Moyo Studio/E+ via Getty Images

Earnings of First Internet Bancorp (NASDAQ:INBK) will most probably continue to decline next year. Normalization of provision expense and lower non-interest income will undermine the benefit of loan growth. Overall, I’m expecting First Internet Bancorp to report earnings of $3.84 per share for 2022, down 20% year-over-year. For 2023, I’m expecting earnings to slip by a further 12% to $3.40 per share. Next year’s target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on First Internet Bancorp.

Margin Contraction to Counter the Benefits of Loan Growth

First Internet Bancorp’s net interest margin shrank in the third quarter as interest rates rose because of the liability-sensitive balance sheet. The margin contracted by 20 basis points during the quarter, following a four basis points rise in the second quarter of the year. The repricing of deposits overtook the repricing of assets during the third quarter due to a timing difference. The company’s deposits are quick to reprice because of the large balance of interest-bearing demand, savings, and money market accounts which altogether made up 57% of total deposits in the third quarter.

The management is expecting the deposit cost to rise between 75 to 95 basis points, as mentioned in the conference call. This is much higher than the increase of 56 basis points in the third quarter of the year. The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing showed that a 200-basis points hike in interest rates could reduce the net interest income by 6.1% over twelve months.

Considering these factors, I’m expecting the margin to decline by 18 basis points in the fourth quarter of 2022. Further, I’m expecting the margin to get some respite after the up-rate cycle is over, most probably by the mid of 2023. Once the cycle is over, most deposits will stop repricing soon; however, the loans and securities will continue to reprice. Therefore, I’m expecting the margin to rise by 10 basis points in the second half of 2023.

Loan growth will likely counter the damage from margin contraction. The loan portfolio’s growth in the last two quarters has far exceeded my expectations. The portfolio grew by 7.0% in the second quarter and 5.7% in the third quarter of 2022. Loan growth is unlikely to remain at this unusually high level in the coming quarters, partly because of the high-rate environment. However, growth will likely remain at a decent level thanks to internal and external factors.

The management appeared optimistic about loan growth in the conference call, saying that the pipeline is continuing to grow. As mentioned in the conference call, the construction lending team made $190 million worth of new loan originations during the quarter, out of which very little was funded. The management expects to fund these over the next 12 to 18 months. To put this number in perspective, $190 million is 6% of total loans outstanding as of the end of September 2022.

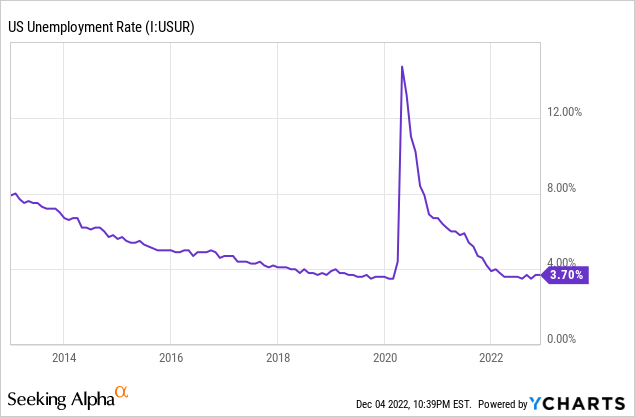

The loan portfolio is well diversified in terms of geography and type of loans. Therefore, the national average unemployment rate is an apt indicator of credit appetite. As shown below, the rate has remained stubbornly low throughout this year, which bodes well for credit demand.

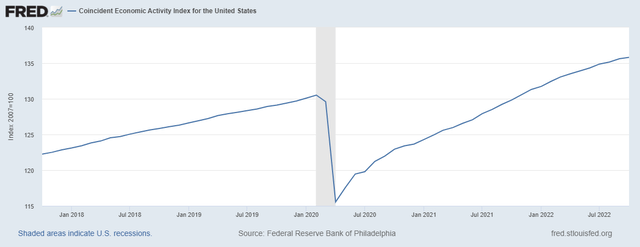

Further, the coincident economic activity index is showing healthy economic activity in the country. However, currently the curve is not as steep as before.

The Federal Reserve Bank of Philadelphia

Considering these factors, I’m expecting the loan portfolio to grow by 3.0% in the last quarter of the year, leading to full-year loan growth of 16%. For 2023, I’m expecting the portfolio to grow by 6%. Meanwhile, I’m expecting deposits to grow in line with loans. The following table shows my income statement estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net Loans | 2,698 | 2,942 | 3,030 | 2,860 | 3,323 | 3,527 |

| Growth of Net Loans | 30.0% | 9.0% | 3.0% | (5.6)% | 16.2% | 6.1% |

| Other Earning Assets | 704 | 981 | 1,018 | 1,146 | 822 | 856 |

| Deposits | 2,671 | 3,154 | 3,271 | 3,179 | 3,256 | 3,456 |

| Borrowings and Sub-Debt | 559 | 584 | 595 | 619 | 701 | 730 |

| Common equity | 289 | 305 | 331 | 380 | 356 | 374 |

| Book Value Per Share ($) | 30.4 | 30.4 | 33.6 | 38.1 | 37.3 | 39.2 |

| Tangible BVPS ($) | 29.9 | 29.9 | 33.1 | 37.7 | 36.8 | 38.7 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Considering the loan and margin outlook, I’m expecting the net interest income to dip by just 1% year-over-year in 2023.

Provision Normalization to Drag Earnings

Provisioning has remained subdued so far this year despite the strong loan growth. First Internet Bancorp reported a net provision expense of $2.9 million during the first nine months, which is 0.13% of average loans, annualized. This is below the five-year average of 0.19%. Due to the threats of a recession, provisioning is unlikely to remain below normal for long. Additionally, the high inflation environment is likely to push some already stretched borrowers to the brink of default.

However, provisioning is unlikely to go too high because First Internet Bancorp already has a very large reserve for loan losses relative to problematic assets. Non-performing loans made up 0.18% of total loans at the end of September 2022, as mentioned in the earnings presentation. In comparison, allowances were around five times higher at 0.92%.

Considering these factors, I’m expecting the net provision expense to make up around 0.17% of total loans in 2023, which is close to the last five-year average.

Earnings Likely to Dip by 12% Next Year

Despite the decent loan growth, earnings will most probably trend downward next year. The anticipated provision normalization will contribute to an earnings decline. Further, the non-interest income will likely decline due to lower mortgage refinance income amid the rising rate environment. The banking-as-a-service initiative appears well on track, which will provide some support for fee income. The management expects to onboard its first relationship in early 2023, as mentioned in the conference call.

Overall, I’m expecting First Internet Bancorp to report earnings of $3.84 per share, down 20% year-over-year. For 2023, I’m expecting earnings to slip by a further 12% to $3.40 per share. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net interest income | 62 | 63 | 65 | 87 | 98 | 97 |

| Provision for loan losses | 4 | 6 | 9 | 1 | 4 | 6 |

| Non-interest income | 9 | 17 | 36 | 33 | 20 | 18 |

| Non-interest expense | 43 | 47 | 58 | 62 | 73 | 72 |

| Net income – Common Sh. | 22 | 25 | 29 | 48 | 37 | 32 |

| EPS – Diluted ($) | 2.30 | 2.51 | 2.99 | 4.82 | 3.84 | 3.40 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates(In USD million unless otherwise specified) | ||||||

Compared to my last report on First Internet Bancorp issued before the second quarter’s results, I’ve significantly slashed my earnings estimate mostly because the margin has dipped by more than I anticipated in the last two quarters. Further, the non-interest income, especially mortgage banking income, has already declined by more than I expected.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

INBK is Trading at a Discount to the Target Price

First Internet Bancorp is offering a dividend yield of 0.9% at the current quarterly dividend rate of $0.06 per share. The earnings and dividend estimates suggest a payout ratio of 7.1% for 2023, which is close to the five-year average of 8.8%. Further, First Internet Bancorp has maintained its quarterly dividend at $0.06 per share since 2013. Therefore, I’m not expecting an increase in the dividend level.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value First Internet Bancorp. The stock has traded at an average P/TB ratio of 0.83 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 29.9 | 29.9 | 33.1 | 37.7 | ||

| Average Market Price ($) | 32.5 | 21.4 | 19.4 | 34.5 | ||

| Historical P/TB | 1.09x | 0.72x | 0.59x | 0.92x | 0.83x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $38.7 gives a target price of $32.0 for the end of 2023. This price target implies a 22% upside from the December 2 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.63x | 0.73x | 0.83x | 0.93x | 1.03x |

| TBVPS – Dec 2023 ($) | 38.7 | 38.7 | 38.7 | 38.7 | 38.7 |

| Target Price ($) | 24.3 | 28.2 | 32.0 | 35.9 | 39.8 |

| Market Price ($) | 26.3 | 26.3 | 26.3 | 26.3 | 26.3 |

| Upside/(Downside) | (7.5)% | 7.3% | 22.0% | 36.8% | 51.6% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 9.1x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 2.30 | 2.51 | 2.99 | 4.82 | ||

| Average Market Price ($) | 32.5 | 21.4 | 19.4 | 34.5 | ||

| Historical P/E | 14.1x | 8.5x | 6.5x | 7.2x | 9.1x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $3.40 gives a target price of $30.8 for the end of 2023. This price target implies a 17.5% upside from the December 2 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 7.1x | 8.1x | 9.1x | 10.1x | 11.1x |

| EPS 2023 ($) | 3.40 | 3.40 | 3.40 | 3.40 | 3.40 |

| Target Price ($) | 24.0 | 27.4 | 30.8 | 34.2 | 37.6 |

| Market Price ($) | 26.3 | 26.3 | 26.3 | 26.3 | 26.3 |

| Upside/(Downside) | (8.4)% | 4.5% | 17.5% | 30.4% | 43.4% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $31.4, which implies a 19.7% upside from the current market price. Adding the forward dividend yield gives a total expected return of 20.7%.

The large discount to the target price shows that the market has clearly overreacted to the outlook of earnings decline. Based on the total expected return, I’m maintaining a buy rating on First Internet Bancorp.

Be the first to comment