Althom/iStock Editorial via Getty Images

Earnings of First Commonwealth Financial Corporation (NYSE:FCF) will most probably dip this year due to provision normalization. On the other hand, the rise in interest rates and the management’s efforts to improve loan originations will boost the net interest income, thereby supporting the bottom line. Overall, I’m expecting First Commonwealth Financial to report earnings of $1.35 per share for 2022, down 6% year-over-year. Compared to my last report on the company, I’ve barely changed my earnings estimate for the year. The year-end target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on First Commonwealth Financial.

Internal Factors, Strength In The Regional Economy To Drive Loan Growth

First Commonwealth Financial’s loan portfolio grew by 1.7% in the first quarter of 2022, which was slightly below my expectation. This growth was the highest quarterly loan growth since the second quarter of 2022 when the Paycheck Protection Program gave a boost to the loan portfolio. The management mentioned in the latest conference call that the quarter witnessed the first significant uptick in commercial line utilization since the onset of the pandemic.

The management’s ongoing efforts will likely keep the loan growth momentum going for the remainder of the year. As mentioned in the conference call, First Commonwealth Financial is currently working on its front-end loan system. Moreover, the company is installing a new credit card platform for consumer and commercial customers later this year.

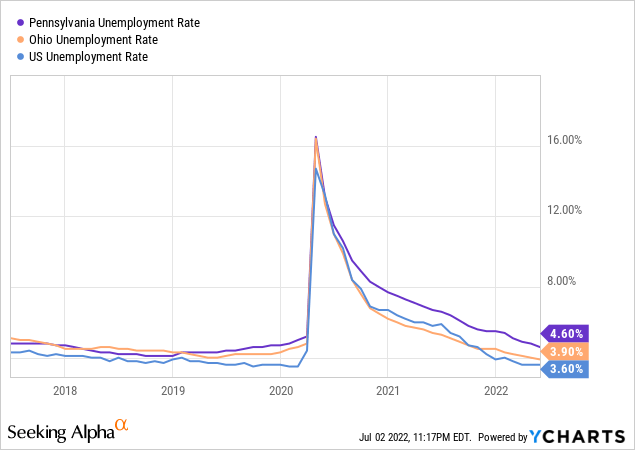

Besides, improvement in economic activity will help sustain loan growth. First Commonwealth Financial operates in the states of Pennsylvania and Ohio. Although the job markets of both these states are trailing the national average, they are still much better than the last two years and back to the pre-pandemic levels.

Considering these factors, I’m expecting the loan portfolio to increase by 7.9% by the end of 2022 from the end of 2021. In my last report on First Commonwealth Financial, I estimated loan growth of 8.2%. I have now tweaked downwards my estimate because the growth was slightly below my expectation for the first quarter of the year.

Meanwhile, deposits will mostly grow in line with loans. The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Financial Position | |||||||

| Total Loans | 5,407 | 5,774 | 6,189 | 6,761 | 6,839 | 7,378 | |

| Growth of Total Loans | 11.0% | 6.9% | 7.2% | 8.5% | 1.3% | 7.9% | |

| Other Earning Assets | 1,207 | 1,350 | 1,292 | 1,495 | 2,443 | 1,989 | |

| Deposits | 5,581 | 5,898 | 6,678 | 7,439 | 7,982 | 8,608 | |

| Borrowings and Sub-Debt | 795 | 907 | 436 | 351 | 321 | 282 | |

| Common equity | 888 | 975 | 1,056 | 1,069 | 1,109 | 1,134 | |

| Book Value Per Share ($) | 9.3 | 9.8 | 10.7 | 10.9 | 11.6 | 12.0 | |

| Tangible BVPS ($) | 6.5 | 6.9 | 7.5 | 7.7 | 8.3 | 8.7 | |

|

Source: SEC Filings, Author’s Estimates (In USD million, unless otherwise specified) |

|||||||

Interest Income Is Barely Sensitive To Rate Hikes

Although around 51% of the loan portfolio is based on variable rates (source: earnings presentation), First Commonwealth Financial’s average loan yield is not very sensitive to interest rate hikes. This is because around 45.3% of the variable portfolio has in-the-money floors, which means the yields of these loans will start responding after a large hike in interest rates.

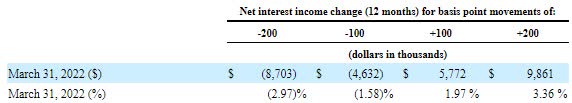

Nevertheless, the net interest income will in general benefit from higher rates this year, as more assets than liabilities will re-price in 2022. The asset-liability gap was 11.10% of total assets at the end of March 2022, as mentioned in the 10-Q filing. The management’s interest-rate sensitivity analysis shows that a 200-basis point hike in interest rates can boost the net interest income by only 3.36% over twelve months.

1Q 2022 10-Q Filing

Overall, I am expecting the margin to increase by 18 basis points in 2022. In my last report on First Commonwealth Financial, I estimated the margin to increase by only eight basis points this year. I have increased my margin estimate following the release of the Federal Reserve’s revised projections.

Due to the combination of a downward revision in the loan growth estimate and an upward revision of the margin estimate, my net interest income estimate for the full year is now lower than what I previously anticipated.

Provisioning Normalization To Drag Earnings

Contrary to last year, when First Commonwealth posted a net provision reversal, the company will report a net provision expense this year because reversals of provisions cannot be sustained for prolonged periods.

Further, high interest rates are likely to take a toll on asset quality during the year ahead. However, the allowances for loan losses are already quite high, due to which the company will not have to rebuild too much of its reserves. The allowances-to-nonperforming loan ratio stood at 243.38% at the end of March 2022, up from 192.06% at the end of March 2021. As a result, I’m expecting the provision expense to be at a normal level this year, despite the heightened interest rates and the threat of a recession.

I’m expecting the provision expense, net of reversals, to make up 0.18% of total loans in 2022, which is the same as the average from 2017 to 2019.

Earnings To Dip By 6%

The provision normalization will likely be the biggest reason for an earnings decline this year. Further, the non-interest expenses will rise mostly in line with balance sheet growth. I’m expecting the company to report non-interest expenses of $225 million for 2022, up 5.0% year-over-year. Compared to my last report on First Commonwealth Financial, I’ve revised downwards my non-interest expenses estimate following the first quarter’s performance, which was better than my expectations.

On the other hand, anticipated loan growth and margin expansion will support the bottom line. Overall, I’m expecting First Commonwealth Financial to report earnings of $1.35 per share for 2022, down 6% year-over-year. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21 | FY22E | ||

| Income Statement | |||||||

| Net interest income | 229 | 252 | 270 | 268 | 279 | 294 | |

| Provision for loan losses | 5 | 13 | 15 | 57 | (1) | 13 | |

| Non-interest income | 80 | 89 | 85 | 94 | 107 | 105 | |

| Non-interest expense | 200 | 196 | 210 | 216 | 214 | 225 | |

| Net income – Common Sh. | 55 | 107 | 105 | 73 | 138 | 128 | |

| EPS – Diluted ($) | 0.58 | 1.08 | 1.07 | 0.75 | 1.44 | 1.35 | |

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million, unless otherwise specified) |

|||||||

In my last report on First Commonwealth Financial, I estimated earnings of $1.34 per share for 2022. My updated earnings estimate has barely changed, as my downward revision of the net interest income estimate cancels out the downward revision of my non-interest income estimate.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my expectation.

High Total Expected Return Justifies A Buy Rating

First Commonwealth is offering a dividend yield of 3.5% at the current quarterly dividend rate of $0.12 per share. The earnings and dividend estimates suggest a payout ratio of 35% for 2022, which is below the five-year average of 43%. Although the payout ratio suggests that there is room for another dividend hike this year, I’m not assuming any change in the dividend level to be on the safe side.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value First Commonwealth Financial. The stock has traded at an average P/TB ratio of 1.7x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 6.9 | 7.5 | 7.7 | 8.3 | ||

| Average Market Price ($) | 15.0 | 13.4 | 9.6 | 14.1 | ||

| Historical P/TB | 2.2x | 1.8x | 1.2x | 1.7x | 1.7x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $8.7 gives a target price of $15.0 for the end of 2022. This price target implies a 9.6% upside from the July 1 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.5x | 1.6x | 1.7x | 1.8x | 1.9x |

| TBVPS – Dec 2022 ($) | 8.7 | 8.7 | 8.7 | 8.7 | 8.7 |

| Target Price ($) | 13.3 | 14.1 | 15.0 | 15.9 | 16.7 |

| Market Price ($) | 13.7 | 13.7 | 13.7 | 13.7 | 13.7 |

| Upside/(Downside) | (3.1)% | 3.2% | 9.6% | 15.9% | 22.3% |

Source: Author’s Estimates

The stock has traded at an average P/E ratio of around 12.2x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 1.08 | 1.07 | 0.75 | 1.44 | ||

| Average Market Price ($) | 15.0 | 13.4 | 9.6 | 14.1 | ||

| Historical P/E | 13.9x | 12.5x | 12.7x | 9.8x | 12.2x | |

Source: Company Financials, Yahoo Finance, Author’s Estimates

Multiplying the average P/E multiple with the forecast earnings per share of $1.35 gives a target price of $16.6 for the end of 2022. This price target implies a 20.9% upside from the July 1 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 10.2x | 11.2x | 12.2x | 13.2x | 14.2x |

| EPS – 2022 ($) | 1.35 | 1.35 | 1.35 | 1.35 | 1.35 |

| Target Price ($) | 13.9 | 15.2 | 16.6 | 17.9 | 19.3 |

| Market Price ($) | 13.7 | 13.7 | 13.7 | 13.7 | 13.7 |

| Upside/(Downside) | 1.2% | 11.0% | 20.9% | 30.8% | 40.7% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $15.8, which implies a 15.2% upside from the current market price. Adding the forward dividend yield gives a total expected return of 18.7%. Hence, I’m maintaining a buy rating on First Commonwealth Financial.

Be the first to comment