oatawa

Device Protection – the New Crown Jewel

The device protection business appears to be the new crown jewel of FingerMotion’s (NASDAQ:FNGR) business units. Investors unfamiliar with FingerMotion’s divisions should review their strategy and organization, they have a Top-up service, an SMS/MMS service, and Big Data analytics. The company has a history of separating out the revenue streams in the financials which will make the device protection revenue and earnings easily trackable. At the LD Micro Conference, the CEO spoke and projected that after a soft launch with either China Mobile or China Unicom, 1.0 million users a month would be added in each of the 3 Chinese provinces after the rollout. He continued to say that this business is expected to contribute to the bottom line significantly in the coming 2 quarters. Investors should keep in mind that it is just a starting number and as one province projects a rollout of 1.0 million subscribers in the first month, there is no reason why that same province couldn’t add an additional 1.0 million subscribers in the following months.

Comparing providers, the cheapest device protection plan in the United States is about $60/year which is $5/month and has a high deductible. Assuming that they can cut US insurance costs in half, and assuming a 10% finder’s fee, they could get about $.25 monthly off of every cell phone contract rolled out in 3 provinces in the coming quarter. The rollout will be in one province per month. The first province will be active for 3 months, the second for 2 months, and the third for only 1 month. Therefore, this equates to 6.0 million subs during the quarter, bringing $1.5 million monthly and an $18 million run rate after 3 months. When the company does provide guidance after the soft launch, there should be great interest in the stock as investors reset their expectations. In November after the next earnings are due to be released, investors will find out the actual progress.

Big Data Deal with Pacific Life RE

FingerMotion, Inc. announced a big data deal with Pacific Life RE (PLRe), an insurance company with over $200 billion in assets under management. It serves as a major endorsement of FNGR and its technology because a business with $200 billion in assets would never move forward with its technology unless they were certain it was transformative. The immediate significance is that the contract win represents their first major Big Data services deal within the division. This deal should significantly increase their credibility and standing in the marketplace instantly. FingerMotion has also been courting Munich Re and since there is no exclusive relationship with PLRe this could be the first domino to fall in a string of potential contracts. While this contract win represents the potential for exponential revenue growth in the future, the device protection business is sure to attract investors interested in the short term. The company has near-term earnings catalysts and the necessary resources from the recent non-dilutive financing of $4.0 million.

Monetization Deal with Pacific Life Re

Pacific Life RE gave more clarity regarding the next phase of the collaboration agreement with FingerMotion. The new agreement was more defined with respect to its duties and responsibilities for both parties. Over the past year, the analytics engine was upgraded by both teams and ensures the underwriting principles driving the insurance business meshed with the predictive algorithms that define a risk score to users. The Pacific Life RE reported the analytics engine was validated and ready for deployment. The analytics engine is essentially the key part of the process that crunches all the data. It contains all the algorithms. The application programming interface (API) is the customer-facing script that presents the customized user data in such a manner that the user is encouraged to buy.

Patent Recognition

Many investors may be attracted by the growing revenue base but at its core FingerMotion is a technology company. In the past 2 years Sapeintus, the Insuretech division, was granted 7 patents from the National Copyright Administration of China (NCAC) for their algorithms. The reason this is so important is that it really stops other would-be competitors from entering the market without a significant amount of work and a long development process. No existing players have access to both telecoms the way FingerMotion does.

Core Business (Company Presentation)

Non-Dilutive Financing Analyzed

The company recently announced non-dilutive financing. Unfortunately, investors have been selling on the news probably due to the negative connotation associated with a convertible note, instead of actually reading the investor-friendly terms in the 8-K Filing. The first issue to address is what many would consider the original issue discount (OID), where the company actually receives a bit less cash than the face value of the note. While called a “coupon,” it acts like an OID. The face value of the note, on which Lind Partners gets interest, is $4.8 million, but Lind Global Fund II LP, only paid $4.0 million in cash. They are getting a 20% coupon rate and purchase warrants for close to 3.5 million shares at $1.75/share, which represents about 78% warrant coverage, with a note conversion price of $2.00/share. If this were a traditional convertible note it would be an investor-friendly above-market transaction. However, there are warrant cancellation provisions when a registration is done (it was submitted this week), and that is the opportunity for investors. Investors are encouraged to actually read the 8-K.

The terms of the note are very company friendly as opposed to some convertible notes microcap investors are used to where the price of conversion doesn’t have a floor, the conversion has a discount to the trading price, and this results in a “death spiral” for the stock as shares are converted, sold, and the price drops, resulting in more shares being converted at lower prices and then sold. This phenomenon is simply nonexistent with FNGR’s convertible note as it has a floor price of $0.86, and the company has the ability to pay in cash or stock. The other central provision is that monthly payments don’t start until 7 months from now. The significance is that the note allows them ample time to build up their revenue generation from device protection, as well as other sources, that will enable them to easily make payments on the note in cash instead of equity. The warrants at $1.75 are well above the market and also have the cashless provision which incentives the investor, Lind Global Fund II LP, to wait until the warrants are deep in the money for optimal conversion without committing any more capital. In the final analysis, the worst-case dilution is 3.5 million shares at $1.75. With approximately 43 million shares issued this represents an 8% dilution. In the month preceding the financing, the stock dropped from $1.50 to under $1.00 on incessant selling that may have been used by the financier to get a better deal, but these temporary supply-demand imbalances tend to be transient.

Competition

In a recent webinar when CEO Shen was asked about competition, he painted a picture that there really wasn’t any serious competition and that there were fewer than 10 licenses that allowed wholesalers to tap into the Chinese telecoms. The holders of these licenses were small and didn’t present much of a competitive threat.

It’s a global economy and there are always competitive forces at work. Snowflake (SNOW) is a big data company worth $62 billion and its business model isn’t too far from FingerMotion’s model. SNOW takes data insights from its customers and then builds models on how to better target its customer’s user base. This is essentially a monetization of their customer’s user base and not much different than what FNGR is doing in the big data segment of the business. It is worth pointing out that if SNOW was interested in entering the Chinese market it would need an established Chinese company like FNGR due to the restrictions on data management from the Chinese government. In my opinion, FNGR is the ideal acquisition target for any competitor looking to get a beachhead in the Chinese market.

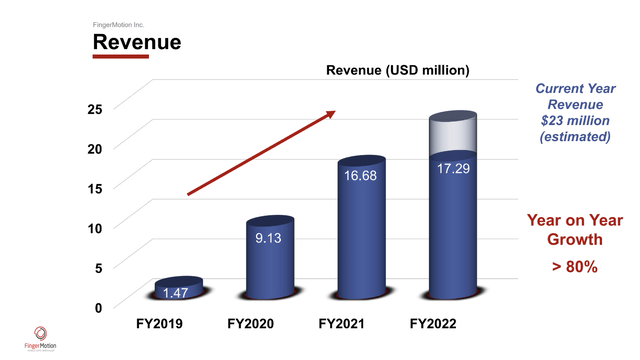

Projected Revenue (Company Presentation)

Financial Analysis

The company’s completed FY 2022 with $22.9 million in revenue. During the year they up-listed to NASDAQ but were not immune from the lockdowns in China, so revenues were running a little light and they lost sequential quarterly revenue growth. In terms of financial reporting, they don’t run the risk that other companies like DiDi Global (OTCPK:DIDIY) and Alibaba (BABA) do with respect to the auditing of financial results, because these companies’ stocks trade as a Variable Interest Entity in the US, but are China-based. The company recently raised $4.0 million in a convertible debt offering to increase the growth of the device protection insurance initiative. If successful, they are expected to repay all of their debt within 24 months. The cash flow of the company is expected to improve substantially in the next 2 quarters and may grow exponentially thereafter. FNGR’s 2-year revenue CAGR is 59% (taking into account expected full-year 2022 results), and currently expected growth of 38%. Growth like this usually results in a revenue multiple of 6-10x if not more.

FNGR is difficult to value using the traditional P/E ratio because there are no earnings or guidance on the device protection revenues. The only metric available is the historical 38% expected growth. This puts revenue projections at $31.7 million assuming the $23 million for this year. Assuming, in my opinion, a very conservative revenue multiple of 4x, the company would be trading at $126.8 million. Based on 43 million shares outstanding I suggest a conservative 12-month target price is $2.95.

Risks

The regulatory climate for e-commerce companies that operate in China has been very volatile depending on government policy changes and actions. The e-commerce companies that collect data, especially on individuals, are targets for the government to implement their need to regulate the information. China wants to control the narrative and the data. Luckily for FNGR their business model steers well clear of any regulatory involvement because they deal with algorithms based on the customers’ data, but don’t own or store the data that has gotten companies like DiDi Global in trouble. The DiDi issue was about controlling the Chinese personal data that was collected from the ride-hailing operation.

Some perceive the VIE structure that FNGR operates as a large risk. So large that it has led to a “drop in Chinese companies listing in the United States” as covered in the University of Oxford blog. This perception has been generalized to all Chinese companies that sought capital in the US. The VIE structure has evolved into a stigma that quite frankly hurts the valuation of companies like FNGR but lacks merit for small growth companies.

In addition to the obvious regulatory risks, there is a material execution risk that they don’t hit their projections and generate the cash flow needed to support the debt. Device protection on this scale was never rolled out in China so projections should be discounted until firm guidance arrives. They are currently doing a soft launch to ensure there are no hiccups, but investors should be aware that FNGR is responsible for paying out any initial claims. This was a portion of the use of proceeds from the $4.0 million financing. Another risk is the undefined nature of the existing soft launch and when it will transition. The good news according to the Skyline Interview is that the insurance is bundled with the phone purchase in yearly contracts on a majority of the phones, which means there won’t be any customer attrition starting for at least a year for each new customer.

When the contracts are up for renewal, the customer will have the ability to opt out of the service. The customer will have to actively cancel, or the renewal will be automatic. The attrition rate is an unknown at this time. The eventual losses should be small and could be offset by adding new customers, but the attrition rates will not be easy to determine until the first renewals next year.

Investment Summary

Monetization of FingerMotion’s user base from China Mobile and China Unicom is the Company’s central focus. FNGR has been successfully improving margins over the past 3 years. The Company started off with the top-up business and its tiny margins, then migrated to selling text messages that were also capital intensive but had better margins. In the coming quarter, further margin expansion is expected to come from its portal operations with hardware sales. Investors should also get a glimpse of the device protection rollout that started weeks ago. The recent non-dilutive capital raise was needed to provide cash flow for the device protection program to roll out quickly, and cover claims until the revenues increase.

FNGR’s future is in the Insuretech business as it offers the greatest increase in margin expansion. While the Company hasn’t disclosed what the revenue split is going to be, their early agreements were cooperation agreements which imply 50/50 splits. The company has been growing revenues consistently for 3 years and operations are projected to be cash flow positive in the coming quarters. If the device protection revenues hit the income statement, the company could see exponential growth and profitability. For investors with a low-risk tolerance, the company trades at just 5X its cash equivalent value of $.20 (from the 10-Q), and doesn’t factor in the $4.0 million recently raised which would add another roughly $.10. Now that the financing is done, investors should view the Argus Research Report, which sees a fair value of $6.50 which is a little generous compared to my $2.95 price target. In my opinion, FNGR has existing revenues and significant potential from their device protection business for revenue with a higher margin product, which is why I think, it is significantly undervalued.

Be the first to comment