metamorworks/iStock via Getty Images

Fidus Investment Corporation (NASDAQ:FDUS) is a high-quality business development firm with a well-managed investment portfolio and excellent credit ratings.

The BDC invests a large portion of its funds in secured debt, but it also holds equity positions for higher profits.

Fidus Investment’s dividend payout is covered by net investment income, and the stock continues to trade at a discount to net asset value.

A High Quality BDC With A Unique Twist

Fidus Investment serves the lower middle market by providing companies with money to help them grow. While the BDC invests in equity, its primary concentration is on first and second liens (the most secure type of debt for investment companies).

Fidus Investment generally invests in firms with proven business concepts and a track record of debt service: The company seeks enterprises in the United States with annual revenues of $10 to $150 million and EBITDA of $5 to $30 million. Fidus Investment typically invests in private enterprises that have limited access to cash and need growth capital from private lenders.

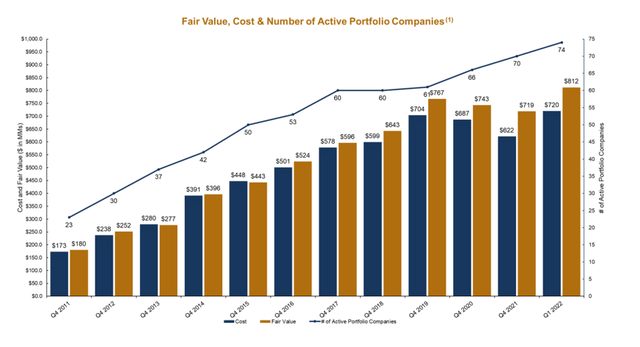

Fidus Investment had $812 million in active portfolio firms as of March 31, 2022. The majority of the investments (59.1%) were in first lien debt, with the remaining 24.7% in second lien debt.

The entire percentage of secured debt investments now stands at 83.8%. Furthermore, Fidus Investment allocated 7.4% of its assets to subordinated debt and 8.8% to equity. All of the percentages given here are cost-based.

The portfolio performs well as well: at the end of March, only 1.1% (cost) and 0.3% (fair value) of the company’s investments were non-accrual.

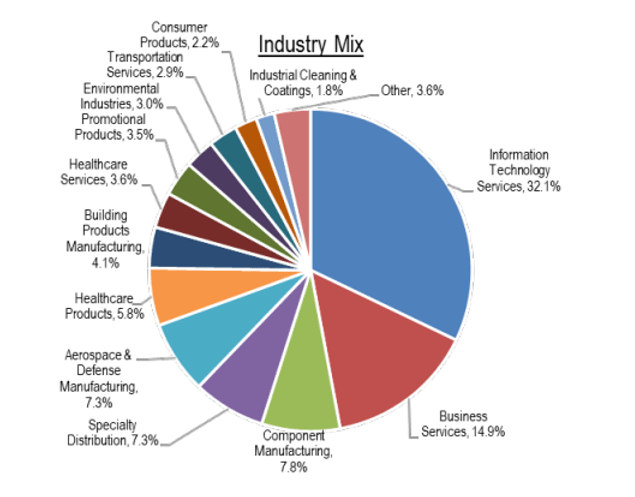

In terms of industry exposure, Fidus Investment seeks to invest in companies with an established business plan, consistent revenues and cash flow, and less cyclical exposure to the economy. With a 32.1% stake, Fidus Investment is most exposed to the information technology services business.

Industry Mix (Fidus Investment Corp)

Fidus Investment’s portfolio saw a decade of continuous expansion, resulting in the most portfolio investments and the highest-ever fair value of the BDC’s portfolio on March 31, 2022. Since the company’s inception more than a decade ago, the portfolio value has climbed 316% based on cost.

Fair Value, Cost And Number Of Active Portfolio Companies (Fidus Investment Corp)

There is a unique twist with Fidus Investment

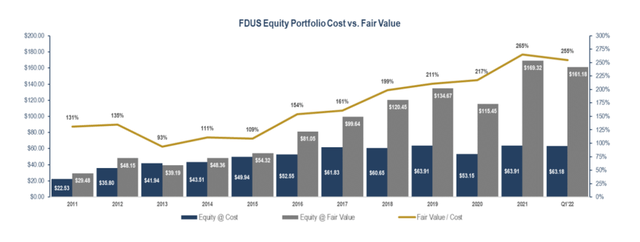

Despite its debt focus, Fidus Investment has had significant success with equity transactions over the last decade. Based on fair value, Fidus Investment’s equity investments were valued at $161.2 million, accounting for 19.8% of the BDC’s overall portfolio.

Fidus Investing has generated $183.4 million in realized net cumulative capital gains since its IPO, showing that the company’s equity investment philosophy has paid out solid dividends to the BDC and its shareholders.

Equity Portfolio Cost vs Fair Value (Fidus Investment Corp)

Adjusted NII Covers Dividend

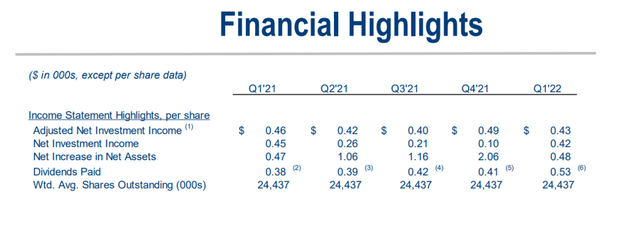

Fidus Investment’s dividend payout is covered by adjusted net investment income. The BDC now pays a quarterly base dividend of $0.36 per share, but it also pays special dividends, resulting in a changing total dividend payout.

In the last twelve months, the business development company’s investments generated $1.74 per share in adjusted NII, compared to $1.75 per share in total dividends.

The payout ratio in 1Q-22 was 84% based only on the basic dividend, implying that the present regular payout of $0.36 per share is covered by adjusted NII. The variable dividend varies according to the BDC’s investment performance, allowing Fidus Investment to disburse extra revenue.

Financial Highlights (Fidus Investment Corp)

The stock has a 7.8% yield based on a base payout of $0.36 per share ($1.44 per share yearly). Because management declares special dividends on a regular basis to share surplus portfolio income, the effective dividend yield is likely to be significantly greater than this.

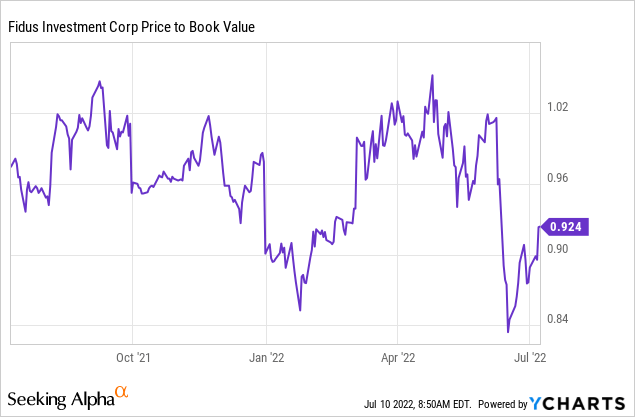

Book Value Multiple

Fidus Investment is currently selling at an 8% discount to net asset value, but the BDC has historically traded at a net asset value premium. The stock market correction in June, which was primarily driven by increasing inflation, higher predicted interest rates, and growing recession fears, is to blame for the company’s valuation decrease. Fidus Investment might trade at a premium to book value again if the BDC maintains its book value growth while keeping defaults to a low.

Why Fidus Investment Could See A Lower Valuation

The market’s expectations for future economic growth and the possibility for credit losses in a weaker market drive the valuation of business development organizations.

Fidus Investment’s credit quality was strong in the first quarter, but an increase in non-accruals in the coming quarters is likely to raise concerns about the BDC’s book value’s durability. An increase in loan losses and a decline in book value could allow the BDC’s stock to trade at an ever-increasing discount to net asset value.

My Conclusion

Fidus Investment is a higher-quality business development company with a diverse debt portfolio and a track record of strong equity returns that contribute to the BDC’s total returns.

The equity component of Fidus Investment’s portfolio makes the BDC more appealing than more conservative BDCs, but it also makes the BDC potentially riskier if the market experiences another slump.

FDUS is a wonderful stock to earn passive income from because it has a high portfolio quality (few non-accruals) and the company covers its dividend pay-out with net investment income.

Be the first to comment