nikitos77

Macroeconomic Overview

Running a trading desk in iron ore would have been tough this year. The base metal used widely in structural steels has seen prices falter.

The threat of a blow-out recession on both sides of the Atlantic coupled with a property crisis in China has weighed heavily on demand. So much so that Rio Tinto, the Anglo-Australian mining stalwart made recent headlines by warning of renewed iron ore price downside.

We are a million miles away from the post Covid inflationary boom which took prices of Ex-Tianjin 63.5% iron ore cargoes North of $200/t. A Chinese construction industry bust, radical Covid lockdowns and a cooling global economy have all willingly conspired to pressure prices below $100/t. So, if I pitched you on iron ore upside, you would probably think I am crazy.

But wait, there is more.

Iron ore prices have been extremely volatile over the past 2 years.

Only a handful of countries have had a more forgettable 2022 than Ukraine. A vestige of the Soviet empire like many of its neighboring countries, the far Eastern nation, renowned for a wide range of commodities, has found itself in the middle of a geo-political spat between East & West.

With weapons, technology, and funding flooding in from abroad, the nation has endured relentless aggression. The country has also attracted extensive claims of corruption, political misappropriation of funds and even using now defunct FTX as a transmission tool for ill-gotten gains. The Bankman Fried analogy is interesting given the situation.

But wait, there is more.

Queue corporate leader and majority shareholder, Konstantin Zhevago – an ex Ukrainian politician and self-made mining magnate. Recent accusations include $113M of money laundering and embezzlement during his time leading now defunct lender Finance & Credit bank.

Apparently, Finance & Credit bank at the time worked closely with Ferrexpo. If it sounds like FTX and Alameda research, then we can perhaps highlight the distinction that at least this company with its iron ore pellet business did ultimately create economic utility.

For investors looking for perilous price action, commodities speculation, and more volatility than C4, enter blemished Ukrainian Iron Ore industrial conglomerate Ferrexpo (OTCPK:FEEXF). I remain surprisingly bullish on the company’s prospects, provided they don’t diversify into crypto. I know, I know – I am a boomer.

Company Introduction

Ferrexpo posts a compelling narrative for investment thrill seekers. The world’s third largest iron ore pellet manufacturer has an integrated approach to the mineral value chain controlling mines, processing facilities, railways, and port complexes.

The Ukrainian iron ore conglomerate is listed on the London Stock Exchange and posts almost £900M in market capitalization. The company is one of Ukraine’s largest employers with a workforce of approximately 10,000. Tragically, several of its employees participating in military activities against Moscow have been killed.

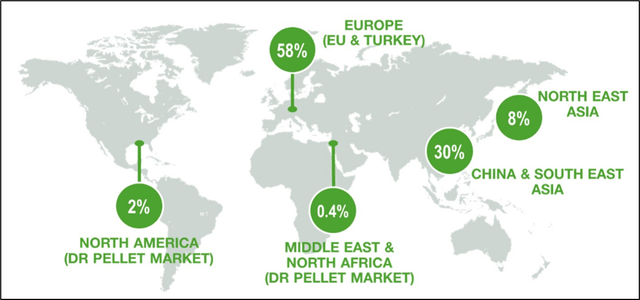

Ferrexpo’s traditional markets are Europe. Expect a change in marketing mix with US taking on more future volume.

The company serves mainly European markets with a focus on higher grade iron ore content. This allows the company to maintain some degree of margin power as the firm pitches its product to more upscale markets. Exposure to a slowing European market is high – but so too is US support for Ukrainian political and economic efforts. A redistribution of the present marketing mix may be possible.

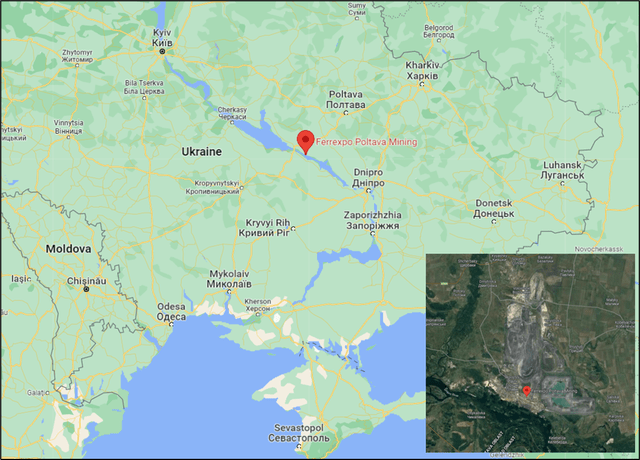

Ferrexpo’s Poltava Mining Asset is among the biggest in the company’s portfolio.

The company showcases several world class assets. The Poltava mine has been operating for over 50 years and posts 1.1B tons of JORC compliant ore reserves. At today’s rates, the mine has an additional 50 years of operations before end of life of mine.

The Yeristovo ore body is a newer one, with operations having commenced in 2011. It’s Ferrexpo’s second largest mine with about 510M tons of reserves and another 35 years ahead of it.

The company’s third operation, the Belanovo Project started only 4 years ago. It has about 1.7B tons of reserves, situated within proximity of the Yeristovo mine. All in, the mine has operations and reserves which will carry it well into the second half of the century.

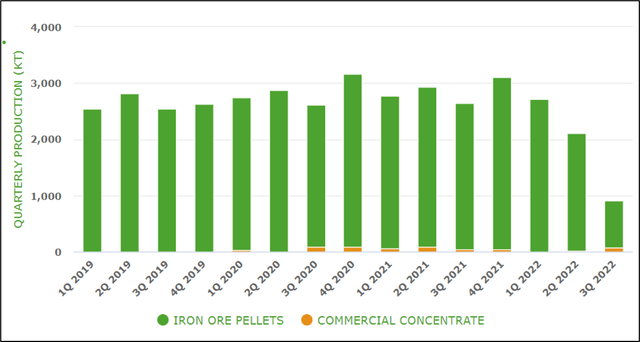

Production volume has dropped off a cliff with almost a 60% reduction as the firm deals with labor and logistics constraints.

The company embraces technology and innovation. It was one of the first to deploy a large-scale fleet of autonomous dump trucks. It also is testing semi-autonomous drill rigs and rolling out drone utilization for mine surveying activities. A lot of these activities have contributed to improvements in safety while also helping the organization face challenges regarding labor shortages, particularly during war time.

The company has started dabbling in technology, with its Yeristovo 993s among the first to be fully autonomous.

Financial Overview

When the invasion of Ukraine broke out, investors ran for the doors. Since then, the stock price has capitulated with shares giving up 60% of their value in 2022. That overcorrection may be too aggressive, particularly if a few different geopolitical moons align in 2023.

While annual sales have been lower (FY 2021 – $3,465B v $3,041B LTM), the company has maintained profitability. Gross margins have receded but still hover around 60%.

The company faced extreme logistics strife with its port complexes shuttered and an inability to move product via the Black Sea. Despite this, Ferrexpo has posted ~ $1B in EBITDA over the last 12 months. Not bad given the circumstances.

The company has prudently maintained healthy liquidity levels with $250M cash on hand. The generous dividend policy appears to have been shelved for the time being while awaiting some degree of normalcy to return to current operations. Ferrexpo has virtually no debt, which bolsters its financial defenses even more during this time of need.

Operating income has halved (FY 2021 = $1.5B v $881M LTM), but that is to be expected given the present circumstances. Cash flow from operations has remained solid (FY 2021 = $1.5B v $964M LTM) allowing the firm to deploy almost $500M of capital into plant, property, and equipment each of the last two years.

Technology and innovation have been focal spend areas. Ferrexpo continues also to invest in an army of railcars, dump trucks, dozers and other ancillary equipment.

Valuation

The company posts a forward PE of 4.7x reflecting pressure on the equity price and extrinsic risk linked to the war. Yet despite the wholesale disruption, the company continues to be a cash machine. EBITDA margins remain strong (~34%) albeit somewhat depleted with return on assets (19% LTM) and return on equity (16.72%) each remaining robust.

The company’s current ratio (4.2x) and quick ratios (2.2x) emphasize the degree of financial conservatism taken by management in the stewardship of the firm during war.

Cash conversion cycles have expanded as Moscow tries to disrupt revenue sources by cutting shipping lines and upending logistics. Yet with virtually no debt, big cash on hand and operations which continue to turn over, it will be difficult for the firm to be pushed into insolvency.

Risk

Risks are gargantuan for the integrated Ukrainian miner. Front on center remain risks that had previously forced the firm to call force majeure on a range of contracts. That risk includes logistics disruption to Black Sea trade routes which have since smothered revenues.

Operational risk stressed by manpower shortages as resources are diverted to war time efforts is prevalent. Markets are still open for the company’s products and no open sanctions look like they will harm sales.

The company’s largest shareholder, Konstantin Zhevago, appears to be investigated for fraud. Given Mr. Zhevago did relinquish operational leadership of the firm some time ago, proper functioning should remain intact. The opposite may be true regarding any financial risk should Mr. Zhevago be forced to dump equity to manage personal liabilities. Last I heard however, he did not have any meaningful assets at Alameda Research.

Key Takeaways

If ever there was an out-on-a-limb, fly-by-the-seat of your pants investment pitch for 2023 it would be Ferrexpo. The integrated Ukrainian minerals conglomerate finds itself in a war zone with logistics and human constraints all hampering commercial efforts.

The iron ore market does not look rosy, Europe is reeling in economic pain and a global slowdown appears at the fore. China lockdowns plague the World’s growth engine. All-in, it looks like it’s in a bad space.

But at 4x forward earnings, it seems investors have punished the firm prematurely. The company’s prudence, careful cash management, modest leverage and financial conservatism have allowed it to navigate this tumult. Maybe Sam should have done that.

Be the first to comment