vitranc

Ferguson (NYSE:FERG) shares have underperformed in recent months, but I think the company could surprise to the upside in a cost-push inflationary environment – not only could it benefit from share gains from smaller distributors, but its ability to pass on inflation to customers should also help protect its margins. Another key FERG advantage is its balanced residential/non-residential portfolio, which should allow for resilient top-line growth through the cycles. The strong balance sheet also offers a tremendous advantage on the capital allocation front – amid rising rates and lower asset valuations, the accretion potential from future bolt-on acquisitions and share repurchases is especially compelling. And with a potential inclusion in US indices also on the horizon, FERG could see meaningful tailwinds to its valuation over the next year.

Stronger Than Expected Sales Trends Indicate The Peak Is Not Here Yet

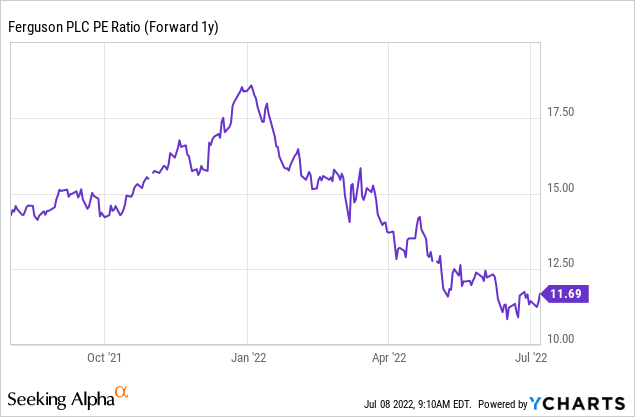

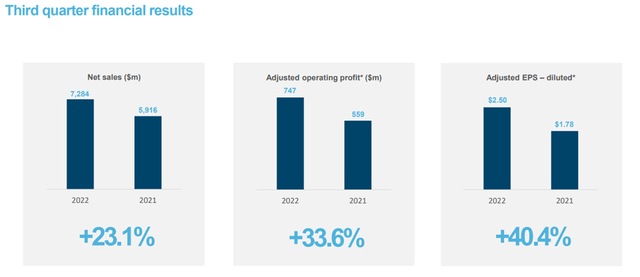

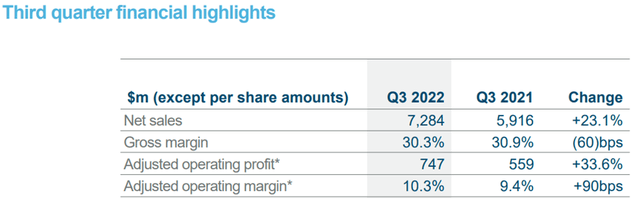

Over the past two years alone, FERG has delivered impressive EPS growth of 90+% and a similarly strong 80+% EBITA growth to c. $2.9 billion. Yet, shares have traded sideways from the early 2020 highs – the key contributor being a substantial multiple de-rating to c. 11x P/E amid investor skepticism about the sustainability of the current top-line trajectory. As the FQ3 ’22 report showed, however, FERG has not seen any signs of a rollover in operational performance just yet – despite a backdrop of escalating US housing concerns and rising interest rates. Specifically, the quarter saw +23% like-for-like growth and +20% pricing (up from the high teens % previously), with volumes also still growing at +3%.

Considering these results came despite difficult Y/Y comparables and commodity-driven inflationary pressures, I think FERG could surprise many with its resilience through any macro turbulence ahead. Key metrics to monitor include non-residential construction (+29% growth in FQ3′ 22), which looks set to pick up post-COVID-19 slowdown, along with the sustainability of residential growth (+20% in FQ3′ 22) in the face of more rate hikes throughout the year.

Operating Profit Outlook Remains Resilient Despite The Inflationary Pressures

Although FERG saw its gross margins down by c. 60bps Y/Y (c. 10-20bps from mix), EBITA margins have been resilient, increasing by c. 90bps to 10.3% in FQ3 ’22. As a result, the company has maintained its 30-31% margin guidance range, and it intends to grow this once the macro headwinds abate over the upcoming years. Notably, half of the full-year operating profit guidance was driven by a stronger than expected FQ3 ’22, while the other half came from increased confidence in the FQ4 ’22 outlook – despite inflation continuing to be elevated. These trends are likely still some way off normalized growth trends, however, and judging from Ferguson’s bullish commentary throughout the year, there could be plenty of upside surprises ahead.

While the rest of the year will be challenging from an inflation standpoint, the Y/Y comparables should moderate heading into the upcoming year and beyond. This should be felt especially within the non-residential segments, where inflation has been higher – a key driver of the growth differential between US residential (+20%) and non-residential (29%) in FERG’s latest quarter. The evolution of commodity pricing across steel, copper, and plastics (c. 15% of revenues), will be worth keeping an eye out for, as any signs of moderation here could be a considerable margin tailwind. Even if inflation persists, however, demand patterns remain strong across the board, and the fact that we have seen no signs of a FERG slowdown is especially encouraging for the longer-term margin expansion path.

Well-Capitalized Balance Sheet Supports Capital Allocation Optionality

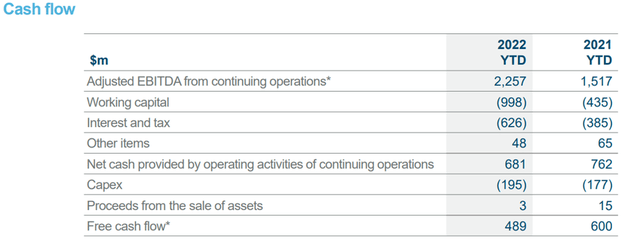

As of its latest quarter, FERG held net debt of c. $2.4 billion after completing a c. $501 million of share repurchases during FQ3 ’22 – in turn, implying a very manageable net debt/EBITDA ratio of 0.8x. Management has also capitalized on lower asset valuations following the recent Fed hikes, completing four acquisitions with annualized sales of $50 million in FQ3 ’22 and acquiring another four businesses post the period-end (including an own-brand lighting and fan business) with annualized sales of $400 million. Encouragingly, FERG has shown strong discipline in its deal-making, with multiples paid for its M&A deals running largely in line with the 7-10x target. Considering the strong pipeline offering plenty of geographic and capability opportunities, I see plenty of incremental upside to the top-line in the upcoming years.

Looking ahead, the FERG balance sheet continues to look conservative in light of its strong cash generation (c. $489 million in FQ3′ 22). Even assuming lower growth assumptions in future years, net debt/EBITDA should remain considerably below the 1-2x target range – my base case is for a 0.5x leverage ratio in fiscal 2023 and for the balance sheet to turn net cash soon after. And considering only $700 million of authorized repurchases remain (out of a $2 billion total), there is a clear opportunity for FERG to initiate an upsized repurchase should the share valuation remain depressed.

Final Take

The FERG equity story remains fundamentally robust, benefiting from top-line resilience and gradual margin expansion, along with capital allocation optionality from an underleveraged balance sheet. While market concerns around a slowdown in residential spending could prove warranted, non-residential construction indicators continue to trend favorably post the COVID-19 slowdown – in its latest quarter, for instance, FERG posted c. 29% non-residential growth.

More broadly, the balanced residential/non-residential profile offers resilience through the economic cycles and, coupled with incremental growth from M&A and share repurchases, should ensure a steady medium-term EPS CAGR. Yet, the FERG valuation multiple has de-rated substantially in recent months and now stands at an undemanding c. 11x P/E relative to new guidance numbers. As such, I see current levels as attractive, especially with a potential US index inclusion catalyst also on the horizon.

Be the first to comment