SB/iStock via Getty Images

Earnings of First Internet Bancorp (NASDAQ:INBK) will most probably dip this year relative to last year because of an increase in operating expenses as well as provision normalization. On the other hand, the upcoming acquisition of First Century Bancorp, team expansion, and fintech partnerships will likely drive the topline. Further, the upcoming maturities of costly deposits will likely support the net interest income. Overall, I’m expecting First Internet Bancorp to report earnings of $4.42 per share in 2022, down 8% year-over-year. The year-end target price suggests a decent upside from the current market price. Based on the total expected return, I’m maintaining a buy rating on First Internet Bancorp.

Management’s Efforts to Drive Balance Sheet Growth

The upcoming acquisition of First Century Bancorp will provide a much-needed boost to First Internet Bancorp’s balance sheet. As mentioned in the merger presentation, First Internet Bancorp was previously expected to close the transaction in the first quarter of 2022. As no announcement of transaction closing was made during the first quarter, I’m assuming the transaction will now close sometime in the second or third quarter of 2022. The upcoming acquisition will likely add loans totaling $32 million, deposits totaling $330 million, and securities totaling $150 million.

Further, First Bancorp is continuing to work on fintech partnerships that will add low-cost deposits, as mentioned in the conference call. Additionally, First Internet Bancorp hired small business (“SBA”) personnel last year, which will likely boost the balance sheet. As mentioned in the conference call, the company is planning further hiring for this year.

Moreover, economic recovery will boost the balance sheet. First Internet Bancorp is a nationwide lender; therefore, the country’s strong economic growth bodes well for First Internet Bancorp’s product demand. The country reported strong GDP growth of 6.9% in the last quarter of 2021 and a low unemployment rate of 3.6% in March 2022.

Considering these factors, I’m expecting the loan portfolio to increase by 6%, other earning assets to increase by 19%, and deposits to increase by 10% in 2022. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | |

| Financial Position | ||||||

| Net Loans | 2,076 | 2,698 | 2,942 | 3,030 | 2,860 | 3,035 |

| Growth of Net Loans | 67.5% | 30.0% | 9.0% | 3.0% | (5.6)% | 6.1% |

| Other Earning Assets | 587 | 704 | 981 | 1,018 | 1,146 | 1,366 |

| Deposits | 2,085 | 2,671 | 3,154 | 3,271 | 3,179 | 3,490 |

| Borrowings and Sub-Debt | 447 | 559 | 584 | 595 | 619 | 657 |

| Common equity | 224 | 289 | 305 | 331 | 380 | 422 |

| Book Value Per Share ($) | 31.3 | 30.4 | 30.4 | 33.6 | 38.1 | 42.3 |

| Tangible BVPS ($) | 30.7 | 29.9 | 29.9 | 33.1 | 37.7 | 41.8 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

CD Maturity, Upcoming Acquisition to Lift the Margin

The average loan portfolio yield is quite sticky as adjustable-rate loans make up just 14.4% of total loans, according to details given in the 10-K filing. Additionally, the predetermined-rate loans maturing within one year make up just 2.5% of total loans. As of December 2021, the management’s interest-rate sensitivity analysis showed that a 200-basis points increase in interest rates could DECREASE the net interest income by 4.86%, as given in the 10-K filing.

Fortunately, the balance sheet has plenty of opportunities to improve from its year-end positioning. Certificates of deposits (“CD”) totaling $713 million are scheduled to mature in 2022, according to details given in the conference call. These CDs carry a weighted average rate of 1.02%. The replacement cost of CDs was around 0.55% at the time of the conference call. Considering these factors, the scheduled maturity can reduce the average funding cost by around nine basis points, according to my calculations. However, as interest rates will increase in the year ahead, the actual impact will likely be lower than nine basis points.

The net interest margin also stands to benefit from the upcoming acquisition of First Century Bancorp in the following two ways.

- Average deposit cost will decline as the acquisition will add low-cost deposits of $330 million with an average funding cost of only six basis points.

- The acquisition will improve the asset mix. First Internet Bancorp will pay $80 million as cash consideration for the acquisition, which will reduce the cash drag. Further, the acquisition will add $150 million of securities earning rates of 1.5%, which is higher than the profit earned on cash and cash equivalents.

Considering these factors, I’m expecting the average margin in 2022 to be around 27 basis points higher than the average margin for 2021. Compared to my last report on First Internet Bancorp, I have tweaked up my margin estimate.

Management’s Plans to Push up Operating Expenses

The jump in First Internet Bancorp’s non-interest expenses in the last quarter of 2021 surprised me. As mentioned in the conference call, the management is expecting these expenses to surge by a further 15% to 17% in 2022, excluding the effect of First Century Bancorp’s acquisition. The planned increase in non-interest expenses is attributable to the following factors.

- Investment in SBA personnel hired throughout 2021. The management expects last year’s hiring to have a full-year impact in 2022.

- The management plans further hiring for 2022.

- Premises and equipment costs will increase as First Internet Bancorp has recently moved to new headquarters.

Considering these factors, I’m expecting the non-interest expense to increase by 20% year-over-year to $74 million in 2022. In my last report on First Internet Bancorp, I estimated operating expenses of $64 million for this year. I have increased my estimate because expenditure in the last quarter surprised me. It is apparent that I previously underestimated the management plans.

Expecting Earnings to Dip by 8%

Earnings will likely decline in 2022 on a year-over-year basis mostly because of higher non-interest expenses. Further, the provision expense will likely return to a normal level in 2022 after a year of provision reversals. In my opinion, the decent loan growth will likely ensure the provision normalization for this year.

Overall, I’m expecting First Internet Bancorp to report earnings of $4.42 per share in 2022, down 8% year-over-year. For the first quarter of 2022, I’m expecting the company to report earnings of $1.03 per share. First Internet Bancorp is scheduled to announce the first quarter’s results on April 20, 2022. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Income Statement | |||||||

| Net interest income | 54 | 62 | 63 | 65 | 87 | 101 | |

| Provision for loan losses | 5 | 4 | 6 | 9 | 1 | 6 | |

| Non-interest income | 11 | 9 | 17 | 36 | 33 | 31 | |

| Non-interest expense | 37 | 43 | 47 | 58 | 62 | 74 | |

| Net income – Common Sh. | 15 | 22 | 25 | 29 | 48 | 44 | |

| EPS – Diluted ($) -Adjusted | 2.13 | 2.30 | 2.51 | 2.99 | 4.82 | 4.42 | |

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

|||||||

My earnings estimate is almost unchanged from the previous earnings estimate given in my last report on First Internet Bancorp. This is because the increase in the margin estimate cancels out the increase in the non-interest expense estimate.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to the COVID-19 pandemic and the timing and magnitude of interest rate hikes.

Decent Total Expected Return Justifies a Buy Rating

First Internet Bancorp is offering a dividend yield of 0.6% at the current quarterly dividend rate of $0.06 per share. The earnings and dividend estimates suggest a payout ratio of just 5% for 2022. First Internet Bancorp has maintained its quarterly dividend at $0.06 per share since 2013. Therefore, I’m not expecting an increase in the dividend level despite the low payout ratio.

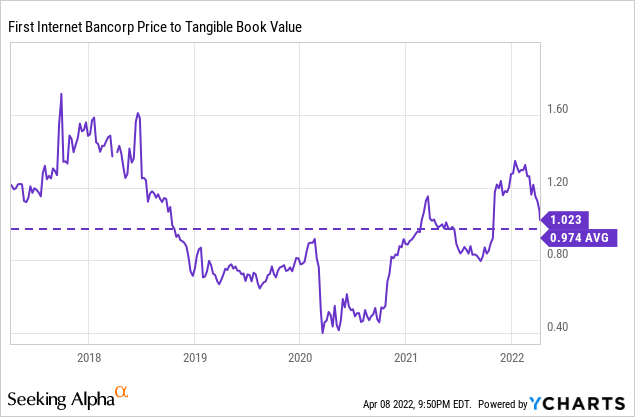

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value First Internet Bancorp. The stock has traded at an average P/TB ratio of 0.974x in the past, as shown below.

Multiplying the average P/TB multiple with the forecast tangible book value per share of $41.8 gives a target price of $40.7 for the end of 2022. This price target implies a 2.6% upside from the April 8 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.8x | 0.9x | 0.97x | 1.1x | 1.2x |

| TBVPS – Dec 2022 ($) | 41.8 | 41.8 | 41.8 | 41.8 | 41.8 |

| Target Price ($) | 32.3 | 36.5 | 40.7 | 44.9 | 49.1 |

| Market Price ($) | 39.7 | 39.7 | 39.7 | 39.7 | 39.7 |

| Upside/(Downside) | (18.5)% | (8.0)% | 2.6% | 13.1% | 23.6% |

| Source: Author’s Estimates |

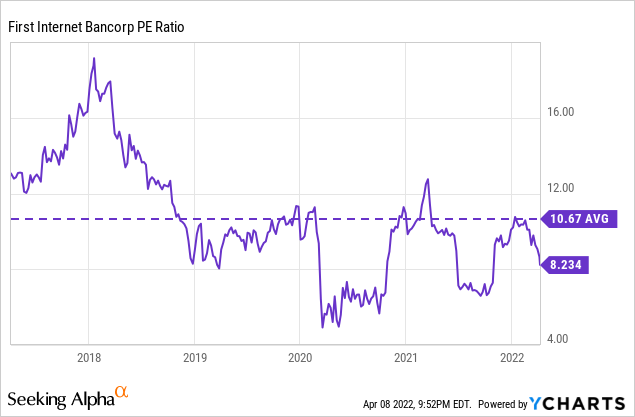

The stock has traded at an average P/E ratio of around 10.7x in the past, as shown below.

Multiplying the average P/E multiple with the forecast earnings per share of $4.42 gives a target price of $47.1 for the end of 2022. This price target implies an 18.8% upside from the April 8 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 8.7x | 9.7x | 10.7x | 11.7x | 12.7x |

| EPS 2022 ($) | 4.42 | 4.42 | 4.42 | 4.42 | 4.42 |

| Target Price ($) | 38.3 | 42.7 | 47.1 | 51.6 | 56.0 |

| Market Price ($) | 39.7 | 39.7 | 39.7 | 39.7 | 39.7 |

| Upside/(Downside) | (3.5)% | 7.7% | 18.8% | 30.0% | 41.1% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $43.9, which implies a 10.7% upside from the current market price. Adding the forward dividend yield gives a total expected return of 11.3%. Hence, I’m maintaining a buy rating on First Internet Bancorp.

Be the first to comment