ArtRachen01/iStock via Getty Images

Investment Thesis

The Fintech space has seen a huge amount of weakness in the past year, after the COVID-19 bounce arguably took shares to overvalued territory. This has been an industry wide market correction with shares of Fidelity National Information Services (NYSE:FIS), Global Payments Inc (GPN), Fiserv Inc (FISV), PayPal Holdings Inc (PYPL) and Square Inc (SQ) all falling considerably from their 52-week highs.

As Warren Buffett said “be greedy when others are fearful”. I was happy to start a position in Fidelity National Information Services around $91 per share and will dollar cost average into the position if the price falls below $90. The current share price is attractive from a dividend growth and total return perspective.

I’ll refer to the company as FIS going forward in the article.

Company Overview

FIS splits its results into 3 main segments. Firstly, representing around 46% of 2021 revenue is “Banking Solutions.” This segment saw growth of 8% in 2021. This segment includes a large amount of recurring revenue in relation to core and transaction processing. Clients are mainly large financial institutions such as banks and investment managers.

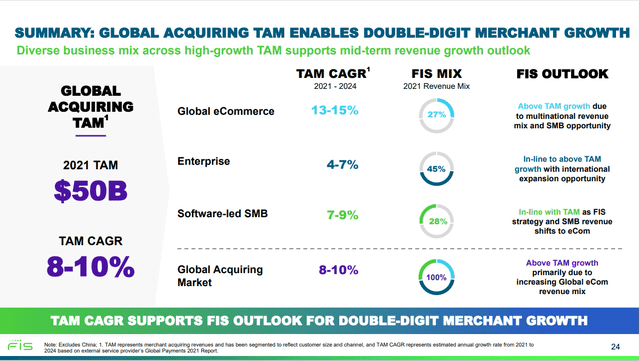

The fastest growing segment is “Merchant Solutions”, which grew by 19% in 2021 and now represents 32% of 2021 revenue. This includes payment processing for both point-of-sale and e-commerce payments. This segment is most exposed to the tailwinds of non-cash transactions and e-commerce growth. I’d expect this segment to eventually replace Banking Solutions as the largest component of the business due to the strong underlying market growth. The below graphic shows the expected total addressable market growth for several components of the “Merchant Solutions” segment. FIS is expecting to be able to achieve growth higher than the wider total addressable market from 2021-24.

Fidelity National Information Services

The final notable segment is “Capital Market Solutions” which focuses on support and services to financial services companies. These include solutions for data and analytics, financing, trading and risk management. This segment also saw growth of 8% in 2021 and is fairly similar to “Banking solutions” in terms of the characteristics of the revenue and the long lasting client relationships. This segment made up 19% of 2021 revenue.

2021 Results & Guidance

FIS posted revenue of $13.9 billion in 2021, up 11% from 2020. This translated to adjusted EPS of $6.55 in 2021 which was up 20% from 2020. Most interestingly to me, management made several announcements on capital allocation in its earnings release. Firstly, the dividend was increased by 20% to $1.88 per share annualized.

Consistent with its capital allocation strategy, FIS plans to increase its annual dividend approximately 20% per year, beginning with the quarterly dividend payable in March 2022. By accelerating its target annual dividend growth rate to approximately 20% from approximately 10% previously, the Company intends to gradually increase its dividend payout ratio over several years to approximately 35% of adjusted net earnings from approximately 25% in 2021.

Secondly, although not explicitly stated, Management intends to continue to repurchase shares. In 2021 the diluted shares outstanding was reduced from 627 million to 614 million. In its guidance for FY2022, the assumption for shares outstanding is a further reduction to 609 million. With recent share price weakness I would expect the number of shares outstanding to be reduced more significantly than these forecasts in 2022.

Going forward I noted management’s optimism to grow the underlying business, one of its three priorities for 2022 is to “generate exceptional growth and free cash flow to maximize shareholder returns”. Management issued guidance for EPS in FY2022 in the range $7.25-$7.37 per share. At the lower end of this range the full year growth would be in excess of 10%.

Competitors

The main competitors to FIS are other leading Fintech names such as PayPal Holdings Inc (PYPL) and Global Payments Inc (GPN) in the Merchant Solutions category. In e-commerce, card payments are processed using a payment processor of which the two companies above, directly compete with FIS. This is similar to point-of-sale transactions where businesses choose which processor to use for card and contactless transactions. The FIS brand most familiar to me is “Worldpay” which processes many online card payments in the UK and also offers security checks by linking directly to banks.

In Banking Solutions and Capital Market Solutions there is less competition for FIS, due to the recurring nature of the relationships with financial institutions and the slower rate of growth compared to Merchant Solutions. Fiserv Inc (FISV) does offer similar services to FIS but the size of the market is large and will grow over time. I believe FIS can continue growing in these markets but will focus more on Merchant Solutions in order to benefit from the higher growth in non-cash transactions and e-commerce.

Risks

The main market-wide risk I see currently is inflation. Inflation erodes consumers’ desire to make purchases and spend money. This clearly has a significant impact on FIS as the number of e-commerce and point-of-sale transactions processed directly impacts the revenue and earnings of FIS.

On the other hand, FIS is one of the companies which may be less at risk of inflation than it would seem. As prices increase the size of transactions processed also increases, this is likely to lead to higher revenue for FIS over time, as it makes money based on both the number and size of transactions processed.

Any escalation in Ukraine has the potential to lead to a market-wide sell-off. There are 2 impacts, one based on the geo-political impact and general uncertainty. The second impact is on inflation due to higher energy and food costs that could affect global demand for products and services. In my opinion, this would be a buying opportunity for long-term investors in FIS. The underlying industry growth is strong and this will eventually feed through to the business, even if there are a couple of difficult years ahead.

Current Valuation & Balance Sheet Health

At the time of writing, the FIS share price is $97.45, down over 33% from its 52-week high of $155.96. In the last 10 years, FIS shares have grown around 200%. The current valuation is attractive, with a forward PE of 13.4 and a free cash flow yield of over 5.9%.

Per its 2021 results, the balance sheet is fairly healthy with total debt of around $18.7 billion and cash of $2.0 billion. EBITDA was around $5.1 billion in 2021, so net Debt/EBITDA is a reasonable 3.27 times. I’d like to see this below 3 times, but I’m prepared to look past this based on the strong growth potential of the business.

Looking at my favored free cash flow yield valuation metric, cash provided by operating activities was $4.81 billion in 2021, and total capital expenditures amounted to around $1.25 billion, leaving free cash flow of $3.56 billion. The latest diluted shares outstanding number is 614 million. On a per share basis, free cash flow was $5.79, this is a current free cash flow yield of 5.94% which is attractive on the basis of strong double-digit growth going forward.

Opportunity

In 2021 FIS was punished by the market, falling over 34% from its 52 week high. Analysts and TV pundits started talking about buy-now-pay-later and how this was a huge threat to the dominance of the incumbent Fintech companies mentioned above. In reality, these are just installment payment plans which offer no real value to consumers above what a standard credit card provides. Wall Street believes this is a great new business model and that the increased competition will hit FIS and others hard.

In many cases negative market sentiment has the tendency to over-correct stock prices. I believe this is the case with FIS and that the poor share price performance in 2021 has now brought the shares into good value territory. FIS has dealt with competition in the payments processing space for years, and despite this management has achieved adjusted earnings growth averaging 11.5%.

Inflation might slow the growth in non-cash transactions and e-commerce temporarily, but these trends aren’t going away anytime soon. Double-digit earnings growth and a PE ratio under 15 is a great deal and you can have confidence in the future growth of the business. FIS has excellent gross profit margins in the 30-40% range which should protect the earnings somewhat as input costs continue to rise.

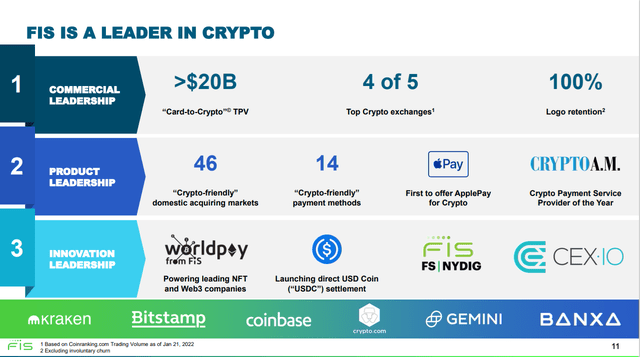

FIS has shown itself to be adaptable to the rapid industry change in recent years. Management has invested to ensure the company is well placed for the future. A good example of this is the leadership shown by FIS in relation to cryptocurrencies and related payments.

Fidelity National Information Services

Attractive Returns, Dividend Growth & Future Yield-On-Cost

The current forward yield on FIS shares is 1.9%. The 3-year dividend growth rate is 7.8% and the 5-year dividend growth rate is 8.9%. Going further back, the 10 year-dividend growth rate is over 16%. Assuming the dividend grows in line with managements’ capital allocation policy at 20% for the following 3 years and then grows at a very conservative 5% for the following 7 years, the yield on cost of an investment today will stand around 4.6%. For such a solid company that has a great future, this is a buy for dividend growth investors. The dividend has now grown consistently for 11 consecutive years.

Looking at analyst estimates for growth, current projections are for strong earnings growth in 2022 (11.1%) and 2023 (13.0%). Over the next 5 years, growth is expected to be 13.7%. Assuming a 15 P/E as fair value and growth of 11.1%, followed by 13.0% and then 13.7% for the next three years, FIS would earn $12.09 per share at the end of the 5-year period. With a 15 P/E assigned, this would lead to a share price of $181.45. This would result in an annualized return of around 17%. I’d also note that a 35% payout ratio on earnings of $12.09 per share would equate to annual dividends of $4.23 per share, or a 5 year yield on cost of over 4.3%.

Conclusion

FIS shares offer great return potential to long-term investors. This is a solid business operating in a growth industry. Managements’ commitment to enhanced dividend growth in the coming years offers a great entry point for dividend growth investors. Look back in 5 years and this could be yielding over 4.3% with more growth to come.

Be the first to comment