Solskin/DigitalVision via Getty Images

Thesis

We believe FIGS (NYSE:FIGS) is starting to look attractive for investors who are looking for an unconventional growth play in the fashion industry. The company’s financial performance has been strong in recent quarters, and the company is growing on all key metrics. Given that the company is now profitable, we believe that valuation will benefit as the company goes to grow its earnings and improve margins.

Company Overview

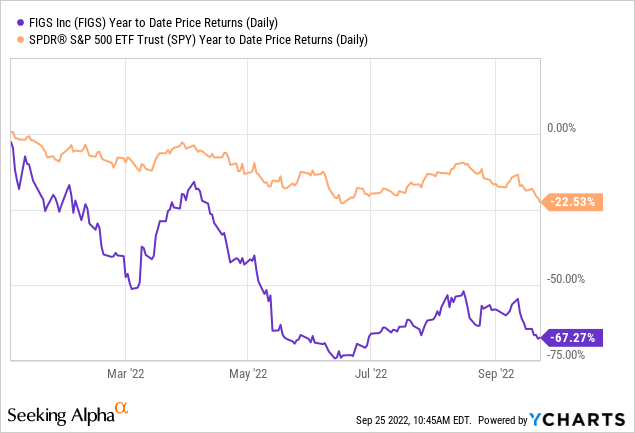

FIGS is an American healthcare apparel company that is based in Santa Monica, California. The company primarily sells scrubs that come in a variety of colors and styles, and has proven to be a popular choice of apparel for many healthcare workers. FIGS completed its initial public offering in May 2021, at a $22 per share. Year-to-date, FIGS has significantly underperformed the market, as the company’s stock returned -67.27% since the beginning of the year. In that time frame, S&P 500 returned -22.53%. The company’s market capitalization now stands at $1.49 billion.

Recent Earnings

Improvements in Key Metrics

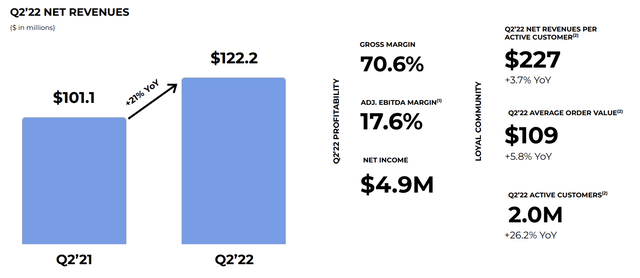

The company has had a good quarter, and most notably, the company reported a 21% YoY growth in Q2 2022 net revenues, from $101.1 million to $122.2 million. In addition to the top line growth, we were pleased to see a continued strong performance in other key metrics, such as Active Customers and Revenues per Active Customer. The YoY growth of Active Customers stood at 26.2% which outpaced even the net revenue growth, and the company was able to improve its revenue per active customer metric, which demonstrates the company’s ability to squeeze extra value of its users either through the form of price hikes or the sale of additional products.

Solid Guidance

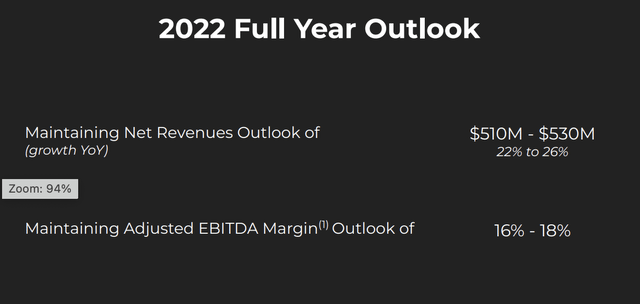

Management’s guidance for this year has been promising with a full year revenue guidance of between $510 million and $530 million. Such guidance represents a 22% to 26% YoY growth, which we believe is solid for a company that is operating in a less than favorable macroeconomic environment this year. The Adjusted EBITDA Margin has also a reasonable range guidance of between 16% to 18%, which pegs the 2022 Adjusted EBITDA to be between $81.6 million and $95.4 million. Though this Adjusted EBITDA range is lower than the reported Adjusted EBITDA of last year, we believe that the lower adjusted EBITDA can be explained by the company’s continued investments in its product line and capitalizing on expansion opportunities to continue to grow its top line.

Valuation

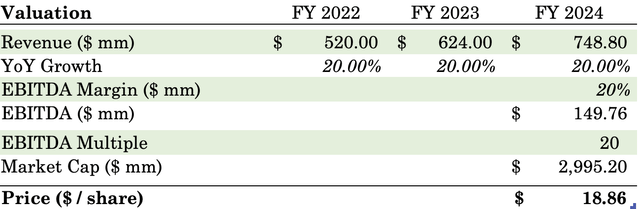

We conducted a valuation exercise based on the company’s current revenue growth rate and an EBITDA margin of what we think to be reasonable in the next couple of years. We used a YoY revenue growth rate of 20% based on the midpoint of FY 2022 revenue guidance. We then used an EBITDA margin of 20% which we believe should be achievable given the current Adjusted EBITDA margin, and our belief that the company’s margins will expand as the company achieves more scale and higher cost efficiencies. Assuming an EBITDA multiple of 20x, our model prices the share at $18.86 per share in FY 2024, which represents a ~109% upside from its current levels. The valuation model assumes our bull case scenario, but we do believe that the assumptions are reasonable given it is close to current financial performance.

Sweet Minute Capital Valuation Model

Risks

FIGS operates in the consumer discretionary industry and its products are akin to fashion products. Similar to other companies selling consumer discretionary goods, the FIGS is exposed to risks stemming from a macroeconomic slowdown in addition to a slowdown in U.S. consumption. Recently, the Federal Reserve raised the benchmark interest rate by 0.75% and such hawkish monetary policy could significantly affect consumption in the U.S. and abroad. Consumption in the U.S. is already slowing down, and further rate hikes or hawkish language from the Federal Reserve could exacerbate consumer demand. Nevertheless, we remain positive on FIGS outlook, as unlike other recently IPO-ed companies of its size, FIGS is now a profitable company and financial fundamentals are strong. FIGS also has a strong balance sheet with no debt and $170 million in cash on hand, which is more than 10% of its market capitalization. Furthermore, the core consumption demographic for FIGS is healthcare workers, we believe that the group’s consumption level will remain stronger than others due to the stability of the profession. In all, the strong balance sheet and the profitable business model provide us a level of confidence that the company will be able to navigate through a recessionary environment.

Conclusion

FIGS presents an attractive risk/reward proposition for investors looking into interesting growth stories in the consumer discretionary sector. We believe the company’s growth in revenue and other key metrics will continue to drive shareholder value, and our valuation model based on these key metrics show potential for substantial stock price appreciation. Though risks tied to the economic environment remain, we believe FIGS is well-poised to ride out the volatility.

Be the first to comment