power-plant generation due to its lack of direct input costs and lower labor overhead. Fossil fuel and nuclear power plants have significant labor overhead costs, rising quickly due to the skilled worker shortage. Solar farms like First Solar generally have lower overhead labor costs than traditional plants. Roof-top solar is even better since it circumvents utility companies’ power delivery labor (and other) fees. Both fossil fuel commodity shortages and labor shortages are driving the rise in electricity costs. While solar has substantial upfront labor and materials investment costs, I believe its dramatically lower overhead power-generation costs give it a great demand outlook in today’s inflationary environment.

Will the inflation reduction act’s green energy proposal lower inflation dramatically? Not necessarily. However, in combination with the inflationary environment, it should accelerate demand for solar on both a commercial and residential front. In addition, it may finally improve the manufacturing cost in the US, allowing First Solar to extend its market dominance here. There is some risk that rising interest rates will offset rising demand factors, but since power costs are rising much faster than 5-7% (today’s commercial mortgage rates), solar still appears a cost saver. Overall, I believe this set of economic and policy conditions will cause First Solar’s sales to rise substantially over the coming three years. However, without an improvement in microeconomics, First Solar may not see profits soar accordingly.

First Solar’s Valuation Is Hard To Justify

For a stock to have value, the company that issues it must earn a profit or reasonably expect to do so within the foreseeable future. Today, many of 2020’s high-flying technology stocks are learning this the hard way as “growth firms” see chronically negative earnings weighing on cash balances to potential bankruptcy. Indeed, many green energy firms, such as Sunrun (RUN), face a similar circumstance.

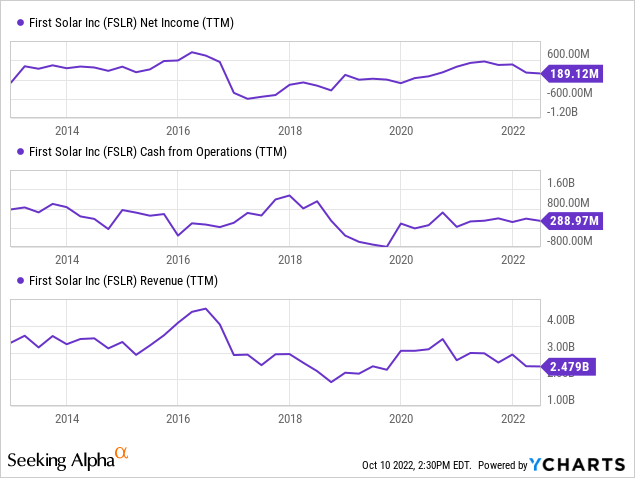

While First Solar has strong growth tailwinds, like many green energy companies in the US, it does not generate consistent profits. Further, its sales, income, and cash flow have all stagnated in recent years. See below:

First Solar took a hit in 2020 as projects were delayed and investments cost more than anticipated. Investors should note the firm’s lack of growth and volatile profits; however, its sales are anticipated to rise by around 27% in 2023 and maintain a rapid growth pace through 2027. Analysts anticipate its EPS will rise to $9 by 2028, but I have doubts as a considerable increase in margins would be necessary for that to occur.

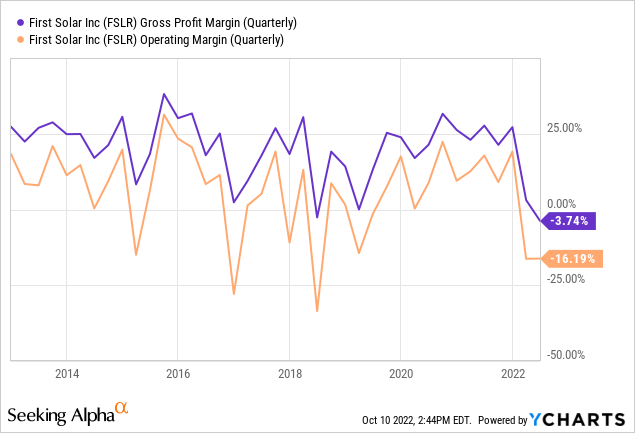

Numerous solar demand drivers may be problematic for First Solar’s profit margins. Rising skilled labor costs, power costs, and materials costs may benefit solar demand, but they will weigh on First Solar’s production costs. First Solar’s gross margins are already relatively low and will likely be constrained by the inflationary economic environment, particularly combined with the decline in business and household spending capacity. These strains are very clear in First Solar’s critical margin data:

First Solar’s cost of goods solar was greater than its sales in Q2, a particularly troubling sign considering that it does not account for operating expenses, interest, depreciation, and potential taxes. The company’s gross margins took a 9% hit in Q2 due directly to an impairment in its Luz Norte project, but even taking that out, its “adjusted” gross margin would still be a meager 5% to 6%, far below prior quarters. The other major factor negatively impacting its margins was the rise in freight costs, accounting for a 16% decline in gross margins.

The freight cost factor is critical because it shows First Solar is struggling to keep up with rising energy costs and is unlikely to earn a profit without substantially increasing its unit prices. In the current economic environment of rising interest rates (and virtually all overhead costs), I doubt companies and households will necessarily pay too much more for solar panels. The bulk of First Solar’s sales come from modules and power system products, which face rising input and manufacturing costs. A considerably (<10% of all) smaller portion of its sales are derived from maintenance and power generation. Thus, First Solar’s cost structure is very exposed to inflationary dynamics. Given the rapid decline in its gross margins (even after impairment adjustments), it is doubtful First Solar will have strong profit capacity anytime soon.

The Bottom Line

Overall, I have a positive outlook for the solar industry and believe First Solar’s sales may rise substantially over the coming quarters and years due to strong solar tailwinds. Rising fossil fuel and labor costs are great for aiding solar demand, but they will likely make it difficult for solar manufacturers to maintain high profits. Yes, First Solar can raise the price of its products to offset growing input costs. However, the net change to profits may still be negative as rising interest rates and a slowing economy may likely make households and companies more price sensitive. That said, I am bearish on FSLR and believe the stock will eventually decline from its current price.

Even if First Solar overcomes profitability obstacles, it is not expected to earn a high EPS of ~$9 until the late 2020s. At such an EPS, it would have a “P/E” of 14.3X today, which is high given the significant uncertainties regarding its ability to achieve this level of profitability and the substantial time necessary to do so. In the meantime, First Solar may need to pursue debt financing or equity dilution to maintain cash balances amid rising CapEx investments and volatile costs.

While I would not bet against the stock (due to its apparent retail investor popularity), I would not buy it and believe it would be more fairly valued at a share price of $60 or below. In my view, that price better discounts its risks at a 7X price ratio to potential long-term profits (based on current analyst expectations). With that in mind, the high uncertainty surrounding First Solar’s margins and potential sales growth allows for a wide valuation range.

Be the first to comment