coldsnowstorm

Thesis highlight

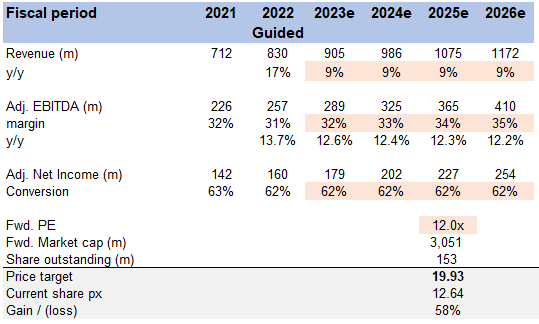

I recommend going long First Advantage (NASDAQ:FA) ($12.64 as of this writing). It is a leading player in a large and growing TAM with significant opportunities available to grow at above industry rates. I expect it to generate $410m EBITDA in FY26, with a 12x forward PE multiple resulting in $20/share of equity value in FY25 (60% upside).

Company overview

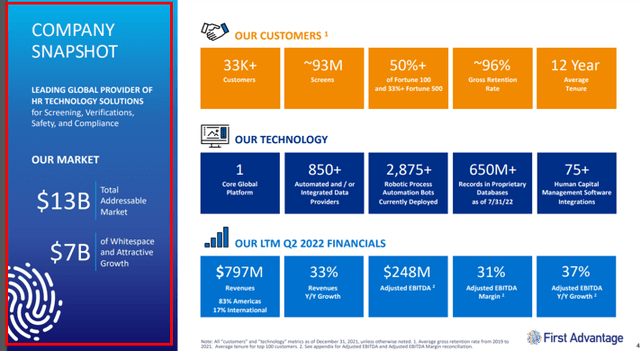

FA is a leading global provider of technology solutions for human capital screening, verification, safety, and compliance. FA solutions assist their customers in risk management, hiring qualified employees, and brand protection. Criminal Background Checks, Biometrics & Identity, Drug/Health Screening, and other services are among its offerings. As of FY21, FA has 86% of revenue originated from the U.S. and 14.1% from International countries.

Investments merits

Large and growing TAM

The current global market for background screening and verification is massive, and new product offerings are expected to expand it even further. The current TAM is estimated to be $6 billion, with $7 billion in potential growth, for a total of $13 billion. In my opinion, the importance of checking people’s backgrounds is rising.

First is globalization when companies shift gears from domestic markets to international markets. In many cases, the company’s home country is able to conduct the rudimentary checks required for hiring, such as checking references and pulling credit reports. Dealing with an employee who is 10,000 kilometers away on the other side of the world is not always easy, especially if the company does not have a human resources team in place. No business owner or manager wants to hire a crook or con artist who will damage their reputation in the eyes of customers. Also, the popularity of social media has made it more likely that bad publicity and comments will hurt companies’ brands.

Second, businesses are under a lot of pressure to comply with a wide variety of global regulatory requirements that change over time and vary by region, sector, and application. Such anti-corruption laws include the Foreign Corrupt Practices Act (FCPA), the Bribery Act, the Foreign Contribution Regulation Act (FCRA), and many others that target money laundering and politically exposed individuals. As a result of these regulations, an increasing number of businesses are conducting extensive background checks and teaming up with screening providers that can match their needs in terms of scale, scope, increased compliance standards, and auditability. Performing all of these checks on a single employee might seem easy, but doing so for hundreds of thousands of employees every few weeks when a new group of employees joins is a massive undertaking.

Third, enterprise software for human capital management, such as Workday (WDAY), is gaining popularity among businesses. Screening, verification, and compliance solutions that can automatically connect with these systems to provide a smooth applicant and user experience, as well as insights based on data analytics, are projected to see an increase in demand as these systems become more widely used. I also believe that the development of relevant data sources, such as US government agencies and third-party vendors, will contribute to meeting the growing demand for screening and verification. Businesses are increasingly relying on large-scale, experienced service providers to gain speedy access to these many data sources. Because of this, there is a growing need for large-scale service providers, like FA, who can quickly get, combine, and integrate data from many different sources and use it to draw conclusions.

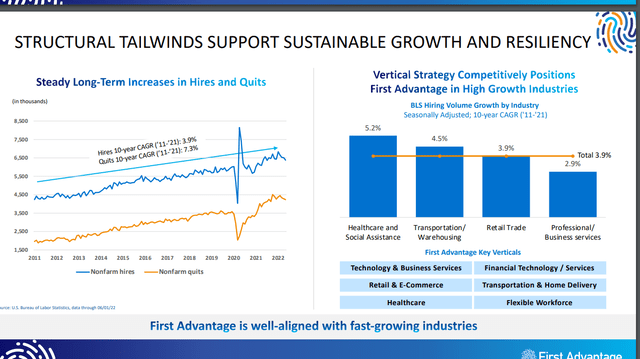

The United States is a key market for FA right now, and the growing need for verification and screening services is being driven by factors like worker turnover, the proliferation of the gig economy, and a flexible workforce. In 2022, millennials make up over a third of the U.S. workforce; they are also three times more likely to switch careers than older workers in search of more financial security, quicker promotion opportunities, and a more harmonious match with their company’s culture. Freelancers, independent contractors, consultants, and other outsourced and non-permanent workers make up about 25-30% of the American workforce, and most large companies plan to considerably increase their use of a flexible workforce in the coming years (source: FA S-1). Companies must do thorough background checks on independent contractors, outside consultants, and temporary workers who have access to confidential information, work on company property, or have direct contact with customers.

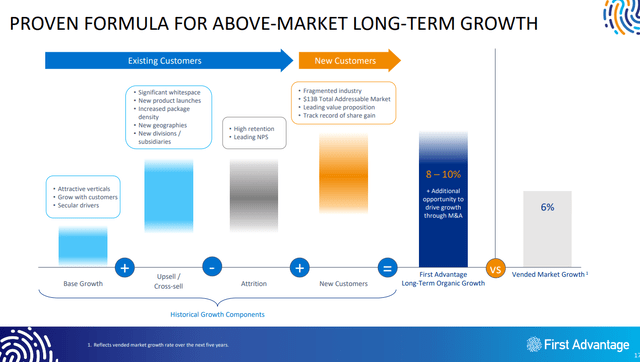

In addition to the factors I’ve already mentioned, growth in the total addressable market is expected to be fueled by other factors, such as the increasing demand for post-onboarding and adjacent products in the United States. Moreover, the top three competitors make up less than a third of the industry, suggesting that there is still substantial room for FA to acquire market share and, by extension, improve revenue growth (source: FA S-1). As a matter of fact, FA should expand at a quicker rate than the industry average of 6% due to its over-indexing to high-growth categories like technology, business services, retail, e-commerce, and transportation.

Verticalized GTM strategy supports the opportunity to expand dollar TAM

FA’s go-to-market (GTM) approach allows it to deeply enter several different industry verticals, increasing its market share. Each member of its sales team is well-versed in a certain area thanks to the company’s emphasis on vertical sales. The importance of sending in professional salespeople to pitch anything to potential clients cannot be overstated; if the client even suspects that the salesperson is not up to snuff, the deal is doomed from the start. With an in-depth understanding of the challenges faced by their particular industry, sales reps are better able to upsell and cross-sell related products, thus raising their monetization rate. Like any other practical company, FA’s clients typically start by using just a handful of items before expanding their use over time. Similar to direct sales, FA’s GTM strategy may help the company build lasting connections with its customers. The relationship between FA and its customers is strengthened by the sales team’s habit of working closely with the latter to set up the latter’s compliance and risk management procedures. There are a number of ways to boost product and service revenue, including expanding into new markets, conducting more thorough screenings, and cross-selling extra compliance solutions like post-onboarding checks. According to management, FA has a revenue potential with its current customers that is twice as large as its current revenue base. This suggests the company has room to expand (source: FA S-1).

Broad geographic coverage improves value proposition

As was previously mentioned, globalization is a key factor in rising demand. Therefore, a global presence is essential, especially when working with MNCs. Because of its worldwide reach, FA is able to meet the requirements of its international clientele despite the complexities of their local regulatory and compliance environments. Companies have previously relied on diverse vendors across countries, making it impossible to maintain consistent and compliant global workforce standards due to the highly fragmented nature of the global screening sector. With FA’s product, businesses are able to implement consistent screening procedures in more than 200 jurisdictions worldwide. FA is also one of the best ways for U.S. companies to screen people with international backgrounds because it has access to data and can do international verification.

Valuation

Price target

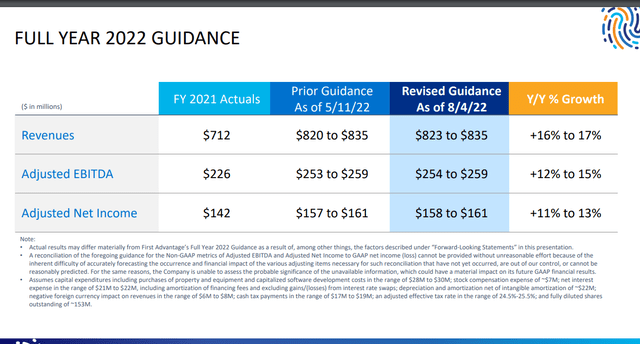

My model suggests a price target of ~$20 or ~60% upside from today’s share price of $12.64. This is based on organic growth in the high single digits (9%) from FY22 to FY26, an exit adjusted EBITDA margin of 35%, and a forward PE multiple of 12x. My assumptions for FY22 are based on management guidance, which was revised higher during the 2Q22 earnings call.

Image created by author using data from FA’s filings and own estimates 2Q22 earnings ppt

Revenue growth

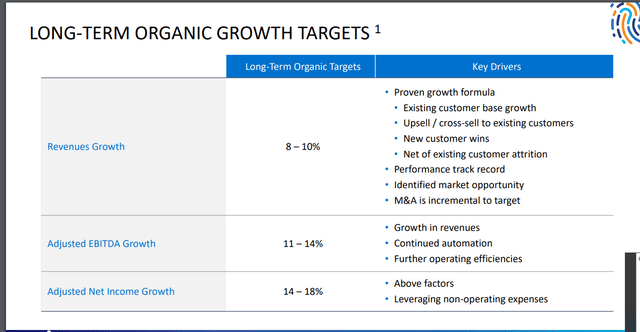

I expect revenue to grow in line with management’s long-term organic growth guidance. This is not an aggressive assumption given that the industry is growing at 6%, and FA has plenty of opportunities to capture volume share and expand monetization. It has historically performed better than the industry, so I do not see why it cannot do so moving forward.

EBITDA margin

I expect EBITDA margin to expand as revenue grows, translating to low-teens EBITDA growth over the long term, which is in line with management’s guidance. Given the nature of FA’s business, there are high incremental margins for increasing usage of the same set of data. Hence, as revenue grows, EBITDA should grow asymmetrically.

Valuation multiple

FA’s forward PE has been re-rated downwards from ~20x to the current 12x since the start of the year, mostly due to the market sell-down, in my opinion. Nonetheless, this is an attractive entry point for us, and even if the valuation holds (as I modeled), we can still get an attractive upside.

Risks

Fragmented market could possess strong local or vertical competitor

Even though FA’s reach spans many industries and countries, it may come up short against competitors who focus exclusively on one area. Some competitors in the pre-onboarding market are more closely allied with a single offering than others, especially in the areas of drug/health screening and executive screening. If the underdog is “good enough,” then the chances of FA gaining the client are low.

Recession drives unemployment

A recession causes a decline in consumer confidence and spending as well as an increase in unemployment and underemployment rates. The volume of hires has a sizable effect on FA’s bottom line because most of the company’s money comes from its pre-onboarding screening services. Both current and potential clients may delay or cancel the hiring of new staff, lay off workers to cut costs, or look for ways to cut back on screening expenses.

Conclusion

To conclude, I believe FA is worth ~60% more than its value today ($12.64 as of writing). FA should continue to grow at a level above the industry given the opportunity available to capture market share and upsell its products. Overall, this is a fairly easy business to understand and the outlook for the industry is well supported by key growth drivers.

Be the first to comment