undefined undefined

Thesis

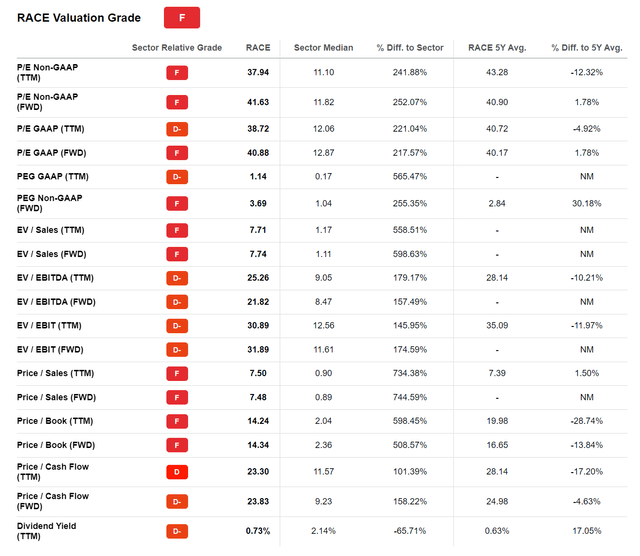

Ferrari (NYSE:RACE) is trading very expensive at a 2023 P/E > x30 and EV/Revenue x7. Even for a luxury company, this valuation premium is not justified, in my opinion. LVMH, for example is trading at a P/E of about x20. And most car companies, even premium automaker trade at a P/E significant below x10. Heading into a recession, I believe Ferrari is exposed not only to a significant EPS slowdown, but also to a multiple contraction.

Ferrari stock has outperformed the market in the past 5 years. But this outperformance may be connected to a booming economy, as Ferrari’s business is sensitive to wealth generation. Respectively, In a recessionary environment RACE stock could potentially fall much more than the broad market.

The world’s leading luxury car OEM

Ferrari is arguably the world’s most popular sports car OEM. The company produces as little as 11.15K cars a year (2021 record) with price-tags starting from about $300.000. Accordingly, Ferrari sells to the world’s wealthiest consumers and demand generally exceeds the company’s production capacity and/or willingness. Geographically, Ferrari operates worldwide: the EMEA is Ferrari’s most important market accounting for approximately 45% of sales, followed by the Americas with about 35%, China with 10% and APAC excluding China with slightly more than 10%. Most notably, since 1947 Ferrari cars have been produced exclusively in Maranello, Italy.

Arguably Overvalued

Demand for Ferrari cars has exploded significantly in recent years, as low cost of capital and asset price inflation – including the crypto boom – has inflated global wealth and crowned a young generation of millionaires. In addition, the urge for self-advertisement on social media certainly helped fuel demand for high-prestige cars. That said, 2021 was a record year for Ferrari: The company generated revenues of about $5.1 billion (up about 23.4% as compared to 2021) and EBITDA of $1.8 billion (up 35.7% respectively). Q1 2022 did not indicate a slowdown as Ferrari achieved $1.33 billion of revenues and $471 million of EBITDA. Moreover, guidance remained very bullish as well, as Ferrari indicated that order-backlog supports demand well into 2023.

However, despite-or because of – the bullish fundamentals, Ferrari stock is trading expensive. At > x30 P/E the market is certainly pricing an acceleration of Ferrari’s business expansion. This, however, seems farfetched, in my opinion. Most drivers for Ferrari’s bullish upswing are softening: asset prices deflate, capital costs rise and the crypto economy slows. Moreover, the market believes that Ferrari’s business is very resilient going into a recession. But there are good reasons to disagree. Most notably, during the financial crisis, luxury car sales contracted by about 35%.

That said, Ferrari is trading at a significant premium to peers – no matter if you define the benchmark as the automotive industry or the luxury segment. For reference, Ferrari’s P/E is about 50% more expensive than LVMH and > 500% more expensive than Mercedes Benz. Thus, I view RACE stock as highly vulnerable to a multiple contraction. This may be add on top of the EPS slowdown.

Residual Earnings Valuation

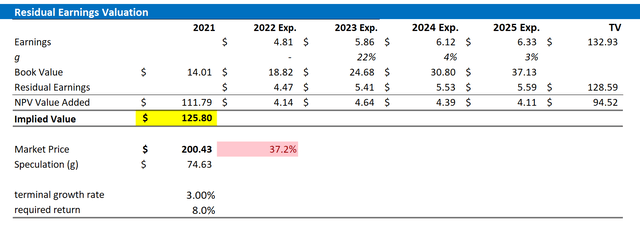

Let us now look at Ferrari’s valuation in more detail. I have constructed a Residual Earnings framework based on the analyst consensus forecast for EPS ’till 2025, a WACC of 8% and a TV growth rate equal to nominal GDP growth (3%).

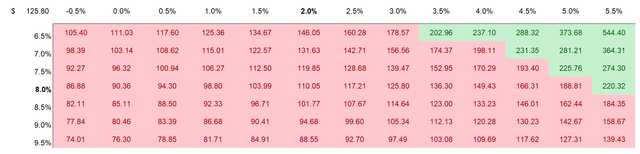

In my opinion, the long-term growth assumption equal to GDP growth might definitely be an underestimation, in my opinion, but I prefer to be conservative. If investors might want to consider a different scenario, I have also enclosed a sensitivity analysis based on varying WACC and TV growth combination. For reference, red cells imply an overvaluation, while green cells imply an undervaluation as compared to Ferrari’s current valuation.

Based on the above assumptions, my valuation estimates a fair share price of $125.80/share, implying a more than 35% downside potential based on accounting fundamentals.

Analyst Consensus EPS; Author’s Calculation Analyst Consensus EPS; Author’s Calculation

Risks

The major risk to my thesis is, in my opinion, that the market re-discovers his appetite for high-multiple stocks, or in other words long duration assets. However, since this risk would be closely associated with falling interest rates and lower real yields, I do not see this risk as a major anti-argument for my thesis. Or at least, I don’t see these scenarios playing out within the next 6-12 months. Other than that, I do not see explosive upside potential for Ferrari. The stock might, however, outperform the broad market on a long term timeline (+5 years).

Conclusion

Ferrari is definitely a great brand and company. But unfortunately, investing is not about buying great companies, but buying companies well. That said, I see the current valuation for RACE as simply too high. Personally, I value RACE at $125.80/share. I anchor my valuation on a residual earnings framework and EPS analyst consensus estimates. Thus, I see more than 35% downside for the stock before the risk/reward becomes balanced.

Be the first to comment