ugurhan/E+ via Getty Images

Main Thesis / Background

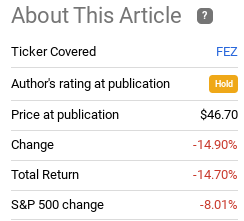

The purpose of this article is to evaluate the SPDR EURO STOXX 50 ETF (NYSEARCA:FEZ) as an investment option at its current market price. This is a fund that invests in large-cap European companies, and one I consider when looking for overseas exposure. Despite warming up to FEZ in the past, I placed a neutral rating on it as we moved into 2022. In hindsight, I was right to suggest avoiding this fund, but the reality is I should have been more bearish than I was, as it has sharply under-performed the S&P 500:

Fund Performance (Seeking Alpha)

Given this drop, and the relative under-performance, I thought I should take another look at FEZ to see if I should reconsider my outlook. Clearly, a lot has happened since 2022 got underway, including a Russian invasion of Ukraine, new Covid-variants, and a more dovish ECB to account for these risks. Taking all this into account, it could seem like FEZ is set for a rebound.

However, I am reluctant to get too bullish here. There are still too many concerns, which I will discuss below, which suggest to me that waiting for a better entry point is the prudent move.

Concern #1: Inflation Is Surging

To start, I want to focus on the major concerns I have regarding Euro-zone equities. This is important because by all accounts I could easily be a buyer here. The fund is down into correction territory, bordering on bear market. There is a discount compared to U.S. equities, as well as the very real chance of a post-invasion surge if the Ukraine situation is resolved. Yet, with these potential tailwinds, some very real headwinds balance out the potential that make me reluctant to put new capital to work at the moment.

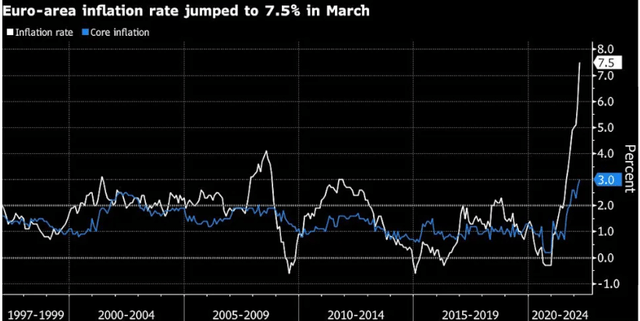

The first of which is inflation. This is a major headline story that we know quite a bit about in America. Unfortunately for the global economy, this is not a U.S. phenomenon. In fact, just like the U.S., Euro-zone inflation has been accelerating near-term rather than decelerating. This has yet again proved that the “transitory” messaging we heard from central bankers around the world last year was simply misguided:

European Inflation (Yahoo Finance)

So, why is this a problem? A few reasons. One, during times of rapid inflation, equity returns can be quite mild. This is true over time, and if we are talking about U.S., Europe, or emerging equities. Two, inflation eats away at consumer buying power (all other things being equal). Even if wages are increasing, which they have been in the developed world, inflation reduces purchasing power when the rate of inflation is higher than the rate of wage gains. This, unfortunately, has also been happening in the developed world.

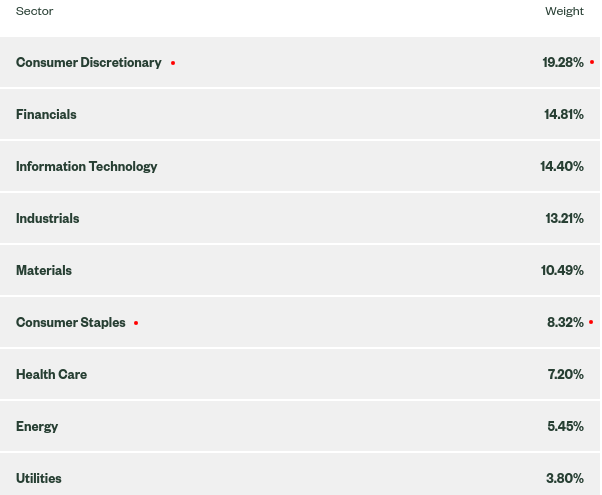

Importantly, this impacts FEZ in a very real way. The fund’s largest sector weighting is Consumer Discretionary, at almost one-fifth of assets. Once we tack on Consumer Staples exposure, we see the fund has almost 28% of its assets tied to Consumer-oriented sectors:

Sector Weightings (State Street)

For me, I need to see inflation subside around the globe before I get excited about any consumer or retail play. This is not Euro-specific, as I have written about this topic in-depth regarding U.S. retail funds. However, FEZ is extremely reliant on consumer spending to drive returns, more so than the S&P 500. This suggests to me that FEZ is not the right way to play an environment fraught with inflation risk.

Concern #2: Consumer Sentiment Has Dropped

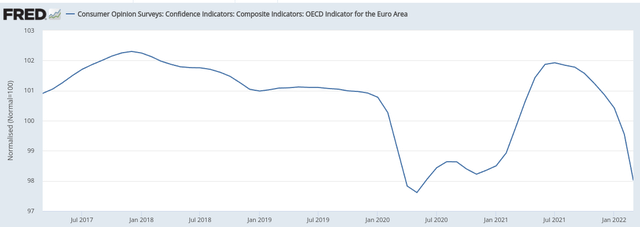

Expanding on the above point, readers should note the inflation concern I share is not one I have in isolation. This is a top-of-mind worry for many consumers and households, whether in America or Europe. And the truth is that inflation has finally started taking its toll, after consumers largely brushed it aside in 2021. In fact, we see that Euro-area consumer confidence has taken a nosedive in recent months, with Ukraine worries and inflation worries hitting forward outlooks quite hard:

Consumer Sentiment in the Euro-zone (St. Louis Fed)

Again, this reverts back to why I am not too bullish at the moment. While sentiment does not always correlate with equity moves, FEZ’s over-weight exposure to Euro-area consumers has me concerned. If consumers do pull back, which I expect, revenue and earnings at the fund’s underlying companies are going to take a hit. With such a sharp drop in confidence, this seems likely, and supports why inflation is such a pain point right now.

Concern #3: We Have Already Seen A Post-Invasion Rebound

My next point looks at how opportunistic a play like FEZ really is. In fairness, there are a lot of reasons why one may want to add to European exposure at this juncture. I laid out a few of these reasons early on in this review, and the fact is this is a contrarian play to some degree. Markets have soured on global equities, and Euro stocks in particular have been hit hard by the Russian invasion of Ukraine, the resulting supply-chain concerns, the hit to their energy supplies, and the risk that the Ukraine conflict will spread.

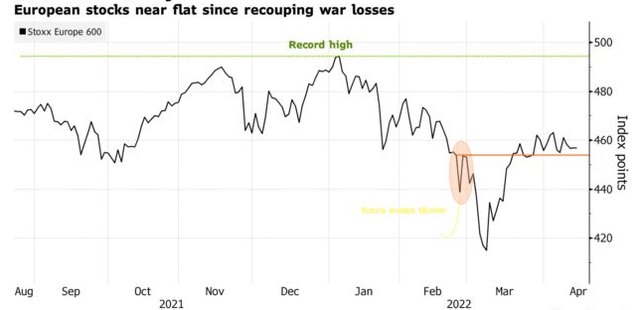

In truth, much of this has been reflected in share prices. FEZ is down roughly 15% since the year started, if we look at a more short-term horizon, we see that European equities have actually rallied sharply off their lows. In fact, the broader Euro-stock index has essentially recovered all its losses since the Russian invasion of Ukraine. To me, this suggests that some of the contrarian element has already passed, for those wanting to buy when uncertainty was at its highest peak:

Euro Stocks Performance (Bloomberg)

The takeaway is that stocks have started to look past the Ukraine conflict, and whether or not this is appropriate depends on each investor’s individual outlook on how and when this conflict will end. Clearly, buying it during the immediate sell-off from the invasion would have been rewarding. Now that stocks have rallied, the path ahead may not be quite as lucrative. This tells me that while there is upside potential, there is plenty of downside risk to evaluate as well. It is not unlikely, for instance, that Euro-stocks will re-test the early March lows if the conflict escalates or expands in the months ahead.

Central, Eastern Europe At Risk Of Escalation

Digging deeper into the Ukraine crisis, my final concern is that the war escalates beyond Ukraine’s borders. If so, that is going to have severe economic and humanitarian implications for Europe. Most at risk would be the nations in Eastern Europe, in terms of those at-risk from military intervention. While developed, large countries in Western and Central Europe are less at risk of an actual invasion, the economic implications are significant. With this perspective, it could make sense to focus on regions and nations further from the Russia/Ukraine border, such as the U.K., Ireland, or Spain. By contrast, one may want to steer clear of nations like Germany, Italy, and France that are more reliant on trade with Russia and are closer to the conflict’s doorstep.

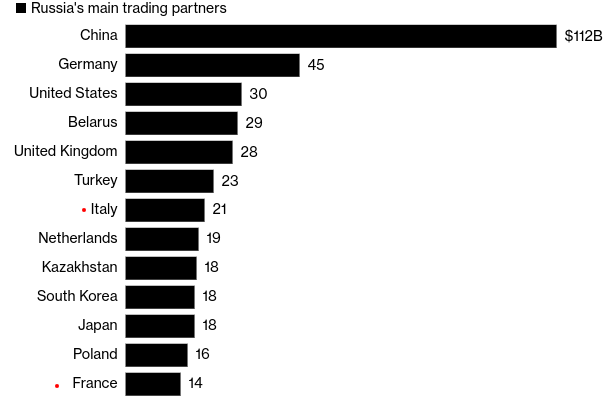

The problem here is multi-fold. These are the nations closest to the conflict, so they have the most to lose if it escalates. However, they have a delicate balance to manage because they are also more reliant on trade with Russia than other developed markets around the globe (think U.S., Australia, Canada, etc.). Countries like Germany, Italy, and to a lesser degree, France, all have greater exposure to the supply-chain disruptions and drops in export demand that have resulted from both the invasion of Ukraine and also the sanctions on Russia that followed.

Why is this relevant to this discussion? Because these three countries make up a large chunk of FEZ’s portfolio:

Country Weightings (State Street)

Of particular relevance is Germany, which is the closest to Russia and the largest European trading partner. But we should note that nations like France and Italy are also quite close to the conflict in terms of distance, and share a sizable trading partnership with Russia in their own right:

Russian Trade Relationships (Bloomberg)

It is clear that the fortunes of Russia are inter-twined with the global economy. While punishing or sanctioning Russia may be politically convenient, and even the right thing to do, it is not without cost. For example, Europe gets more than half its oil and gas from Russia, and households were already paying higher bills for power and heating as 2022 got underway. With supply-chains pressured and energy costs soaring, this situation has quickly deteriorated. This relates back to the consumer pressures I mentioned before, and helps justify my cautious stance.

Not All News Is Bad News

While the focus of this piece was to highlight some of the reasons why I am not going to recommend FEZ at this juncture, I must balance out this review with some positives. Importantly, the story is not all bad, and I was to reiterate I am not bearish on this fund. There is a path forward for gains, albeit it is one fraught with risk. Yet, we must remember FEZ has already seen significant downside moves, so if conditions improve and/or the situation in Ukraine sees positive progress, then plenty of upside remains. That is why I am not putting a “sell” or “bearish” rating on this fund – the upside potential is certainly there.

Beyond the macro-improvement argument, other attractive attributes exist. One is the relative value in European stocks, compared to those in the U.S., based on current P/E ratios. This suggests there is some merit to taking a gamble on European stocks, if value is a chief prerogative. To illustrate, consider the chart below, that shows the current P/E of FEZ compared to the S&P 500:

| Current P/E – S&P 500 | Current P/E – FEZ | FEZ – Relative Discount |

| 22 | 13 | 41% |

Source: State Street; Multpl.com

Clearly, when it comes to price to own, FEZ is sharply less expensive. Again, there are valid reasons for this – such as the U.S.’ isolation from Eastern Europe and less reliance on Russian energy. But the discount is getting quite wide to the point where buying in could be worth the gamble. Do I believe the timing is great right now? No. But that doesn’t mean I won’t keep a close eye on this investment potential going forward given the valuation gap.

Dividend Growth Was Strong In Q1

Another strong metric to consider is the dividend growth FEZ saw in March. Not surprisingly, Q1’s distribution in 2021 was quite weak on a historical basis, given how difficult the macro-economic climate was in 2020, which impacted what companies could pay out at the start of the new year. The good news is that some of these headwinds have passed, and the underlying companies have made a stronger commitment on returning capital to shareholders. This is evident in the sharp increase in the Q1 distribution year-over-year:

| 2021 Q1 Distribution | 2022 Q1 Distribution | YOY Growth |

| $.02/share | $.098 | 390% |

Source: State Street

The conclusion here is straight forward. As an income play, FEZ has improved quite a bit. The share price is down and the distribution has been rising. This could interest income-oriented investors to the point where they are willing to take some headline risk because they are capturing a reasonable yield to do so. On this point, I do find some merit. If one is going to take on a riskier play, it helps to earn a healthy income stream in the meantime.

Bottom-line

I started out the year cautious on European equities, and the macro-environment ended up being much worse than I imagined. In fairness, I certainly did not predict a Russian invasion of Ukraine, but my hesitancy for other factors turned out to be rewarded as conditions got much worse than I anticipated. With that in the rear-view, there is certainly an argument for buying in now. Euro-zone equities are relatively cheap, and the dividend has been pumped up. Further, if the situation in Ukraine improves, there is plenty of upside potential in large-cap European stocks.

Despite that positive potential, I remain convinced I am better served investing elsewhere. Central Europe has too much exposure to this conflict to the point where there is plenty of pain that could be forthcoming if conditions in Ukraine take a turn for the worse, or expand beyond Ukraine’s borders. Further, inflation is raging, and consumer sentiment is taking a big hit. This is concerning for FEZ, as the fund has a large allocation to consumer-oriented companies. As a result, I will be remaining on the sidelines for now, and will reiterate my neutral/hold rating. At this juncture, I suggest readers approach any positions in this fund very selectively at this time.

Be the first to comment